Embedded treasury refers to the integration of treasury management capabilities directly into business platforms, workflows, and software applications. Rather than relying on standalone treasury systems or manual banking processes, companies can manage cash flow, liquidity, payments, and foreign exchange within the tools they already use.

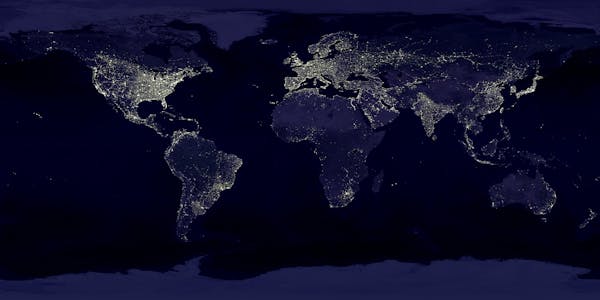

This shift is being driven by fintech solutions that embed treasury functions into enterprise software, ERP systems, and operational platforms. As businesses become more global, digital, and real-time, embedded treasury is emerging as a critical component of modern financial operations.

What Embedded Treasury Means

Embedded treasury is the delivery of treasury services through integrated digital platforms rather than separate treasury management systems or bank portals.

It allows businesses to manage cash positions, execute payments, handle foreign exchange, and monitor liquidity directly within their core operational software. Treasury becomes a background capability rather than a standalone function.

In practical terms, it brings together payments, banking, FX, liquidity management, and reporting into a unified, API-driven layer. This layer connects businesses to banks, payment networks, and financial infrastructure without requiring multiple logins or manual reconciliation.

Embedded treasury does not replace treasury expertise. It changes how treasury capabilities are accessed and executed.

Why Traditional Treasury Struggles at Global Scale

Traditional treasury models were designed for large corporates with centralised finance teams and relatively stable banking relationships. They rely heavily on manual processes, spreadsheets, bank portals, and batch-based reporting.

As companies expand internationally, these models break down. Multiple bank accounts across jurisdictions create fragmented visibility. Different payment rails increase complexity. Currency exposure becomes harder to manage in real time.

Treasury teams often operate with delayed data. Cash positions may only be reconciled daily or weekly. Decision-making becomes reactive rather than proactive.

Embedded treasury addresses these challenges by providing real-time visibility and automated execution across markets.

The Role of Fintech in Embedded Treasury

Fintech companies like Stripe play a central role in enabling embedded treasury. They provide the infrastructure, APIs, and software layers that connect businesses to financial services seamlessly.

Rather than acting as banks, most providers operate as intermediaries. They integrate with multiple banking partners, payment networks, and FX providers behind the scenes.

Key fintech capabilities include:

- Real-time cash visibility across accounts and currencies

- Embedded payments and collections

- Automated foreign exchange execution

- Virtual account structures

- Liquidity forecasting and reporting

- Programmatic access through APIs

By abstracting complexity, fintech platforms allow businesses to manage treasury operations without deep banking integration work.

Core Components of Embedded Treasury

Embedded treasury is not a single feature. It is a combination of tightly integrated capabilities.

Cash visibility is foundational. Embedded treasury platforms aggregate balances across banks, accounts, and currencies into a single view. This enables finance teams to understand available liquidity instantly.

Embedded payments allow businesses to initiate domestic and international payments directly from their operational systems. This includes supplier payments, payroll, and intercompany transfers.

Foreign exchange management is a critical component. Embedded FX enables automatic conversion at the point of payment or receipt, reducing manual intervention and pricing uncertainty.

Virtual accounts and wallets simplify account structures. They allow businesses to segregate funds by entity, customer, or purpose without opening physical bank accounts in every jurisdiction.

Reporting and forecasting tools turn transaction data into actionable insight. Treasury teams can model cash flows, identify risks, and optimise working capital.

Embedded Treasury Versus Treasury Management Systems

Treasury management systems are dedicated platforms designed for complex corporate treasury functions. They are powerful but often expensive, slow to implement, and difficult to integrate.

Embedded treasury differs in philosophy. It prioritises integration over specialisation. Instead of centralising treasury work in a separate system, it distributes treasury capabilities across existing workflows.

For mid-sized and fast-growing companies, embedded treasury often provides sufficient functionality without the overhead of a full TMS. For large corporates, embedded treasury may complement rather than replace traditional systems.

The distinction lies in accessibility, speed, and integration depth.

Embedded Treasury and Global Cash Flow Management

Global cash flow management is one of the strongest use cases for embedded treasury.

Companies operating across multiple countries face challenges in moving money efficiently. Delays, fees, and FX spreads can erode margins. Regulatory requirements add further friction.

Embedded treasury platforms streamline cross-border cash movement by optimising routing, automating FX, and reducing reliance on manual processes. Funds can be consolidated or deployed where needed with greater speed and transparency.

This improves liquidity utilisation. Cash trapped in one region can be redeployed elsewhere. Working capital becomes more dynamic.

For businesses with thin margins or high transaction volumes, these improvements can materially impact profitability.

Who Uses Embedded Treasury Solutions

Embedded treasury is particularly valuable for digital-first and globally distributed businesses.

SaaS companies benefit from integrated billing, collections, and multi-currency revenue management. Marketplaces use it to manage payouts to sellers across regions. E-commerce platforms rely on it to handle international payments and currency conversion.

Financial services firms embed treasury capabilities into their own products, enabling banking-like functionality without becoming banks.

Even traditional enterprises are increasingly adopting embedded treasury as they modernise finance operations.

Embedded Treasury and Embedded Finance

Embedded treasury is a subset of embedded finance, but it serves a distinct purpose.

There are clear between the two differences.

Embedded finance focuses on delivering financial products within non-financial experiences. Embedded treasury focuses on internal financial operations.

The two often overlap. A platform offering embedded payments to customers may also rely on embedded treasury to manage its own cash flows behind the scenes.

Understanding this distinction is important when evaluating fintech solutions.

Risk, Compliance, and Control

Embedded treasury does not eliminate risk. It is changing how we manage risk.

Centralised visibility improves control, but reliance on third-party platforms introduces operational dependency. Businesses must assess provider resilience, regulatory coverage, and safeguarding arrangements.

Compliance remains essential. Embedded treasury platforms must support KYC, AML, reporting, and local regulatory requirements. The responsibility is shared between the provider and the business.

Strong governance and clear ownership of treasury decisions remain critical, regardless of tooling.

The Strategic Impact of Embedded Treasury

Beyond operational efficiency, it has strategic implications.

Real-time cash data enables better decision-making. Finance leaders can invest, hire, or expand with greater confidence. Scenario planning becomes more accurate.

Embedded treasury also supports scalability. New markets can be added without reengineering banking infrastructure. This reduces friction in international expansion.

In this sense, embedded treasury is not just a finance tool. It is an enabler of business agility.

A Clear Definition of Embedded Treasury

Embedded treasury is the integration of treasury management capabilities into business software, enabling real-time control of cash flow, payments, FX, and liquidity through fintech-driven infrastructure.

It represents a shift from fragmented, manual treasury operations to integrated, programmable financial management.

Final Perspective

Embedded treasury reflects a broader transformation in how businesses interact with financial infrastructure. As fintech continues to abstract complexity, treasury becomes less about managing systems and more about managing decisions.

For global businesses, it is rapidly becoming a necessity rather than a competitive advantage.

It does not replace treasury expertise, but it reshapes how that expertise is applied in a digital, real-time world.