The fintech industry has no shortage of trading apps, but few have managed to combine investing with the cultural pull of social media. dub, launched in early 2023, has taken on that challenge. It brands itself as the “Instagram for investing,” making portfolios as shareable as photos and allowing everyday investors to mirror the moves of hedge fund managers, political insiders, and social media influencers.

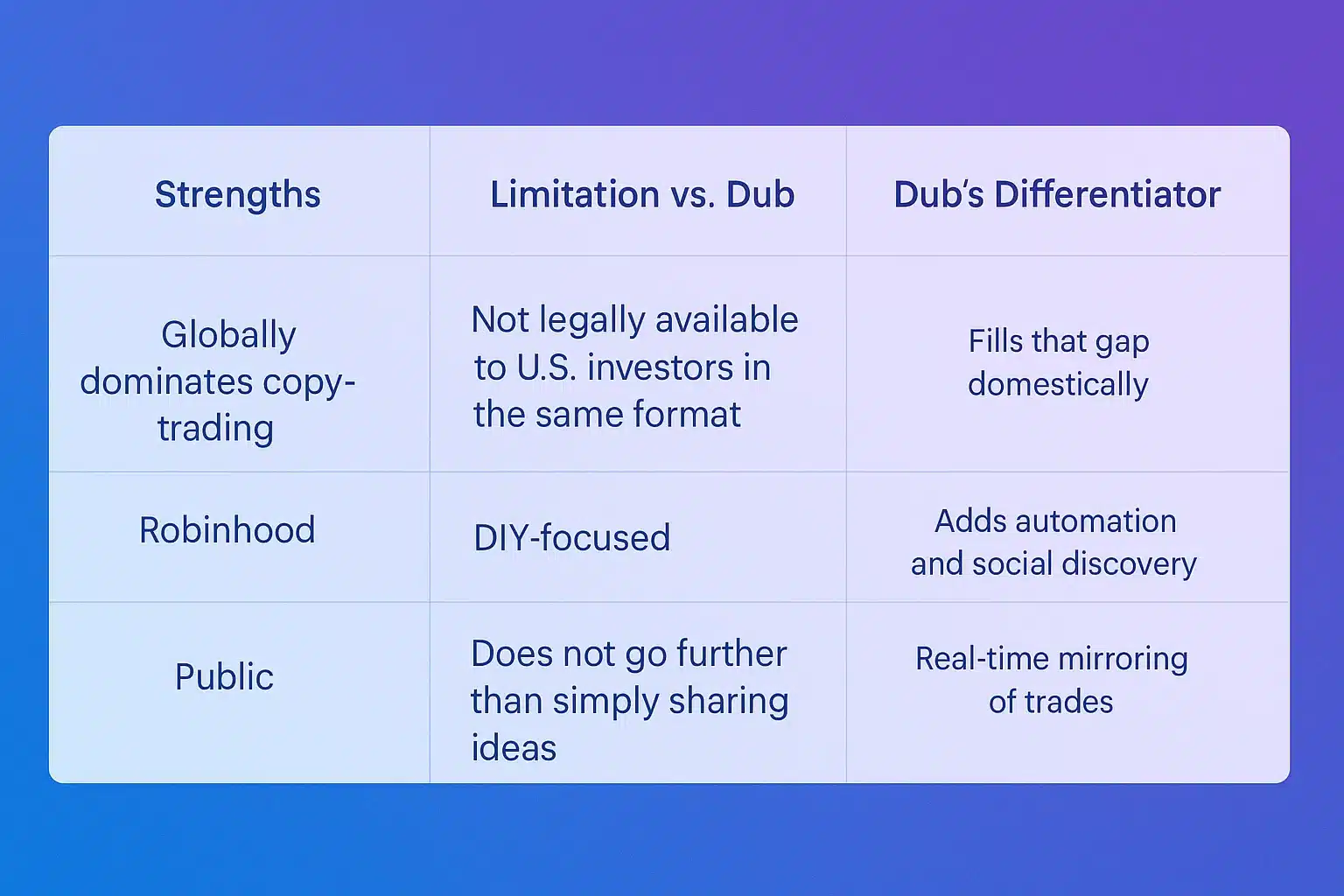

Unlike most copy-trading experiments, dub operates under the strict oversight of the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). This makes it one of the first legally compliant copy-trading platforms designed for U.S. retail investors, a market that has historically lacked regulated access to such services.

In this Fintech Review, we will explore how dub works, what it offers, its pricing, user experience, benefits and limitations, and whether it is the right tool for your investment goals.

What is dub?

At its core, dub is a copy-trading platform built to democratize access to professional and public investment strategies. Instead of manually researching and building a portfolio, users can choose from a range of available creators and automatically replicate their trades.

dub’s portfolio sources include:

- dubCapital – the in-house registered advisor that publishes portfolios for users to copy.

- Political insiders – based on public filings by members of Congress.

- Hedge fund managers – drawn from quarterly 13F disclosures.

- Finance influencers – creators who share their trading strategies publicly.

- Everyday users – who opt to make their portfolios discoverable to others.

When you copy a portfolio, your account reflects the same positions proportionally. If a portfolio allocates 5% to Tesla and 3% to Apple, dub adjusts your funds accordingly. You can choose a one-off copy, which duplicates the current portfolio snapshot, or live tracking, where every new trade made by the creator is automatically mirrored.

