Airwallex has emerged as one of the most powerful, yet understated, players in global fintech. Originally launched to simplify cross-border payments for businesses, the company has rapidly expanded into a full financial infrastructure platform.

In this Airwallex review, we explore how the company operates, what sets it apart, and why it is becoming essential for high-growth businesses globally.

Airwallex Origins and Mission

Airwallex was founded in 2015 by a team of Australian entrepreneurs frustrated by the inefficiencies and high costs of international payments. Their vision was simple: create a faster, cheaper, and more transparent way for businesses to move money globally.

Starting with cross-border payments for SMEs and marketplaces, Airwallex quickly expanded its product set. Today, it offers multi-currency accounts, corporate cards, treasury management, embedded finance APIs, and international payouts. It is serving thousands of businesses across Asia-Pacific, Europe, and North America.

Its mission is clear: to build a global financial operating system that empowers businesses of all sizes to operate without borders.

Key Products and Platform Features

Airwallex offers a wide range of solutions designed to simplify financial operations for companies scaling internationally:

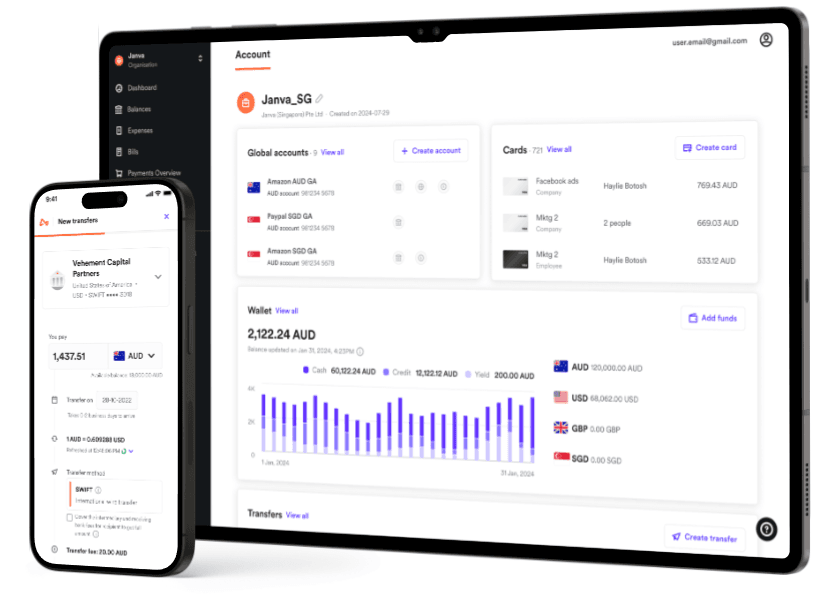

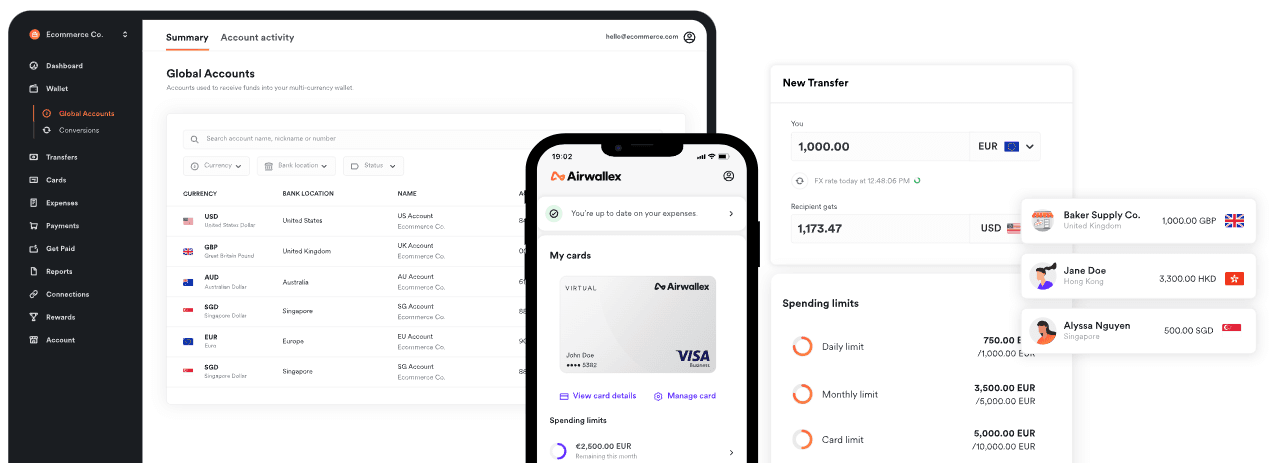

1. Multi-Currency Business Accounts

Businesses can open accounts in multiple currencies without needing a local banking presence. These accounts allow companies to hold, convert, and pay globally with low FX fees.

