Justwealth has become one of Canada’s most trusted robo advisors. It is praised for strong performance, dedicated portfolio managers, and a wide range of account options. Unlike many digital-only platforms, Justwealth blends automation with personal service. This review explores how the platform works, what it costs, how it performs, and whether it is the right fit for your investment goals.

What Is Justwealth?

Justwealth is an independent Canadian robo advisor based in Toronto. It is registered as a Portfolio Manager across all provinces and territories. This means it is held to fiduciary standards, where advisors must act in the best interest of clients. Investments are held through BBS Securities and protected by the Canadian Investor Protection Fund, with coverage up to CAD 1 million per account type.

Unlike some competitors, Justwealth provides each client with a dedicated portfolio manager. This person is available to answer questions, explain investment decisions, and support long-term planning.

Portfolio Choices and Strategy

One of Justwealth’s strongest features is its wide range of portfolios. The platform offers over 80 unique investment options. These include growth, income, preservation, and special-purpose portfolios such as RESP and FHSA target-date options. These target-date portfolios automatically reduce risk as the maturity date approaches.

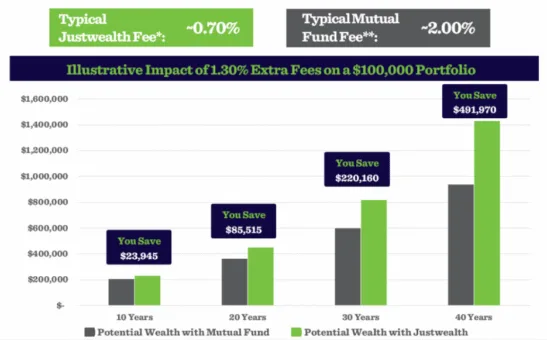

All portfolios are built using low-cost ETFs. These cover Canadian, US, and international equities, as well as fixed income. Most underlying ETF fees (MERs) fall between 0.15 percent and 0.25 percent. When combined with Justwealth’s own management fee, total annual costs usually land between 0.55 percent and 0.75 percent.

Fees and Pricing

Justwealth charges a 0.50 percent management fee on balances under CAD 500,000. The fee drops to 0.40 percent on larger balances. Accounts are subject to a minimum charge of CAD 4.99 per month, or CAD 2.50 for RESP and FHSA accounts. A minimum investment of CAD 5,000 is required for most account types.

Although not the lowest-fee robo advisor in Canada, Justwealth’s pricing remains competitive. It is far more affordable than traditional mutual funds, which often cost over 2 percent annually. There are no trading fees, withdrawal fees, or hidden costs.

Platform and Security

The Justwealth platform is simple and straightforward. Account setup takes just a few minutes. New users answer a short questionnaire to determine their risk level and investment goals. Based on the results, a tailored portfolio is selected. Clients can then fund the account via direct deposit, bill payment, or transfer.

Once invested, users can view account performance, asset allocation, and contribution history online. A mobile app provides access to key features. Security measures include 256-bit SSL encryption, multi-factor authentication, and full compliance with Canadian privacy laws.

Performance Compared to Competitors

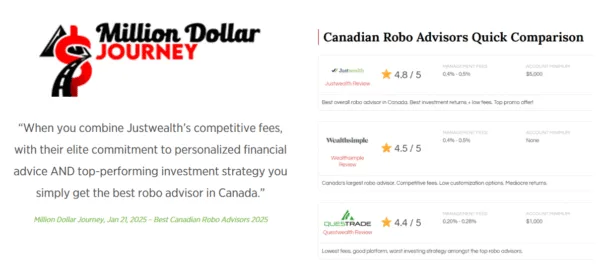

Justwealth has consistently delivered strong after-fee returns. According to MoneySense, it ranked as the best overall robo advisor in Canada in 2025. Its five-year performance for growth and balanced portfolios remains among the highest in the market.

Independent platforms such as Million Dollar Journey have echoed that assessment. Many comparisons place Justwealth above competitors like Wealthsimple, CI Direct Investing, and Questwealth when factoring in net returns, portfolio variety, and personal service.

Strengths of Justwealth

Wide portfolio selection

With more than 80 portfolios available, Justwealth covers nearly every investment goal. The RESP and FHSA target-date options are especially well designed for Canadian families.

Dedicated portfolio managers

Unlike most robo advisors, Justwealth assigns each client a named advisor. This person can help with rebalancing, tax efficiency, and goal setting. Many users value the ability to speak with a human expert.

Consistent returns

Justwealth has a strong track record, with net-of-fee returns that often outperform competing robo advisors.

Transparent fee structure

All fees are clearly disclosed. There are no commissions, trading costs, or surprise charges. The overall cost remains low for the level of personalisation provided.

Registered account support

Justwealth supports all major Canadian account types. These include RRSP, TFSA, RESP, FHSA, RRIF, LIRA, joint, corporate, and non-registered accounts.

Strong regulation and security

As a licensed portfolio manager, Justwealth is held to strict standards. Client funds are secure and insured.

Weaknesses and Limitations

- High minimum investment – Justwealth requires at least CAD 5,000 to open most account types. This could discourage new investors or students who want to start with smaller amounts.

- Flat monthly fee – Although overall fees are fair, the minimum monthly charge can reduce returns for smaller balances. Investors with CAD 5,000 may see a larger portion of gains eaten by fees.

- No access to individual stocks or crypto – Justwealth invests only in ETFs. It does not support trading of individual stocks, bonds, real estate, or cryptocurrency. Those seeking broader asset exposure may need to use another platform in parallel.

- Basic user interface – The online dashboard works well but lacks some of the modern design and features found in newer apps. Navigation is simple but not especially dynamic.

- Less suited to DIY investors – Investors who want full control over asset selection, timing, or tactical allocation will find the platform too hands-off.

Who Should Use Justwealth?

Justwealth is ideal for:

- Long-term investors seeking a set-it-and-forget-it solution

- Parents investing through RESP or FHSA

- Canadians planning for retirement with RRSPs or TFSAs

- Professionals or families with more than CAD 10,000 to invest

- Anyone who wants a low-cost solution with real human advice

It may not be the right choice for:

- Beginners with less than CAD 5,000

- DIY investors who want full trading control

- Crypto investors or those seeking alternative assets

- Users who prefer flashy apps and daily engagement

Getting Started

Opening a Justwealth account is quick and paperless. After completing a short online questionnaire, clients receive a tailored portfolio recommendation. The assigned portfolio manager then follows up to answer any questions.

Once funded, the platform handles portfolio management, rebalancing, dividend reinvestment, and performance monitoring automatically. Clients can reach out at any time to discuss changes or get personalised guidance.

Final Verdict

Justwealth stands out among Canadian robo advisors by combining high-quality portfolios with professional human support. It is a strong fit for investors who want low costs, consistent returns, and help reaching long-term goals.

Although the platform may not suit absolute beginners or highly active traders, it offers exceptional value for most Canadians with medium to large portfolios. Whether you are saving for education, retirement, or general wealth building, Justwealth deserves serious consideration.