In today’s world of online financial tools, platforms that promise to simplify mortgage and insurance decisions are everywhere. Fynance Hub is one such site, offering a combination of rate comparisons, mortgage origination, and access to credit reports. But how does it compare to competitors like RateHub or LowestRates.ca? And can you trust it with your financial journey? This review explores Fynance Hub in detail, helping you decide if it’s worth using.

1. What Is Fynance Hub?

Fynance Hub is a Toronto-based financial platform that offers rate comparisons for mortgages, insurance, credit cards, and other financial products. The platform combines a comparison engine with a licensed mortgage brokerage and in-house lending arm, giving users the option to both browse and apply directly for financial products.

It originated as CanWise Financial and has evolved into a broader platform under the Fynance Hub brand. While much of its interface looks like a typical aggregator, the company also generates revenue through mortgage originations, allowing it to offer its own rates alongside third-party options.

The platform is free to use and positions itself as an information hub. However, it does not act as a financial advisor. Instead, it directs users to external vendors or allows them to apply through its own services.

2. Key Features and Tools

Fynance Hub’s core features center around helping users make informed decisions about loans and insurance.

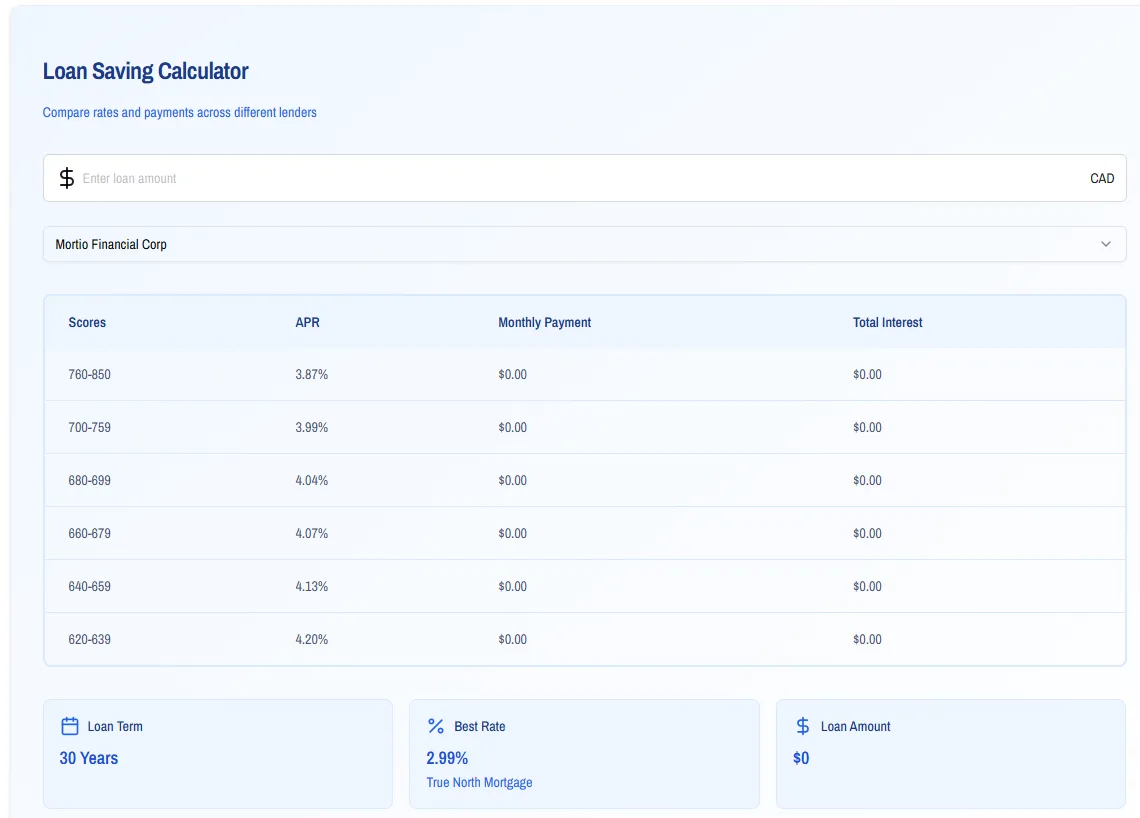

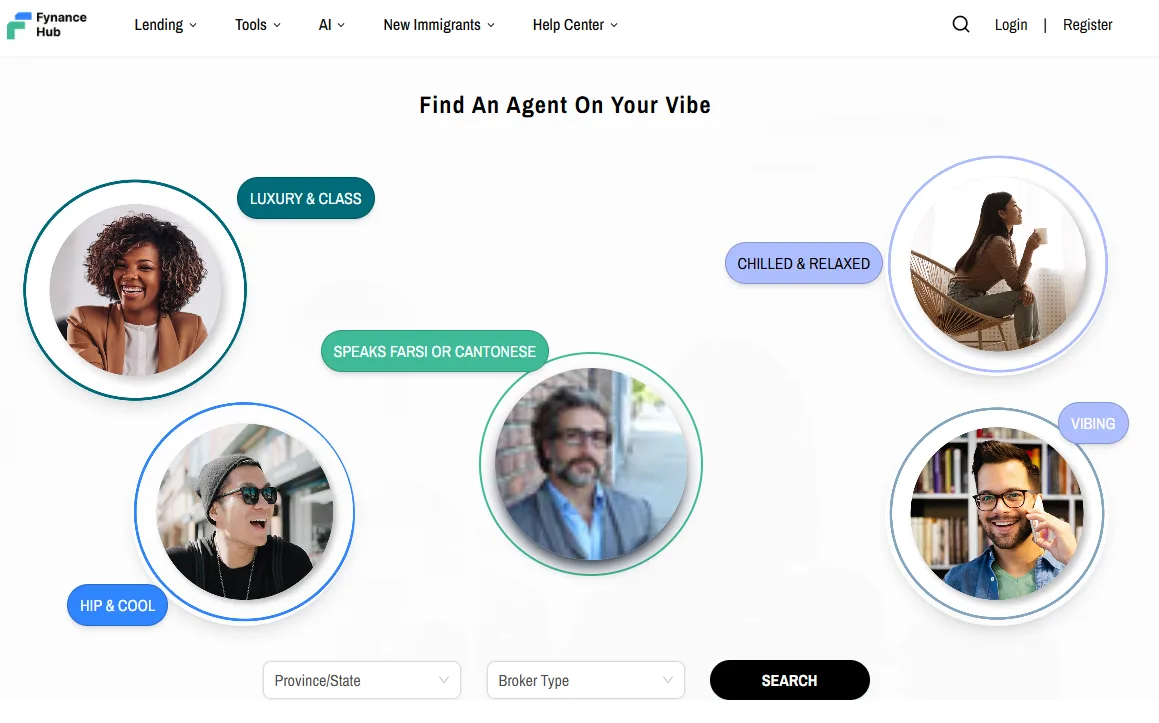

- Mortgage Comparison Tool: Users can compare fixed and variable rates from a variety of lenders. The listings include interest rates, term lengths, and estimated monthly payments.

- Insurance Comparisons: The platform connects users with third-party insurance providers for auto, home, and life insurance quotes.

- Credit Report Integration: One of the most unique features is free access to an Equifax credit report. After registering an account, users can check their score and use it to assess eligibility.

- Mortgage AI Tools: Users can access interactive tools to simulate affordability, stress tests, and payment projections.

- Lead Forms: These forms capture user information and direct them to the appropriate lender or advisor, depending on the selected product.

3. How Fynance Hub Makes Money

Fynance Hub does not charge users. Instead, it earns money through:

- Sponsored Listings: Certain financial products receive preferred placement on the site. These products are marked as “Featured” or “Sponsored,” and their rankings may be influenced by commercial agreements.

