In today’s global economy, businesses increasingly rely on fast, secure, and scalable cross-border payment infrastructure. From fintech startups to enterprise platforms, the demand for developer-first solutions that simplify international payments is greater than ever. Enter Nium, a global real-time payments platform that combines fintech-grade APIs, multi-currency support, and regulatory coverage across over 190 countries.

This Nium review explores the company’s mission, technology stack, use cases, and why it’s gaining momentum as a developer-centric payments platform. Whether you’re building a neobank, payroll solution, travel platform, or B2B marketplace, the company offers the tools to launch and scale your global payments strategy efficiently.

What Is Nium?

Nium is a Singapore-headquartered global financial infrastructure platform that enables businesses to move money across borders quickly and securely. Formerly known as InstaReM, Nium rebranded and expanded its scope to serve enterprises, fintechs, and platforms.

Nium provides APIs for cross-border payments, real-time payouts, card issuance, foreign exchange (FX), and treasury management. It operates as a licensed financial institution in over 11 jurisdictions and serves clients in sectors such as banking, payroll, travel, e-commerce, and crypto.

Unlike traditional correspondent banks or manual SWIFT workflows, Nium offers a modern, programmatic way to send and receive money globally, purpose-built for developers and digital-native businesses.

Key Features of Nium

1. Real-Time Global Payouts

Nium allows businesses to send payments to over 100 countries in real time, and to more than 190 countries in total, using a combination of local clearing systems, direct integrations, and partner rails.

Supported payout methods include:

- Bank accounts (ACH, SEPA, Faster Payments, etc.)

- Wallets (e.g. GCash, Paytm)

- Debit and credit cards (Visa Direct, Mastercard Send)

Key benefits:

- Faster settlement than traditional SWIFT

- Lower transaction costs

- Improved payment transparency

Nium’s platform automatically chooses the most efficient payment rail based on destination and transaction type.

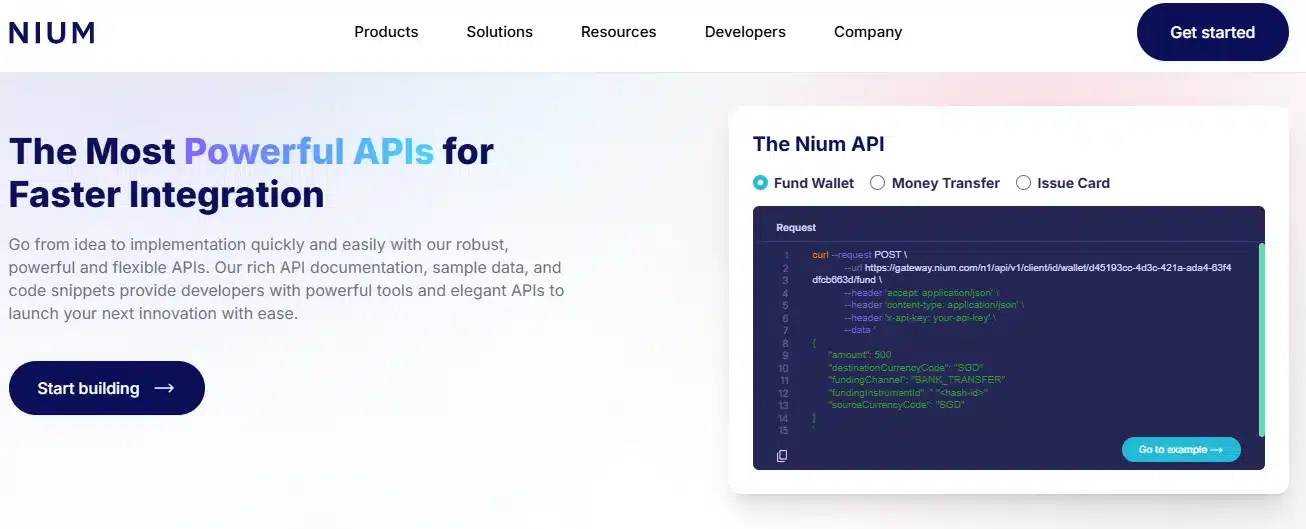

2. Developer-Centric APIs

Nium was built with developers in mind. Its RESTful APIs enable rapid integration for sending, receiving, and managing payments.

