In the ever-changing world of financial technology, infrastructure has become the new frontier. For decades, banks and payment providers relied on rigid legacy systems that were difficult to integrate, expensive to maintain, and slow to adapt. Now, a wave of modern core banking providers is challenging this status quo. Among them is Baseella, a London-based SaaS platform founded in 2021 that is already making waves with its modular and cloud-native approach.

This review explores Baseella’s origins, architecture, value proposition, and competitive positioning. It also looks at how the company differentiates itself in an increasingly crowded space of core banking technology and why its model may be particularly well suited to modern PSPs, EMIs, and digital financial institutions.

Company Background

Baseella was founded in 2021 in London, United Kingdom. From the outset, its mission has been clear: to provide a flexible, modular, and scalable core banking solution designed specifically for the new generation of financial services providers.

Unlike traditional core banking systems that evolved from decades-old technology stacks, Baseella was built from the ground up as a cloud-native SaaS platform. This means it is not a legacy system trying to retrofit modern needs, but a purpose-built infrastructure solution designed to address the operational and regulatory challenges that fintechs face today.

The company has quickly gained recognition for its rapid deployments and real-world impact. Early clients have migrated entire banking systems to Baseella over a single weekend, eliminating multiple third-party tools in the process. Others have used the platform to demonstrate fully branded customer portals for investor pitches within just 24 hours of the deployment request. These stories illustrate both the speed and flexibility at the core of Baseella’s proposition.

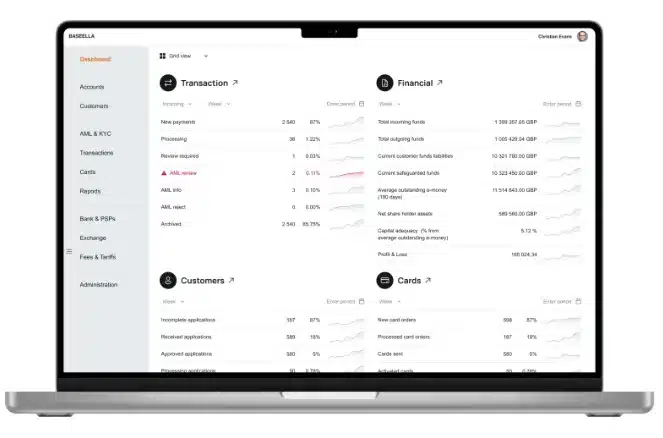

What Baseella Offers

At its core, Baseella provides modular core banking infrastructure for financial institutions. Its services are tailored primarily for Payment Service Providers (PSPs), Electronic Money Institutions (EMIs), and other digital-first financial entities.

The platform’s microservices-based architecture makes it highly adaptable, allowing institutions to select only the modules they need. This reduces both cost and complexity while ensuring scalability as business needs evolve.

Some of Baseella’s standout features include:

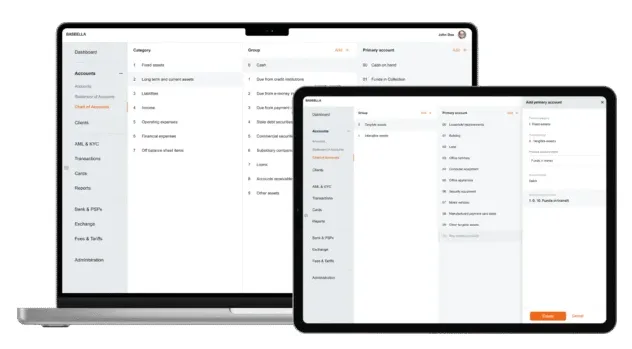

- Core Banking Engine: A fully integrated core capable of handling multicurrency accounts, ledgers, and transactions at scale.

- Powerful APIs: Developer-first interfaces that enable seamless integration with existing systems or third-party services.

- Compliance Tools: Built-in KYC/AML modules, transaction monitoring, and risk scoring to meet strict regulatory requirements.

