In the ever-expanding world of crypto finance, Nexo stands out as one of the most established and user-friendly platforms. With a combination of high-yield interest accounts, instant crypto loans, and integrated exchange features, Nexo offers a comprehensive suite of services tailored to both new and experienced crypto users.

This detailed Nexo review explores the platform’s core offerings, strengths, weaknesses, security measures, fees, and how it compares to competitors in the space. Whether you’re a casual holder looking to earn passive income or an active trader needing liquidity, this guide will help you understand if Nexo is the right platform for your crypto wealth management.

What Is Nexo?

Nexo is a fintech platform that bridges traditional finance and digital assets through crypto-backed loans, interest-earning accounts, a built-in exchange, and a crypto card. Launched in 2018, the company is based in Switzerland and Bulgaria and is operated by a team with a background in financial services and blockchain technology.

The platform supports over 60 crypto assets including Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), and more. Nexo has over 5 million users globally and manages assets worth billions of dollars.

Key Features of Nexo

1. Crypto-Backed Loans

Nexo allows users to borrow fiat or stablecoins against their crypto holdings without selling them. This is ideal for long-term holders who want liquidity without triggering a taxable event.

- Loan-to-Value (LTV): Up to 50% for BTC/ETH and up to 90% for stablecoins.

- Instant approval: No credit checks.

- Repayment: Flexible repayment terms with options to pay in crypto, fiat, or a combination.

- Borrowing rates: Start as low as 0% APR for Platinum users, depending on LTV and loyalty tier.

