In 2025, virtual banks are no longer a niche alternative. They are mainstream. Millions of consumers now rely on digital-only financial platforms for everyday banking. Whether it is for checking accounts, savings, credit, or international transfers, the best virtual banks in 2025 offer simplicity, transparency, and better tools than many traditional institutions.

These banks operate without physical branches. Instead, they use mobile apps, real-time APIs, and smart automation to deliver personalised, efficient services. As competition grows, standout virtual banks combine intuitive design with features that empower users to manage money on their terms.

In this article, we explore the top virtual banks for 2025, what makes them exceptional, and how they serve the evolving needs of digital-first customers.

What Defines a Top Virtual Bank?

A leading virtual bank should offer more than a sleek interface. It needs to deliver consistent value across four key areas:

- Product depth: From accounts and cards to savings, lending, and budgeting tools

- Fee transparency: No hidden charges, with competitive rates and fair terms

- Technology infrastructure: Fast transfers, uptime reliability, and responsive apps

- Customer empowerment: Features that help users track spending, build credit, and improve habits

The best virtual banks combine functionality with financial literacy, supporting smarter decisions, not just faster transactions.

Top Virtual Banks Leading the Pack

1. Revolut

Revolut remains one of the most complete virtual banking platforms. Users benefit from:

- Multi-currency accounts and real-time exchange

- Crypto, stock, and ETF investing

- Built-in budgeting and analytics

- Global cards with fee-free international spending

Revolut’s expansion into credit, savings vaults, and business banking makes it a top choice for flexible, global users.

2. Monzo

UK-based Monzo has become a customer favourite thanks to its user-first design. Features include:

- Fee-free accounts and smart savings pots

- Salary advances and overdraft management

- Built-in bills splitting and group accounts

- Transparent loan and credit card options

Monzo shines in everyday use cases, helping users stay organised and financially aware.

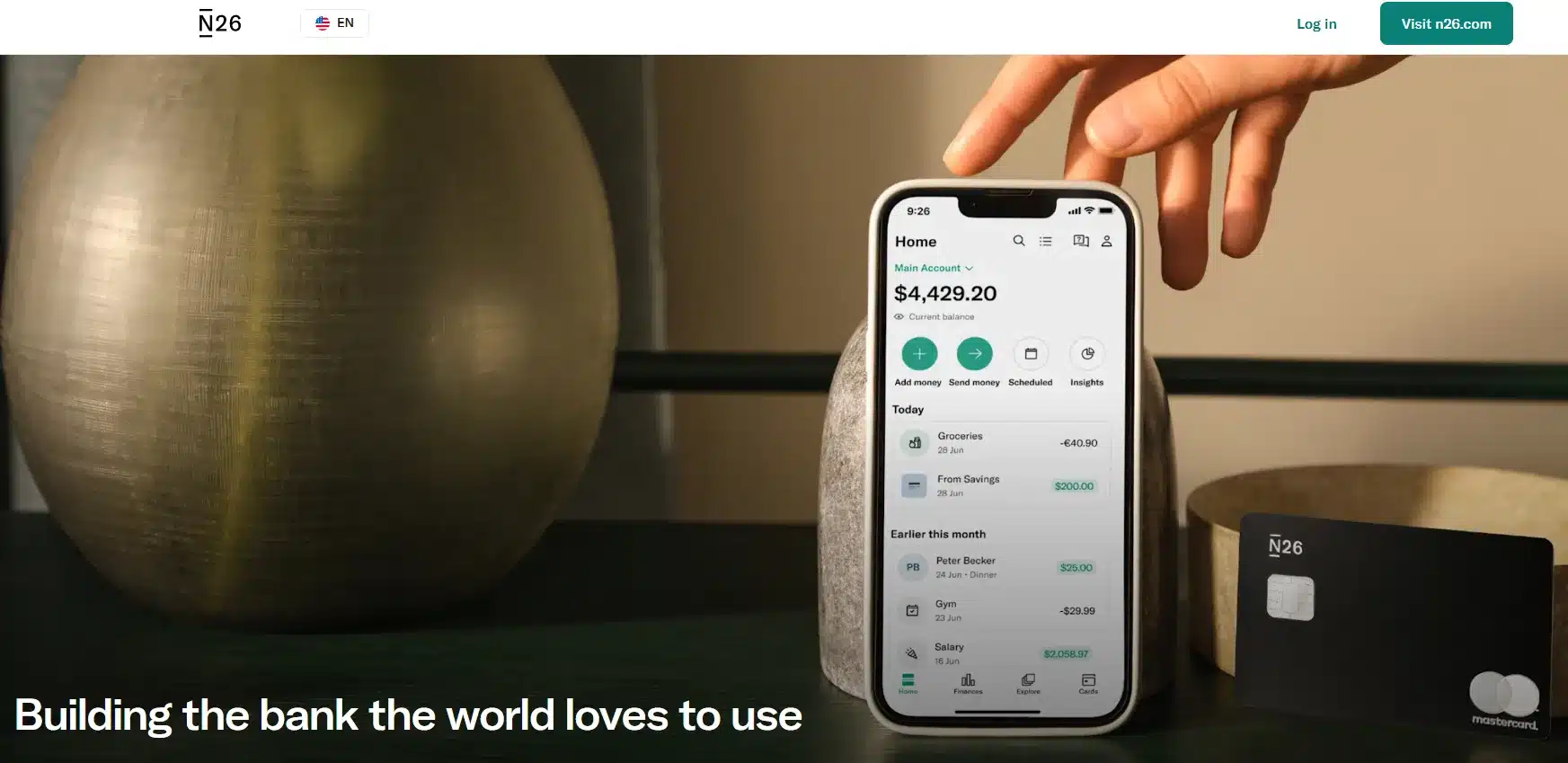

3. N26

N26 delivers clean, efficient banking across Europe and the US. Its app includes:

- Real-time transaction notifications

- Custom sub-accounts for budgeting

- Google Pay and Apple Pay integration

- Paid tiers with insurance and travel benefits

The bank’s focus on simplicity and modern financial tools makes it ideal for those who value frictionless digital access.

4. Chime

In the US, Chime has become the go-to bank for users seeking no fees, early direct deposits, and credit building tools. With features like SpotMe and a secured credit builder card, Chime supports users with limited financial histories or irregular income patterns.

Its strategy of pairing ease of use with practical tools has won over millions of users, especially in underserved segments.

5. Current and Varo

These two US-based virtual banks are closing the gap by offering:

- Competitive APYs on savings

- Early paycheque access

- Integrated budgeting tools

- Youth accounts and financial education features

Both continue to add credit, investing, and crypto support, making them compelling all-in-one options.

What to Watch in 2025

The best virtual banks in 2025 are investing heavily in:

- AI-powered financial insights and alerts

- Real-time fraud detection and biometric security

- Embedded finance features like subscription cancellation and bill negotiation

- Cross-border capabilities for a globalised workforce

Additionally, partnerships with fintech platforms and third-party apps are enhancing flexibility. Allowing users to build their own personalised financial stack.

The best virtual banks in 2025 combine efficiency, clarity, and powerful financial tools in one app. They support real people in managing real-life finances. Offering better alternatives to outdated systems and impersonal service.