Microfinancing has become a powerful tool for promoting financial inclusion and economic empowerment around the world. By providing small loans and financial services to individuals and small businesses that lack access to traditional banking, microfinancing supports entrepreneurship, especially in low-income and rural communities.

In this article, we explore some of the best examples of microfinancing from different regions and models, highlighting their structure, impact, and innovations.

Grameen Bank – Bangladesh

No discussion of microfinancing is complete without mentioning Grameen Bank. Founded in 1983 by Nobel Laureate Muhammad Yunus, Grameen Bank pioneered the modern concept of microcredit.

It provides small, collateral-free loans to women in rural Bangladesh, enabling them to start or expand small businesses such as weaving, livestock farming, or selling goods at local markets. Repayment rates have consistently been above 95%.

Grameen’s model emphasises trust, community accountability, and regular group meetings, rather than legal contracts. This approach has inspired microfinance institutions (MFIs) across the globe.

Kiva – Global (US-Based)

Kiva is a non-profit platform that connects lenders and borrowers across the world through crowdfunding. Individuals can lend as little as $25 to support entrepreneurs in over 80 countries.

What sets Kiva apart is its ability to connect small-scale lenders with verified micro borrowers, often through local field partners. Kiva supports projects in agriculture, education, and small business, with most loans repaid over 6 to 18 months.

Kiva blends philanthropy with finance, offering a zero-interest lending model that makes micro loans accessible and transparent for donors and borrowers alike.

SKS Microfinance – India

India’s microfinance market is one of the largest in the world. SKS Microfinance, now part of Bharat Financial Inclusion, was one of the country’s earliest large-scale micro lenders.

It provides loans to rural women, often structured as joint liability groups. Borrowers use funds to purchase seeds, livestock, or retail inventory. Loan sizes typically range from INR 10,000 to 50,000 (£100 to £500).

The Indian model has increasingly integrated with digital banking and Aadhaar-linked KYC, making micro lending faster, scalable, and compliant with financial regulations.

BancoSol – Bolivia

BancoSol is a prominent example of a microfinance institution that evolved into a full-service bank. It started as an NGO and now operates under Bolivia’s formal banking system while still serving low-income entrepreneurs.

The bank offers micro loans, savings accounts, and financial education to thousands of small vendors, artisans, and farmers. Its average loan size is small by traditional standards, but significant in the context of local economies.

BancoSol demonstrates how microfinance can scale sustainably within regulated banking, without losing its focus on financial inclusion.

Musoni – Kenya

Musoni is an innovative microfinance institution in Kenya that operates entirely without paper. It uses mobile technology to disburse, track, and collect loans via mobile money systems like M-Pesa.

Clients apply for loans through mobile channels and receive funds within hours. Musoni also uses alternative credit scoring based on mobile usage and digital footprint.

This model reduces operational costs and makes it easier for borrowers in remote areas to access credit. Musoni is a strong example of fintech-enabled microfinance that bridges the gap between modern technology and underserved populations.

FINCA International – Global

FINCA (Foundation for International Community Assistance) operates in over 20 countries, offering small loans, savings products, and social enterprise support. It focuses on low-income entrepreneurs, particularly women.

FINCA’s microfinance model is tailored to local conditions, with flexible repayment structures and support services. It also invests in social performance measurement to ensure long-term impact.

Over the years, FINCA has expanded from traditional microcredit to include digital finance, energy lending, and health access, making it one of the most diversified microfinance operators.

BRI Micro Banking – Indonesia

Bank Rakyat Indonesia (BRI) is one of the largest state-owned banks in Indonesia. Its micro banking division is focused on serving small traders, farmers, and rural entrepreneurs.

BRI uses a decentralised model where field agents operate locally and understand the needs of the community. It also offers micro savings accounts and insurance products.

BRI shows that government-supported microfinance can be effective when paired with market-based principles and community engagement.

Tala – Philippines, Mexico, Kenya, India

Tala is a fintech app offering small loans through mobile phones in emerging markets. Using non-traditional credit scoring, Tala analyses smartphone data, such as app usage and SMS patterns, to assess risk.

Loans are approved in minutes and disbursed via mobile money or bank transfer. Tala’s model makes it possible to reach unbanked populations with no formal credit history, offering loans of $10 to $500.

As a mobile-first lender, Tala is an excellent example of how microfinance is adapting to a digital-first generation.

