Millions of crypto holders let their assets sit idle in wallets, earning nothing while inflation and opportunity costs erode their real value. Yet in today’s decentralised finance ecosystem, there are multiple ways to make those assets productive. Understanding how to earn yield on idle crypto is now essential for long-term investors, not just active traders.

Yield generation isn’t about speculation or risky leverage. It is about choosing where your assets live, and what protocols or services can help them grow. From staking to lending, the DeFi space in 2025 offers structured, relatively low-risk opportunities to earn passive income on your crypto portfolio without constantly moving in and out of positions.

This guide explores the main options available to earn yield on idle crypto, along with the practical and strategic factors to consider.

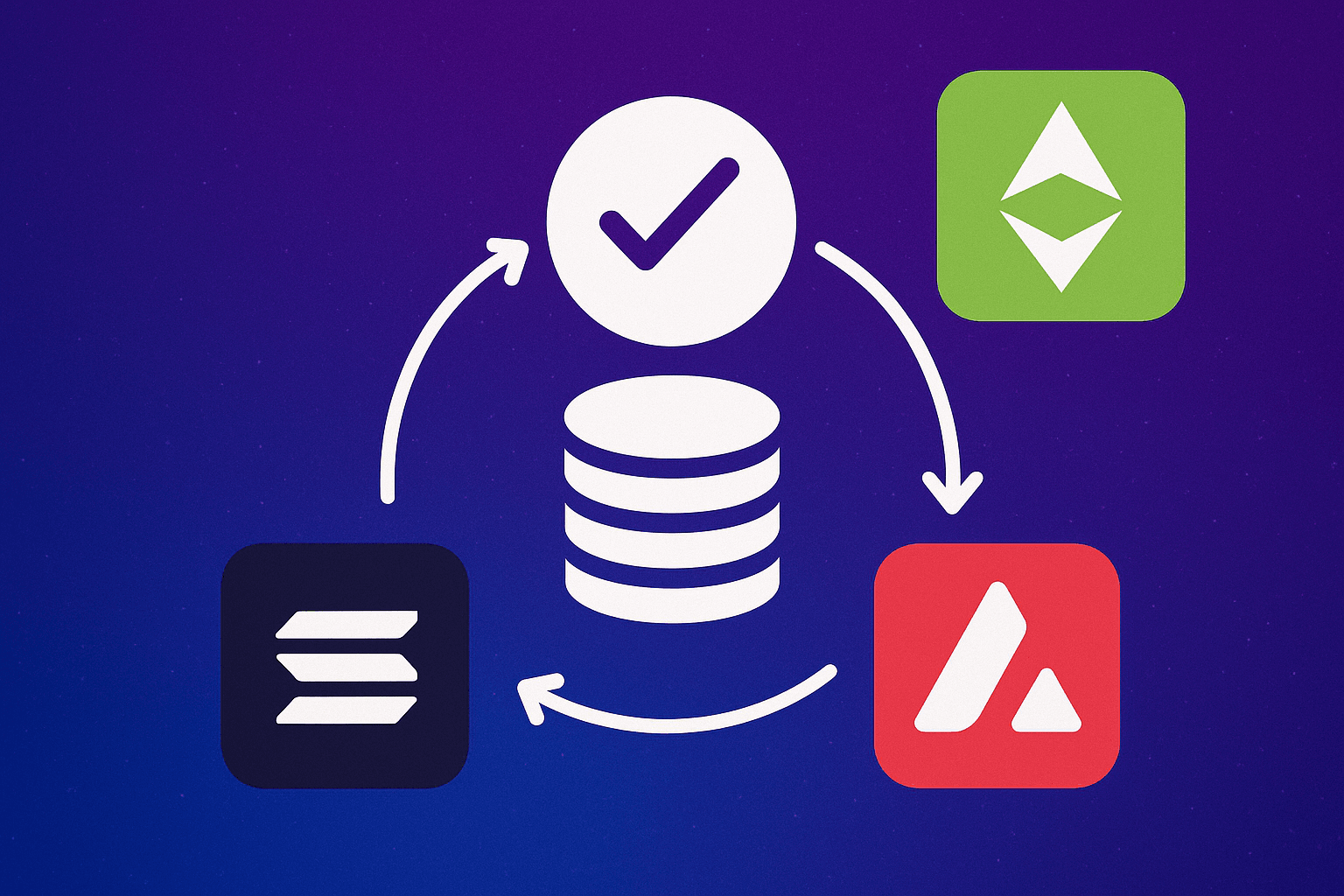

Staking: Secure the Network and Earn Rewards

Staking is one of the most accessible ways to earn yield. In proof-of-stake networks like Ethereum, Solana, and Avalanche, token holders can lock up their assets to help validate transactions and secure the network. In return, they receive rewards in the form of newly issued tokens or transaction fees.

You can stake directly through a wallet like MetaMask or Keplr, or use a staking-as-a-service provider like Lido, Rocket Pool, or Binance.

Liquid staking platforms are particularly popular, as they give you a tradable derivative token (e.g., stETH or rETH) while your original tokens remain staked. This allows you to maintain liquidity and even earn additional yield by using the derivative in DeFi protocols.

