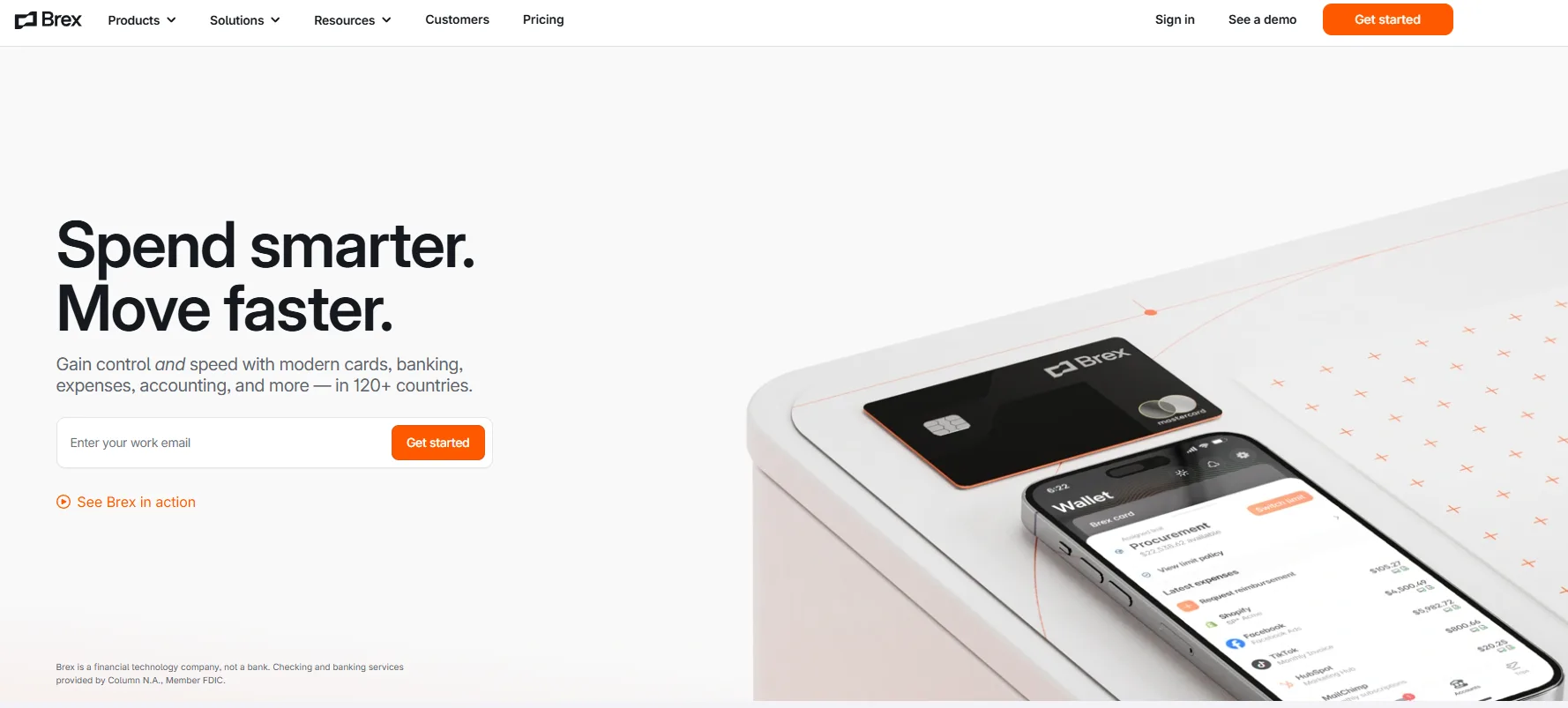

Brex is one of the standout fintech stories of the past decade. Launched in 2017, it began as a corporate card provider for startups and has since evolved into a full-fledged financial operating system for modern businesses. Today, Brex offers everything from credit cards and business accounts to expense management and travel booking. All in one unified platform.