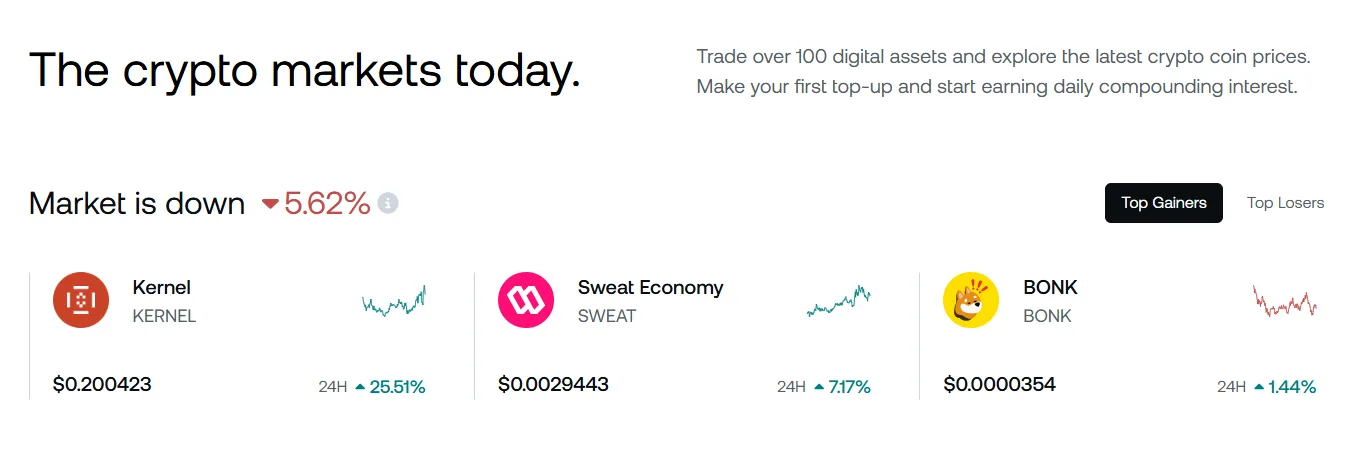

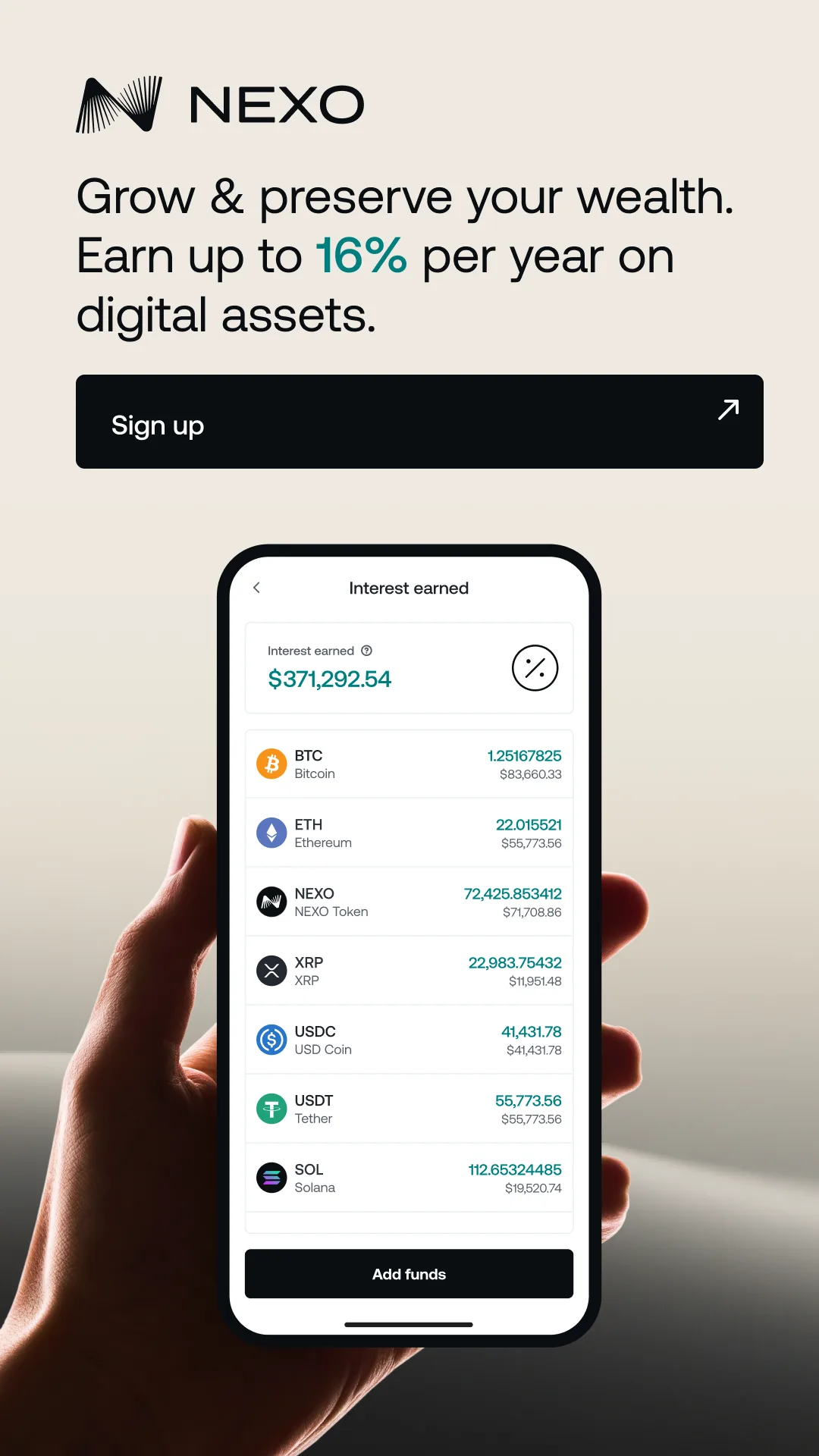

2. Earn Interest on Crypto and Fiat

Users can earn daily compounded interest on their crypto, stablecoin, and fiat holdings. Nexo supports:

- Crypto: BTC, ETH, SOL, and more.

- Stablecoins: USDT, USDC, DAI.

- Fiat currencies: EUR, GBP, and USD.

Rates:

- Stablecoins: Up to 12% APR.

- Bitcoin/Ethereum: Up to 8% APR.

- Paid out daily, with options to receive in-kind or in NEXO tokens for boosted returns.

3. Nexo Exchange

The Nexo Exchange allows for instant swaps between 300+ pairs with no slippage for most major assets. It’s designed for long-term users rather than high-frequency traders.

- Supports limit and market orders.

- Integrates with the rest of the platform

- Swapped assets can immediately earn interest or be used as collateral.

