In the world of modern investing, few companies have had the impact and staying power of Betterment. Founded in 2008, Betterment was a trailblazer, launching one of the first fully automated robo-advisors at a time when wealth management was still largely reserved for the affluent and manual in nature. Fast forward more than a decade, and Betterment has evolved well beyond its robo-advisory roots, positioning itself as a comprehensive digital wealth platform serving both retail investors and businesses.

This review explores Betterment’s journey from fintech innovator to mature wealth management player. We’ll look at its core offerings, investment methodology, pricing, user experience, strengths, and limitations. Whether you’re a hands-off investor, a small business owner, or someone planning for retirement, Betterment now offers a range of tools that aim to make wealth building more accessible and personalised.

The Origins of Betterment: Democratising Investing

Betterment was born out of frustration with the traditional investing world. Jon Stein, the company’s founder, saw a financial services industry that was confusing, expensive, and inaccessible to the average person. Along with early team members, he envisioned a new type of investment service. One that used software, not human advisors, to construct portfolios and manage money in a cost-efficient, automated way.

The result was Betterment, which officially launched to the public in 2010 at TechCrunch Disrupt. It gained early traction by offering a low-cost, easy-to-use platform that automated key investing tasks: asset allocation, rebalancing, and tax optimisation. In doing so, Betterment helped birth the broader robo-advisor category, a market segment that has since grown into a multi-billion-dollar industry.

From Robo to Full-Stack Wealth Management

Betterment’s early pitch was clear: a robo-advisor that uses modern portfolio theory and ETFs to provide diversified, goal-based investing. Over time, the company expanded its services to reflect the increasingly complex needs of its users. What began as an investment-only platform gradually transformed into a full-spectrum wealth management solution.

Today, Betterment offers the following core services:

- Automated Investing with personalised portfolios

- Cash Management, including checking and high-yield cash accounts

- Crypto Investing through curated portfolios

- Retirement Planning with IRAs, Roth IRAs, and 401(k) rollovers

- Financial Planning Tools and access to human advisors

- Betterment for Business, an automated 401(k) solution for employers

- Betterment for Advisors, a white-label robo-advisor solution for financial professionals

This evolution has enabled Betterment to serve a wider audience. From novice investors and high-net-worth individuals to small business owners and independent advisors.

Investment Strategy: Passive, Diversified, and Goal-Based

At the heart of Betterment’s platform is a passive investment philosophy built on diversification, low-cost ETFs, and algorithmic management. Users start by setting financial goals (such as retirement, buying a home, or building wealth) and answering questions about their risk tolerance and time horizon.

Based on this information, Betterment constructs a personalised portfolio that typically includes a mix of:

- US stocks (via ETFs like VTI)

- International stocks (VEA, VWO)

- US bonds (BND, TIP)

- International bonds

- Real estate and other diversifiers

- Optional crypto assets (BTC, ETH via grayscale-like trusts)

Portfolios are automatically rebalanced as markets shift, and dividends are reinvested. Users can also apply tax-loss harvesting strategies to reduce capital gains liabilities, a feature once reserved for high-end wealth managers.

The platform offers both Core Portfolios, designed with Betterment’s in-house methodology, and Flexible Portfolios, which allow users to adjust asset class weights. For values-based investors, Betterment also offers Socially Responsible Investing (SRI) portfolios, including climate impact and broad ESG variants.

Betterment Premium: Access to Human Advice

For many years, Betterment was purely digital. However, as users’ financial lives became more complex, the need for human guidance grew. In response, Betterment introduced Premium, a hybrid plan that combines robo-advisory automation with access to real, certified financial planners (CFPs).

Betterment Premium is available for clients with at least $100,000 in assets. It includes:

- Unlimited calls and emails with a financial advisor

- Guidance on external accounts (like 401(k)s, pensions, or real estate)

- Personalised financial planning for retirement, taxes, and large purchases

This hybrid model helps Betterment bridge the gap between digital convenience and human expertise, offering clients a more holistic experience without transitioning to a traditional advisor.