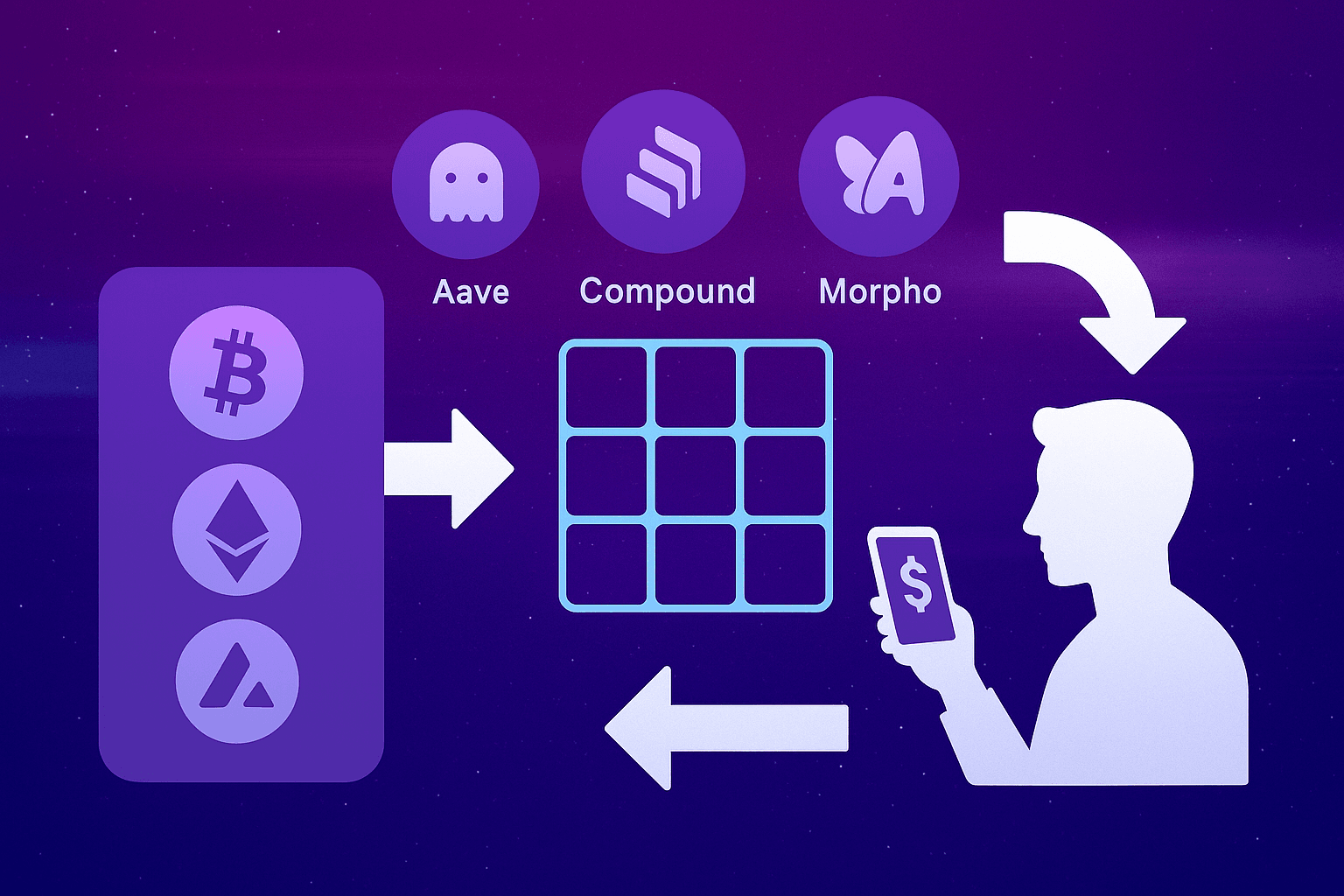

Lending: Provide Liquidity and Collect Interest

Lending your idle crypto through decentralised protocols is another effective way to earn yield. Platforms like Aave, Compound, and Morpho allow users to supply assets to liquidity pools, where borrowers can access them under overcollateralised terms. In return, you earn interest, paid in the asset you deposited or the protocol’s native reward token.

This approach works well with major assets such as ETH, USDC, DAI, or wrapped BTC. Interest rates vary by demand and market conditions, but returns are often steady, especially during periods of low volatility. Some platforms offer fixed-rate lending, which helps users lock in predictable returns over a chosen term.

