Investing has never been more accessible. What was once the domain of stockbrokers and wealthy individuals is now open to anyone with a smartphone and a modest sum of money. Platforms like Robinhood and eToro showed the world that commission-free trading could reshape retail investing. The new generation of apps is going further, focusing on thematic exposure, integrated savings, and AI-powered insights to guide users.

Nemo Money is one of the newest entrants in this category. Its name, short for “Never Miss Out”, reflects its ambition to give everyday investors a chance to participate in global markets with ease and confidence. Backed by the Exinity Group, a financial services provider with more than 25 years of experience, Nemo offers commission-free trading, thematic investment bundles, crypto exposure, and a conversational AI assistant. It also pays interest on idle cash, turning the platform into more than just a brokerage.

Fintech Review explores what Nemo Money is, how it works, and where it sits in the crowded landscape of mobile-first investment platforms.

What is Nemo Money?

Nemo Money was launched under Exinity ME Limited, part of the wider Exinity Group. Exinity has been active in online trading since the 1990s and already serves more than one million customers across over 100 countries. That history gives Nemo a level of credibility uncommon in younger fintech startups.

Importantly, Nemo is regulated by the Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM). This provides a strong foundation of oversight and ensures client funds are handled securely. Stock portfolios benefit from SIPC protection up to $500,000, and client assets are held separately from company funds.

This regulatory backbone is central to Nemo’s value proposition. Many retail investors, particularly those new to markets, want simplicity without sacrificing trust. Nemo positions itself as both modern and reliable, combining a mobile-native app with the safeguards of an established financial group.

Mobile-First Experience

Nemo has been built as a mobile-only service. There is no web or desktop platform. Everything is designed around a smartphone interface, with simple navigation and a clean design.

- The app’s sections are organized into stocks, crypto, Nemes, and Boost (for CFDs).

- Opening an account is straightforward and can be completed in minutes.

- Execution is fast, with trades confirmed almost instantly.

This mobile-first approach is particularly appealing to younger investors and beginners. It reduces the complexity of traditional trading platforms, which often overwhelm users with data and charts. On the other hand, advanced traders may find the lack of detailed analytics, custom charting, and complex order types restrictive. Nemo is not trying to be a professional-grade platform. It is positioning itself as an accessible entry point into investing.

Asset Coverage

Nemo offers a broad range of investment options, with an emphasis on accessibility and simplicity.

- Stocks and ETFs: More than 8,000 global stocks and exchange-traded funds are available. Fractional investing means users can start with as little as $1, making it possible to own a slice of companies like Apple or Tesla without significant capital.

- Crypto exposure: The app provides crypto trading through CFDs. This means users can speculate on price movements of assets like Bitcoin and Ethereum, but they cannot withdraw coins into a private wallet. For those who want to trade rather than hold, this is sufficient, but long-term crypto investors may find it limiting.

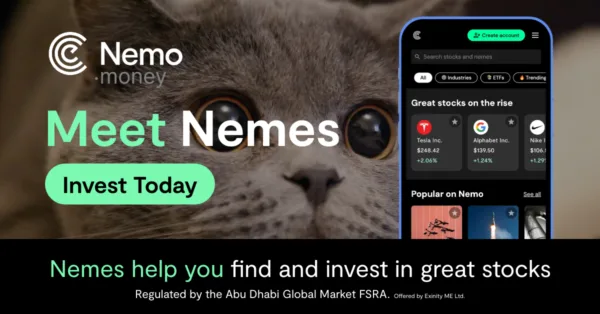

- Thematic bundles (“Nemes”): Perhaps Nemo’s most distinctive feature is its curated investment categories. Nemes allow users to invest in themes such as artificial intelligence, electric vehicles, or renewable energy. Instead of picking individual companies, users allocate to a theme with a single tap.

This combination caters to a wide spectrum of beginners, from those who want to buy a few individual shares to those who prefer broad thematic exposure without detailed research.

AI-Powered Investing

Where Nemo really sets itself apart is in its use of artificial intelligence. The app includes Nemo AI, a conversational assistant powered by large language models.

Nemo AI can:

- Explain why a stock is moving.

- Provide portfolio insights, such as identifying concentration risks.

- Suggest diversification strategies.

- Answer investment-related questions in plain language.

This feature reduces the learning curve for beginners. Instead of digging through analyst reports or financial news, users can ask questions directly and receive tailored insights. While AI is not a substitute for independent research or financial advice, it makes the app more interactive and educational. Few competitors currently offer this level of conversational guidance.