Cash Management and Everyday Banking

Betterment’s wealth platform extends beyond investing. It also offers:

- Betterment Checking, a no-fee checking account with a Visa debit card, mobile check deposit, and no minimum balance

- Betterment Cash Reserve, a high-yield cash account designed to store emergency savings and short-term funds, often earning higher interest than traditional banks

These cash tools are integrated with Betterment’s goal-based system, allowing users to allocate money toward specific savings objectives and track progress.

Is Betterment FDIC-insured?

Yes, funds held in Cash Reserve are FDIC-insured up to $2 million through program banks.

By integrating basic banking functionality, Betterment aims to be more than an investment platform. It positions itself as a full financial command center.

Crypto Investing: A Cautious Entry

In 2022, Betterment began offering cryptocurrency investing through diversified crypto portfolios. These portfolios provide exposure to top crypto assets like Bitcoin and Ethereum via trusts or ETFs, rather than direct custody.

Key features of Betterment’s crypto offering include:

- Professionally managed portfolios

- Risk-adjusted allocations based on investor profiles

- Education and disclosures to help users understand volatility

Betterment’s approach to crypto is intentionally conservative. Rather than appealing to speculative traders, the platform aims to help long-term investors allocate a small, controlled portion of their portfolio to crypto as a diversifier.

Betterment for Business: 401(k) Solutions for Employers

Betterment isn’t just for individuals. It also provides a digital 401(k) solution for small and mid-sized businesses. Betterment for Business offers:

- Low-cost, automated retirement plans for employees

- Modern user experience and mobile app

- Employer tools for managing contributions and compliance

- Integration with payroll providers

This B2B offering has grown significantly, appealing to startups and SMBs that want to offer employee benefits without the complexity or cost of traditional providers. It also serves as a channel for user acquisition. Employees who start with a Betterment 401(k) often open personal accounts on the platform later.