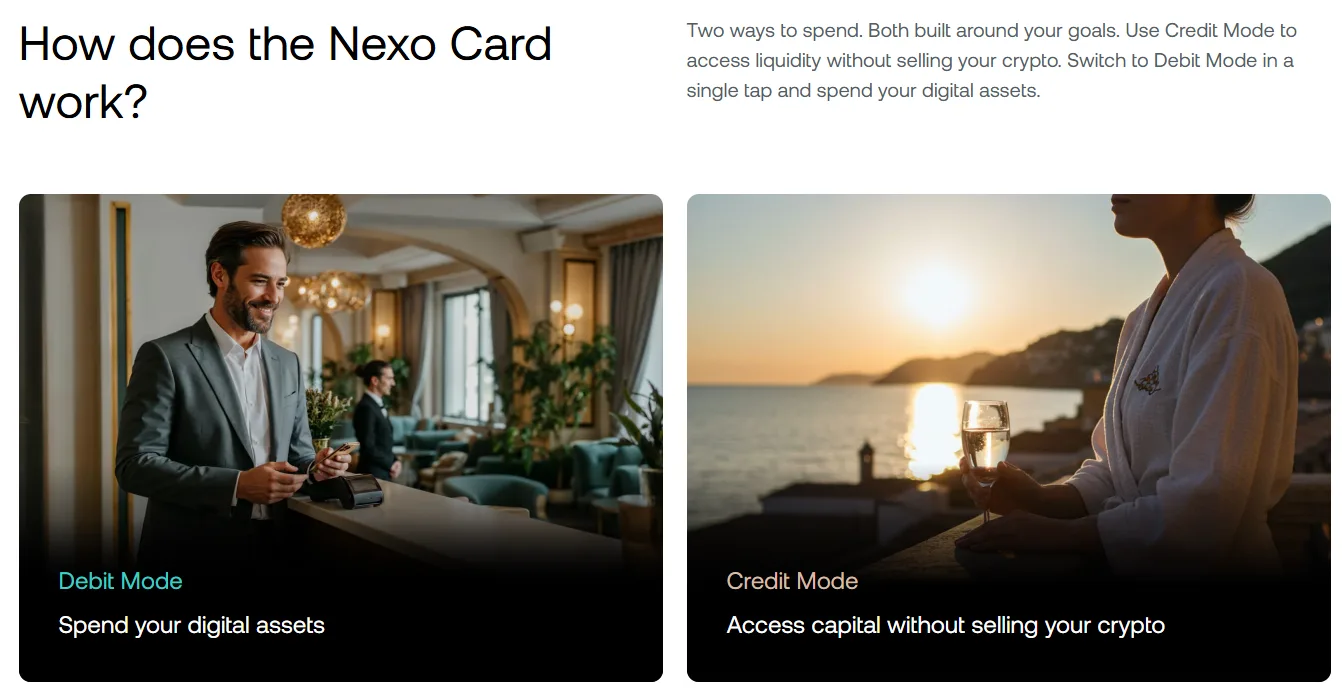

4. Nexo Card

The Nexo Card is a Mastercard-backed debit card that lets users spend without selling their crypto. It automatically uses crypto as collateral and deducts funds from the credit line.

- Up to 2% cashback in BTC or NEXO tokens.

- No monthly or foreign exchange fees.

- Linked with Google Pay and Apple Pay.

5. Loyalty Program

Nexo’s loyalty system is based on how much of your portfolio is held in NEXO tokens.

- Base, Silver, Gold, Platinum tiers.

- Higher tiers unlock:

- Lower loan interest rates.

- Higher earnings rates.

- Free crypto withdrawals (up to 5 per month).

- Better exchange rates.

Supported Assets

Nexo supports a wide range of cryptocurrencies, stablecoins, and fiat currencies. Key supported assets include:

- Crypto: BTC, ETH, SOL, AVAX, LTC, LINK, MATIC.

- Stablecoins: USDT, USDC, DAI, TUSD.

- Fiat: EUR, GBP, USD (in earn accounts and loan payouts).

- NEXO Token: Native utility token providing loyalty benefits and yield bonuses.

The platform is constantly adding new coins based on liquidity and security assessments.

