Anchorage Digital has become one of the most talked-about names in institutional crypto. In a sector where security, compliance, and trust are paramount, Anchorage has positioned itself as the bridge between traditional finance and digital assets. It is not a retail exchange. It does not chase consumer trading volume. Instead, Anchorage has carved out a niche as a regulated, institution-first crypto platform built on secure custody, compliance, and a suite of financial services.

The story of Anchorage Digital is also the story of crypto’s maturation. Early blockchain adoption was dominated by enthusiasts and retail investors. As institutional interest grew, the need for professional-grade infrastructure became unavoidable. Anchorage stepped into that gap, offering a combination of security technology, regulated status, and integrated services designed for large financial players.

This review explores Anchorage Digital in depth: its origins, technology, services, regulatory approach, competitive positioning, and the challenges it faces as the crypto industry evolves.

Origins and Vision

Anchorage Digital was founded in 2017 by Diogo Mónica and Nathan McCauley, both veterans of security engineering at Square and Docker. From the start, their vision was clear: build a crypto-native custodian that would satisfy the strict requirements of institutions without compromising the decentralization ethos of blockchain.

At the time, most custody solutions relied on cold storage, keeping private keys offline in hardware devices or even physical vaults. While secure, these methods were clunky, slow, and incompatible with active participation in crypto networks. Anchorage argued that custody should not mean “lock it in a box.” Institutions needed security with usability: the ability to stake, vote, trade, and lend while keeping assets safe.

This dual focus, security and functionality, remains at the core of Anchorage’s value proposition.

Custody Technology: Security Without Compromise

Anchorage’s custody solution is built around multi-party computation (MPC) and hardware security modules (HSMs). Instead of storing a single private key in one location, MPC splits cryptographic keys into multiple parts, distributed across secure hardware and controlled environments. No single device ever has the full key, eliminating single points of failure.

The advantage of this approach is that it combines the offline security of cold storage with the accessibility of online systems. Institutions can approve transactions securely without waiting hours or days for manual processes.

Anchorage also integrates policy controls, such as whitelisting addresses, transaction limits, and multi-approver workflows. This allows clients to align custody with internal compliance requirements, a critical need for banks, hedge funds, and asset managers.

By combining cutting-edge cryptography with institutional-grade controls, Anchorage offers custody that is both highly secure and operationally efficient.

Regulated Status: The First OCC-Chartered Crypto Bank

In January 2021, Anchorage Digital Bank received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) to become the first federally chartered crypto bank. This was a milestone not only for Anchorage but also for the broader crypto industry.

The charter allows Anchorage to provide custody and settlement services under federal banking law, giving institutions a regulated partner in a sector often criticized for lacking oversight. For clients such as traditional banks, pension funds, and corporates, the charter adds credibility and assurance.

Anchorage’s regulated status differentiates it from many crypto firms. While others face uncertainty over whether they operate within existing laws, Anchorage positions itself as fully compliant, working with regulators rather than against them.

Services Beyond Custody

Anchorage started with custody but has expanded into a broader suite of services designed for institutions:

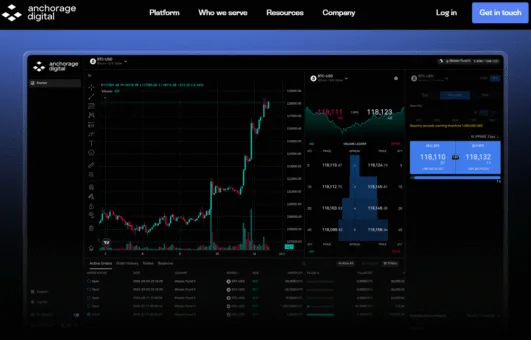

- Trading: Anchorage offers execution services that integrate directly with custody. Clients can trade assets without moving them out of secure storage.

- Staking: Institutions can earn rewards by staking assets like Ethereum, Polkadot, and Solana. Anchorage handles the operational complexity while ensuring assets remain protected.

- Financing: Anchorage provides crypto-backed loans, enabling clients to access liquidity without liquidating holdings.

- Governance: For networks that use on-chain governance, Anchorage enables institutional clients to participate in protocol votes securely.

This expansion reflects Anchorage’s vision of being more than a vault. It aims to be a full-service institutional partner, offering the tools necessary to participate in digital assets at scale.

Anchorage Digital Bank: Bridging TradFi and Crypto

The OCC charter allows Anchorage to operate as a crypto bank. This means it can provide custody and settlement services under federal law while interfacing more seamlessly with traditional finance. For institutions wary of regulatory grey areas, this makes Anchorage a safer entry point.

The charter also positions Anchorage as a bridge between digital assets and the existing financial system. In the long term, Anchorage could play a role in integrating stablecoins, tokenized securities, and central bank digital currencies (CBDCs) into institutional portfolios.

Few competitors have achieved comparable regulatory standing. This is both a moat and a responsibility, as Anchorage is closely watched as a test case for how crypto-native banks can operate within U.S. regulation.

Institutional Clients and Partnerships

Anchorage’s client base includes hedge funds, venture firms, banks, and large corporates. While many names are confidential, Anchorage has been publicly linked to partnerships with Visa and other high-profile institutions.