The entry process is simple. You open an account with dub Financial, a licensed broker-dealer, deposit a minimum of $100, and begin exploring available portfolios. This low barrier to entry is part of dub’s appeal to beginner investors.

How dub Works

dub’s workflow is built for ease and familiarity. The app resembles a social network feed rather than a trading terminal. You swipe through creators, check performance metrics, and decide whether to copy.

Onboarding

Creating an account takes minutes. After verifying identity and funding your account, you can immediately browse portfolios. The $100 minimum is enough to get started, and fractional investing ensures you don’t need thousands of dollars to replicate high-priced holdings.

Copying portfolios

You have two options:

- Snapshot copy: Mirror the current positions only.

- Ongoing copy: Continue following all new trades in real time.

This distinction matters. A snapshot is more of a starting template, while ongoing copy ensures you track the creator’s future decisions.

Execution and timing

dub executes trades proportionally in your account, typically in the same price window. However, slight delays can occur, especially for portfolios based on 13F filings, which are already lagging by weeks.

Features and What It Offers

dub’s feature set is focused on accessibility rather than complexity.

- Fractional investing: Start with $100 and copy even portfolios containing expensive stocks.

- Social interface: Feels like browsing Instagram, creators, feeds, and portfolios are presented visually.

- Creator community: You can publish your own portfolio and attract followers, adding a gamified layer.

- Performance data: Public charts display portfolio performance, though accuracy depends on source filings.

- Regulatory safeguards: Accounts are SIPC insured up to $500,000. dub’s broker-dealer subsidiaries are SEC and FINRA regulated.

By combining social design with regulatory protection, dub tries to make investing both engaging and trustworthy.

Pricing and Subscription Model

dub uses a subscription-based pricing structure rather than commissions.

- Free trial: Seven days with full access.

- Monthly plan: $9.99/month.

- Annual plan: $89.99/year (about 25% savings).

There are no per-trade commissions. The subscription covers access to unlimited portfolios and copying features.

For investors with small balances, this can feel expensive. On a $1,000 account, $90 per year is a 9% drag before performance. For accounts of $5,000–$10,000 or more, the flat fee becomes far less significant, making dub more suitable for higher balances.

User Experience

dub’s design philosophy is clear: make investing feel familiar. The app’s interface mirrors social media platforms, with feeds, profiles, and swipe-based browsing.

The positives

- Fast onboarding: Sign-up and deposit take minutes.

- Clean design: Performance charts and creator profiles are visually intuitive.

- Community feel: Users can publish and compare portfolios, adding a gamified edge.

The drawbacks

- Data delays: Performance metrics may lag, especially for 13F-based portfolios.

- Occasional bugs: Users report portfolio refresh issues and broken percentages after adding funds.

- Limited insights: Once you copy a portfolio, visibility into specific holdings is reduced.

On the App Store, ratings are high, around 4.7/5, highlighting smooth onboarding and sleek design.

Pros and Benefits

- Regulated and insured: Unlike many global copy-trading platforms, dub is U.S. based, SEC-registered, and SIPC-insured.

- Accessible entry: $100 minimum deposit and fractional investing lower the barrier for beginners.

- Social design: The Instagram-style feed makes investing approachable and less intimidating.

- Unique access: Users can follow political insiders and hedge funds, something usually limited to financial professionals.

- Responsive support: Many reviews cite direct outreach from senior staff, unusual in fintech.

Cons and Limitations

- Delayed data: 13F filings can be weeks old, showing only long positions, not shorts or derivatives.

- Limited asset coverage: Only U.S. stocks and ETFs are available. No crypto, bonds, or international equities.

- Subscription burden: Flat fees reduce returns for small accounts; best suited for balances over $5k.

- Transparency issues: Limited post-copy visibility into exact holdings reduces control.

- Minimal education: Lacks tutorials or risk guidance, making it more of a passive copying tool.

Who Should Use dub?

dub is best for investors who:

- Want to experiment with copy trading legally in the U.S.

- Have at least $5,000 to $10,000 to invest, minimizing the impact of subscription costs.

- Enjoy social investing and following creators.

- Are comfortable with U.S.-only stock exposure.

dub is not ideal for:

- Investors with balances under $1,000.

- Those looking for crypto, global stocks, or diversified asset classes.

- Passive index investors focused on low-cost ETFs.

- Users seeking educational resources or in-depth analytics.

Comparisons with Other Platforms

dub sits somewhere between a regulated brokerage and a social investing network. It isn’t as broad as eToro or as mainstream as Robinhood, but it offers a unique blend of both.

Final Verdict

dub is one of the most interesting fintech launches of the past few years. By combining social media design with regulated brokerage infrastructure, it makes copy trading both engaging and legal in the U.S. market.

For investors with sufficient balances, dub offers a way to gain exposure to unique portfolios, from hedge funds to political insiders, without the effort of self-research. Its intuitive interface, fractional investing, and regulatory protections make it especially appealing to younger, tech-savvy investors looking for new ways to engage with markets.

That said, dub is not for everyone. The data delays inherent in 13F filings, limited asset coverage, and flat subscription fees make it a niche platform. It is not a replacement for diversified, low-cost investing but rather a complement for those who want to experiment with social and guided trading.

If you are curious about what professional investors and influencers are buying, and you are willing to pay for access, dub can provide a novel and enjoyable investing experience. If your priority is low fees, broad diversification, or full control, you may be better off with more conventional platforms.