Core API features:

- Payout initiation and tracking

- Real-time FX rates and conversions

- Beneficiary management and KYC

- Webhooks for payment status

- Card issuing and wallet top-ups

Nium also offers SDKs, sandbox environments, and enterprise onboarding support, making it ideal for tech teams building custom payment flows.

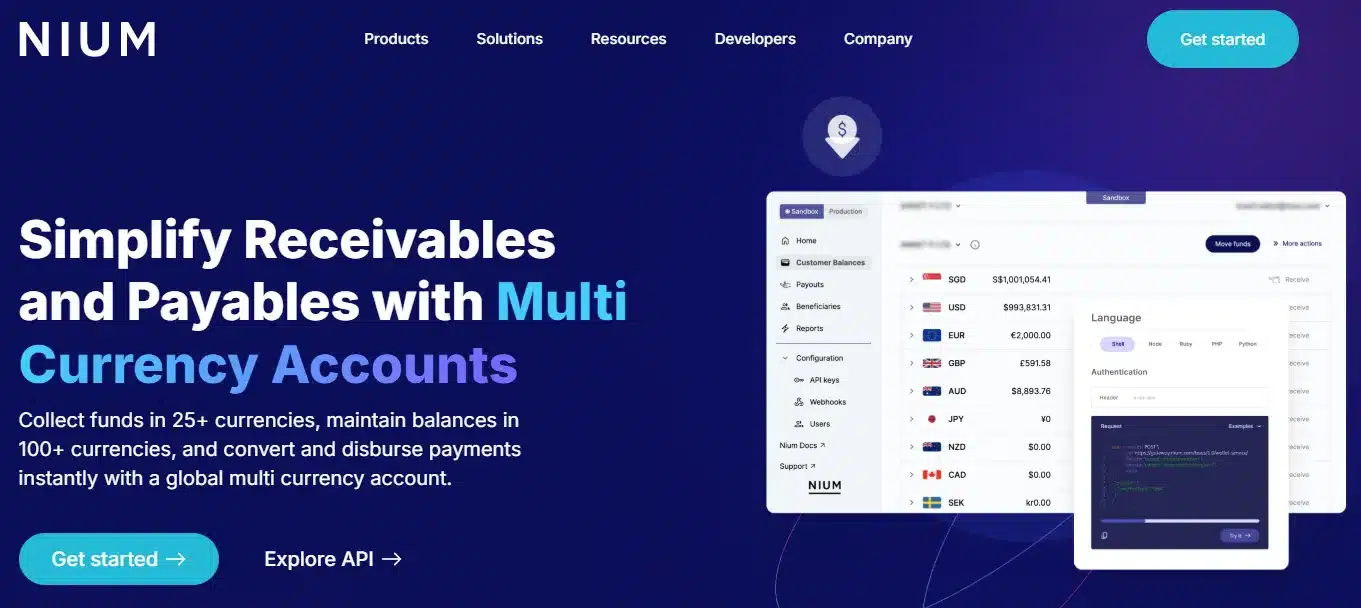

3. Multi-Currency FX and Treasury

Nium provides competitive FX rates and the ability to hold balances in multiple currencies via its virtual accounts. Businesses can:

- Convert funds in real-time or at locked rates

- Manage exposure across currency pairs

- Set up automatic or scheduled conversions

This treasury functionality supports margin management for platforms operating in multiple markets or currencies.

4. Card Issuance

Through its card-as-a-service (CaaS) offering, Nium allows businesses to issue physical or virtual cards under their brand.

Features include:

- Prepaid or debit cards

- Issuance in multiple countries

- API-controlled spend limits and usage

- Instant top-ups and real-time controls

- Visa and Mastercard networks

Use cases include travel cards, corporate expense cards, and embedded card products within fintech or B2B platforms.

5. Compliance and Licensing Coverage

Nium is regulated and licensed in key global markets:

- MAS (Singapore)

- FCA (UK)

- FinCEN and Money Transmitter Licenses (U.S.)

- ASIC and AUSTRAC (Australia)

- Bank of Indonesia, Malaysia, and others

This allows Nium to offer cross-border payment services legally and compliantly on behalf of its customers, removing the regulatory burden from its clients.

Nium also provides compliance tools such as:

- KYC and KYB onboarding flows

- AML transaction monitoring

- Sanctions screening and reporting

Use Cases for Nium

Nium’s flexibility makes it relevant for a wide range of business models:

1. Payroll and Gig Economy Platforms

Nium supports real-time payments to freelancers, contractors, and employees across borders. Payroll platforms can use Nium’s APIs to automate disbursements, reduce FX costs, and track payout status.

