Ray Dalio is one of the most recognisable names in global finance. As the founder of Bridgewater Associates, the world’s largest hedge fund, he built a reputation not only for extraordinary investment performance but also for pioneering new ways of thinking about economics, risk, and organisational culture.

Dalio’s journey from a middle-class upbringing in New York to becoming one of the most influential investors of his generation reflects both a deep understanding of markets and an unrelenting drive to learn from mistakes. Today, his principles-based approach to investing and life continues to shape thinking among investors, policymakers, and entrepreneurs.

This Fintech Review profile explores Ray Dalio’s early life, the rise of Bridgewater Associates, his investment philosophy, leadership style, notable successes and challenges, and the legacy he is building in the world of finance.

Early Life and Education

Raymond Thomas Dalio was born in 1949 in Jackson Heights, Queens, New York. His father was a jazz musician, and his mother a homemaker. Dalio’s first experience with investing came at the age of 12, when he bought shares of Northeast Airlines with money he earned as a golf caddy. The stock tripled after a merger, sparking his lifelong interest in markets.

Dalio went on to study finance at Long Island University before completing his MBA at Harvard Business School in 1973. His time at Harvard exposed him to the mechanics of global finance at a critical moment, the collapse of the Bretton Woods system and the end of the dollar’s convertibility to gold. These events profoundly shaped his views on currencies and monetary policy.

Ray Dalio: Key Milestones

-

1949Early Life

Born in Queens, New York. His first stock trade at age 12 sparks an interest in investing.

-

1975Founding Bridgewater Associates

Starts Bridgewater from his apartment. Initially advises clients on currency and interest rate risks.

-

1980s–1990sBuilding Systematic Strategies

Bridgewater develops its research-driven macro approach. Risk parity and diversification become central ideas.

-

1996All Weather Fund

Launches the All Weather portfolio, designed to perform across economic environments through risk parity.

-

2008Navigating the Financial Crisis

Bridgewater correctly anticipates the global crisis, protecting client portfolios and boosting reputation.

-

2011–2017Publishing Principles

Releases his principles on management and decision-making, culminating in the bestselling book Principles: Life and Work.

-

2018–2021Economic Thought Leadership

Publishes Principles for Navigating Big Debt Crises and Principles for Dealing with the Changing World Order, influencing global debates.

-

TodayPhilanthropy and Legacy

Focuses on philanthropy through the Dalio Foundation, education, and ocean exploration, while Bridgewater remains the world’s largest hedge fund.

Founding Bridgewater Associates

In 1975, Dalio founded Bridgewater Associates out of his apartment in New York. Initially, the firm provided risk consulting and advised corporate clients on hedging currency and interest rate exposures. Over time, Bridgewater evolved into a full-scale investment management firm.

The turning point came in the 1980s, when Dalio and his team began to develop systematic, research-driven investment strategies. Bridgewater distinguished itself by combining macroeconomic research with quantitative models, seeking to understand the cause-and-effect relationships that drive markets.

Bridgewater grew steadily, attracting institutional investors such as pension funds, endowments, and sovereign wealth funds. By the 2000s, it had become the world’s largest hedge fund, managing over $150 billion in assets.

Ray Dalio’s Investment Philosophy

Dalio’s philosophy centres on understanding how economies and markets work as “machines” driven by cause-and-effect relationships. He believes that by studying history, developing frameworks, and using systematic processes, investors can anticipate market movements more effectively. Ray Dalio has a few key investment principles.

Radical Transparency: Dalio fosters a culture of openness and directness at Bridgewater, where employees are encouraged to speak candidly, challenge ideas, and learn from mistakes.

