Few blockchain networks have grown as quickly and decisively as BNB Chain. Originally launched in 2019 as Binance Chain, it has since evolved into one of the largest ecosystems in the blockchain industry. What began as an exchange-focused network has transformed into a multipurpose platform hosting thousands of decentralised applications, billions of dollars in total value locked, and a thriving community of developers and users.

BNB Chain’s journey reflects the rapid evolution of Web3 itself. By combining high performance, compatibility with Ethereum, and the backing of the Binance brand, it has carved out a unique space in the blockchain landscape. Today, BNB Chain is not just an extension of Binance but a global ecosystem with its own identity, governance, and ambitions. This review examines BNB Chain’s origins, architecture, ecosystem growth, strengths, weaknesses, and future outlook.

Origins and Evolution

BNB Chain began as Binance Chain in April 2019. The original network was designed primarily for fast trading and token issuance, supporting Binance’s decentralsed exchange. In September 2020, Binance launched Binance Smart Chain (BSC), a parallel chain compatible with the Ethereum Virtual Machine.

The introduction of BSC was a turning point. It opened the door for developers to migrate Ethereum-based applications to a faster and cheaper network. The timing was perfect. As Ethereum struggled with congestion and high fees during the DeFi boom of 2020 and 2021, BSC attracted a wave of projects and users seeking efficiency.

In 2022, Binance rebranded its blockchain ecosystem as BNB Chain, merging Binance Smart Chain and Binance Chain under one identity. The move was intended to give the ecosystem more independence and to emphasise the role of the BNB token as “Build and Build,” not just “Binance Coin.”

Core Architecture

BNB Chain is designed as a dual-chain system, allowing users to take advantage of both high performance trading functions and smart contract execution.

- BNB Beacon Chain handles staking and governance. It also manages token issuance and remains focused on security and validator coordination.

- BNB Smart Chain is EVM compatible and supports decentralised applications, smart contracts, and DeFi protocols.

This dual chain design allows BNB Chain to scale effectively. Developers can deploy applications on BNB Smart Chain using familiar Ethereum tools, while validators manage staking and consensus on BNB Beacon Chain. Together, they create a balance between performance and functionality.

Consensus Mechanism

BNB Chain uses a consensus model known as Proof of Staked Authority (PoSA). It combines elements of delegated proof of stake and proof of authority. A limited number of validators, selected based on their BNB holdings and community reputation, produce blocks.

This model enables fast block times, usually around three seconds, and low transaction costs. It also allows the network to scale without requiring thousands of nodes to participate directly in block production. Critics argue that PoSA reduces decentralisation because the validator set is relatively small compared to networks like Ethereum. However, supporters point out that the trade-off enables the kind of performance needed for large-scale adoption.

Ecosystem and Adoption

BNB Chain has grown into one of the most active blockchain ecosystems in the world. Its strengths are particularly visible in decentralised finance and gaming.

- Decentralised Finance (DeFi): Platforms such as PancakeSwap, Venus, and Alpaca Finance have become household names within the BNB Chain ecosystem. PancakeSwap, in particular, has consistently been one of the most used decentralised exchanges across all chains.

- Gaming and NFTs: BNB Chain has attracted gaming studios and NFT projects thanks to its low fees and high throughput. Play to earn titles and NFT marketplaces have leveraged the network to reach a broad audience.

- Infrastructure and Tools: Wallets, explorers, bridges, and development tools have been built to support developers and users. MetaMask integration further simplified access, since users could connect without learning new tooling.

By 2021, BNB Chain regularly surpassed Ethereum in daily transaction volume. At its peak, it processed over ten million transactions in a single day.

Tokenomics and Utility

The BNB token plays a central role in the ecosystem. Originally created as a utility token for discounted trading fees on Binance, BNB has expanded into a multi-purpose asset that underpins the entire network.

BNB is used for:

- Paying transaction fees on BNB Chain.

- Participating in governance through staking and validator selection.

- Serving as collateral within DeFi applications.

- Powering token sales and launches on Binance Launchpad.

A key feature of BNB is its ongoing burn program. Binance and the community commit to reducing the token’s total supply through regular burns. This deflationary mechanism is designed to support long term value appreciation by gradually reducing supply.

Strengths of BNB Chain

BNB Chain’s success is driven by several key strengths:

- High performance and low fees make it one of the most user-friendly blockchains for everyday transactions.

- EVM compatibility allows developers to port applications seamlessly from Ethereum, lowering the barrier to entry.

- Mass adoption driven by Binance’s global user base and brand recognition.

- Vibrant DeFi ecosystem with high liquidity and significant total value locked.

- Strong token utility with BNB serving as the backbone of both Binance and the blockchain network.

These factors combined have made BNB Chain one of the most widely used platforms in Web3.

Weaknesses and Criticisms

Despite its achievements, BNB Chain has faced criticism and challenges.