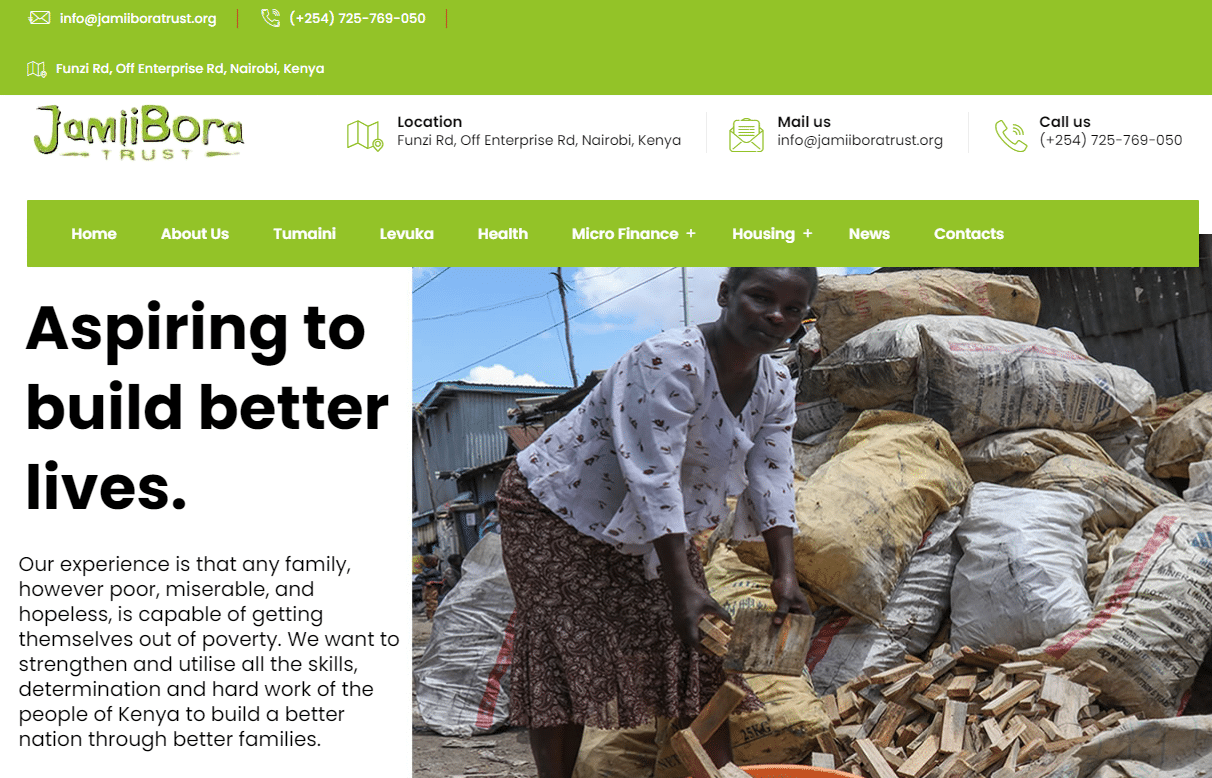

Jamii Bora – Kenya

Jamii Bora, now part of Faulu Microfinance Bank, started as a small initiative to help street beggars and low-income women in Nairobi access credit. It has grown into a licensed deposit-taking microfinance institution.

The programme offers group loans, business training, and micro health insurance. Clients are encouraged to form savings groups, with joint accountability for repayment.

Jamii Bora’s success lies in community-driven lending and its emphasis on transforming lives beyond finance through education and support.

VisionFund – Global

VisionFund is the microfinance arm of World Vision, a humanitarian organisation. It operates in Africa, Asia, Latin America, and Eastern Europe.

VisionFund combines micro loans with social impact objectives, including child education, health, and disaster recovery. It works through community-based models and integrates with World Vision’s wider development programmes.

It is one of the best examples of mission-led microfinance, where the goal extends beyond profit to sustainable community empowerment.

Conclusion

Microfinancing continues to be a catalyst for grassroots economic growth. Whether through digital innovation, community lending, or hybrid financial models, these examples demonstrate that small loans can make a big difference.

From the women of Bangladesh to digital borrowers in Kenya, microfinance is proving to be one of the most scalable and impactful financial tools of the modern age.