Smart money management starts with small, consistent actions. In an era of subscriptions, contactless payments, and one-click orders, it’s easy to lose track of where your money is going. But rather than focusing solely on tracking expenses, it’s more effective to establish a spending routine that helps you stay in control, reduce stress, and make confident financial choices. Building a smarter spending routine is about developing awareness, setting priorities, and making informed decisions, without feeling like you’re constantly budgeting. With a few intentional habits and tools, you can shift from reactive spending to proactive planning.

Start Your Week with a Financial Check-In

One of the simplest ways to anchor your spending routine is by starting each week with a brief money check-in. This can be a 10-minute review every Sunday evening or Monday morning where you look at your current account balances, upcoming bills, and planned purchases.

You don’t need a detailed spreadsheet. Just review your banking app or dashboard. The goal is to stay aware of your financial position and spot any red flags early. This habit builds mindfulness and prevents “surprise” expenses from throwing off your plans midweek.

Set Spending Intentions, Not Just Budgets

Budgets are useful, but many people abandon them because they feel too rigid. Instead, try setting spending intentions. For example, decide ahead of time that you’ll eat out only twice this week, or that you’ll walk instead of using rideshares for short trips.

These small, situational intentions help you make conscious decisions throughout the week. They’re easier to stick to and adapt more naturally to real-life shifts. Over time, they guide your routine without needing strict rules.