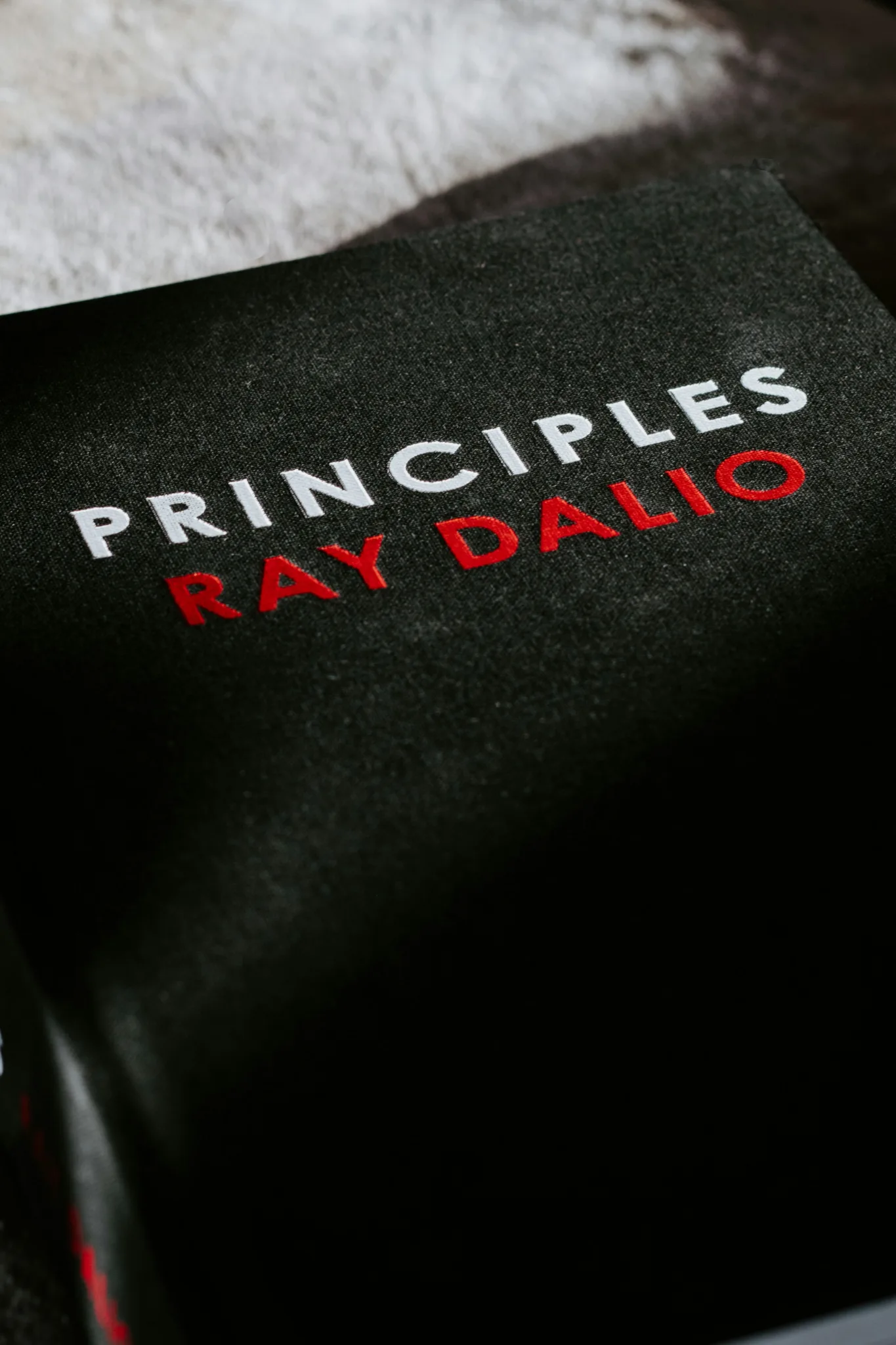

Principles-Based Decision Making: He codified his beliefs into “Principles,” a framework for making decisions systematically rather than emotionally. His book Principles: Life and Work outlines these concepts in detail.

Risk Parity: Dalio pioneered the concept of risk parity, an asset allocation strategy that balances risk across asset classes rather than weighting them by capital. This approach underpins Bridgewater’s All Weather Fund.

Diversification: He emphasises diversification across assets, geographies, and strategies to manage uncertainty. His oft-repeated advice is “don’t bet on one thing.”

Big Debt Cycles: Dalio argues that long-term debt cycles drive major economic events. His study of these cycles informs Bridgewater’s macroeconomic positioning.

The All Weather Fund

One of Dalio’s most influential contributions to investing is the All Weather Fund, launched in 1996. The fund was designed to perform well in different economic environments, growth, decline, inflation, and deflation.