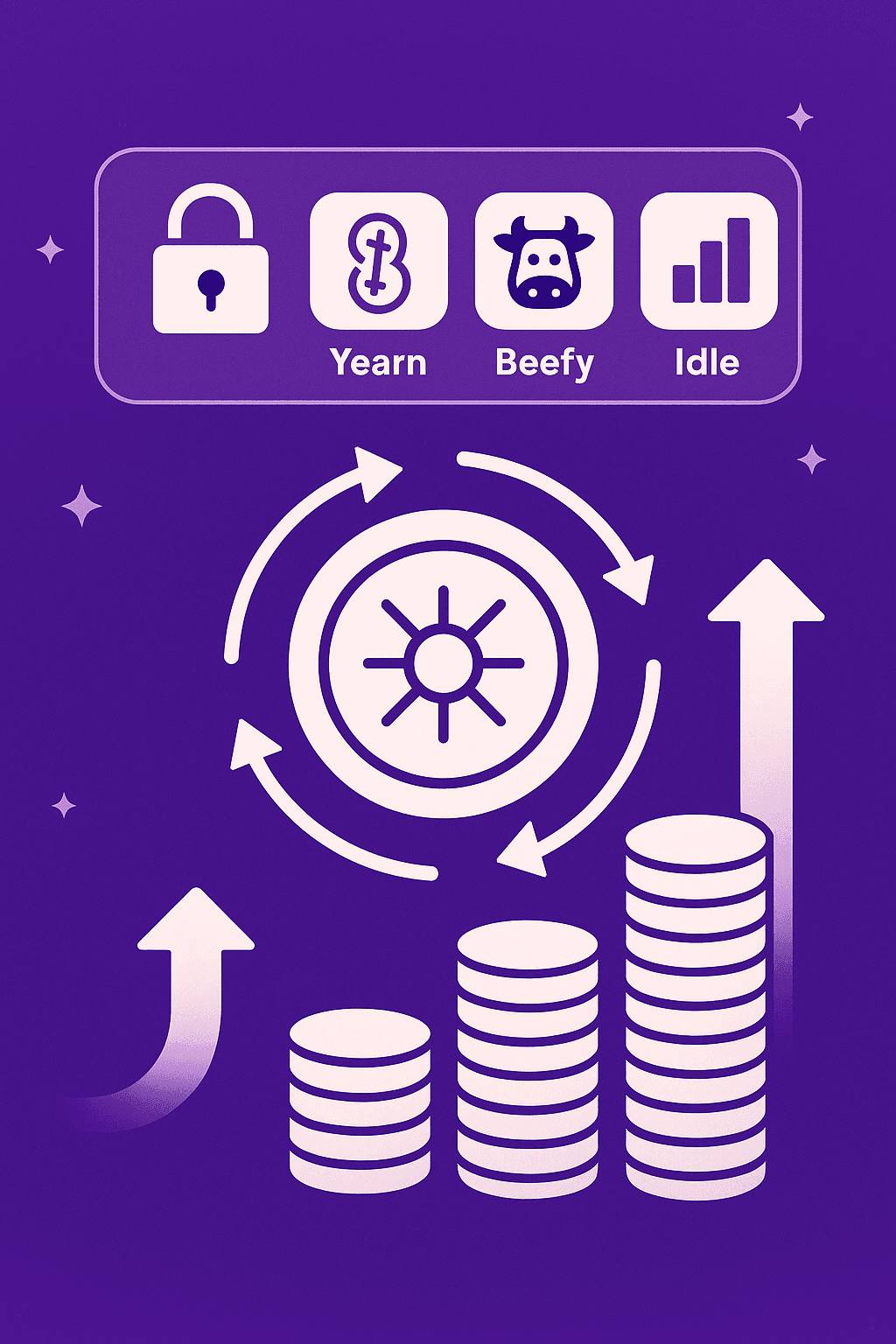

Vaults and Yield Aggregators: Passive, Optimised Returns

For those who want hands-off management, vault-based platforms like Yearn, Beefy, and Idle Finance offer auto-compounded strategies. These protocols bundle user deposits and route them through the highest-yielding opportunities within a defined risk profile. They continuously optimise for return, harvesting and reinvesting rewards automatically.

Vaults often support single-token deposits and are ideal for users who want to avoid manual claim-and-reinvest cycles. The trade-off is that you pay performance or management fees, but these are usually justified by better net yield compared to unmanaged strategies.