Nexo Token (NEXO)

NEXO is the native ERC-20 token of the Nexo platform. It plays a central role in the ecosystem by providing:

- Boosted yields: Earn 2% more interest by receiving rewards in NEXO.

- Lower borrowing rates: Up to 0% for top-tier users.

- Dividends: Nexo previously paid out a portion of profits to NEXO holders, though this has since shifted toward token buybacks.

The token supply is capped at 1 billion. Nexo has conducted buyback programs to manage supply and support long-term price stability.

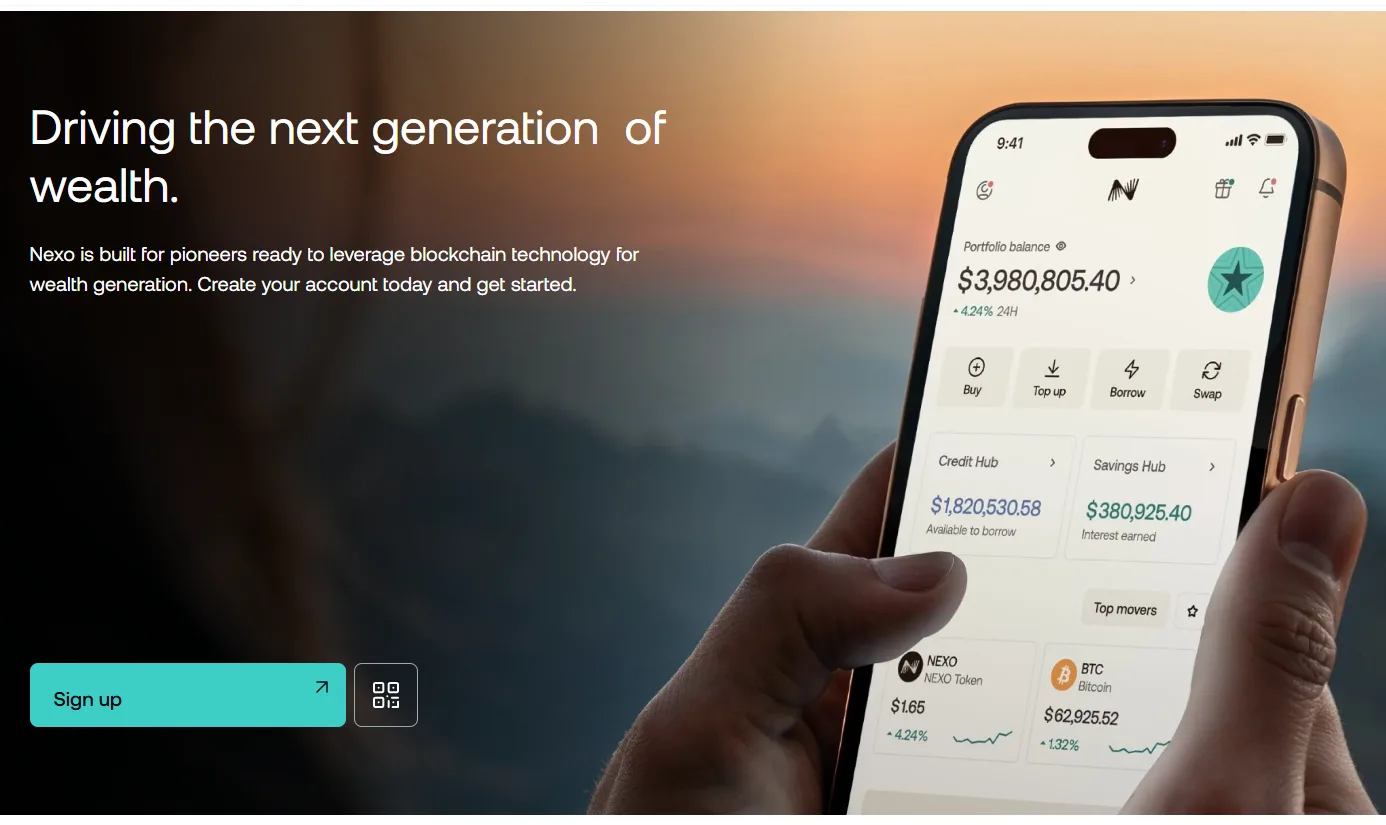

User Experience and Interface

Nexo offers both a web app and mobile application (iOS and Android), with a clean and intuitive design. The platform’s dashboard is well-organized, with clear views of:

- Asset balances

- Interest earnings

- Loan details and LTV ratios

- Loyalty tier status

Onboarding is straightforward. Users need to complete basic KYC (know-your-customer) checks to access full features. The app also includes a Help Center and in-app support chat.