2. Travel and Expense Management

Travel platforms can integrate Nium for dynamic currency conversions, card issuance, and instant refunds. Expense management tools can use CaaS features to issue branded cards with programmable spend rules.

3. Banking-as-a-Service Providers

BaaS platforms can use Nium to offer international transfers, foreign currency wallets, and cards without building or acquiring their own global infrastructure or licenses.

4. Crypto and Fintech Companies

Crypto platforms can integrate Nium to off-ramp stablecoins into fiat bank accounts globally. Fintechs can offer enhanced global payment capabilities and faster settlement options.

5. Marketplaces and B2B Platforms

E-commerce platforms, B2B suppliers, and logistics marketplaces can use Nium for secure, fast supplier payouts, commission payments, and customer refunds.

Nium’s Global Coverage

Nium supports:

- 190+ countries for payouts

- 100+ countries with real-time rails

- Over 100 currencies

- 35+ real-time clearing systems

Its global coverage is backed by direct connections to banks and regulators, including access to domestic payment networks like:

- SEPA (EU)

- FPS (UK)

- ACH (US)

- IMPS/UPI (India)

- DuitNow (Malaysia)

- InstaPay (Philippines)

This global infrastructure helps businesses avoid the delays and fees associated with SWIFT-based systems.

Security and Reliability

Nium meets high standards for security and compliance:

- ISO 27001-certified data centers

- TLS encryption for data in transit

- Role-based access controls

- Regular penetration testing

- 24/7 monitoring and SLAs for enterprise customers

Funds are held in safeguarded accounts where required, and Nium is regularly audited by global regulatory bodies.

Pros of Using Nium

- Developer-first API experience

- Fast cross-border settlement in 100+ markets

- Licensed and regulated globally

- Integrated FX, treasury, and card issuing

- Strong compliance and onboarding support

- Highly scalable for enterprise-grade applications

Cons of Using Nium

- Not ideal for small businesses, best suited to platforms or enterprises

- No self-service dashboard for basic use (API access required)

- Pricing not public, must contact sales for quotes

- Some features gated behind volume thresholds

Nium vs. Other Platforms

Feature comparison: Nium vs Wise Platform vs Airwallex vs Currencycloud

| Feature | Nium | Wise Platform | Airwallex | Currencycloud |

|---|---|---|---|---|

| Real-time payouts | 100+ countries | Limited | 30+ countries | Limited |

| FX conversion | Yes, with treasury tools | Yes | Yes | Yes |

| Card issuing | Yes | No | Yes | No |

| Developer tools | Advanced APIs | Moderate | Advanced | Moderate |

| Compliance stack | Global licenses | EU/USA | APAC-heavy | FCA-regulated |

| Ideal for | Platforms, fintechs | SMBs, SaaS | Startups, e-commerce | Banks, FX apps |

Nium is particularly strong for enterprise and platform-scale integrations, offering more payment methods and regulatory reach than most competitors. Wise and Airwallex are better suited for SME use cases or prebuilt dashboards.

Who Should Use Nium?

Nium is ideal for:

- Fintech developers building global finance apps

- B2B platforms needing real-time supplier payouts

- Payroll services handling contractor payments in multiple currencies

- SaaS platforms embedding financial services

- Travel, gig, and remittance apps seeking real-time, low-cost global transfers

Nium is less relevant for:

- Freelancers or individuals making occasional transfers

- Small e-commerce shops with low cross-border volumes

The Future of Nium

Nium is investing in:

- Network expansion into Africa and LATAM

- New card issuance capabilities in Asia and the Middle East

- Embedded finance partnerships with banks and SaaS platforms

- Deeper fraud detection and identity verification tools

With the rise of global marketplaces, embedded payments, and fintech-as-a-service, Nium is well positioned to become a core infrastructure layer for cross-border money movement.

Final Verdict: Is Nium a Good Fit?

Nium delivers a compelling package for businesses building global financial services. Its API-first approach, combined with real-time payout rails, currency management, and compliance infrastructure, makes it one of the most complete cross-border payments solutions available today.

If you’re a fintech, marketplace, or enterprise SaaS provider looking to embed payments at scale, Nium provides the global reach, flexibility, and speed needed to compete in today’s digital economy.