- Centralisation concerns: The PoSA model relies on a relatively small number of validators, raising questions about censorship resistance.

- Security issues: The ecosystem has been targeted by several high profile exploits, including bridge hacks. While these were not always direct flaws in the protocol, they damaged confidence.

- Dependence on Binance: Although the rebranding emphasised independence, BNB Chain remains closely associated with Binance. Regulatory scrutiny of the exchange can impact perception of the network.

- Competition: Ethereum continues to dominate in developer mindshare, while Solana, Avalanche, and others compete aggressively on performance.

BNB Chain must address these issues to ensure long term credibility and resilience.

Competitive Positioning

BNB Chain occupies a unique space in the blockchain landscape. It combines the global reach of Binance with the technical advantages of low cost, high performance infrastructure. Its closest competitors include Ethereum for smart contracts, Solana for throughput, and Avalanche for modularity.

Where BNB Chain stands out is in accessibility and adoption. For many retail users entering Web3 for the first time, BNB Chain is their introduction to decentralised applications. Its close integration with Binance exchange products provides a funnel of users that no other network can match.

Who Should Use BNB Chain

BNB Chain is well suited for a wide range of users.

- Retail users seeking low cost and fast transactions will find it user friendly.

- Developers building DeFi protocols or gaming applications benefit from its EVM compatibility and large user base.

- Institutions interested in consumer facing applications can leverage its scale and liquidity.

It may be less suitable for projects that prioritise decentralisation above all else, or for developers seeking the largest open source community, which still resides on Ethereum.

Future Outlook

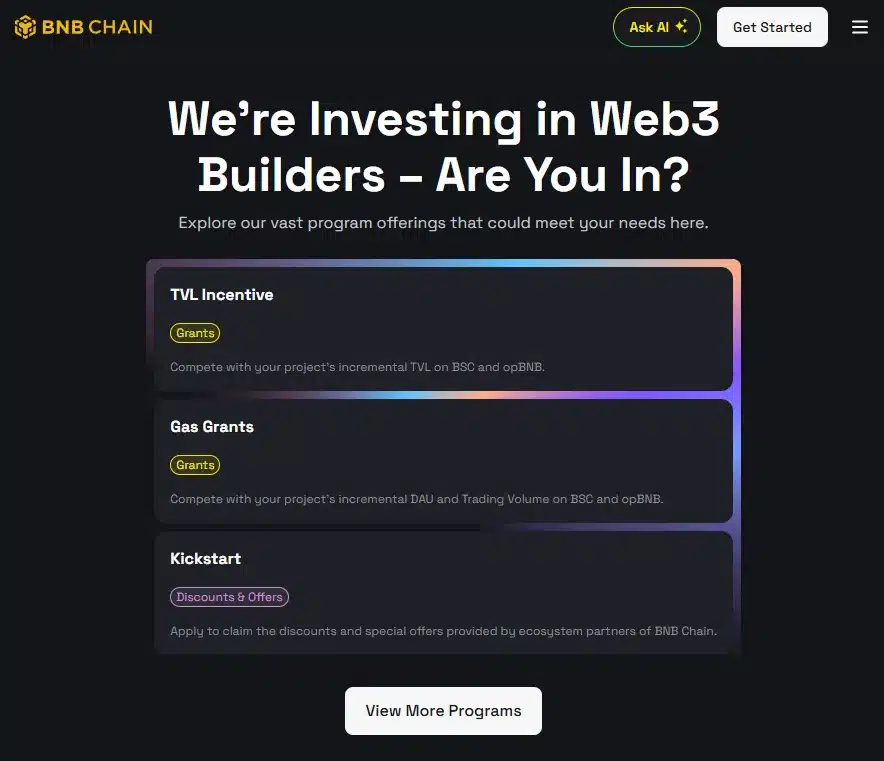

BNB Chain’s roadmap emphasises scalability, security, and continued decentralisation. Ongoing initiatives include:

- Enhancing throughput to handle even higher transaction volumes.

- Expanding cross chain capabilities through bridges and interoperability solutions.

- Improving security infrastructure to protect against exploits.

- Growing the validator set to address concerns about centralisation.

The long term outlook will depend on whether BNB Chain can sustain developer interest, expand beyond its Binance association, and continue to attract mainstream adoption.

Conclusion

BNB Chain has evolved from a side project of Binance into one of the most important blockchains in the industry. Its combination of speed, low fees, and massive adoption has made it a leader in decentralised finance and a strong competitor in gaming and NFTs. The BNB token provides a robust economic backbone, while the ecosystem continues to expand rapidly.

At the same time, BNB Chain faces questions about decentralisation, security, and independence from Binance. Its challenge is to move from being seen as an exchange-centric chain to being recognised as a truly global, independent Web3 platform.

For users and developers seeking accessibility, liquidity, and speed, BNB Chain remains one of the most compelling choices. Its trajectory shows how quickly blockchain platforms can evolve when backed by scale, vision, and strong community engagement.