- CRM: unlike many others, Baseella offers a powerful customer relationship module, with customer lifecycle management, secure messaging and notifications, documents repository, profitability statistics, etc.

- Fiat and Crypto Support: The ability to operate across traditional and digital asset rails, a growing necessity in today’s hybrid financial environment.

- Powerful management and financial reporting: Baseella core banking system was designed as an accounting system first of all, which enables PSPs to produce real-time financial and management reports.

- Customisable Customer Portals: White-label web interface and mobile apps for clients to deliver branded digital banking experiences without lengthy development cycles.

- Licensing Support: Assistance for institutions in the process of obtaining licenses, helping them demonstrate operational readiness to regulators and investors.

By unifying these features in one platform, Baseella eliminates the need for institutions to purchase multiple third-party tools, reducing both costs and operational complexity.

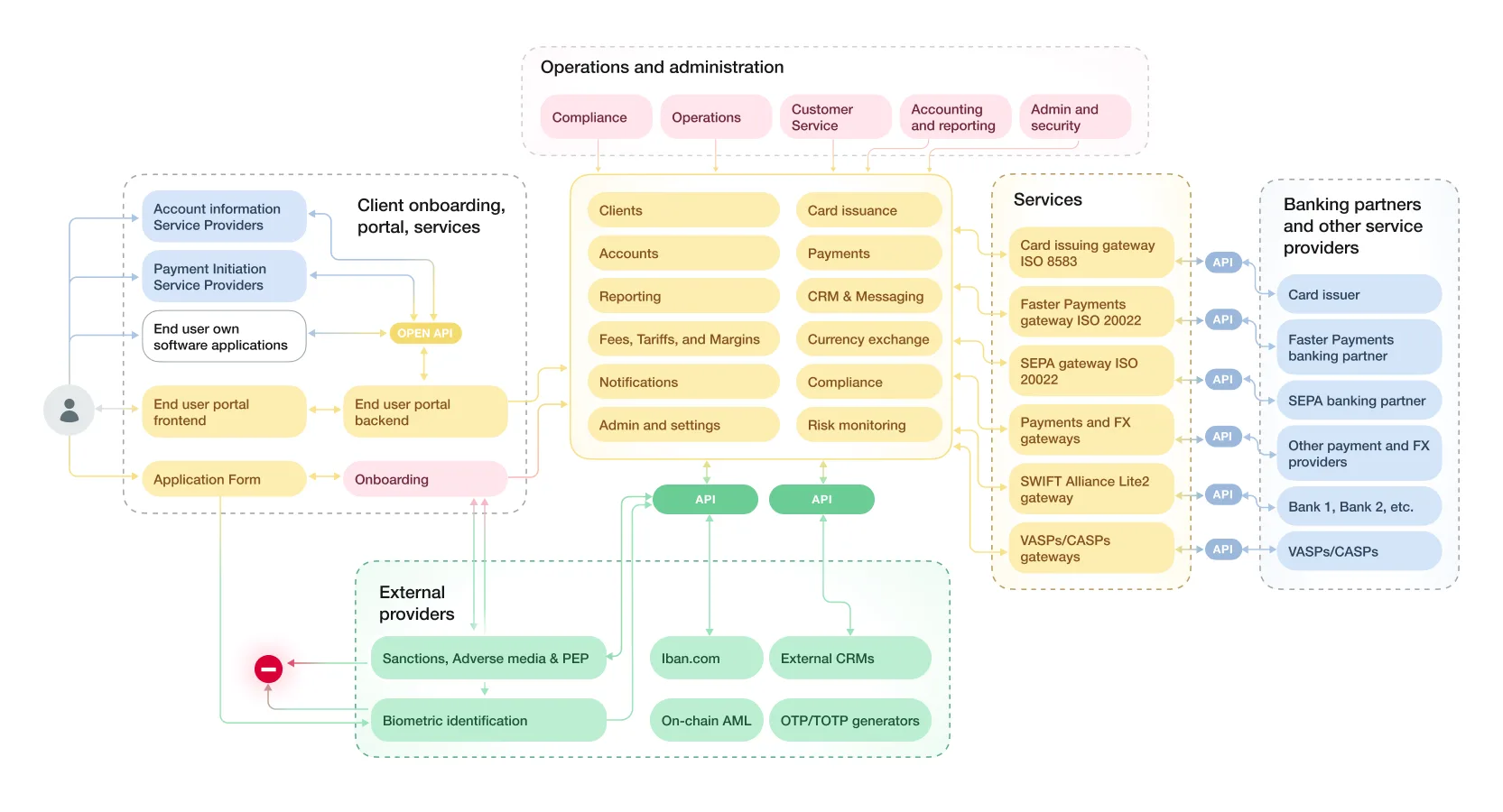

Architecture and Deployment

A defining characteristic of Baseella is its cloud-native architecture. Unlike monolithic systems that are hard to scale or update, Baseella is built around modular microservices. Each function, such as onboarding, compliance, or accounting, operates independently, but integrates seamlessly into the broader platform.

This design ensures:

- Scalability: Institutions can expand without re-architecting their systems.

- Resilience: Failures in one service do not bring down the entire system.

- Flexibility: New modules can be added or removed without disruption.

- Speed of Deployment: Clients can be onboarded and operational in hours rather than months.

This approach is not just theoretical. As highlighted in recent client case studies, Baseella has delivered a complete core banking system with branded customer portals overnight, proving that deployment speed is a key differentiator.

Compliance by Design

For fintechs, compliance is often the biggest obstacle to growth. Regulatory expectations around KYC, AML, and transaction monitoring continue to rise, and non-compliance can result in heavy fines or loss of license.

Baseella has embedded compliance at the heart of its offering. Instead of treating it as an afterthought, the platform includes built-in compliance tools such as:

