Scaling a business today is no longer just about hiring faster or raising more capital. It is about building financial infrastructure that can handle growth without breaking under pressure.

Modern fintech tools help companies automate payments, manage cash flow, unlock new revenue streams, reduce risk, and improve decision-making. Whether you are a SaaS founder, ecommerce operator, marketplace builder, or CFO of a growing SME, the right financial stack can become a strategic advantage.

Below are five fintech tools that consistently help businesses scale more efficiently, with real impact on operations, margins, and speed.

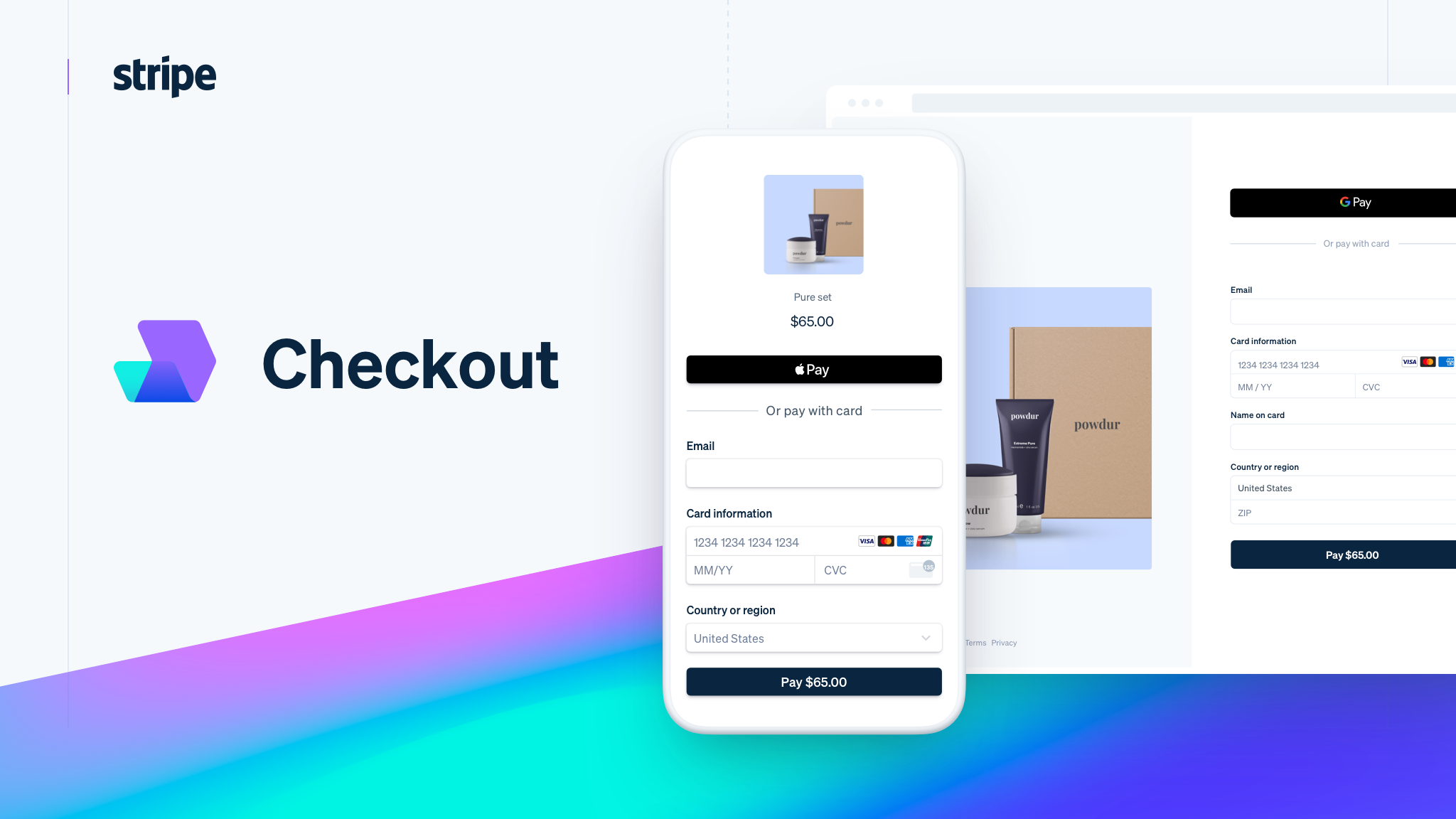

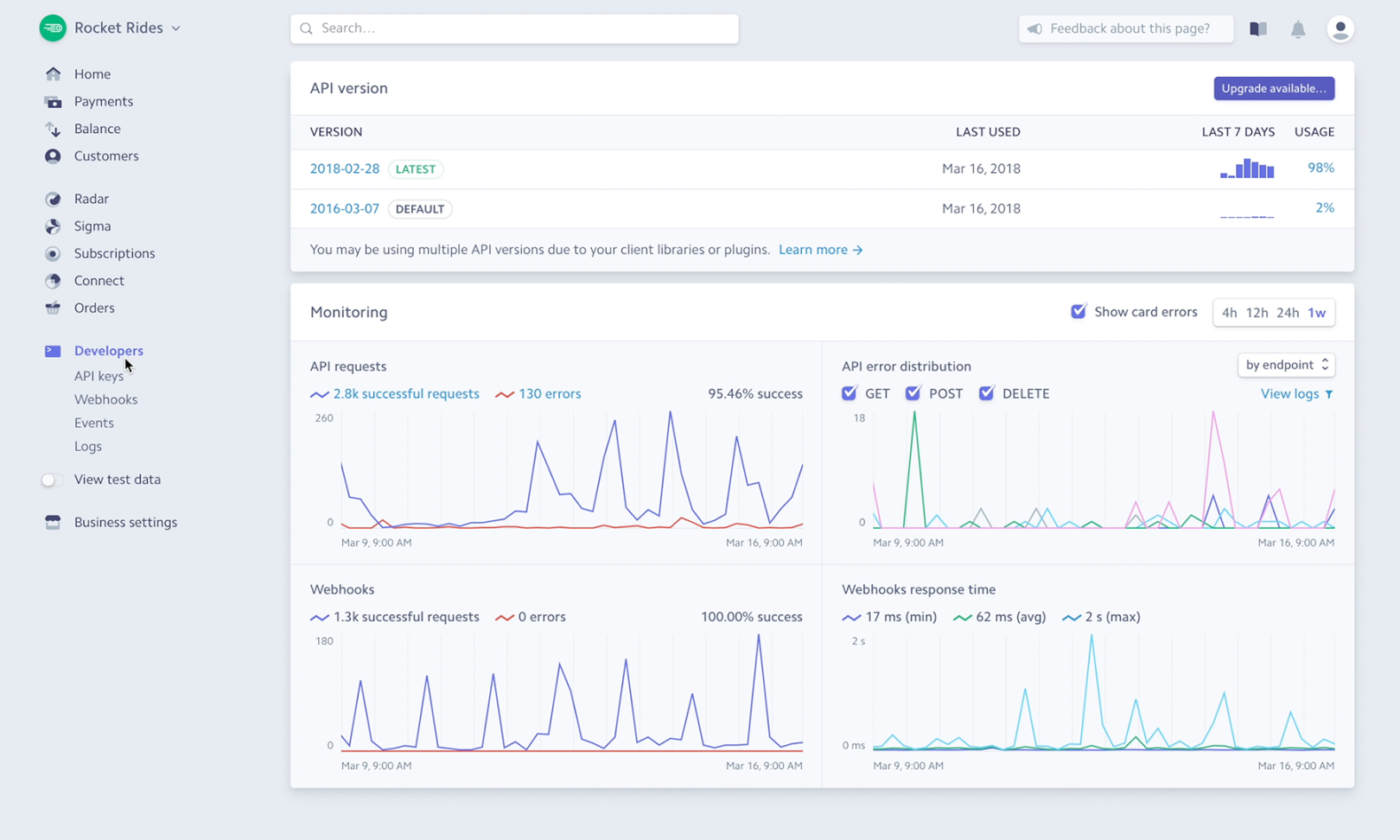

