Debt can be overwhelming. From high-interest credit cards to personal loans and medical bills, many people struggle under the weight of financial obligations with no clear path forward. Traditional debt relief options are often confusing, outdated, or come with strings attached. Mitigately is working to change that. This Mitigately Review explores what it offers, how it works, and why it could be the right choice for anyone serious about getting out of debt.

Mitigately is a modern debt relief company that uses technology to help individuals consolidate, manage, and eliminate debt more effectively. By simplifying the debt resolution process and offering clear, human-centered solutions, it provides a lifeline to those who want to regain financial control- Without judgment or hidden agendas.

What Is Mitigately?

Mitigately is not a lender, a bank, or a credit repair agency. Instead, it acts as a trusted partner for people navigating debt, offering customized plans and hands-on support to help reduce or eliminate what they owe.

The platform uses technology to streamline the process of evaluating debt, identifying options, and negotiating solutions. Whether that means settling accounts, consolidating loans, or structuring payment plans, Mitigately aims to make debt relief less stressful and more transparent.

It combines modern digital tools with a personal, empathetic approach, recognizing that financial hardship isn’t a failure, but a challenge that deserves support.

The Problem Mitigately Solves

Millions of Americans are dealing with:

- High-interest credit card balances

- Personal loans they can’t afford

- Mounting medical or unexpected expenses

- Limited financial literacy about their options

Most traditional solutions are either predatory (like payday loans) or bureaucratic (like calling creditors one by one). Mitigately brings clarity and structure to the chaos of personal debt. It offers:

- A central, guided process to assess your debt situation

- Negotiated relief plans tailored to your needs

- Ongoing support from a team that understands the system

Mitigately exists to demystify debt relief and put people on a faster path to freedom.

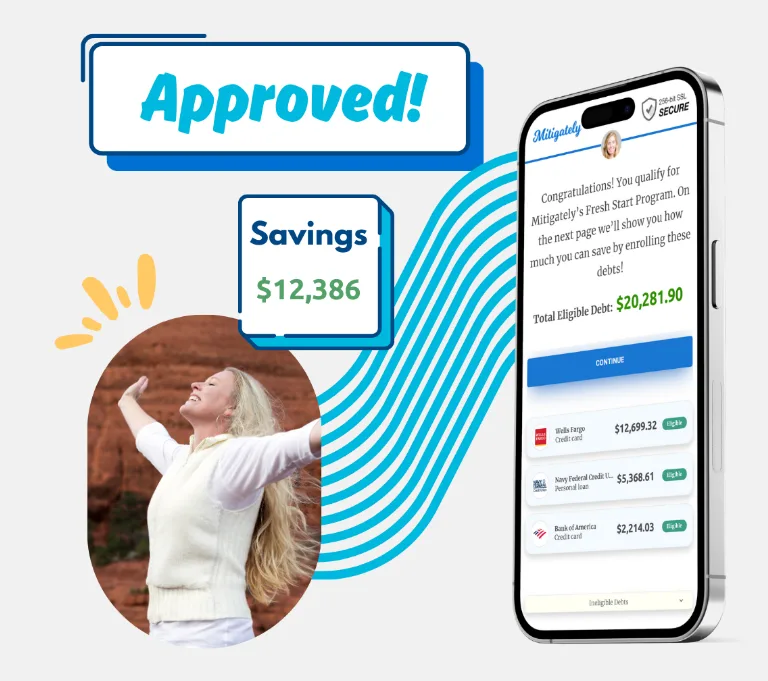

How It Works

Mitigately’s process is designed to be simple and judgment-free:

- Free Evaluation: Users start by answering a few questions about their debt situation. There’s no obligation, and the evaluation is entirely confidential.

- Customized Relief Plan: Based on the information provided, Mitigately outlines available options, such as debt settlement, consolidation, or structured payment plans, and recommends a path that fits the user’s financial goals.

- Action and Support: Once a plan is selected, Mitigately’s team works on the user’s behalf to negotiate with creditors, reduce balances, and create manageable payment structures. They also provide regular updates and support throughout the process.

Everything is built around transparency, simplicity, and real results—not fine print.

Who It’s For

Mitigately is ideal for individuals who:

- Carry more a large amount of unsecured debt (more than $7,500)

- Are struggling to make monthly payments

- Want to avoid bankruptcy or default

- Need professional help but don’t want a complicated or expensive process

It is especially well-suited for people juggling multiple types of debt (credit cards, personal loans, or medical bills) and looking for a consolidated, tech-forward way to take control.