The All Weather portfolio applies risk parity, allocating across stocks, bonds, commodities, and inflation-linked assets in a way that balances risk rather than capital. The result is a portfolio less dependent on any single market condition.

This strategy has influenced institutional investors worldwide and inspired countless retail “all-weather” portfolios that seek to deliver steady returns through diversification.

The Pure Alpha Fund

Bridgewater’s flagship Pure Alpha Fund embodies Dalio’s active macro investing. It uses a combination of fundamental research and systematic strategies to bet on currencies, interest rates, commodities, and global markets.

Pure Alpha has generated strong long-term returns, though like all hedge funds it has faced periods of volatility. Its scale and success solidified Bridgewater as the premier global macro hedge fund.

Leadership and Culture at Bridgewater

Dalio is as famous for Bridgewater’s culture as for its investment performance. He instituted “radical transparency,” where meetings were recorded, performance was constantly assessed, and disagreements were encouraged.

This culture aimed to eliminate hierarchy and ego, allowing the best ideas to rise. Employees were expected to embrace mistakes as opportunities to learn. Dalio argued that such transparency created a more effective and resilient organisation.

While praised by some as revolutionary, the culture also drew criticism for being intense and challenging. Still, Bridgewater’s unique culture became a hallmark of Dalio’s leadership.

Major Successes

Dalio’s career features several major successes:

- 2008 Financial Crisis: Bridgewater was one of the few firms to predict and profit from the global financial crisis, positioning itself defensively and generating strong returns while others struggled.

- Institutional Trust: Attracting some of the world’s largest investors, Bridgewater built long-term relationships with pension funds, central banks, and sovereign wealth funds.

- Influence Beyond Finance: Dalio’s writings on debt cycles and economic principles have influenced policymakers, economists, and investors globally.

Challenges and Controversies

Dalio and Bridgewater have also faced challenges.

- Performance Variability: Despite long-term success, Bridgewater has experienced periods of underperformance, leading to questions about scalability and adaptability.

- Cultural Criticism: Radical transparency, while innovative, was criticised by some former employees as too rigid or confrontational.

- Public Scrutiny: As Dalio became a public figure, his political and economic views attracted debate. His commentary on China, for instance, has sometimes sparked controversy.

Books and Thought Leadership

Dalio has become a prolific author, sharing his ideas beyond the investment world. His books include:

- Principles: Life and Work (2017): Outlining his personal and professional philosophy.

- Principles for Navigating Big Debt Crises (2018): A study of debt cycles and their implications.

- Principles for Dealing with the Changing World Order (2021): Analysing global power shifts, particularly between the US and China.

These works extend his influence far beyond Bridgewater, positioning him as a thinker on economics, leadership, and global affairs.

Philanthropy

Dalio is also a major philanthropist. Through the Dalio Foundation, he has donated billions to causes including education, ocean exploration, and healthcare. His Giving Pledge commitment reflects his belief in using wealth to address societal challenges.

Notable initiatives include support for Connecticut public schools, oceanographic research, and microfinance programmes worldwide.

Ray Dalio’s Legacy

Ray Dalio’s legacy is multifaceted. He is a pioneer of systematic investing and risk parity, the founder of the largest hedge fund in the world, and a thought leader whose principles extend beyond markets.

His emphasis on understanding cause-and-effect relationships, embracing mistakes, and codifying principles has influenced generations of investors and entrepreneurs.

Bridgewater Associates remains a powerful force, but Dalio’s broader impact lies in how he changed the conversation about investing, leadership, and the global economy.

Ray Dalio stands as one of the legendary investors of modern times. From his humble beginnings to building Bridgewater into a global powerhouse, his story combines innovation, resilience, and intellectual curiosity.

Dalio’s principles-driven philosophy, his pioneering of strategies like risk parity, and his willingness to share his thinking openly have made him more than just a hedge fund manager. He is a teacher, author, and philanthropist whose ideas will continue to shape finance and beyond.

For investors, the key takeaway from Ray Dalio is not just the pursuit of returns, but the discipline of learning from mistakes, thinking systematically, and diversifying risks in an uncertain world.