Managing your money is easier than ever. If you use the right tools. Today’s budgeting apps do more than track expenses. They connect to your bank, categorise spending, offer savings tips, and help you set financial goals. Finding the best budgeting apps for banking can make the difference between guessing your balance and actually planning your future.

In 2025, these apps are smarter, more secure, and more tightly integrated with digital banking services. Whether you’re saving for a holiday, managing household bills, or trying to get out of debt, a good budgeting app can provide clarity and structure to your personal finance.

Why Bank-Linked Budgeting Tools Are Essential

Traditional spreadsheets or standalone expense trackers no longer cut it. Modern users expect their budgeting app to pull real-time data directly from their bank. This allows for automated categorisation, better insights, and more accurate forecasting.

Furthermore, these tools must provide:

- Secure bank connectivity with encryption and two-factor authentication

- Clear dashboards for income, expenses, and savings goals

- Customisable categories and alerts

- Suggestions for spending limits or monthly budgets

- Insights into recurring charges and unusual activity

Because many banks now offer basic budgeting features, third-party apps must add value through automation, personalisation, and usability.

Top Budgeting Apps That Sync with Banks

Here are some of the best budgeting apps that work seamlessly with bank accounts in 2025:

1. Emma

Emma connects to hundreds of banks and fintech services. It tracks subscriptions, highlights duplicate charges, and gives users insights into overspending. Its user-friendly interface makes it ideal for those new to budgeting.

2. YNAB (You Need A Budget)

YNAB is designed around goal-based budgeting. It encourages users to give every pound a purpose and supports proactive financial planning. It syncs with major banks and provides detailed reports and coaching.

3. Snoop

Snoop helps users spot ways to save. It connects with your bank, analyses spending, and recommends better deals or cheaper providers. It’s a great choice for cutting costs and managing day-to-day finances.

4. Moneyhub

Popular in the UK, Moneyhub offers secure bank integration and deep financial insights. It’s suitable for individuals and financial advisers, combining budgeting tools with net worth tracking.

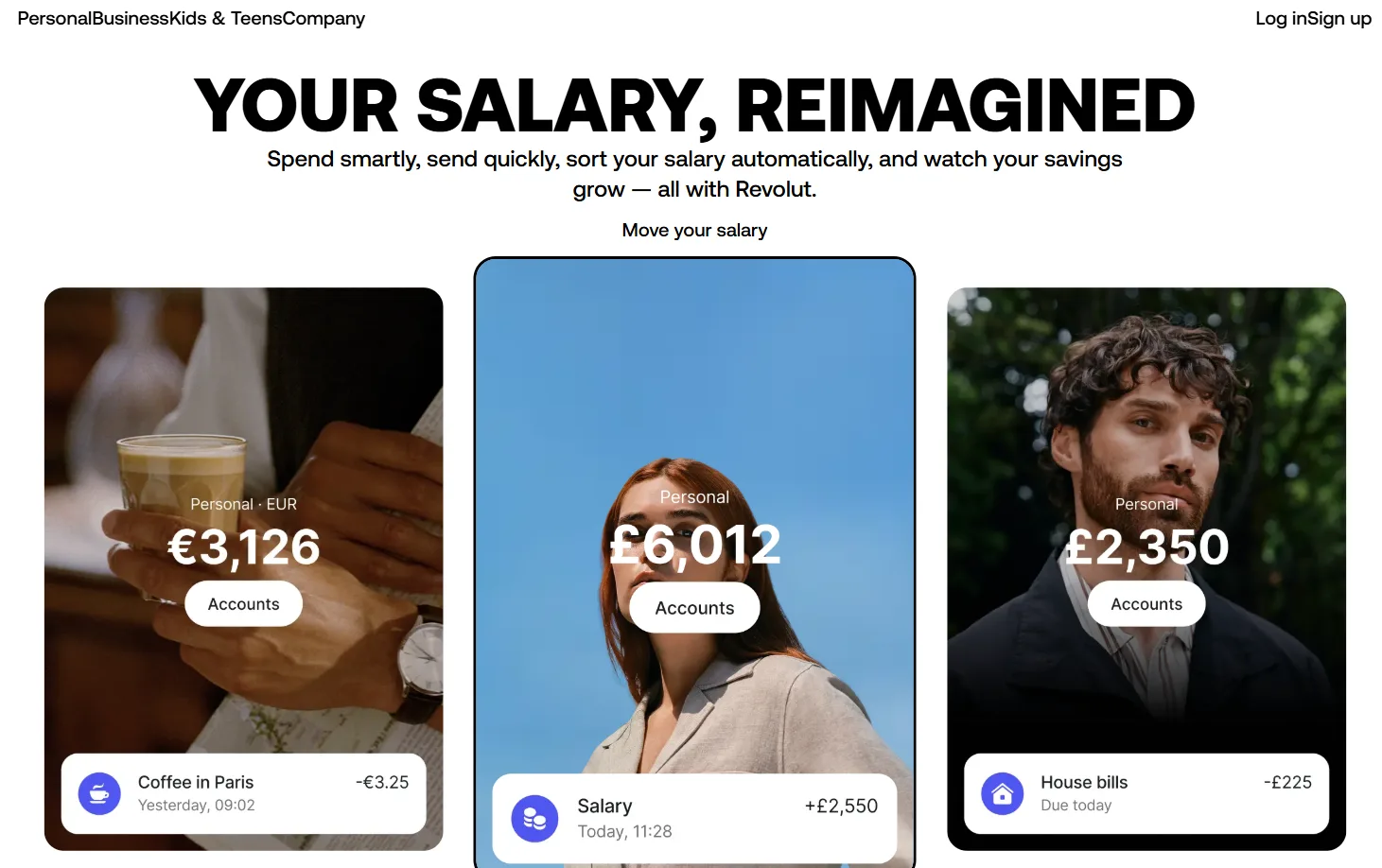

5. Monzo and Revolut (built-in tools)

If you already bank with Monzo or Revolut, their built-in budgeting features are very strong. They provide instant categorisation, spending limits, and custom insights. All directly in the banking app.

What to Consider When Choosing

Not every app suits every user. When comparing options, look for:

- Bank compatibility: Does it support your bank and update reliably?

- User interface: Is it easy to understand and navigate daily?

- Custom features: Can you set unique goals or alerts?

- Data security: Is your financial data encrypted and protected?

- Cost: Free versions often suffice, but premium features may justify a subscription

Testing two or three apps can help you find the best fit for your financial habits and goals. The best budgeting apps for banking make personal finance simple, personal, and actionable. They turn data into decisions and help users understand how small changes improve long-term financial health.