Its rise reflects a broader shift in how companies manage money. Traditional banks often fall short when it comes to speed, user experience, and integration with digital workflows. Brex saw this gap and created a solution tailored to high-growth companies, remote teams, and venture-backed businesses. We review what Brex offers, how it works, and why it is now one of the most influential players in business fintech.

From Corporate Cards to Financial OS

Brex launched with a simple but powerful proposition: offer startups access to a credit card without requiring personal guarantees or complex approvals. Instead of relying on founder credit scores, Brex assessed business cash flow, funding history, and growth potential.

The idea took off. Founders who struggled to get traditional corporate credit now had access to flexible limits, automated expense tracking, and real-time insights.

Since then, Brex has expanded far beyond cards. Today, the platform includes:

- Business accounts with no fees and integrated cash management

- Reimbursement workflows and budget tracking

- Global card issuing with category-level controls

- Embedded travel booking and spend policies

- Bill pay and vendor payments

- Integrations with accounting and HR systems

Everything is designed to serve as a financial command centre for startups, scaleups, and enterprises.

Who Brex Serves

Brex originally focused on venture-backed tech startups. Over time, it expanded its scope to include:

- Growth-stage companies

- Remote-first businesses

- Multinational teams

- Enterprises with decentralised spending needs

In 2022, Brex made the strategic decision to shift away from small startups and focus on larger, funded companies. This allowed it to concentrate on serving clients with more complex financial operations and greater scale.

Its client base now includes household names in tech, ecommerce, and SaaS, as well as new-age global firms looking for more agile finance solutions.

What Makes Brex Different

Several features distinguish Brex from both traditional banks and other fintech platforms:

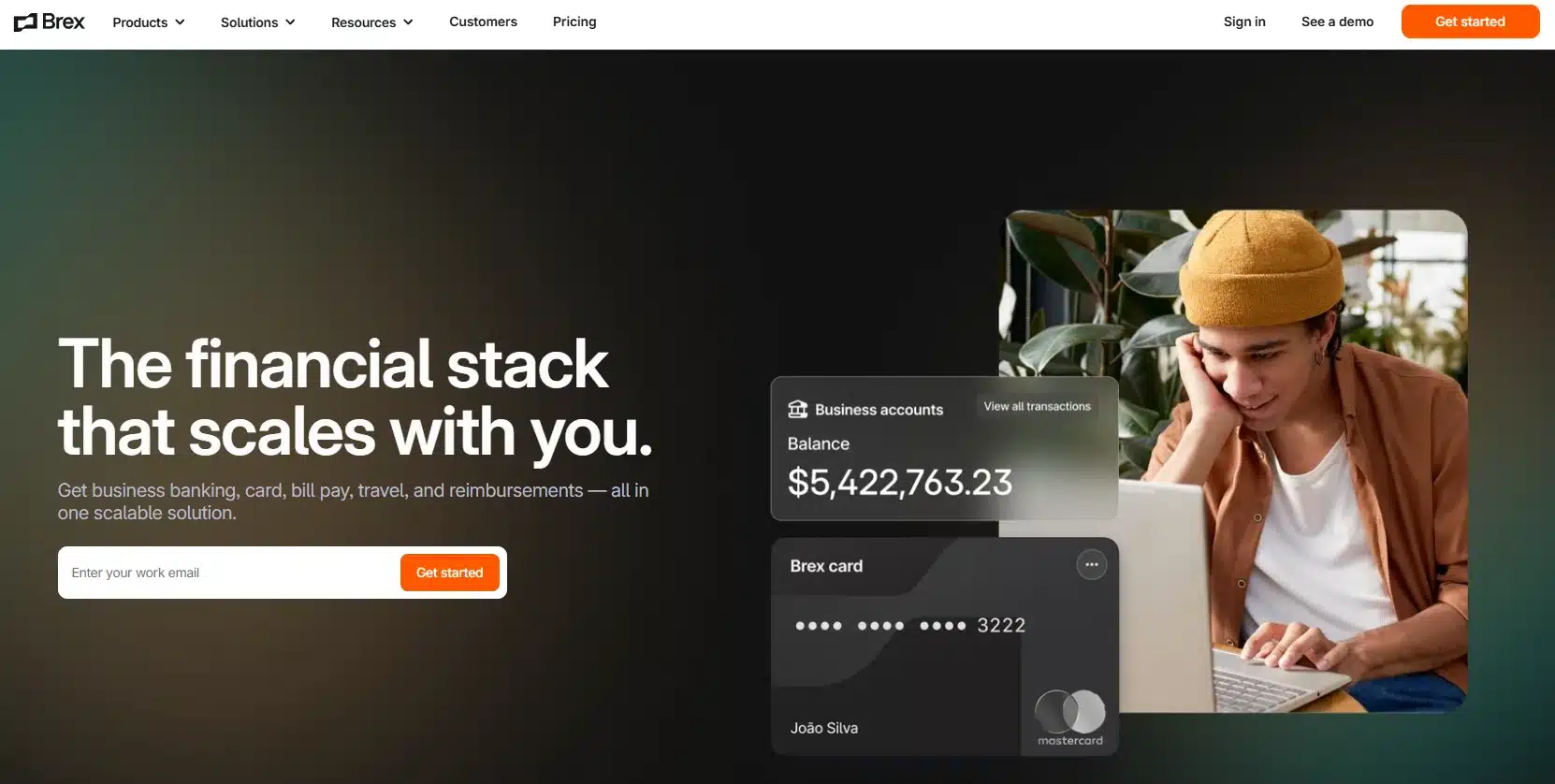

1. Real-Time Visibility

All company spend, across cards, reimbursements, and travel, is tracked in real time. Finance teams gain instant insight into budgets, categories, and policy compliance.

2. Custom Limits and Budgets

Brex lets managers assign budgets to teams or individuals. Employees can spend from those budgets using cards or reimbursements, with built-in policy controls.

3. Global Team Support

Brex cards and budgets work for employees in over 100 countries. Teams can operate globally without relying on multiple banks or reimbursement tools.

4. Software-Led Experience

Unlike traditional banks, Brex builds and owns the software stack. This enables faster updates, better UX, and seamless integration with tools like NetSuite, QuickBooks, Slack, and Ramp.

5. Integrated Travel and Spend

Brex Travel allows employees to book flights and hotels within budget. Travel expenses are automatically categorised and synced to reports.

How Brex Makes Money

Brex earns revenue primarily through:

- Interchange fees from card transactions

- Paid subscriptions for its Empower spend management product

- Float and interest on deposits and treasury services

- Payment services such as bill pay and ACH processing

This diversified model allows the company to keep core services free for qualified clients, while monetising advanced features and payment flows.

Brex Competitive Landscape

The company competes with several fintech and traditional players, including:

- Ramp and Airbase in spend management

- American Express for corporate cards

- Mercury for business banking

- Expensify for expense and reimbursement tools

- SAP Concur for enterprise travel and expense

Brex’s advantage lies in its all-in-one platform, real-time data infrastructure, and focus on modern, digital-native companies.

Future Outlook and Strategy

Looking ahead, Brex is continuing to scale its enterprise offerings, improve automation, and expand internationally. Key priorities include:

- Enhancing AI-powered insights and policy automation

- Deepening integrations with enterprise systems

- Supporting CFOs with strategic financial planning tools

- Strengthening compliance and treasury infrastructure

The company is also exploring use cases beyond traditional fintech. For instance embedded finance, corporate card infrastructure for partners, and payroll-linked spending solutions.

Brex is not just building financial tools. It is reimagining how companies operate in a global, digital-first world. By replacing fragmented systems with one powerful platform, it offers a smarter way to manage business money. Fast, flexible, and fully digital.