Blockchain in fintech is entering a more mature phase. Early experimentation focused on cryptocurrencies and speculative use cases. Today, fintech companies are applying blockchain in quieter but more impactful ways. The technology is increasingly used as infrastructure, embedded deep inside financial products rather than presented as a headline feature.

Blockchain and fintech share a common goal. Both aim to modernise financial services through software, automation, and data. Blockchain provides a shared, tamper-resistant data layer. Fintech firms build applications on top of it. Together, they are enabling new ways to move value, manage risk, and coordinate trust at scale.

What are the new and emerging applications of blockchain in fintech? There is a growing focus on practical use cases that are shaping the next generation of financial services.

What blockchain brings to modern fintech

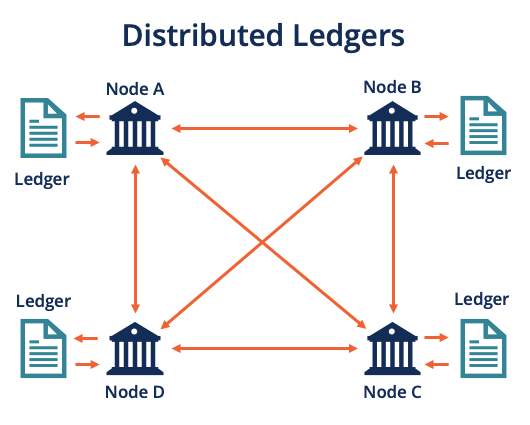

Blockchain is a distributed ledger that allows multiple parties to share the same data without relying on a central authority. Transactions are recorded sequentially, cryptographically linked, and extremely difficult to alter once confirmed.

For fintech firms, the real advantage is synchronisation. All participants see the same information at the same time. This removes the need for reconciliation, reduces operational risk, and simplifies system architecture.

Blockchain also enables programmability. Rules can be embedded directly into transactions through smart contracts. This allows financial logic, such as settlement conditions or compliance checks, to be enforced automatically.

Blockchain as a new settlement layer

One of the most important new applications of blockchain in fintech is settlement infrastructure.

Traditional settlement processes can take days and involve multiple intermediaries. Blockchain-based settlement allows assets and cash equivalents to move simultaneously, often within seconds. This significantly reduces counterparty risk and capital lock-up.

Stablecoins are becoming a key component of this shift. Rather than being positioned as speculative instruments, they are increasingly used as programmable settlement assets within fintech platforms. They support treasury operations, merchant payments, and platform-to-platform transfers.

For B2B fintech companies, this model offers faster settlement, lower costs, and improved auditability without changing the end-user experience.

Tokenisation of real-world financial assets

Tokenisation is moving rapidly from experimentation to real deployment.

Through blockchain, ownership of real-world assets can be represented as digital tokens. These assets include private equity, venture funds, bonds, revenue-sharing instruments, and real estate. Each token is governed by rules embedded in smart contracts.

This approach enables fractional ownership, instant settlement, and automated corporate actions. Compliance requirements can be enforced at the asset level, rather than relying solely on intermediaries.

Platforms such as Securitize are building regulated frameworks for issuing and managing tokenised securities. The focus is on improving efficiency and access within existing financial markets rather than bypassing regulation.

For fintech firms, tokenisation opens new product categories while reducing operational complexity.

On-chain identity and reusable compliance

Digital identity is becoming a strategic application of blockchain in fintech.

Traditional KYC processes are slow, repetitive, and costly. Each institution verifies the same customer independently. Blockchain enables a reusable identity model, where verified credentials can be issued once and selectively shared across platforms.

Modern identity systems rely on encryption and cryptographic proofs. Personal data is not exposed publicly. Users retain control over what they share and with whom.

For fintech platforms, this reduces onboarding friction and compliance overhead. For users, it improves privacy and portability across financial services.

Embedded compliance and real-time auditability

Blockchain enables a shift from periodic compliance reporting to continuous assurance.

Because blockchain records are immutable, they provide a reliable audit trail by design. Fintech firms can grant regulators or auditors controlled access to relevant data in near real time.

Smart contracts can also enforce regulatory logic automatically. Transactions can be blocked if conditions are not met. Limits can be enforced programmatically. Reporting can be generated continuously.

Analytics providers such as Chainalysis and Elliptic support fintech firms with transaction monitoring and risk analysis. Increasingly, these capabilities are being embedded directly into transaction flows rather than applied after the fact.

DeFi components as financial infrastructure

Decentralised finance is often portrayed as an alternative to traditional finance. In practice, many fintech firms are adopting DeFi components selectively as infrastructure.

Smart contract-based lending, automated liquidity pools, and on-chain collateral management can operate behind the scenes. The customer interface remains familiar and regulated, while efficiency gains are captured internally.

Protocols such as Aave and Compound illustrate how capital allocation can be automated using transparent rules. Fintech companies are increasingly exploring hybrid models that combine regulated front ends with decentralised back-end components.

The emphasis is shifting from ideology to operational efficiency.

Blockchain inside digital banks and super-apps

Digital banks and financial super-apps are integrating blockchain in subtle but meaningful ways.

Rather than marketing blockchain explicitly, they use it to enable crypto custody, asset exposure, programmable rewards, and international transfers. The blockchain layer remains largely invisible to users.

Revolut is a clear example. Blockchain underpins several product features, while the overall experience remains consistent with traditional digital banking expectations.

This pattern is likely to become more common as blockchain infrastructure matures.

Constraints and practical considerations

Despite progress, blockchain adoption in fintech still faces challenges.

Scalability and transaction costs vary significantly across networks. User experience can degrade if wallet management or key custody is exposed directly to customers. Regulatory frameworks remain fragmented across jurisdictions.

For fintech firms, successful implementation requires careful system design. Blockchain must integrate cleanly with existing core banking systems, data models, and compliance processes.

As a result, many of the most advanced deployments are deliberately understated.

What to expect next

The next phase of blockchain in fintech will be driven by integration rather than disruption.

Tokenisation of financial instruments is likely to accelerate, particularly in private markets. Identity and compliance layers will mature as regulation becomes clearer. Stablecoins and on-chain settlement are expected to play a larger role in payments and treasury infrastructure.

At the same time, central banks and regulators continue to explore digital currencies and shared ledgers, further embedding blockchain concepts into mainstream finance.

Blockchain is no longer an experimental technology at the edges of fintech. It is becoming part of the financial infrastructure stack.

The most valuable applications are structural rather than visible. They reduce friction, automate trust, and enable financial products that were previously difficult or inefficient to deliver.

As fintech continues to evolve, blockchain will increasingly operate in the background. The firms that understand how to use it pragmatically will be best positioned to turn infrastructure into long-term advantage.