Why Mitigately Stands Out

Unlike many debt relief services, Mitigately prioritizes:

- Clear Communication: No confusing language or bait-and-switch tactics.

- Technology That Helps: From digital onboarding to automated updates, the process is built to be user-friendly.

- People-First Values: Real human support, not just call centers or robo-advisors.

- Ethical Standards: Mitigately is committed to fair practices, transparent fees, and compliance with industry regulations.

It’s a modern solution to an old problem, one that treats clients with dignity and respect.

Pros and Cons

Pros

- Easy online evaluation and onboarding

- Personalized debt relief plans

- Transparent process and pricing

- Supportive, non-judgmental

- Negotiation handled by experts

Cons:

- Not available in all U.S. states

- May not serve individuals with very low debt balances

- Final debt resolution results can vary based on creditor response

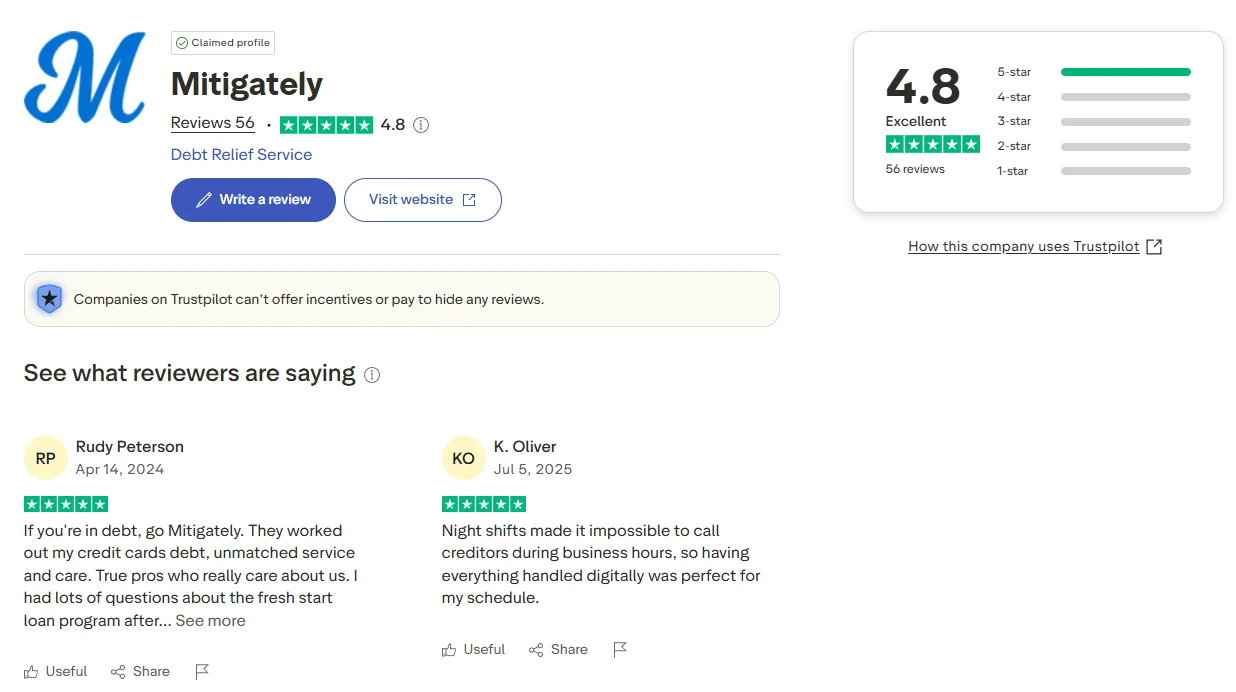

What Clients Are Saying

Client testimonials point to a strong sense of relief and confidence:

“Mitigately helped me settle $25,000 in credit card debt without going bankrupt. I finally feel like I can breathe again.”

“I didn’t know where to turn. Mitigately laid everything out and handled the hard parts. It was a game-changer.”

The focus on real outcomes and genuine support seems to be resonating with users nationwide.

Final Verdict

Mitigately is not just easing the burden of debt, it’s reshaping the experience. By combining compassionate support with smart technology, the company offers a trustworthy path to financial recovery for people who are ready to take control.

If you’re drowning in unsecured debt and unsure what to do next, Mitigately could be your way forward. It’s approachable, effective, and built to make your debt disappear… Not your dignity!