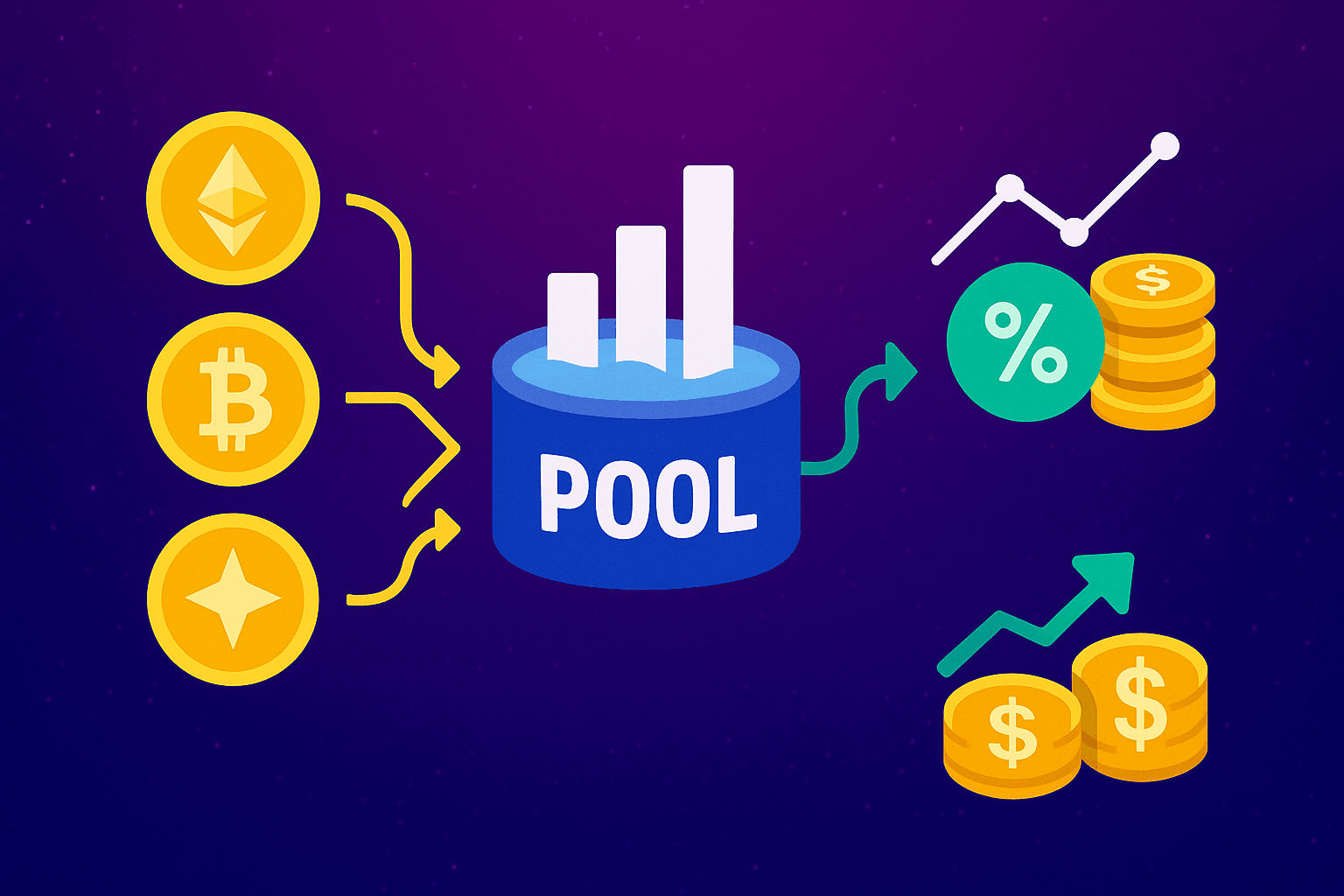

Liquidity Pools: Earn Fees on Trading Activity

Providing liquidity to decentralised exchanges like Uniswap, Balancer, or Curve allows you to earn fees from token swaps. Your crypto earns a return as traders pay fees to interact with the pool. These returns can be enhanced by farming additional tokens from the DEX or affiliated protocols.

To reduce risk, choose stable or correlated pairs (e.g., USDC/DAI or ETH/wstETH) to minimise impermanent loss. This method suits more experienced users who can monitor pool health and rebalance when needed, but it remains a powerful way to make idle assets productive.

Centralised Platforms: Simpler Interface, Lower Control

Some users prefer to earn yield through centralised exchanges or custodians such as Coinbase, Kraken, or Nexo. These platforms offer staking, lending, and interest-bearing accounts with minimal setup. While convenient, they involve custodial risk and may offer lower yields than DeFi.

Still, for users not ready to manage private keys or interact with smart contracts, these platforms offer an accessible bridge into passive crypto income.

Idle Crypto: Don’t Let it Sit Still

Earning yield on idle crypto is not without risk. Protocol smart contracts can be exploited, interest rates can drop unexpectedly, and asset values can fluctuate. Use audited protocols, diversify across multiple strategies, and track your returns regularly to stay in control. Tools like DeFi Llama, APY.vision, and Zapper help you monitor performance and identify new opportunities.

Keep in mind the difference between nominal yield and real return. A 5% APY on an asset that drops 30% in value is not truly profitable. Always align yield strategies with your broader asset allocation and time horizon.

Earning yield on idle crypto turns passive holding into productive participation. Whether you stake, lend, or deploy through DeFi vaults, there are reliable options to grow your portfolio without heavy risk. As infrastructure improves and strategies become more sophisticated, passive income in crypto is no longer a niche activity.

It is an essential component of long-term digital asset management.