- Referral Commissions: If a user clicks through and is approved for a product from a partner, Fynance Hub receives a referral fee.

- In-House Mortgage Origination: When users apply for a mortgage directly via Fynance Hub Services, the company earns origination fees and spreads.

The platform states that its compensation structure does not influence the integrity of its listings, though featured products do appear at the top. This is typical for the industry, but it’s worth keeping in mind when browsing.

4. User Experience and Interface

The site is clean, responsive, and easy to use on both desktop and mobile. Tools are clearly labeled, and the filtering functions are intuitive.

The mortgage calculator allows for quick simulations, while the Equifax credit report tool integrates smoothly into the user dashboard. The site is faster than many competitors, with clear calls to action and simple next steps.

However, lead forms can feel repetitive. After selecting a product, users are often prompted to input contact details multiple times if they navigate between tools. While understandable from a lead-generation standpoint, it may frustrate some users.

5. Strengths and Weaknesses

Strengths

- Seamless Equifax credit integration

- Wide variety of comparison tools

- Clean design and intuitive layout

- Combines aggregator and mortgage lender functions

- Fast and responsive interface

Weaknesses

- Sponsored listings can affect transparency

- Not all available products are listed

- No regulated financial advice offered

- Repetitive lead forms in multi-step journeys

6. Fynance Hub vs. Competitors

Fynance Hub vs. RateHub

RateHub is arguably the most well-known mortgage comparison platform in Canada. It offers more in-depth editorial content, tools for real estate market tracking, and stronger SEO visibility.

However, Fynance Hub’s integration with Equifax and focus on data-driven UX gives it a more modern edge. For users who value credit transparency, Fynance Hub wins. But for deep research and broker access, RateHub offers more.

Fynance Hub vs. LowestRates.ca

LowestRates places greater emphasis on insurance and auto lending. Its interface is slightly more aggressive in lead generation, while Fynance Hub feels more user-centric.

Fynance Hub doesn’t yet have the same volume of reviews or brand recognition but offers a simpler, cleaner experience.

Other Alternatives

- NerdWallet Canada: Better for financial education and broader product reviews.

- Rates.ca: Offers more depth on car and life insurance.

- Direct mortgage brokers: More personalized service but less comparison breadth.

7. Trustworthiness and Transparency

Fynance Hub appears legitimate, with a clean record and no known consumer alerts or regulatory issues.

Key transparency signals:

- Open disclosure of sponsored placements

- Clear privacy policy and user terms

- Explicit disclaimer that it is not a financial advisor

- Legitimate integration with Equifax Canada

There is limited availability of third-party user reviews (e.g., on Reddit or Trustpilot), which may reflect its recent rebranding from CanWise.

8. Who Should Use Fynance Hub?

Best for:

- Canadian homebuyers wanting to compare rates quickly

- Users who want their credit score factored into product recommendations

- People comfortable researching further after using the platform

Not ideal for:

- Those needing ongoing financial advice or planning support

- Shoppers wanting the absolute lowest rate in the entire market

- Users outside Canada or those with limited credit history

9. Final Verdict

Fynance Hub is a credible, user-friendly financial comparison platform with added value through its Equifax integration. It stands out among newer aggregators due to its modern design, dual role as lender and broker, and range of tools.

Still, users should be aware that not all offers are shown, and commercial arrangements can influence rankings. It’s best used as a first step in exploring mortgage and insurance options, not the only one.

When used alongside other tools like RateHub or a direct broker, Fynance Hub can be a powerful ally in making smarter financial decisions.

Tips for Getting the Most Out of Fynance Hub:

- Use the Equifax credit report tool to check your score before applying.

- Take screenshots of your top quotes and compare them across other platforms.

- Read the fine print on featured listings.

- Don’t rely solely on the site’s recommendations, use it to shortlist, then investigate deeper.

If you’re buying a home or renewing your mortgage in Canada, Fynance Hub is definitely worth a look, just make sure it’s not your only stop.