Credit cards are one of the most widely used financial tools in the modern economy. They provide a convenient way to pay for goods and services, access short-term credit, and build a record of financial responsibility. At the same time, they can be misunderstood and, when misused, lead to costly debt.

Understanding how a credit card works is essential for anyone looking to manage money effectively. This article explores the mechanics of credit cards, how transactions are processed, how interest and fees are calculated, the benefits and risks, and how credit cards fit into broader personal finance.

The Basics of a Credit Card

A credit card is a financial instrument issued by a bank or other financial institution that allows the holder to borrow funds up to a pre-approved limit. Unlike a debit card, which draws directly from an existing account balance, a credit card allows spending with borrowed money that must be repaid later.

When using a credit card, the issuer pays the merchant on behalf of the cardholder. The cardholder then repays the issuer, either in full by the payment due date or over time with added interest.

Each cardholder has a credit limit, the maximum amount that can be borrowed. This limit is determined by the issuer based on factors such as credit history, income, and overall financial profile.

How Credit Card Transactions Work

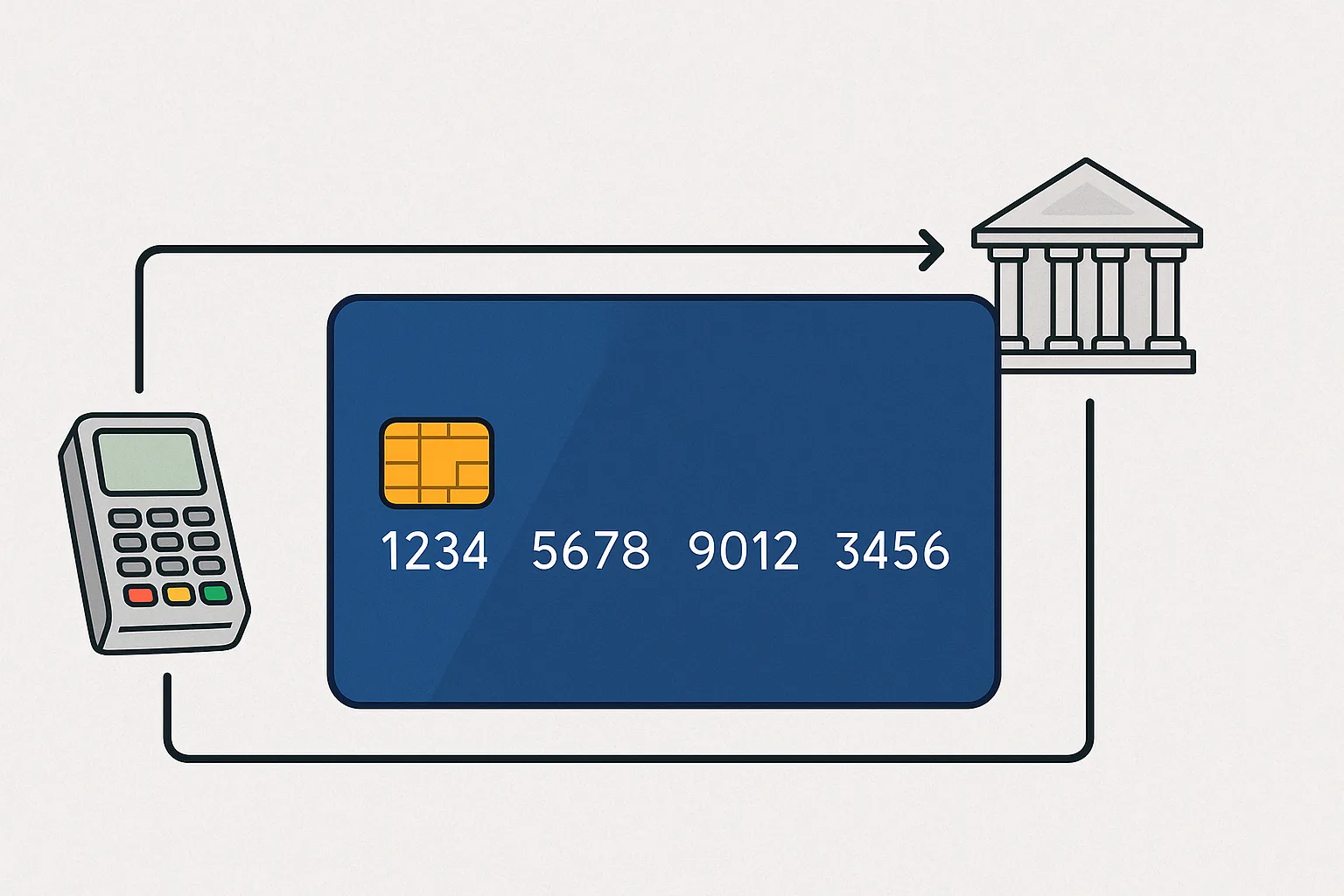

The process of using a credit card involves several parties and systems working together. A typical transaction goes through a few steps.

- Authorisation:

- The cardholder presents the credit card to pay for goods or services.

- The merchant’s point-of-sale (POS) system or online gateway sends a request through the card network (such as Visa or Mastercard) to the card issuer.

- The issuer checks whether the card is valid, whether sufficient credit remains, and whether there are signs of fraud.

- Authentication:

- Security checks confirm the transaction. This may involve a chip-and-PIN, contactless tap, or online authentication such as 3D Secure.

- Approval:

- If approved, the transaction is authorised, and the cardholder receives confirmation.

- Settlement:

- Funds are transferred from the card issuer to the merchant’s acquiring bank, usually within one to two business days.

- Billing:

- The cardholder sees the charge on their monthly statement and is responsible for repayment.

This behind-the-scenes system allows payments to appear instant from the cardholder’s perspective, even though settlement happens later.

Credit Card Transaction Flow

Cardholder

Uses the credit card to make a purchase online or in-store.

Merchant

Accepts the card and requests authorisation through POS or online gateway.

Card Network

Visa, Mastercard or others route the request securely to the issuer.

