Kraken stands out as one of the most established and trusted cryptocurrency exchanges in the industry. Founded in 2011 by Jesse Powell, Kraken has built a reputation for security, regulatory compliance, and a measured approach to growth. Unlike some of its more flamboyant competitors, Kraken has often positioned itself as the steady, professional platform for serious crypto investors. Its longevity in the industry underscores its ability to navigate both market cycles and evolving regulatory challenges, making it a preferred choice for many seasoned participants.

Security and Trust

From the outset, Kraken prioritised security. The exchange has never suffered a major hack, a claim few competitors can make. Its conservative security practices include cold storage of client funds, rigorous internal controls, and regular proof-of-reserves audits. For risk-conscious investors and institutions, Kraken’s reputation for safety has been a key differentiator.

Beyond technical safeguards, Kraken has invested heavily in educating its users about best practices in securing their accounts, including the use of hardware keys and advanced authentication measures.

Kraken’s commitment to transparency is further demonstrated through its frequent publication of security updates and audits. In an industry often criticised for opacity, Kraken’s open communication about its security protocols builds trust among its global user base. The exchange also participates in the Crypto Rating Council, which aims to clarify the regulatory status of various digital assets, further reflecting its transparent and compliant ethos.

Kraken: Regulatory Approach

Kraken has maintained a proactive stance towards regulation. It has secured multiple licences and registrations in jurisdictions such as the United States, Canada, Europe, and Japan. This regulatory posture has enabled Kraken to serve a wide international client base while maintaining compliance with evolving rules. Its US presence is particularly notable, offering full support for American users, which some global competitors lack.

In 2021, Kraken became one of the first crypto exchanges to receive a Wyoming bank charter, positioning itself uniquely to bridge the gap between digital assets and traditional banking infrastructure.

The exchange’s proactive regulatory approach extends to active engagement with policymakers and industry groups. Kraken regularly contributes to discussions on regulatory frameworks and advocates for balanced, innovation-friendly policies. Its leadership team has appeared before government bodies to share insights and recommendations, further strengthening its reputation as a responsible industry participant.

