Miami, Florida, June 26th, 2025, FinanceWire

The $1M pre-seed round, backed by Boost VC and Winklevoss Capital, will enable Castle to onboard forward-thinking SMBs to an automated bitcoin treasury solution.

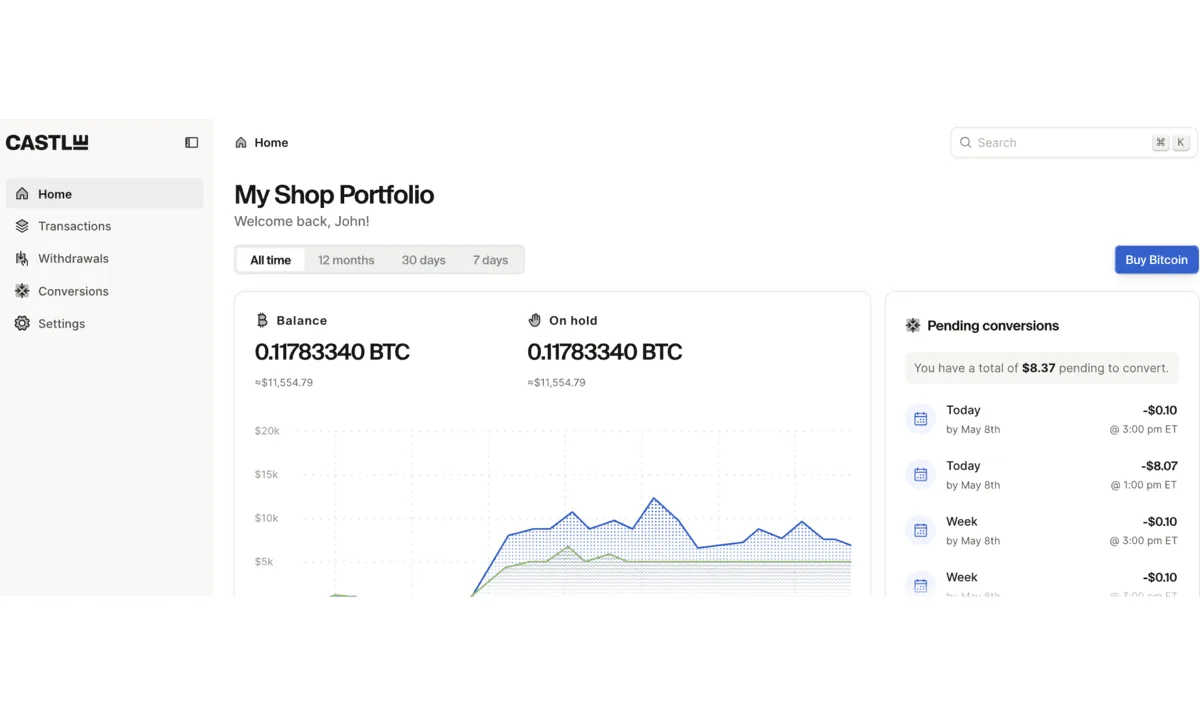

Castle, a bitcoin treasury platform for small and medium-sized businesses (SMBs), announced today it raised $1 million in an oversubscribed pre-seed round to accelerate its mission of making it seamless for businesses to protect and grow their wealth using bitcoin.

The round was led by Boost VC, with participation from Winklevoss Capital, Park Rangers Capital, Epoch VC, and select angel investors. The funding will fuel platform development and scale onboarding efforts to reach SMBs nationwide, serving companies seeking an inflation-resistant, turnkey treasury solution.

“Most savings products used by small and medium businesses, despite being framed as high-yield, actually lose money after accounting for inflation. Business owners are waking up to this and deserve better,” said Stephen Cole, CEO of Castle. “Bitcoin, with its strictly limited supply, has been the best performing asset of the past decade and we’re excited to bring it to companies across America.”

“We see bitcoin as the world’s most powerful savings technology, and Castle is making it easy and accessible for small and medium businesses,” said Brayton Williams, Managing Partner of Boost VC. “The founders are veteran bitcoiners and tech leaders, combining a rare sense of mission and execution ability, and Boost VC is excited to support them.”

“Bitcoin is the ultimate store of value,” said Cameron and Tyler Winklevoss. “Unlike fiat, it protects the value of your life’s work. Castle lives up to its name by helping businesses safeguard their balance sheet by automatically converting a portion of every sale into bitcoin.”

João Almeida, CTO, said “By integrating with tools like QuickBooks, PayPal, Square, and Stripe, our platform gives businesses intelligent bitcoin exposure aligned with their operational requirements. Castle is built to be invisible so owners can focus on what they do best and know their bitcoin treasury will look the way they want.”

By dynamically suggesting strategies ranging from conservative to aggressive, Castle enables businesses to right-size their allocation according to their risk tolerance. Current customers span industries including restaurants, fitness, accounting, e-commerce, SaaS, fine art, real estate, and more.

Castle’s automation and integrations maintain the desired level of bitcoin exposure even in the face of challenges such as fluctuations in revenues, expenses, or overall holdings, through features such as:

- Automated recurring allocations to bitcoin either as a fixed dollar amount or a percentage of revenue (e.g., 5%)

- Setting thresholds on cash accounts to trigger automatic bitcoin purchases or sales, ensuring liquidity for operational expenses.

- Defining maximum and minimum percentages that bitcoin should represent of overall holdings

“Bitcoin isn’t just for Silicon Valley and Wall Street, it’s also for Main Street,” Cole said “We believe all businesses will begin upgrading to bitcoin over the next 10 years, and those earliest to do so stand to benefit the most.”

With free sign-ups and no monthly fees, Castle makes an inflation-proof treasury solution available to SMBs. To sign up today, users can visit savewithcastle.com.

For media inquiries, users can contact 21M Communications at phil@21mcommunications.com.

About Castle

Castle provides businesses with intelligent bitcoin treasury solutions, combining automation and seamless financial integrations to safeguard assets and foster long-term value creation. Learn more at savewithcastle.com

Contact

Founder

Phil

21M Communications.com

phil@21mcommunications.com