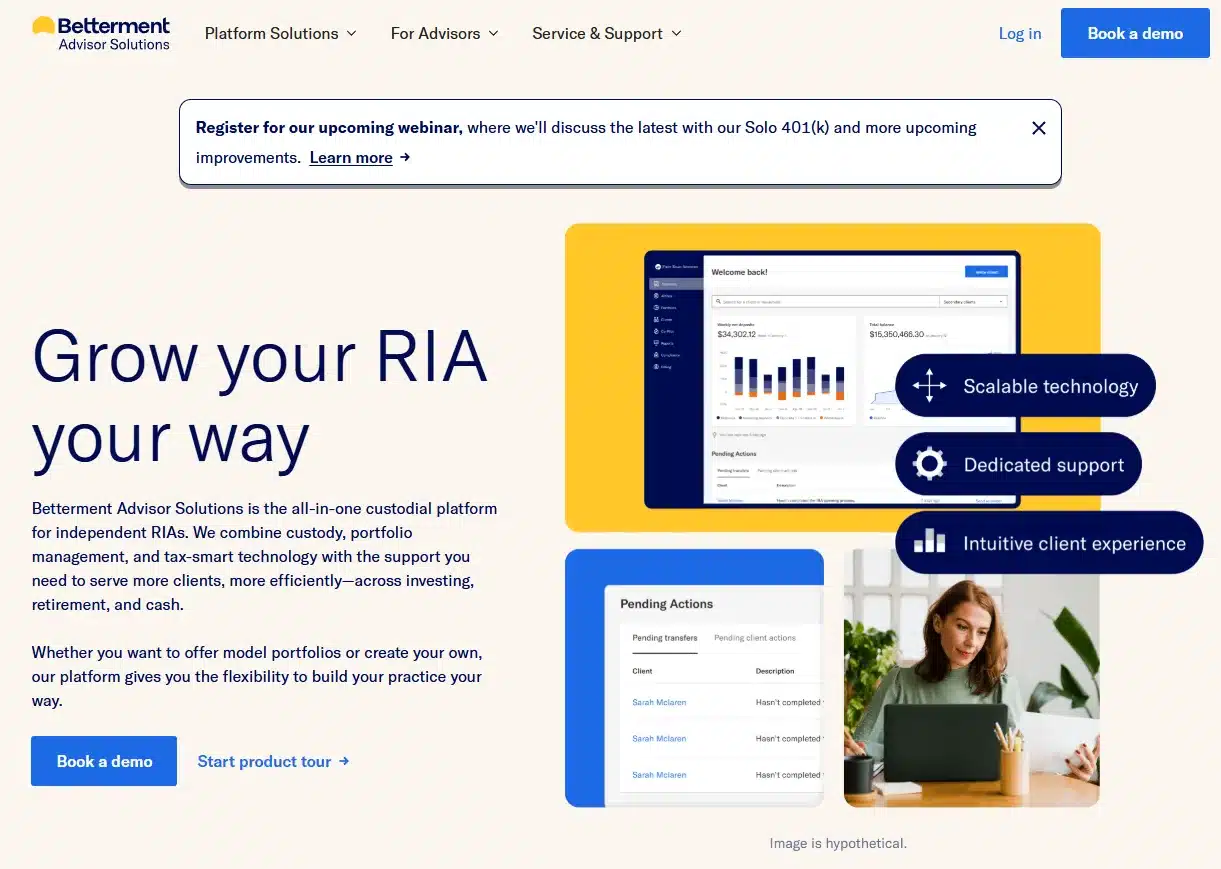

Betterment for Advisors: A White-Label Robo Platform

Another extension of Betterment’s platform is its offering for financial advisors. Betterment for Advisors provides RIAs with a digital backend to manage client portfolios using Betterment’s infrastructure. Advisors can:

- Customise investment strategies

- Automate account management and billing

- Access performance reporting tools

- Serve clients more efficiently with a digital-first experience

This business line positions Betterment not just as a consumer-facing brand, but as a fintech infrastructure player in the broader advisory ecosystem.

User Experience and Mobile App

Betterment is widely praised for its user interface. The platform is clean, intuitive, and designed for goal-based planning. Key features of the user experience include:

- Easy onboarding with risk profiling and goal setting

- Dynamic projections and progress tracking

- Clear performance reporting

- Automatic rebalancing and tax optimisation in the background

The mobile app replicates most of the desktop functionality, making it simple to track goals, move money, or contact advisors on the go. Biometric login, in-app support, and intuitive navigation have helped Betterment maintain high app store ratings across both iOS and Android.

