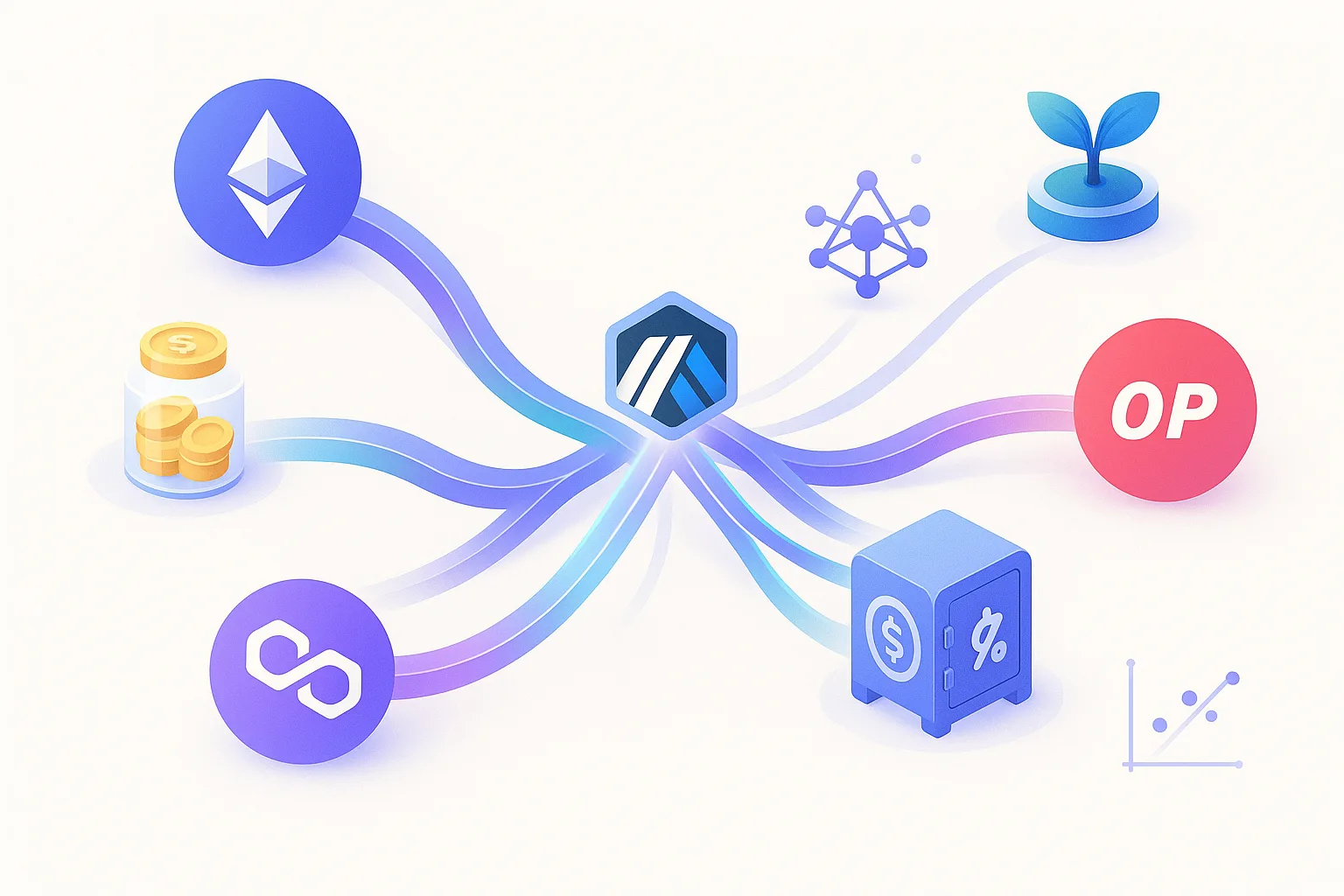

How cross-chain bridges create fee, reward, and lending opportunities.

How bridging yield flows

Provide assets to bridge pools or vaults on chosen chains.

Users bridge, generating swap fees and volume for pools.

Earn fees and, in some cases, native token incentives.

Liquidity can be allocated across chains for efficiency.

Bridge assets to lend or stake in destination markets.

Ways to earn (at a glance)

Provide Liquidity

Bridge Yield Farms

Omnichain Liquidity

Lend Bridged Assets

Where each strategy sits (illustrative)

Positions are conceptual. Evaluate specific protocols, audits, and incentives before allocating capital.

Security models at a glance

Before you participate

Bridging liquidity is a growing lane for returns. Providers who understand mechanics, monitor risk, and allocate wisely can capture yield while strengthening core Web3 infrastructure.