As embedded finance reshapes the financial landscape, one foundational element is quietly powering much of the transformation: data. At the centre of this shift is Finicity, a US-based financial data aggregator acquired by Mastercard in 2020. In the fast-evolving embedded finance ecosystem, Finicity plays a crucial role as the data layer, enabling fintechs, banks, and platforms to access, interpret, and act on financial data in real time.

In this review, we examine how Finicity operates, what makes it essential to embedded finance in the US, and why access to quality data is now a competitive differentiator in financial innovation.

What is Finicity?

Finicity is a financial data network that connects banks, fintechs, lenders, and developers to consumer-permissioned financial data. Its APIs provide real-time access to bank account balances, transactions, income verification, credit data, and more.

Unlike traditional data sources that rely on outdated files or paper statements, Finicity enables live access to financial information, empowering faster, smarter decisions in lending, payments, and personal finance management.

After being acquired by Mastercard, Finicity has become a central part of the company’s open banking strategy in the US. While Europe moved early on open banking regulation (via PSD2), the US has taken a market-driven approach. Making trusted data aggregators like Finicity especially important.

Key Use Cases in Embedded Finance

Finicity plays an enabling role behind the scenes of many embedded finance journeys. Its API layer integrates with apps and platforms that offer financial services natively, without being banks themselves.

1. Credit Decisioning and Lending

Finicity’s income and asset verification APIs are widely used in mortgage underwriting, personal loans, and auto finance. Embedded lending platforms use these tools to verify employment, analyse cash flow, and assess repayment ability. Often in real time.

2. Personal Finance and Budgeting

Apps like Intuit Mint, Experian Boost, and other PFMs rely on transaction data to help users budget, track spending, or boost their credit profile. Finicity’s access to categorised transactions allows these tools to deliver personalised, data-rich insights.

3. BNPL and POS Financing

Embedded finance platforms that offer buy-now-pay-later (BNPL) options use Finicity’s APIs to assess affordability and cash flow before approving point-of-sale loans. This reduces risk and improves customer experience.

4. Open Banking Infrastructure

As Mastercard pushes for a broader open banking framework in the US, Finicity is the backbone. It enables secure consumer-permissioned data sharing, helping platforms build compliant, scalable financial services with transparency and trust.

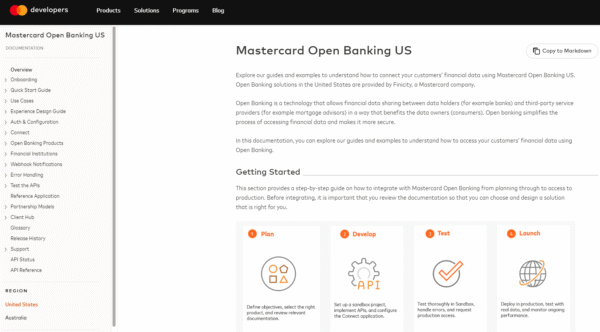

Developer Tools and API Design

Finicity offers a robust set of APIs with developer-friendly documentation, SDKs, and sandbox environments. Its platform includes modules for:

- Account aggregation

- Transaction categorisation

- Asset and income verification

- Connect widget for secure user authentication

- Consumer disclosures and consent tracking

Developers appreciate the ease of integration and flexibility in building flows around Finicity’s endpoints. The APIs are RESTful and use OAuth for secure authentication.

Additionally, the company’s Finicity Connect widget streamlines the end-user experience, allowing customers to securely log into their bank and share data in just a few steps.

Regulatory Compliance and Consumer Control

One of Finicity’s strongest differentiators is its emphasis on consumer-permissioned access. Unlike older screen-scraping methods, Finicity prioritises secure, tokenised connections through partnerships with major banks.

It also complies with guidelines from the Consumer Financial Protection Bureau (CFPB) and participates in industry standards development around fair access, data minimisation, and transparency.

In practice, this means consumers retain control over what data is shared, for how long, and with which third parties, an increasingly important point as embedded finance expands into more sensitive use cases.

Finicity vs Competitors

In the US data aggregation market, Finicity competes primarily with Plaid, MX, and Yodlee. Each has its own strengths:

- Plaid has wide market adoption among fintechs and a strong developer ecosystem.

- MX focuses on data cleansing and visualisation for credit unions and banks.

- Yodlee offers extensive financial datasets and analytics for institutions.

Finicity stands out by aligning closely with Mastercard’s strategic ambitions in open banking and compliance. It is often favoured in regulated lending environments, especially where trust, auditability, and user consent are critical.

Strategic Role in Mastercard’s Vision

Post-acquisition, Finicity now sits at the heart of Mastercard’s data and open banking infrastructure. It supports Mastercard’s move beyond cards. Positioning the company as a key enabler of digital financial services.

Through Finicity, Mastercard can offer embedded finance rails that go beyond payments. This includes lending APIs, credit scoring tools, and embedded verification services. In turn, fintechs and banks can plug into a trusted data network without building their own integrations from scratch.

As the US moves closer to formalising open banking regulation, Finicity will be a vital partner for platforms seeking compliant, user-centric data access.

Final Verdict

Finicity may not be as visible as some of the consumer-facing brands it powers, but its role in embedded finance is critical. As financial services become increasingly distributed, built into apps, platforms, and digital experiences, real-time access to high-quality, consent-driven data is the glue that holds it all together.

With a strong developer experience, regulatory alignment, and deep integration into Mastercard’s ecosystem, Finicity is well-positioned to remain a foundational data layer in the US embedded finance market.

For fintechs, lenders, and platforms looking to embed financial intelligence and verification tools, Finicity offers both credibility and capability, without compromising speed or compliance.