- Automated KYC checks with biometric identification and ID document authentication.

- AML/CTF/sanctions/PEP/ adverse media customer and transaction monitoring with customizable rules and alerts.

- Risk scoring models to assess customer and transaction risk in real-time.

- Audit-ready reporting to simplify regulatory oversight.

By providing these features out-of-the-box, Baseella enables financial institutions to focus on customer growth rather than building compliance infrastructure from scratch.

Crypto and Fiat Rails

One of Baseella’s distinctive advantages is its dual support for traditional fiat systems and crypto assets. As more financial institutions explore digital asset integration, platforms that can bridge both worlds have a clear edge.

This dual capability positions Baseella as a future-ready solution. A PSP or EMI can start with fiat rails and later integrate crypto without migrating to a new core provider. It also helps institutions target broader customer segments, from traditional retail banking to next-generation Web3 users.

Use Cases and Success Stories

Baseella’s flexibility makes it suitable for a wide range of use cases, including:

- Payment Service Providers looking for fast, compliant infrastructure to launch and scale across multiple jurisdictions.

- Electronic Money Institutions that need robust core banking with full compliance integration.

- Fintech Startups seeking rapid deployment to demonstrate capabilities to investors.

- Neo-banks and Challenger Banks aiming for cost-efficient operations with modular functionality.

- Crypto-Friendly Institutions bridging fiat and blockchain ecosystems.

Real-world examples highlight the platform’s impact:

- A client migrated to Baseella over a single weekend, replacing multiple third-party tools and reducing annual costs significantly.

- Another client required a live system for an investor pitch and was provided with a fully functional branded portal in less than 24 hours, helping them secure venture capital funding.

These cases underscore Baseella’s promise of speed, adaptability, and tangible business impact.

Competitive Landscape

The core banking market is undergoing a significant transformation. Long dominated by legacy giants such as Temenos, FIS, and Oracle, the space is now seeing rapid disruption from cloud-native challengers. Companies like Thought Machine, Mambu, and 10x Banking have attracted global attention for their modern architectures and developer-first platforms.