Visa, for example, has worked with Anchorage as part of its efforts to settle transactions in stablecoins. This demonstrates how Anchorage is not just serving crypto-native funds but also helping traditional financial giants experiment with blockchain.

The diversity of clients reflects Anchorage’s positioning: it is not a retail player, but rather a trusted partner for institutions seeking secure, compliant access to digital assets.

Competitive Landscape

Anchorage Digital operates in a highly competitive space. Other major institutional custody providers include:

- Coinbase Custody: Offers similar services under the Coinbase brand, with deep liquidity integration.

- BitGo: One of the earliest custodians, now part of Galaxy Digital.

- Fidelity Digital Assets: Backed by one of the world’s largest asset managers, offering credibility and scale.

- Fireblocks: Provides custody infrastructure and APIs, used by fintechs and institutions.

Anchorage differentiates itself through its OCC charter, security model, and integrated services like staking and governance. However, competition is fierce, and institutions often use multiple custodians to diversify risk.

| Feature | Anchorage Digital | Coinbase Custody | Fidelity Digital Assets |

|---|---|---|---|

| Founded | 2017 | 2018 (spun out from Coinbase) | 2018 |

| Regulatory Status | OCC-chartered national crypto bank | New York DFS trust company | SEC-registered, backed by Fidelity |

| Core Focus | Institutional custody, staking, governance | Custody integrated with trading liquidity | Institutional-grade custody & execution |

| Technology | MPC + Hardware Security Modules (HSMs) | Cold storage with insurance coverage | Cold + warm storage, Fidelity infrastructure |

| Trading | Integrated execution from custody | Deep integration with Coinbase exchange | Execution services with selected liquidity providers |

| Staking | Yes (ETH, DOT, SOL, etc.) | Yes (ETH, SOL, other PoS assets) | Limited, early-stage integration |

| Client Base | Hedge funds, banks, corporates | Crypto-native funds, institutions | Traditional institutions, asset managers |

| Unique Edge | First U.S. federally chartered crypto bank | Liquidity + custody under one roof | Trust of Fidelity brand, Wall Street credibility |

Challenges Facing Anchorage

Despite its strengths, Anchorage faces challenges that reflect broader trends in crypto:

- Regulatory uncertainty: While Anchorage itself is federally chartered, the overall U.S. regulatory environment for crypto remains fragmented and contentious.

- Market volatility: Institutional demand for custody services often rises and falls with crypto prices. Sustained bear markets reduce activity.

- Competition: Rivals like Coinbase and Fidelity have strong brands and massive resources.

- Scalability: As more institutions enter, Anchorage must continue to expand its infrastructure without compromising security.

- Trust in crypto post-crises: Events like the collapse of FTX have damaged institutional confidence, putting pressure on regulated custodians like Anchorage to restore trust.

How Anchorage navigates these challenges will determine whether it remains a leader or is overtaken by larger players.

Anchorage and the Evolution of Custody

Custody may sound like a niche, but it is foundational to institutional crypto adoption. Without secure custody, large players cannot legally or operationally hold digital assets. Anchorage has been at the forefront of redefining what custody means.

Rather than being passive storage, custody now includes governance, staking, and integrated trading. This evolution reflects the reality that institutions want both safety and utility. Anchorage has positioned itself as a platform where digital assets are not just locked away but actively managed under strict security.

The Broader Significance

Anchorage is more than a company. It represents a test case for how crypto can integrate into mainstream finance responsibly. Its OCC charter gives regulators and policymakers a live example of a crypto-native institution operating within the U.S. banking framework.

If Anchorage succeeds, it could pave the way for more federally chartered crypto banks, accelerating adoption. If it stumbles, critics of crypto may use it as evidence that digital assets cannot be safely managed within existing structures.

This symbolic role adds weight to Anchorage’s journey, making its progress important beyond its own business.

Future Outlook

The future for Anchorage Digital depends on several factors:

- Institutional adoption: If more banks, asset managers, and corporates embrace digital assets, demand for Anchorage’s services will grow.

- Expansion of services: Anchorage could expand into tokenized securities, stablecoin settlement, and CBDC integration.

- Regulatory clarity: Progress on U.S. crypto regulation could solidify Anchorage’s role as a compliant leader.

- Global reach: While U.S.-based, Anchorage may expand internationally to serve global institutions.

Anchorage’s challenge will be balancing innovation with compliance. Its core advantage, regulatory approval, also places constraints. It must innovate carefully without jeopardizing trust.

Conclusion: Institutional Custody and Beyond

Anchorage Digital has carved out a unique role in crypto. By focusing on institutions, prioritizing security, and achieving regulatory approval as a federally chartered bank, it has become a cornerstone of institutional digital asset infrastructure.

Its custody technology, service expansion, and partnerships position it as more than a vault. Anchorage is shaping how institutions will engage with digital assets in the years ahead.

The road ahead is not without challenges. Regulatory battles, market cycles, and competition will test Anchorage’s resilience. But its significance is clear. Anchorage Digital is not only about custody, it is about building the foundations of a regulated, secure, and scalable future for institutional crypto.

For investors, fintech professionals, and policymakers, Anchorage offers a window into where digital assets are heading. Institutional custody is no longer just about holding keys, it is about unlocking the next phase of crypto’s integration with global finance.