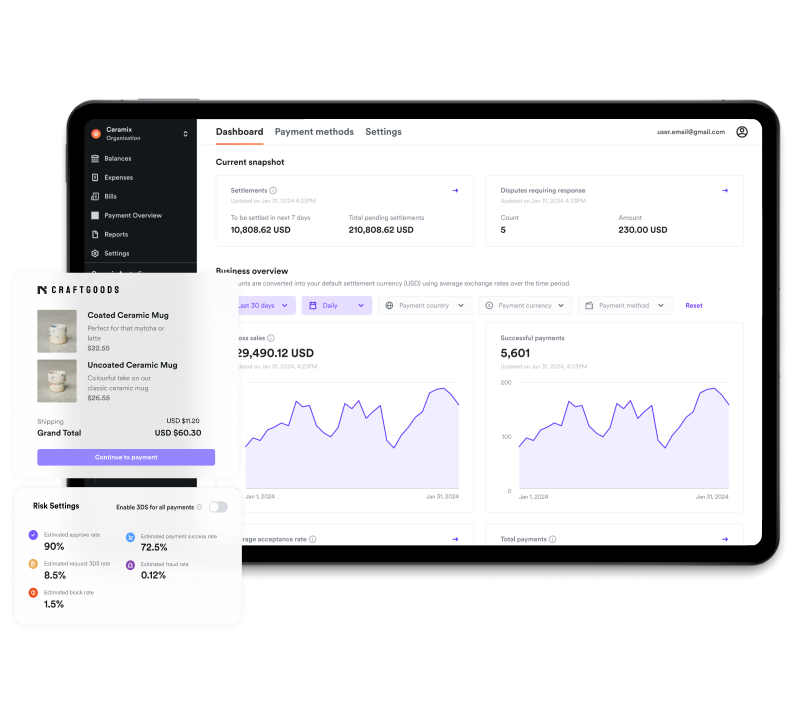

1. Stripe – Payments Infrastructure That Grows With You

When businesses scale, payments often become the first bottleneck. Failed transactions, global expansion friction, compliance complexity, and subscription management issues can quickly slow growth.

Stripe solves this by offering a developer-friendly payments infrastructure that supports:

- Online payments and checkout optimisation

- Subscription and recurring billing

- Multi-currency and cross-border transactions

- Marketplace payments via Stripe Connect

- Embedded finance and card issuing

Stripe’s real scaling advantage lies in its modular architecture. A company can start with simple payment acceptance and later layer on subscriptions, fraud detection, revenue reporting, tax automation, and even embedded financial products.

For SaaS businesses, Stripe Billing enables automated recurring revenue with flexible pricing models. Stripe Connect handles KYC, payouts, and compliance at scale for marketplaces. For global expansion, Stripe supports local payment methods across dozens of markets.

Why it scales well:

- High reliability under transaction spikes

- Strong APIs for automation

- Built-in compliance and security infrastructure

- Advanced reporting and revenue analytics

For many digital-first companies, Stripe becomes the financial backbone of the entire business.