Security and Regulatory Compliance

Security is one of Nexo’s most significant selling points. The platform employs a wide range of protections:

- Custody: Assets are held with BitGo, Fireblocks, and Ledger Vault, industry-leading custodians.

- Insurance: Up to $375 million in custodial insurance via third-party providers.

- 2FA and biometric login: Available on mobile and web.

- Cold storage: The majority of funds are held in cold wallets.

- Real-time audits: Provided by Armanino for proof of reserves.

Regulatory status: Nexo has faced scrutiny, especially in the U.S. In 2023, it agreed to pay a $45 million settlement with U.S. regulators for offering interest products deemed securities. Since then, Nexo has shifted away from interest products in the U.S. and enhanced its compliance policies globally.

Pros and Cons of Using Nexo

Pros

- High interest rates on crypto and fiat balances.

- Flexible crypto-backed loans with instant approval.

- Strong security infrastructure and custodial insurance.

- Integrated ecosystem: Lending, borrowing, earning, and exchanging in one place.

- Daily interest payouts with compounding effect.

- No credit checks or hidden fees on borrowing.

Cons

- Limited availability in the U.S.: Certain features, especially Earn, are restricted.

- Centralized model: Assets are custodial, not in users’ wallets.

- NEXO dependency: Best rewards require holding and using the NEXO token.

- Regulatory uncertainty: May affect future operations depending on jurisdiction.

- Loan risk: If your asset drops in value, margin calls or liquidations may occur.

How Nexo Compares to Competitors

| Feature | Nexo | Crypto.com | YouHodler |

|---|---|---|---|

| Earn interest | Yes, up to 12% | Yes, lower rates | Yes |

| Crypto loans | Yes, instant | Yes | Yes |

| Exchange | Built-in | Yes | Yes |

| Card | Yes (2% cashback) | Yes | No |

| Loyalty program | Yes (based on NEXO) | Yes (CRO-based) | No |

| Regulation | Adjusting post-SEC settlement | Compliant, under scrutiny | EU-based |

Nexo currently stands stronger than many legacy crypto lending firms, particularly after the collapse of Celsius, Voyager, and BlockFi.

However, competition is growing from hybrid DeFi platforms and regulated fintech entrants.

Who Should Use Nexo?

Nexo is best suited for the following users:

- Long-term holders: Those who want to earn yield on idle crypto or stablecoins.

- Crypto enthusiasts needing liquidity: Without selling assets or triggering tax events.

- Passive income seekers: Earning daily interest in a simple way.

- Crypto-first investors: Looking for a unified platform with loans, yield, and trading.

It may not suit users who prioritize:

- Non-custodial DeFi options.

- Anonymous or fully decentralized tools.

- High-frequency or margin trading.

Nexo’s Plans in 2025

Nexo continues to evolve in response to regulatory developments and market dynamics. Key developments include:

- Expansion into new markets: Especially Latin America and Southeast Asia.

- Nexo Wallet and DeFi integrations: Offering self-custody tools with yield features.

- Improved compliance stack: Working with regulators and partners.

- Partnerships: Including integrations with Chainlink, Mastercard, and Fireblocks.

In 2025 and beyond, expect Nexo to push deeper into tokenization, digital identity, and potentially even structured crypto investment products. Nexo has proven resilient through multiple crypto market cycles. Its broad feature set, strong security posture, and user-friendly experience make it a leading choice among centralized crypto platforms.

However, users should remain cautious. Always assess counterparty risk, understand the implications of locking up assets, and monitor regulatory updates that may impact access to key features. For many users, Nexo represents a convenient bridge between traditional finance and crypto, especially for wealth accumulation and liquidity management.