Issuer

The bank checks validity, balance and fraud risk before approval.

Settlement

Funds move from issuer to merchant’s bank. Cardholder later repays issuer.

Billing Cycles and Statements

Credit cards operate on a monthly billing cycle. At the end of each cycle, the issuer generates a statement listing:

- Purchases, payments, and cash withdrawals.

- The statement balance: the total amount owed.

- The minimum payment: the minimum required to keep the account in good standing.

- The payment due date: the date by which at least the minimum must be paid.

If the cardholder pays the statement balance in full by the due date, no interest is charged on purchases. If only the minimum is paid, the remaining balance carries forward with interest.

Interest and Fees

Interest is one of the key ways card issuers make money. Credit card interest rates are expressed as an annual percentage rate (APR). When balances are carried forward, interest is applied daily based on the card’s APR and outstanding balance.

For example, if a card has an APR of 20% and a balance of $1,000 is carried over, interest accumulates each day until repayment.

But in addition to interest, issuers may charge:

- Annual fees: a flat yearly cost for holding the card, often associated with premium cards.

- Late payment fees: penalties for missing the due date.

- Cash advance fees: charges for withdrawing cash with a credit card. Interest on cash advances often accrues immediately without a grace period.

- Foreign transaction fees: applied to purchases in another currency, unless the card is designed for travel.

Credit Limits and Utilisation

The credit limit determines how much can be borrowed at one time. Responsible use involves staying well below the limit, both to avoid fees and to maintain a healthy credit profile.

Credit utilisation ratio, the percentage of available credit being used, is a key factor in credit scoring. While keeping utilisation low, typically below 30%, signals to lenders that the borrower is not overly reliant on credit.

Rewards and Benefits

Many credit cards offer rewards and perks to attract customers. Common programmes include:

- Cashback: A percentage of spending returned as cash.

- Points: Accumulated points that can be redeemed for travel, shopping, or other rewards.

- Airline miles: Travel-focused cards often allow accumulation of miles redeemable for flights.

- Purchase protection: Insurance against theft, damage, or extended warranties.

- Travel insurance: Cover for trips, lost luggage, or accidents.

- Access perks: Priority boarding, airport lounge access, or special event invitations.

While these benefits can add value, they should not distract from responsible use. Interest charges can quickly outweigh rewards if balances are not paid in full.