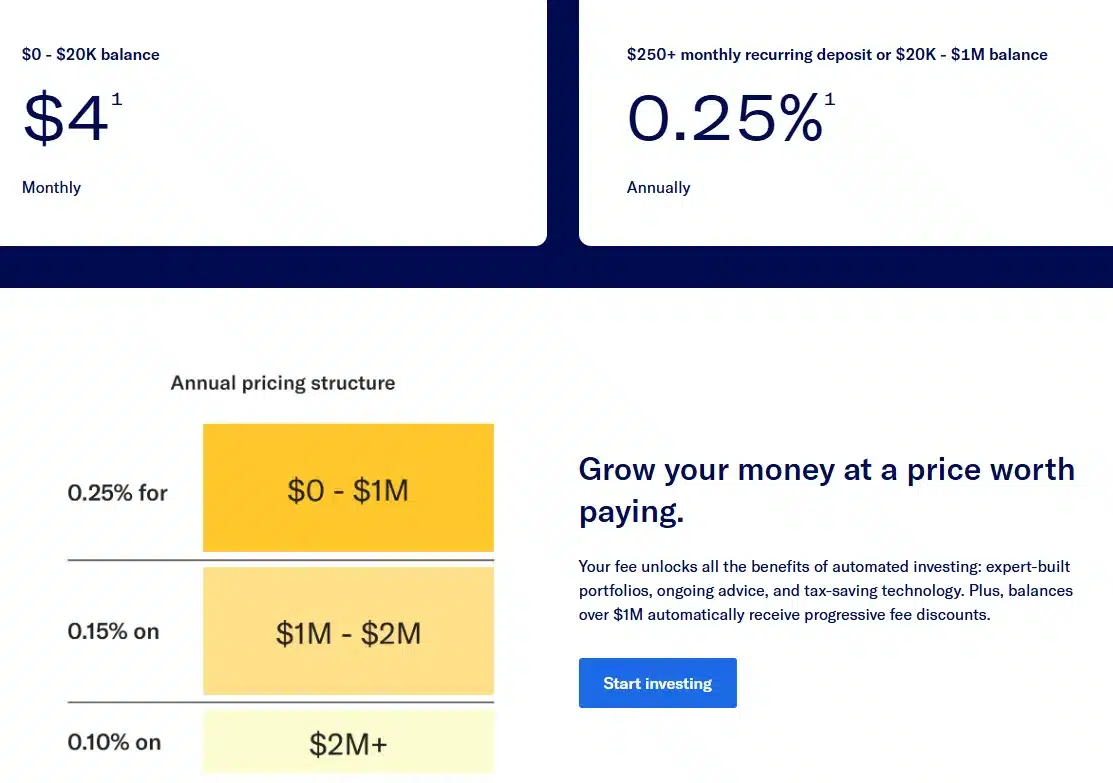

Pricing: Transparent and Competitive

Betterment’s pricing structure is transparent and affordable:

- Digital Plan: 0.25% annual fee with no minimum balance

- Premium Plan: 0.40% annual fee, requires $100,000 minimum

- Betterment for Advisors: Custom pricing for RIAs

- Betterment for Business: Varies by employer size and plan configuration

Cash Reserve and Checking accounts do not have monthly fees. Crypto portfolios carry an additional fee of around 1%, including fund fees and Betterment’s management cut.

Overall, Betterment remains one of the most competitively priced hybrid wealth platforms, especially for clients with simple financial needs.

Pros of Using Betterment

- Low-cost, automated investing with diversified portfolios

- Goal-based planning aligned with personal objectives

- Tax-loss harvesting and rebalancing included

- Hybrid advice model with CFP access (Premium)

- Cash and crypto integration under one roof

- User-friendly interface and highly rated mobile app

- Business and advisor tools for 401(k)s and RIAs

Potential Drawbacks

- No direct indexing or custom individual stock portfolios

- Premium plan requires a $100K minimum

- Crypto offering is limited and higher cost

- Lacks some advanced planning features found in full-service firms

- No physical branches or in-person consultations

Competition: Where Betterment Stands Today

Betterment vs leading digital wealth competitors in 2025

| Platform | Type & Positioning | Core Strengths | Fees & Pricing Snapshot* | Differentiators | Potential Gaps |

|---|---|---|---|---|---|

| Betterment | Robo + Hybrid All-in-one | Holistic product suite UX excellence Tax features | Transparent, competitive robo pricing; add-on for human advice. | Hybrid advice option, cash & checking, goals-driven planning Platform depth | Pressure from low-fee rivals; must keep innovating on personalisation. |

| Wealthfront | Robo-only Tech-forward | Automation Direct indexing Cash management | Low robo fee with strong automation value. | APIs, self-serve tools, sophisticated portfolio features. | No human advisors; narrower advice path vs hybrid peers. |

| Fidelity Go | Incumbent Robo | Brand trust Account range Research access | Very competitive at lower balances; simple tiers. | Seamless tie-in with Fidelity ecosystem and service. | UX feels more “brokerage-first” than app-native for some users. |

| Schwab Intelligent Portfolios | Incumbent Robo | Scale Low headline fees Wide products | Low/zero advisory fee model; cash allocations vary. | Deep Schwab platform, branches, retirement services. | Cash drag concerns; less elegant UX than pure-play robos. |

| SoFi | Super-app Bank + Invest | One-stop bundle Aggressive promos Member perks | Often low or promo-driven pricing across products. | Cross-selling across lending, banking, investing. | Wealth features can feel lighter vs specialists. |

| Vanguard Digital Advisor | Incumbent Low-cost | Ultra-low fees Indexing pedigree Retirement focus | Among the lowest advisory fees in market. | Brand trust, simple portfolios, retirement alignment. | Less feature-rich app; limited bells and whistles. |

*Indicative only. Confirm current fees on each provider’s site.

The Verdict: A Platform for All Stages of Wealth Building

Betterment has come a long way from its early days as a simple robo-advisor. Today, it offers a rich, full-featured ecosystem that supports long-term investing, cash management, retirement planning, and crypto exposure—all while keeping fees low and user experience high.

Its ability to serve diverse audiences, from first-time investors and busy professionals to employers and advisors, makes it one of the most versatile digital wealth platforms on the market.

If you’re looking for a modern, automated solution with optional human guidance and a strong track record of innovation, Betterment is still one of the best in class.