2. Cross-Border Payments

Airwallex enables fast, affordable cross-border transfers to over 150 countries, using its own banking network to bypass traditional SWIFT costs and delays.

3. Corporate Cards

Airwallex provides physical and virtual cards that allow employees to spend in multiple currencies, linked directly to the company’s balance with real-time tracking and controls.

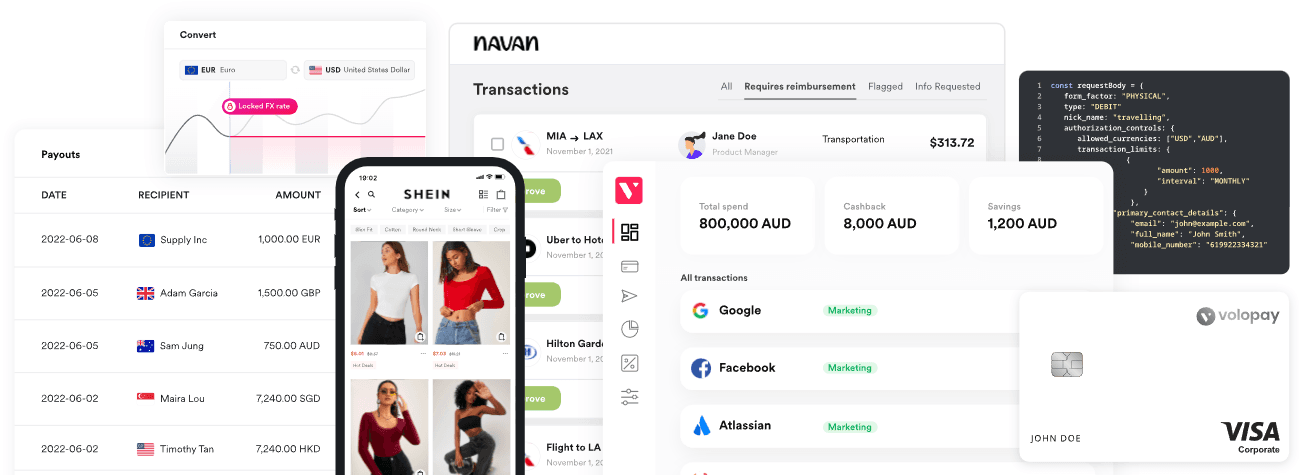

4. Expense Management

The platform offers integrated tools to manage, approve, and reconcile employee expenses, helping businesses stay on top of operational spend.

5. Embedded Finance APIs

Businesses can integrate Airwallex’s financial services directly into their own products via APIs, offering accounts, cards, payments, and FX to their customers.

6. Treasury and FX Management

Advanced treasury tools allow companies to manage liquidity across currencies, automate FX hedging, and optimise global cash flow.

Airwallex’s platform is highly modular, allowing businesses to select only the services they need and scale flexibly as they grow.

What Sets Airwallex Apart?

Airwallex’s strength lies in its infrastructure-first approach. Rather than relying entirely on third parties, it has built a proprietary global network of financial partners and licences. This gives it greater control over costs, speed, and compliance than many competitors.

Its pricing model is transparent, with competitive FX margins and minimal hidden fees. Settlement speeds are significantly faster than those of traditional banks, especially for payments between Asia-Pacific, Europe, and North America.

The platform’s combination of payments, banking, and financial operations into one interface provides real operational efficiency for finance teams. Unlike legacy banks that offer fragmented solutions, Airwallex delivers an integrated, digital-first experience.

Airwallex Competitive Landscape

Airwallex competes with a range of players depending on the service line. For international payments, it rivals Wise Business, Payoneer, and OFX.

In corporate cards and expense management, it faces competition from Brex, Ramp, and Payhawk.

In embedded finance, it goes up against Railsr, Unit, and Nium.

Its differentiation comes from offering all these services natively through a unified platform, combined with deep infrastructure ownership that lowers costs and improves reliability.

Airwallex’s partnerships with Stripe, Shopify, and other major platforms highlight its ability to integrate at an enterprise scale while still serving SMEs efficiently.

Airwallex: Challenges and Future Outlook

Operating a global financial infrastructure business is complex. Regulatory compliance, local licensing, anti-money laundering controls, and cybersecurity are critical challenges that Airwallex must continue to manage carefully.

Geopolitical tensions, especially between China, the US, and Australia, may also impact cross-border operations, requiring agile risk management and contingency planning.

Looking ahead, Airwallex plans to deepen its product offering in North America and Europe, expand its treasury and lending products, and grow its embedded finance API business. It is positioning itself not just as a payments provider but as the operating system for borderless business.

This Airwallex review highlights how the company is quietly becoming the financial infrastructure of choice for ambitious businesses. By simplifying global money movement, expense management, and financial integration, Airwallex empowers companies to think and operate beyond borders.