Building Credit with a Credit Card

One of the most important roles of a credit card is building a credit history. Each month, issuers report cardholder activity to credit bureaus. Responsible use, paying on time and keeping balances low, strengthens credit scores.

This, in turn, helps when applying for loans, mortgages, or even jobs where credit checks are required.

Conversely, late payments, high utilisation, and defaults can damage credit scores, making future borrowing more expensive or unavailable.

Risks of Credit Cards

Credit cards are powerful tools, but they carry risks if not managed carefully.

- Debt Accumulation: High interest rates mean balances can grow quickly if only minimum payments are made.

- Overspending: The ability to defer payment can tempt users into spending beyond their means.

- Complex Fees: Misunderstanding interest rules and fees can lead to unexpected costs.

- Impact on Credit Score: Late payments and high utilisation harm credit ratings, limiting access to future credit.

- Fraud: While credit cards generally offer strong consumer protection, fraud risks remain. Prompt reporting and monitoring are essential.

Fraud Protection and Security

Credit cards have built-in protections against fraud. Most issuers offer zero-liability policies, meaning cardholders are not held responsible for unauthorised transactions if reported promptly.

Security features include:

- EMV chips for secure transactions.

- Contactless payments with encryption.

- Two-factor authentication for online purchases.

- Monitoring systems that flag suspicious activity.

Despite these safeguards, phishing and scams remain threats, making vigilance important.

Credit Cards vs Debit Cards

It is useful to distinguish credit cards from debit cards.

- Debit cards draw directly from an existing bank account balance. Spending is limited to available funds.

- Credit cards allow borrowing up to a pre-set limit, with repayment later.

Credit cards offer more protection, rewards, and opportunities to build credit, but they carry the risk of debt. Debit cards provide simpler money management without risk of interest. Many consumers use both, depending on the situation.

Credit Cards and Regulation in Europe

In Europe, credit cards are subject to regulation under consumer protection and banking laws. The EU Consumer Credit Directive sets rules on transparency of interest rates, fees, and repayment terms. Strong Customer Authentication (SCA), under the revised Payment Services Directive (PSD2), ensures secure online transactions.

These frameworks aim to balance access to credit with consumer protection, reducing risks of over-indebtedness and fraud.

Case Study: A Month in the Life of a Credit Card User

Consider Sarah, who uses her credit card for everyday purchases.

- On 1 March, she buys groceries, petrol, and clothes, totalling $600.

- Her billing cycle closes on 25 March. Her statement balance is $600, with a minimum payment of $25.

- Her payment due date is 20 April.

- If she pays the full $600 by 20 April, she pays no interest.

- If she pays only $25, the remaining $575 accrues interest daily until repaid.

This example shows how discipline and full repayment protect against costly debt.

Credit Cards in Personal Finance

When used wisely, credit cards are versatile tools in personal finance. They provide short-term credit, rewards, and protections that can enhance everyday spending. They are also gateways to building strong credit histories, which are essential for larger financial goals like buying a home.

However, discipline is crucial. Credit cards are not sources of free money but instruments of convenience and responsibility. Successful users treat them as payment tools, not borrowing tools, repaying balances in full each month.

The Future of Credit Cards

Credit cards are evolving with technology. Mobile wallets, biometric authentication, and digital-first issuers are changing how cards are issued and used. Fintech challengers are introducing cards with flexible credit limits, real-time budgeting, and lower fees.

Embedded finance is also influencing the space, with credit card functionality integrated into platforms such as e-commerce checkouts or super-apps. In Europe, regulation around transparency and consumer protection will continue shaping innovation.

Despite competition from new payment methods, credit cards remain central to global finance. Their mix of credit, convenience, and consumer protection ensures ongoing relevance, though their form may change.

Conclusion

A credit card is more than just a piece of plastic. It is a sophisticated financial instrument that connects cardholders, merchants, banks, and global networks in real time. It offers flexibility, rewards, and protections, but also requires responsibility.

Understanding how credit cards work, from transaction processing to billing cycles, interest, and credit scoring, allows consumers to use them wisely. The key is discipline: treating the card as a convenient tool for payments and rewards, not as a way to accumulate debt.

As technology and regulation continue to evolve, credit cards will remain a cornerstone of personal finance. For consumers who understand their mechanics, they can be powerful allies in building financial health.