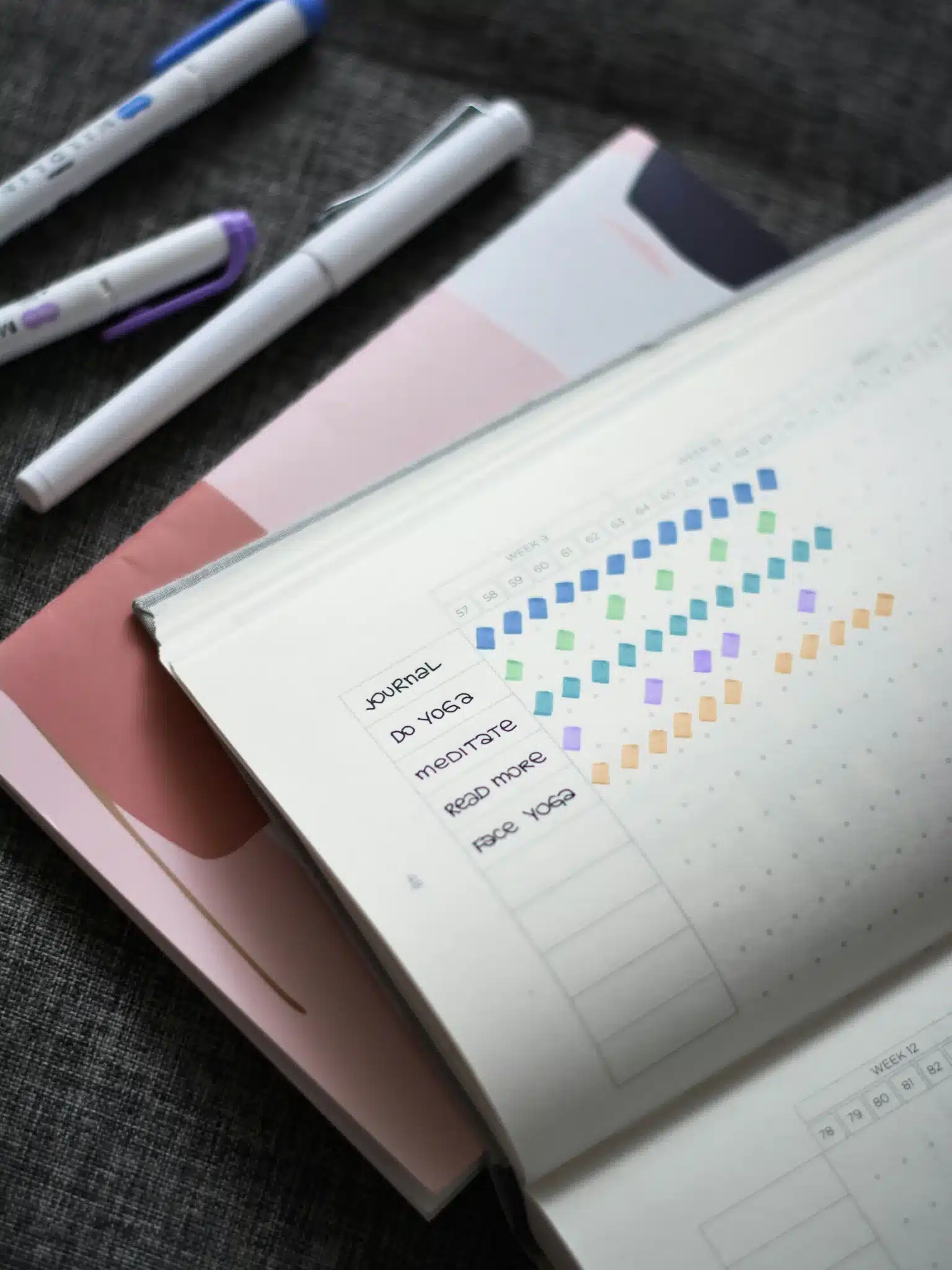

Use an App That Aligns with Your Lifestyle

Today’s personal finance apps offer more than just expense tracking—they can support your entire spending routine. Apps like YNAB (You Need a Budget), Monzo, or PocketSmith let you set goals, receive smart alerts, and visualise trends.

Choose an app that suits your pace and personality. If you like daily check-ins, use one with real-time syncing and notifications. If you prefer weekly reviews, pick an app with calendar views or email summaries. The right tool can gently reinforce positive habits and save you time.

Create Spending Categories That Reflect Your Priorities

One key step in building a smarter spending routine is aligning your categories with your lifestyle. A smarter routine focuses not just on how much you spend, but on what matters to you. Tailor your spending categories to reflect your values. For instance, split your food budget into “groceries,” “takeaway,” and “dining with friends” to understand the context behind each purchase.

This helps you identify where spending aligns with your goals. Such as supporting local businesses, prioritising health, or spending quality time with others. When your categories reflect your real life, they become a tool for alignment rather than restriction.

End the Week with a Micro-Review

Just as you begin the week with a check-in, end it with a short review. Look at how you spent money, what went as planned, and what didn’t. This is not about judgment, it’s about learning.

Ask yourself: Did I spend according to my intentions? What surprised me? What habits worked well? Over time, these reflections sharpen your instincts and make better decisions feel second nature. Even a few minutes each Friday or Sunday can reinforce progress.

Connect Spending to Your Long-Term Goals

Building a smarter spending routine takes time, but linking it to your long-term goals makes it more sustainable. Whether you’re saving for a down payment, reducing debt, or planning for travel, consistent spending habits reinforce progress.

Some apps allow you to tag transactions with goal-related labels or track progress bars. Others let you assign percentages of income to different targets. When you see everyday actions contributing to something meaningful, it becomes easier to say no to impulse buys and yes to purposeful choices.

Build Habits, Not Rules

Rigid rules often lead to burnout or guilt. Instead, build habits that support awareness and adaptability. You don’t need to log every coffee forever. But tracking it for a few weeks might help you spot a pattern. You don’t need a perfect budget, just a realistic one that evolves.

Whether it’s checking your app while waiting for your coffee, reviewing categories each Sunday, or setting a “no-spend day” each week, the key is consistency. These small habits create a rhythm that improves over time.

A smarter spending routine is not about being frugal or restrictive, it’s about feeling confident and in control. By building a few thoughtful habits, choosing the right tools, and connecting daily choices to your personal goals, you can create a system that works for you. Not against you.

The result? Less stress, fewer surprises, and success in building a smarter spending routine that aligns with the life you want to live.