ComplyControl, a UK-based provider of AI-powered compliance solutions, is excited to announce the launch of ComplyControl SafeStart — a dedicated program for fintech startups across the EU and UK. With a mission to help early-stage companies build trust, scale faster, and stay compliant from day one, SafeStart offers access to ComplyControl’s full suite of compliance services.

Compliance is a costly and complicated hurdle for startups to overcome. Data shows that small businesses spend an average of $7,000 per employee annually on compliance — nearly 60% more than large companies. For new businesses operating on a tight budget, that’s a heavy pressure.

But cutting corners is riskier, since it can lead to regulatory fines, loss of investor trust, failed partnerships, and outright business shutdowns. So, in the end, non-compliance is even costlier.

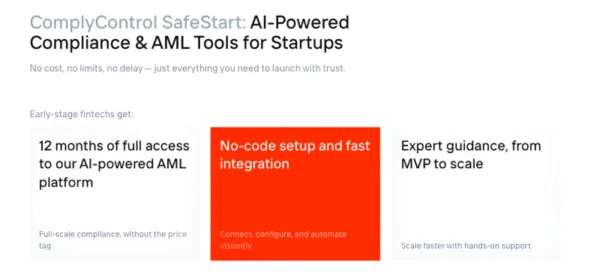

ComplyControl SafeStart program is designed to ease this burden, helping startups integrate advanced compliance solutions from day one without the fear of complexity or high costs. Startups accepted into the program will receive:

- Free access to all ComplyControl tools — including real-time transaction monitoring, AI-driven AML & CTF detection, sanctions screening, and policy gap analysis — for up to 50,000 transactions per month.

- 12 months of free usage with no hidden fees or limited features — enough time to integrate the tools and assess their effectiveness.

- Unlimited no-code rule creation to configure the system in days, not months.

- Early access to new features, expert guidance from the ComplyControl team, and a flexible transition to commercial terms after the first year.

ComplyControl SafeStart offers startups unrestricted access to the same powerful compliance tools that are already used by established financial institutions that have partnered with the company. Its platform makes use of advanced AI to process transactions in under five seconds, reduce false positives by up to 80%, and simplify daily compliance operations through a user-friendly interface and explainable screening results.

Just as important, ComplyControl’s team doesn’t just hand over the software and tell you to figure it out yourself. They act as mentors, sharing their own expertise and offering ongoing support to help startups navigate the early stages of compliance with confidence.

“The field of compliance grows perpetually more complex every day, making it a major roadblock for many fintechs who are just taking their first steps towards growth. With ComplyControl SafeStart, we want to remove that burden and let startups focus on building great products while we take care of the compliance side of things,” — says Roman Eloshvili, Founder of ComplyControl.

Startups can apply for the program either through the company’s website or by contacting the team directly at support@complycontrol.com.

About ComplyControl

ComplyControl is a UK-based provider of AI-driven services that improve risk management and ensure regulatory compliance for financial organisations of all sizes. The company specialises in AI-powered solutions that make compliance faster, smarter, and more cost-effective. Recognised by TechRound as one of the UK’s Top 50 Fintech Startups in 2025, ComplyControl holds to the mission of simplifying regulatory compliance and helping financial organisations stay ahead of the ever-evolving risks.

Contact

ComplyControl

info@complycontrol.com