Commission-Free Trading and Interest on Cash

Like many modern platforms, Nemo offers commission-free trading. Users do not pay transaction fees when buying or selling stocks, ETFs, or CFDs. The company earns its revenue from spreads between buy and sell prices.

What makes Nemo more interesting is how it treats cash balances. Uninvested money in a user’s account earns 6 percent AER interest, calculated and paid daily. In practice, this means that even if users are not ready to invest immediately, their funds are working for them. Few competitors match this rate, and it makes Nemo a viable alternative to low-yield bank accounts.

For retail investors deciding between leaving money in a traditional savings account or transferring it to an investing app, this feature provides an added incentive to use Nemo as their financial hub.

User Experience and Feedback

The app has received positive reviews in both the Google Play Store and Apple’s App Store. Ratings average above four stars, with users highlighting the app’s simplicity, quick setup, and accessibility. Many first-time investors appreciate fractional shares and the thematic Nemes, which make investing feel less intimidating.

Criticism tends to come from more advanced users. Some want integrated charting tools such as TradingView, more order types, or higher leverage options. Others dislike that crypto trading is CFD-only, preventing real asset custody. Customer support is generally well-rated, though available primarily in English, which may limit reach in some markets.

The consensus is clear: Nemo succeeds at being beginner-friendly but does not cater to power users.

Strengths and Weaknesses

Nemo’s strengths are straightforward. It is easy to use, regulated, and offers features that differentiate it from traditional commission-free brokers.

Strengths include:

- Accessibility, with no minimum investment requirement and fractional shares.

- Commission-free trading across a wide range of stocks and ETFs.

- Thematic Nemes bundles, making it easy to invest in trends.

- AI-powered insights for education and portfolio guidance.

- High interest on idle cash, paid daily.

- Strong regulatory oversight under ADGM and FSRA.

Weaknesses include:

- Limited functionality for advanced traders, with few tools for technical analysis.

- Crypto exposure restricted to CFDs, with no asset withdrawals.

- No desktop or web platform, which some users prefer for portfolio management.

- Geographic restrictions, as Nemo is not available everywhere, including the US and UK.

These trade-offs show that Nemo knows its audience. It is not aiming to replace institutional-grade brokers but rather to serve new and intermediate investors who prioritize simplicity.

Competitive Positioning

Nemo operates in a crowded market. Commission-free investing is no longer novel, and competitors like Robinhood, eToro, Webull, and Revolut all offer variations on the theme.

Where Nemo distinguishes itself is in three areas:

- AI guidance through Nemo AI, which is rare among rivals.

- Daily interest on cash balances at 6 percent, far higher than most competitors.

- Curated Nemes bundles, which encourage thematic investing with minimal effort.

Compared to Robinhood, Nemo is less focused on active trading and more on guidance. It does not emphasize social trading like eToro but offers a cleaner mobile interface. Compared to Webull, it lacks advanced charting but is more beginner-friendly.

In many ways, Nemo sits closer to Revolut, though it is more specialised in investing rather than general financial services.

Who Should Use Nemo?

Nemo is best suited for:

- New investors who want a simple, mobile-first entry point into global markets.

- Individuals interested in thematic investing without researching individual stocks.

- Users who value AI-driven insights and portfolio guidance.

- People who want to earn attractive interest on idle cash while deciding how to invest.

It may not suit:

- Advanced traders who need deep analytics, custom charting, or algorithmic tools.

- Crypto investors who want direct custody of assets.

- Users in restricted jurisdictions such as the US.

Future Outlook

Looking ahead, Nemo has room to expand its offering. Direct crypto custody would open new opportunities, particularly for long-term holders. More sophisticated tools could help retain users as they become more advanced. Expanding geographic coverage will also be important to scale.

The challenge for Nemo will be to maintain its accessibility while adding depth. Too much complexity risks alienating beginners, but too little functionality risks losing them once they mature as investors. Balancing simplicity with growth is the strategic challenge ahead.

Conclusion

Nemo represents a new stage in the evolution of retail investing. It takes the commission-free model pioneered by earlier apps and adds distinctive features, including an AI assistant, thematic Nemes, and high interest on cash. Its mobile-first design and strong regulatory backing under ADGM and FSRA further add to its appeal.

The platform is not perfect. Advanced traders will find it lacking in depth, and crypto enthusiasts will be disappointed by the absence of true asset ownership. Yet for its target audience, first-time and intermediate investors looking for an approachable and trustworthy way to access markets, Nemo delivers on its promise.

By focusing on simplicity, education, and added value, Nemo is carving out a distinct niche in the crowded fintech landscape. For many users, it may well become the first step on their investing journey, and perhaps the one that makes them feel they truly never miss out.