Baseella enters this competitive arena with a distinctive proposition:

- Speed and Agility: Ultra-fast deployments set it apart from slower-moving incumbents and even some modern challengers.

- All-in-One Compliance: While competitors often require third-party compliance tools, Baseella integrates them directly.

- SME and Startup Focus: By targeting PSPs, EMIs, and smaller digital banks, Baseella addresses a segment that often finds large platforms too expensive or complex.

- Crypto Integration: Dual support for fiat and crypto is still relatively rare among core providers, giving Baseella a niche advantage.

In many ways, Baseella positions itself as the “startup’s choice” for core banking. It is offering affordability, speed, and compliance without the overhead of enterprise-scale systems.

Business Model and Value Proposition

Baseella operates as a SaaS platform, with clients paying subscription fees for access to its infrastructure. This model aligns with the broader trend of financial institutions shifting from capital-intensive IT projects to scalable, pay-as-you-grow services.

The company’s value proposition rests on three pillars:

- Cost Efficiency: By replacing multiple third-party tools with one unified platform, Baseella reduces annual technology expenses.

- Time-to-Market: Deployments measured in hours or days rather than months accelerate client growth.

- Regulatory Alignment: Built-in compliance ensures institutions remain aligned with regulatory frameworks across jurisdictions.

Together, these pillars make Baseella attractive not just to fintech startups, but also to established institutions seeking to modernize without the pain of legacy migrations.

Challenges Ahead

Like any emerging fintech infrastructure provider, Baseella faces challenges as it scales. These include:

- Market Awareness: Competing against larger, well-funded rivals requires strong brand-building and partnerships.

- Integration Ecosystem: While Baseella provides powerful APIs, expanding its ecosystem of integrations will be key to attracting larger clients.

- Regulatory Complexity: Supporting clients across multiple jurisdictions demands continuous updates to stay ahead of evolving rules.

- Scalability Proof Points: As more clients onboard, demonstrating resilience under heavy transaction volumes will be critical.

The company’s early track record is promising, but continued success will depend on navigating these challenges effectively.

The Future of Baseella

Looking ahead, Baseella’s growth potential lies in expanding its reach among PSPs, EMIs, and digital banks globally. Its modular, compliance-first architecture positions it well for both developed and emerging markets.

Potential future directions may include:

- Deeper Crypto Integration: Supporting tokenized assets, CBDCs, or stablecoins.

- AI-Driven Compliance: Leveraging machine learning for fraud detection and risk scoring.

- Partnership Ecosystem: Collaborating with fintech enablers, accelerators, and regulatory sandboxes.

- Geographic Expansion: Growing beyond Europe into Asia, Africa, and Latin America where demand for digital banking infrastructure is rising rapidly.

If Baseella can sustain its current pace of innovation, it could emerge as a leading player in the new generation of core banking providers.

Conclusion

Baseella represents the new wave of financial infrastructure. Modular, cloud-native, and compliance-driven. By addressing the pain points of speed, flexibility, and regulatory alignment, it provides a compelling alternative to both legacy cores and high-cost modern incumbents.

For PSPs, EMIs, and fintech startups, the ability to launch quickly, scale seamlessly, and meet regulatory requirements without patching together multiple systems is invaluable. Baseella’s early success stories, such as migrating entire systems in a weekend or enabling investor-ready platforms overnight, underscore the strength of its model.

While challenges remain in scaling, brand recognition, and regulatory navigation, Baseella’s proposition is clear. It is an agile partner for financial innovators who want to focus on growth, not infrastructure headaches.

In a world where fintech success often hinges on speed to market and compliance resilience, Baseella offers both. Its story is still being written, but the trajectory points toward a future where modern financial institutions can truly build, adapt, and grow on a unified yet customizable core.