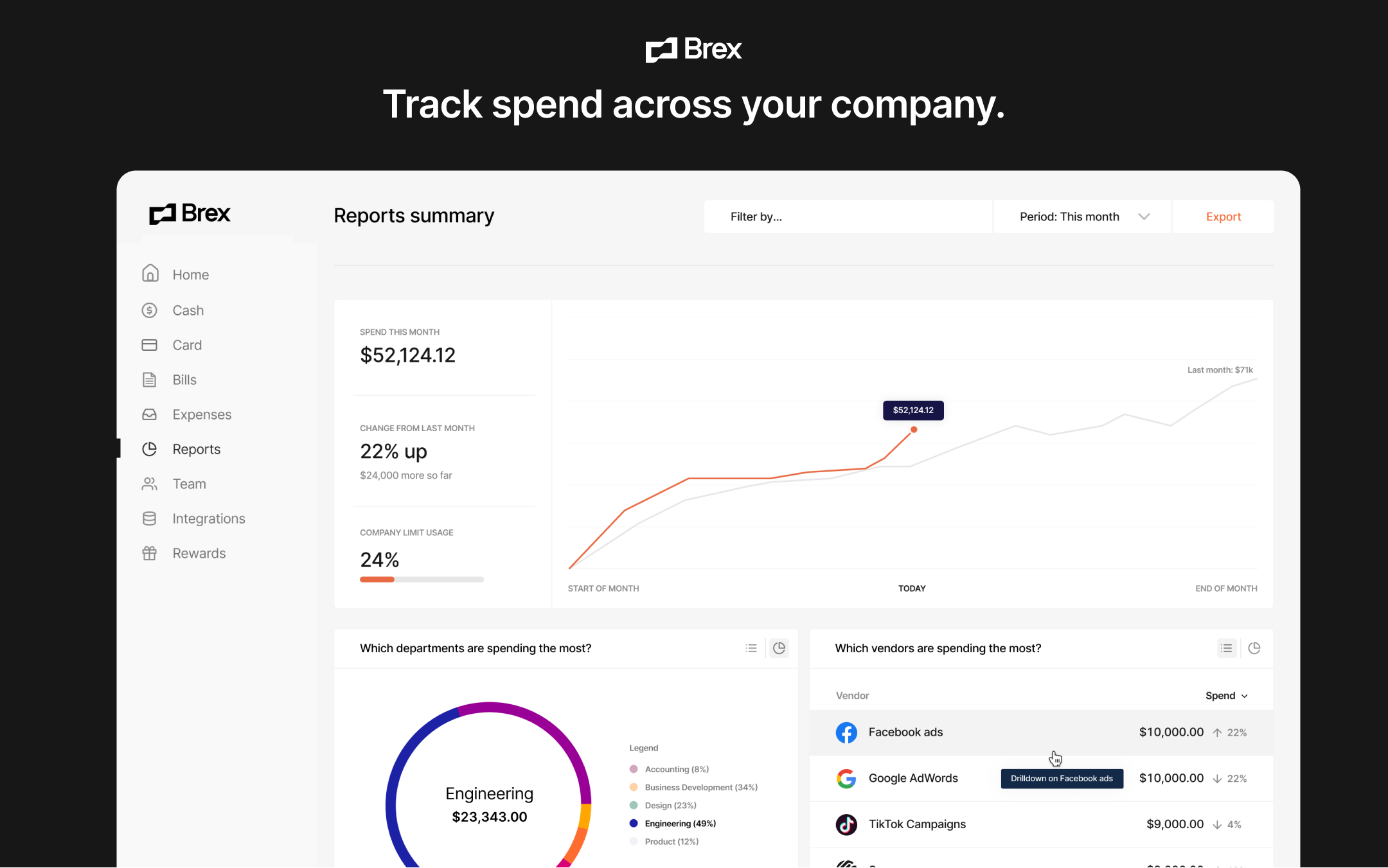

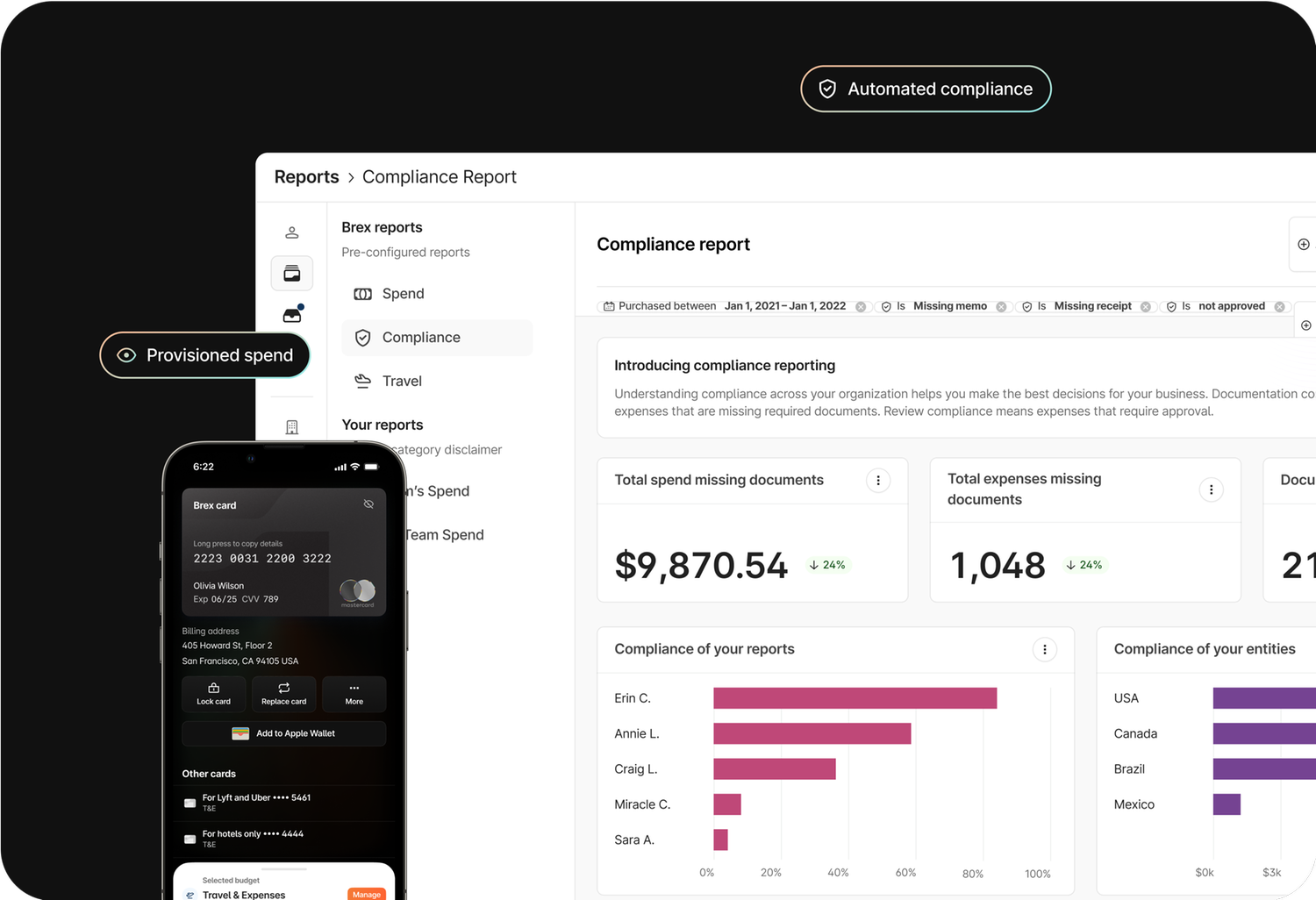

2. Brex – Smart Spend Management and Corporate Cards

As teams grow, spending becomes decentralised. Without proper controls, costs increase, reimbursements become chaotic, and visibility disappears.

Brex provides corporate cards and spend management software built specifically for high-growth companies. It combines:

- Corporate cards with dynamic limits

- Real-time expense tracking

- Automated receipt capture

- Policy enforcement

- Centralised spend analytics

The scaling benefit is operational control. Instead of manually reviewing expenses at month-end, finance teams can define policies in advance. Transactions that fall outside approved rules are flagged automatically.

Brex also integrates with accounting systems, reducing reconciliation time and improving financial accuracy.

For startups scaling internationally, Brex offers global card programmes and multi-entity management, which simplifies expansion.

Why it scales well:

- Real-time financial visibility

- Automated expense compliance

- Reduced manual accounting work

- Strong integration ecosystem

In fast-growing environments, spend discipline becomes a competitive advantage. Tools like Brex help maintain control without slowing the organisation.

3. Airwallex – Cross-Border Payments and Global Treasury

Global scaling introduces foreign exchange costs, international transfers, local banking complexity, and fragmented treasury management.

Airwallex addresses these issues by offering:

- Multi-currency business accounts

- Local bank details in multiple countries

- Low-cost FX conversion

- Cross-border payment infrastructure

- Virtual and physical corporate cards

For ecommerce brands and digital services companies, Airwallex reduces the friction of operating internationally. Businesses can hold, convert, and pay in multiple currencies without relying entirely on traditional banks.

A scaling business can:

- Pay global suppliers efficiently

- Collect payments locally in foreign markets

- Reduce FX fees

- Centralise treasury visibility

Airwallex effectively acts as a global financial operating system. This becomes especially valuable for companies expanding into Asia-Pacific or managing distributed teams.

Why it scales well:

- Lower FX costs

- Faster international transfers

- Unified global cash management

- Reduced dependency on legacy banking systems

For companies going global early, this type of infrastructure prevents treasury complexity from becoming a growth constraint.