Product Offering

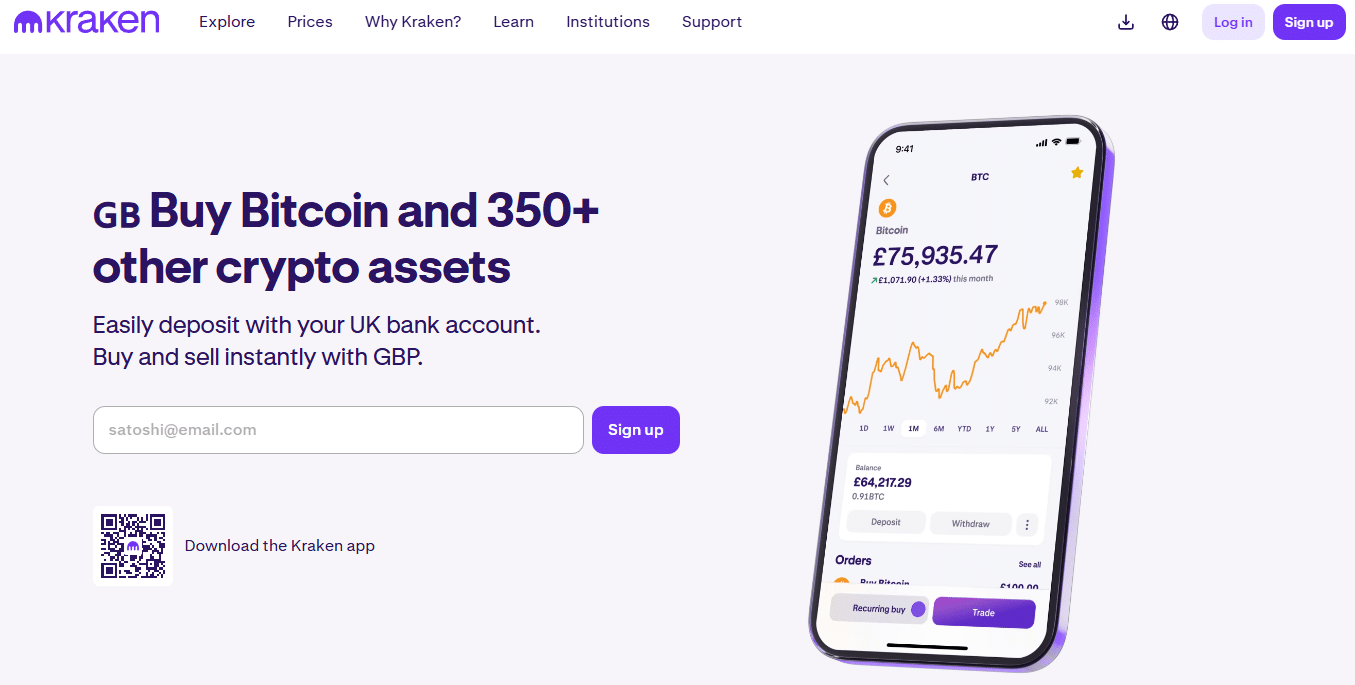

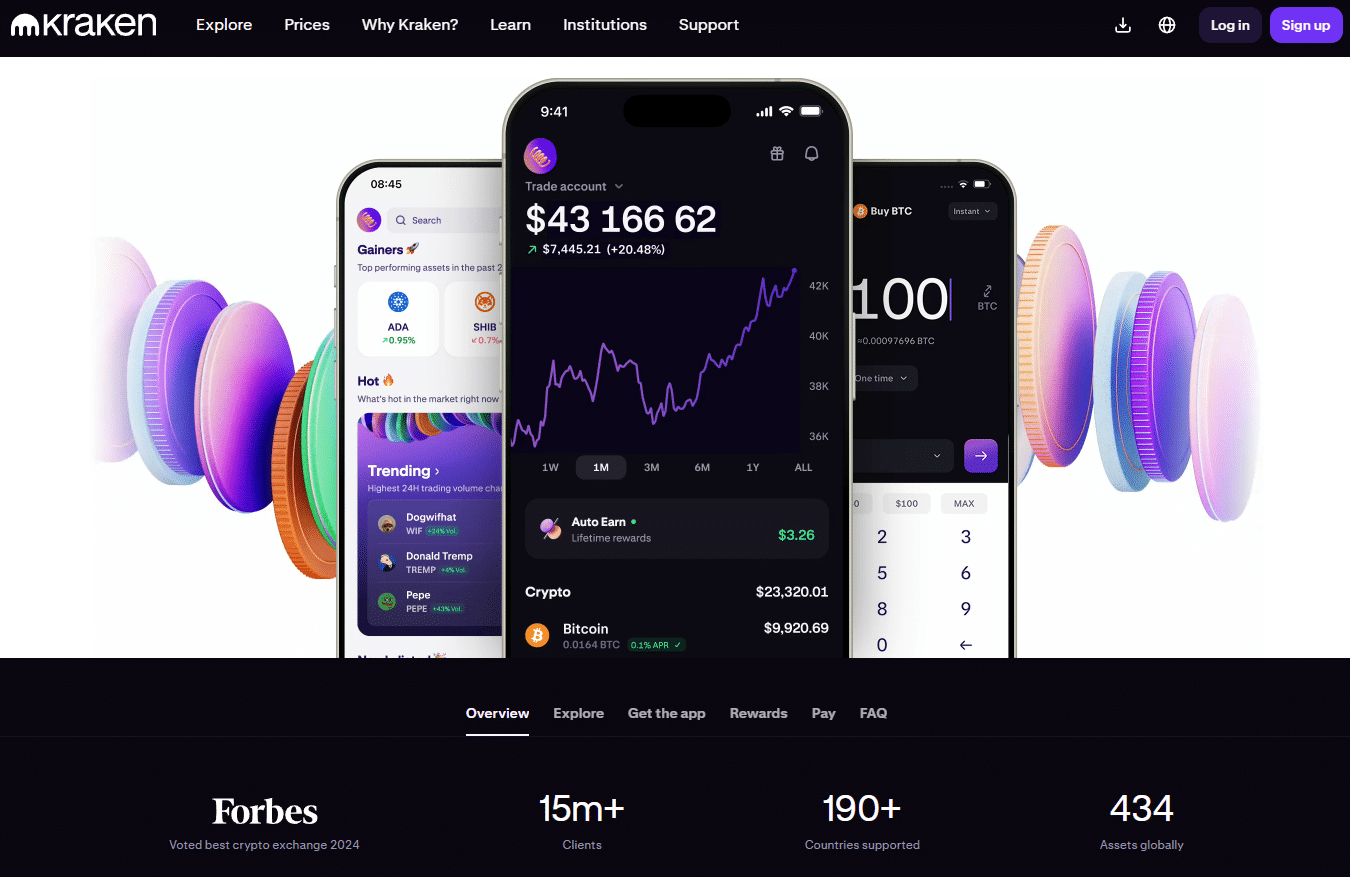

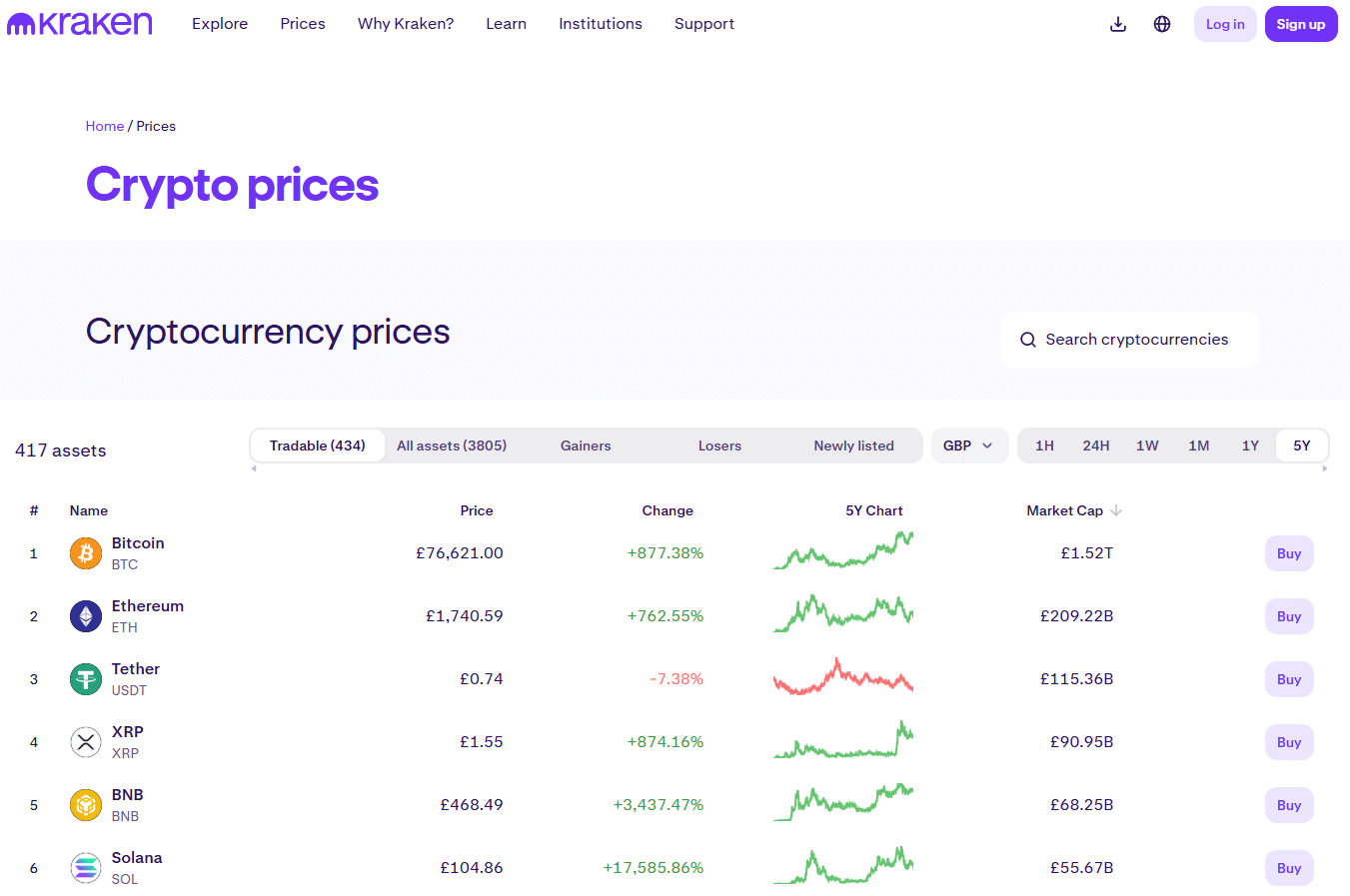

Kraken provides a comprehensive suite of products and services. Its core spot trading platform offers a wide range of cryptocurrencies and fiat pairs. The Kraken Pro platform caters to more sophisticated traders with advanced charting tools, order types, and lower fees for high-volume trading. As of today, Kraken supports trading for hundreds of asset pairs, giving investors ample choice for portfolio diversification.

Beyond spot trading, Kraken has expanded into staking, futures trading, margin trading, and institutional services. Its staking platform allows users to earn rewards on a variety of digital assets directly from the platform, appealing to long-term holders. The futures and margin products provide additional flexibility for professional traders, though they are carefully controlled within regulatory frameworks. Kraken’s futures platform offers up to 50x leverage on certain contracts, catering to sophisticated market participants while incorporating robust risk management systems.

Kraken has also ventured into the NFT space with its own marketplace, enabling users to explore digital collectibles in a secure and regulated environment. While still a developing segment of its business, Kraken’s entry into NFTs reflects its intent to provide a full-service crypto experience, addressing the diverse interests of its growing customer base.

Kraken User Experience