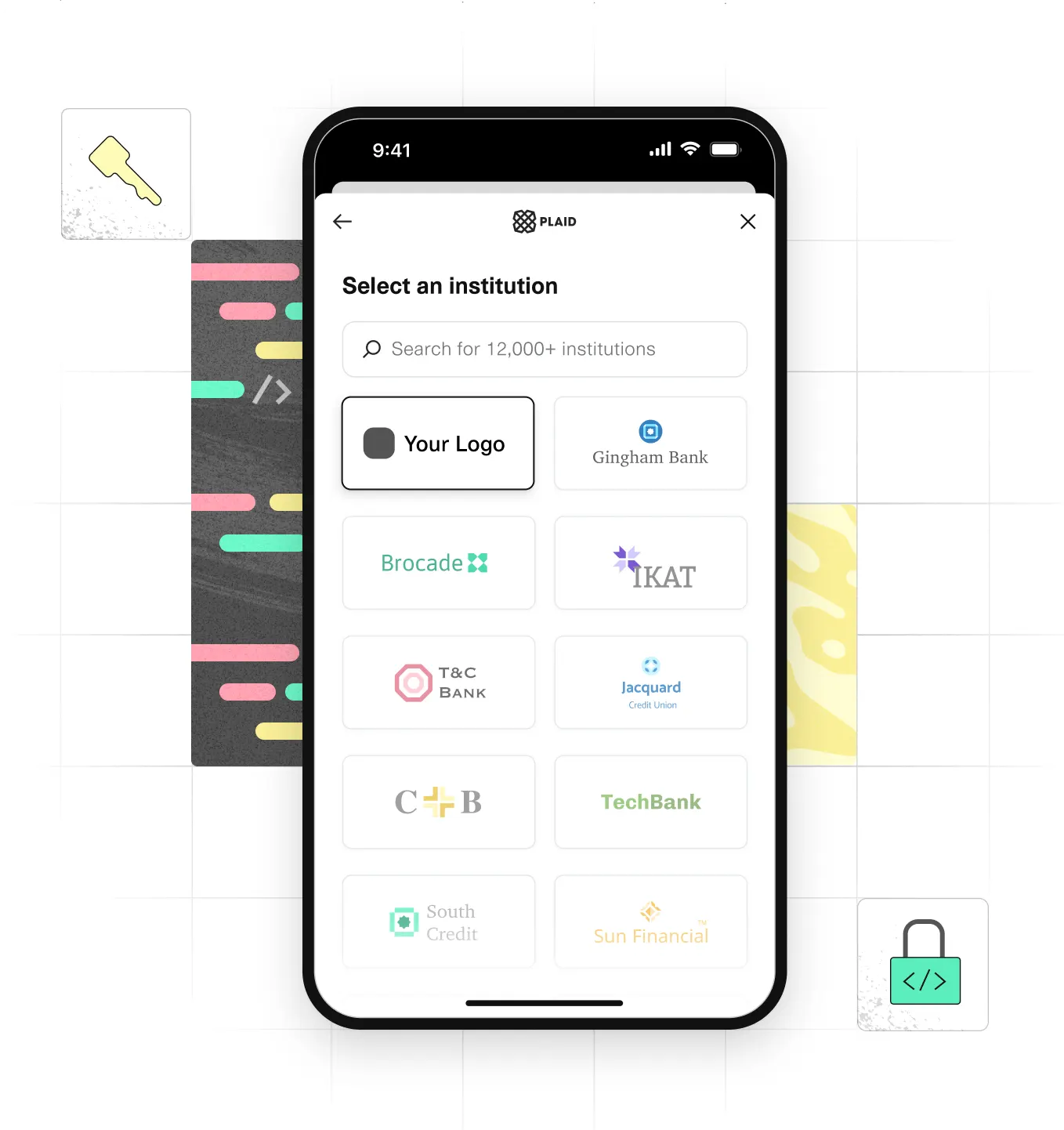

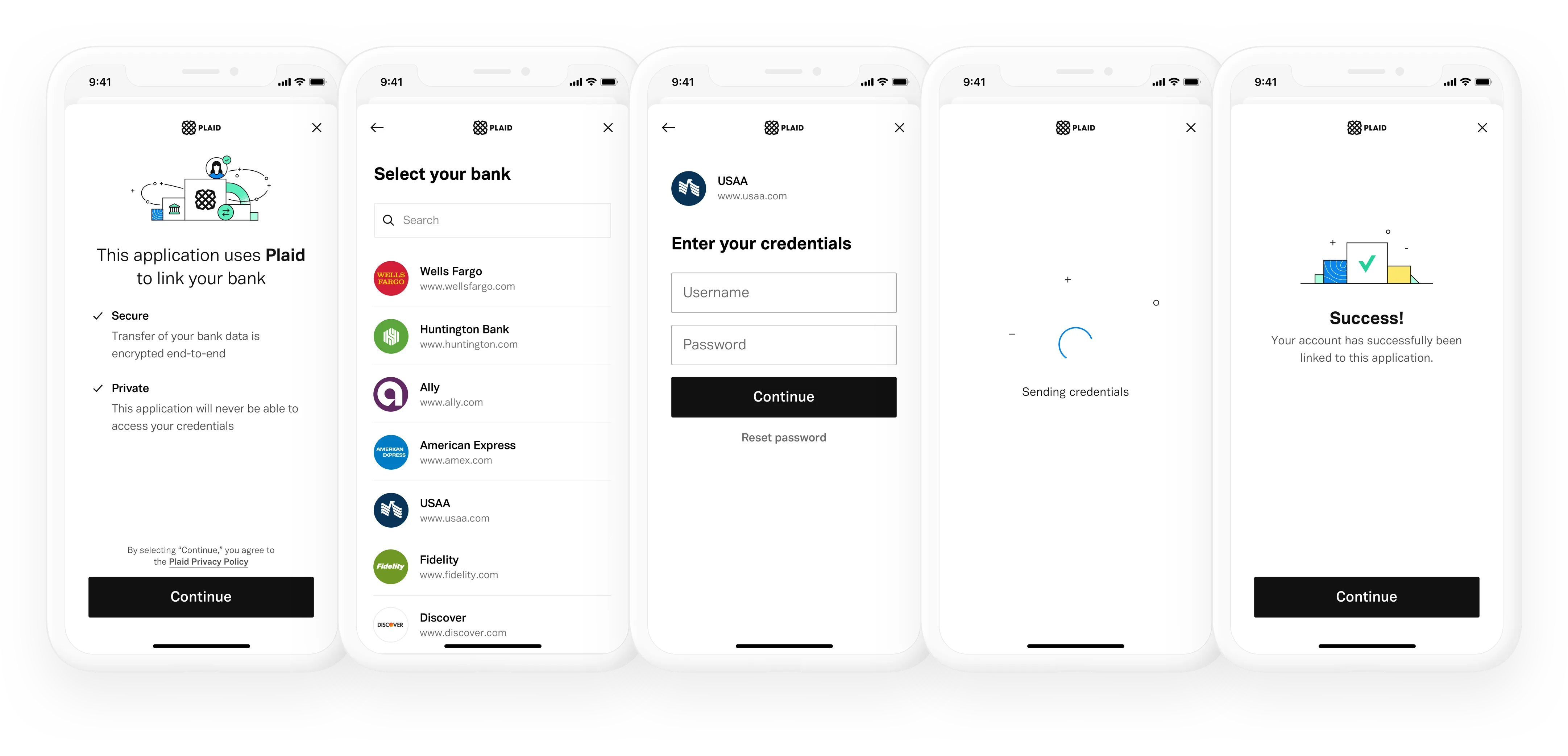

4. Plaid – Financial Data Connectivity

Scaling increasingly depends on data. Financial data in particular drives underwriting, risk management, personalisation, and embedded finance models.

Plaid provides secure APIs that allow businesses to connect to users’ bank accounts and financial data, with permission.

Companies use Plaid to:

- Verify bank accounts instantly

- Assess income and transaction history

- Improve onboarding flows

- Enable embedded financial products

- Reduce fraud risk

For fintech startups, Plaid is often foundational. However, non-fintech businesses can also leverage it to enhance customer verification and credit-based offerings.

For example:

- Marketplaces can verify sellers’ bank accounts quickly

- Lending platforms can automate underwriting

- Subscription platforms can reduce failed payments

The scaling impact lies in automation. Instead of manual document checks or delayed verifications, businesses can make decisions in real time.

Why it scales well:

- API-first design

- Strong security standards

- Faster onboarding and verification

- Enhanced data-driven decision-making

In digital finance, connectivity equals scalability. Plaid enables this layer.