Kraken’s interface is functional and reliable, but it has not always been known for being the most user-friendly for beginners. Recent updates to Kraken Pro and its mobile app have significantly improved accessibility, offering a cleaner experience for both novice and experienced users. Its customer support has also improved over the years, addressing one of the long-standing criticisms of earlier periods. Live chat support, expanded help centres, and multilingual assistance now contribute to a more responsive client service experience.

Educational resources have become another strong point for Kraken. Through its dedicated Learn platform, Kraken offers tutorials, market insights, and security tips, helping users navigate the often complex world of cryptocurrency with confidence. This educational focus not only benefits new entrants but also reinforces Kraken’s positioning as a trustworthy, long-term partner for digital asset management.

Institutional Focus

In recent years, Kraken has made substantial efforts to attract institutional clients. Its OTC desk, dedicated account management, and robust API services provide the features professional investors expect. This institutional focus aligns with Kraken’s conservative, security-first brand image, attracting hedge funds, asset managers, and corporate treasuries. Kraken’s acquisition of crypto-focused banking and trading platform TradeStation further signals its ambitions to deepen institutional engagement.

Kraken Institutional offers bespoke solutions for clients managing significant capital. These services include tailored reporting, high-liquidity execution, and compliance support, helping institutions navigate the still-developing regulatory landscape with confidence. This focus has positioned Kraken as a trusted partner for those entering the digital asset space with rigorous fiduciary and compliance obligations.

Kraken Positioning in the Market

Kraken has carved a distinctive position by balancing innovation with responsibility. It has avoided the high-risk, high-reward tactics seen in parts of the industry, which has enhanced its credibility, especially during periods of market turmoil. While it may not always capture the headlines like some rivals, its stability has earned it a loyal following. During major market downturns or incidents of platform failures across the industry, Kraken has often been cited as a platform that remained operational and trustworthy.

As regulatory scrutiny on the crypto industry intensifies globally, Kraken’s measured approach may prove advantageous. Its ability to navigate complex regulatory landscapes while maintaining product breadth positions it well for long-term growth. The firm’s ongoing investments in compliance, technology, and customer service suggest a strategy aimed at enduring market leadership rather than opportunistic expansion.

Conclusion

Kraken exemplifies a mature, institutional-grade cryptocurrency exchange. For users who prioritise security, regulatory compliance, and a broad but carefully managed product suite, Kraken offers a compelling choice. Its steady hand in a volatile market has helped it endure and grow, making it one of the most respected names in the crypto space. As the industry matures and institutional adoption increases, Kraken’s consistent focus on trust and responsibility may continue to serve as its strongest competitive advantage.