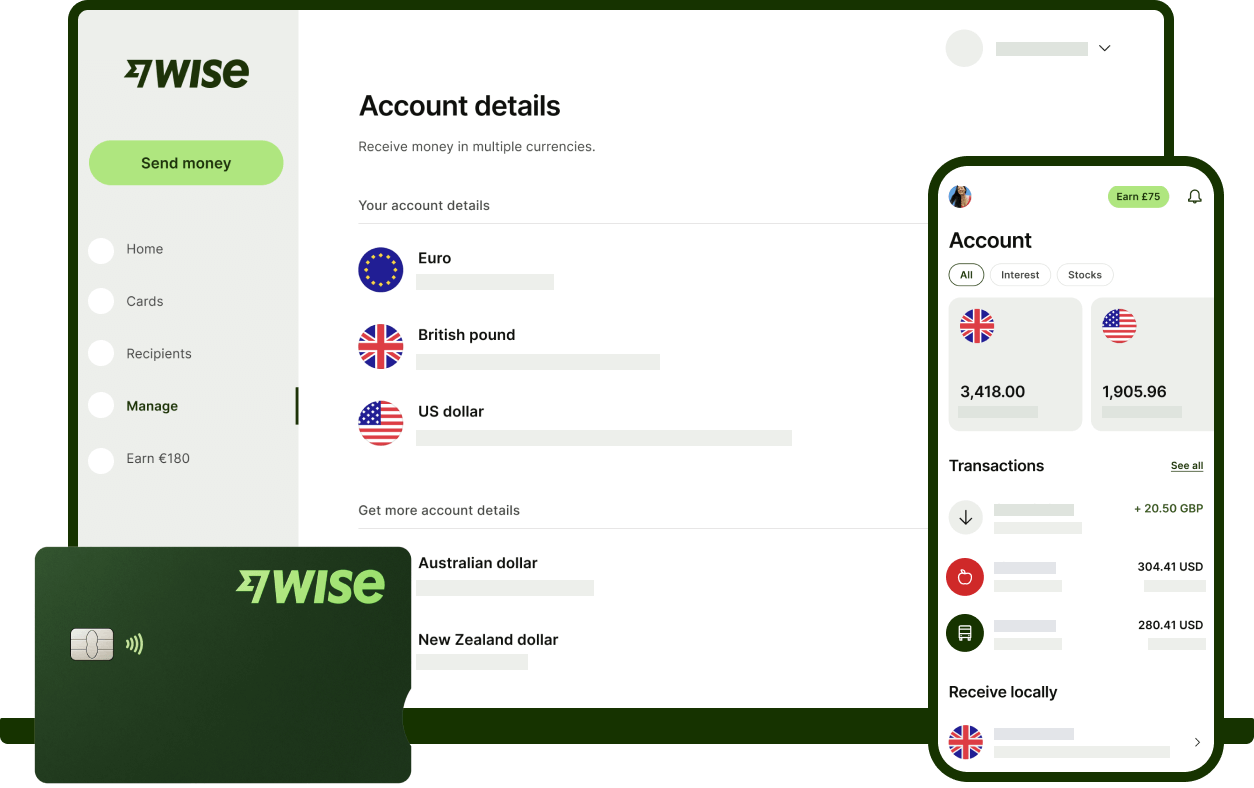

5. Wise – Cost-Effective International Payments

While Airwallex focuses on infrastructure and treasury, Wise offers a highly accessible solution for international transfers and multi-currency management.

Wise Business provides:

- Multi-currency accounts

- Transparent FX pricing

- Local account details in multiple regions

- International payroll payments

- Business debit cards

For SMEs and scaling startups, Wise offers a simpler entry point into global finance. It is particularly effective for:

- Paying remote teams

- Managing overseas contractors

- Receiving international client payments

- Reducing hidden banking fees

Scaling businesses often underestimate FX leakage. Over time, unnecessary currency conversion costs can materially affect margins.

Wise helps reduce these inefficiencies while offering a user-friendly interface that does not require heavy technical integration.

Why it scales well:

- Transparent pricing

- Lower international payment costs

- Easy onboarding

- Practical treasury flexibility

For many companies, Wise complements larger infrastructure providers by covering day-to-day international financial operations.

How These Fintech Tools Work Together

Scaling is rarely about one tool. It is about building a cohesive financial stack.

A typical high-growth setup may look like this:

- Stripe for revenue collection and subscription billing

- Brex for internal spend control

- Airwallex or Wise for global treasury

- Plaid for financial data integration and onboarding

Together, they create:

- Automated revenue flows

- Controlled spending

- Global financial flexibility

- Real-time financial intelligence

This combination reduces operational friction, improves visibility, and supports international expansion.

Key Criteria When Choosing Fintech Tools

Not every business needs all five tools immediately. However, when evaluating fintech solutions for scaling, consider:

- API and integration capabilities

- Geographic coverage

- Compliance and regulatory support

- Reporting and analytics depth

- Pricing transparency

- Scalability under high transaction volume

Fintech tools should reduce complexity, not add it.

Final Thoughts: Financial Infrastructure Is Strategy

In 2026, scaling a business is inseparable from scaling its financial systems.

The companies that grow sustainably are those that treat fintech infrastructure as a strategic asset, not just an operational necessity.

Payments, treasury, spend management, and financial data connectivity are no longer back-office functions. They are growth enablers.

If you are building for scale, the question is not whether you need fintech tools. The question is whether your current financial stack can handle the next 10x.

Because when growth comes, financial systems either accelerate it or constrain it.