In the crowded world of neobanks and fintech apps, North One has carved out a unique niche. Designed specifically for small business owners, freelancers, and startups, North One offers a fast, digital-first alternative to traditional business banking. With features tailored for the real-world needs of entrepreneurs, like envelope budgeting, same-day ACH, and seamless integrations, it’s more than just a business checking account. It’s a financial command center.

In this review, we take a closer look at what North One offers, who it serves best, and how it stacks up against other fintech solutions in the business banking space.

What is North One?

North One is a mobile-first business banking platform founded in 2017 and headquartered in New York. Unlike legacy banks, it does not operate physical branches. Instead, North One offers a digital-only business banking experience through its app and website.

Its mission is simple: to make financial management easier for small business owners. That includes tradespeople, e-commerce sellers, startup founders, consultants, and anyone running a small or solo operation.

North One partners with The Bancorp Bank, N.A., which provides FDIC-insured accounts. While North One is not a bank in the traditional sense, it operates as a fintech layer on top of a regulated financial institution. It is giving it the flexibility of a startup with the security of a bank.

Core Features

North One offers a full-featured business checking account with tools designed for small business workflows. Here are the standout capabilities:

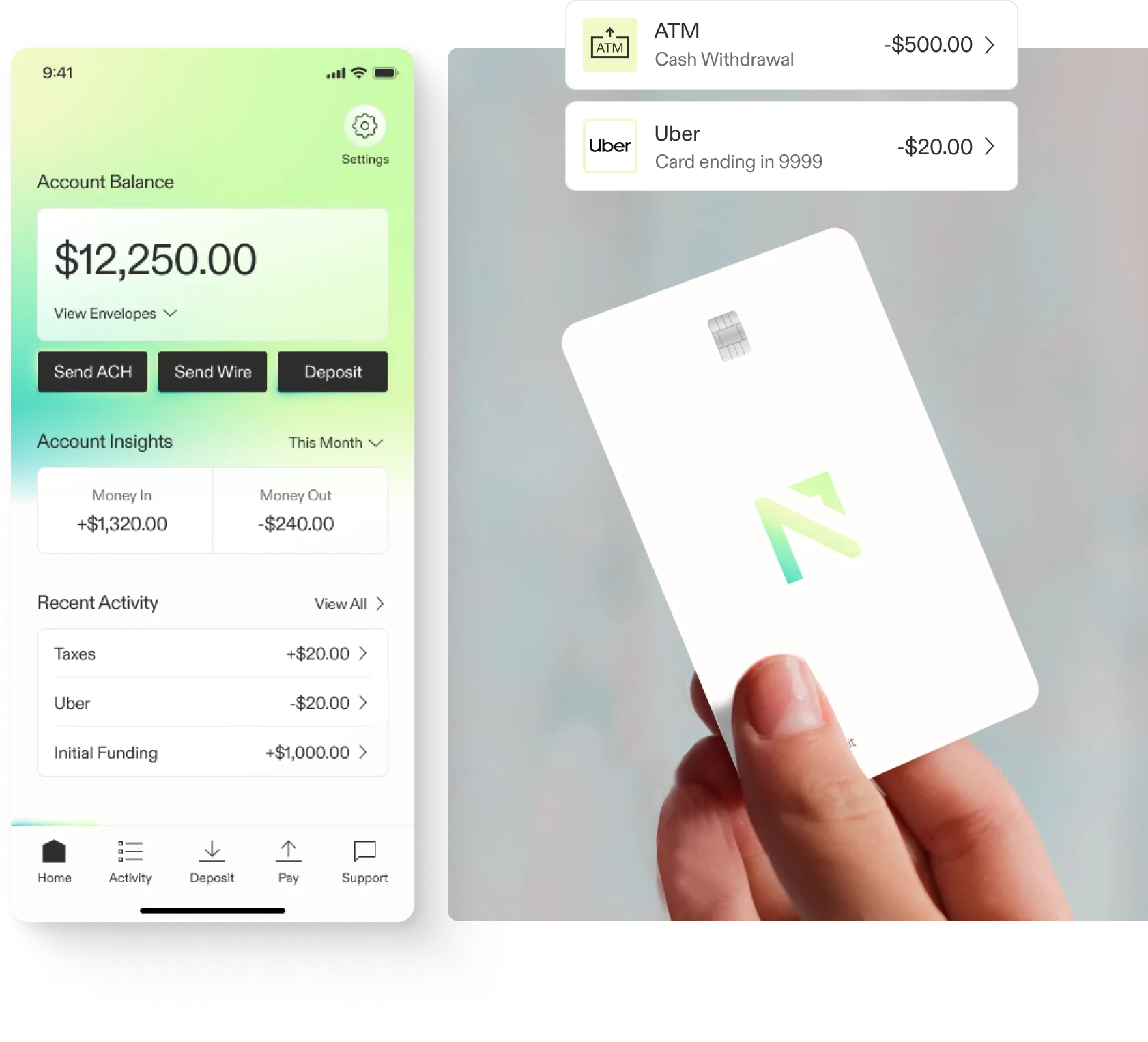

1. Digital Business Checking Account

- FDIC-insured up to $250,000

- No minimum balance required

- Access via mobile and web app

- Same-day ACH transfers (for a fee)

- Mobile check deposit and bill pay

2. Envelope Budgeting

North One allows users to set up “Envelopes”: virtual sub-accounts that help allocate funds for specific purposes like taxes, payroll, rent, or savings. This is a standout feature rarely offered in traditional business accounts and is modeled after a popular personal finance technique.

It helps small business owners plan ahead and avoid the common problem of overspending before tax season.

3. Instant Support

Customer support is available via in-app chat or email, with responses typically within minutes during business hours. North One has built a reputation for high-touch service, something that sets it apart in the fintech world.

4. Integrations

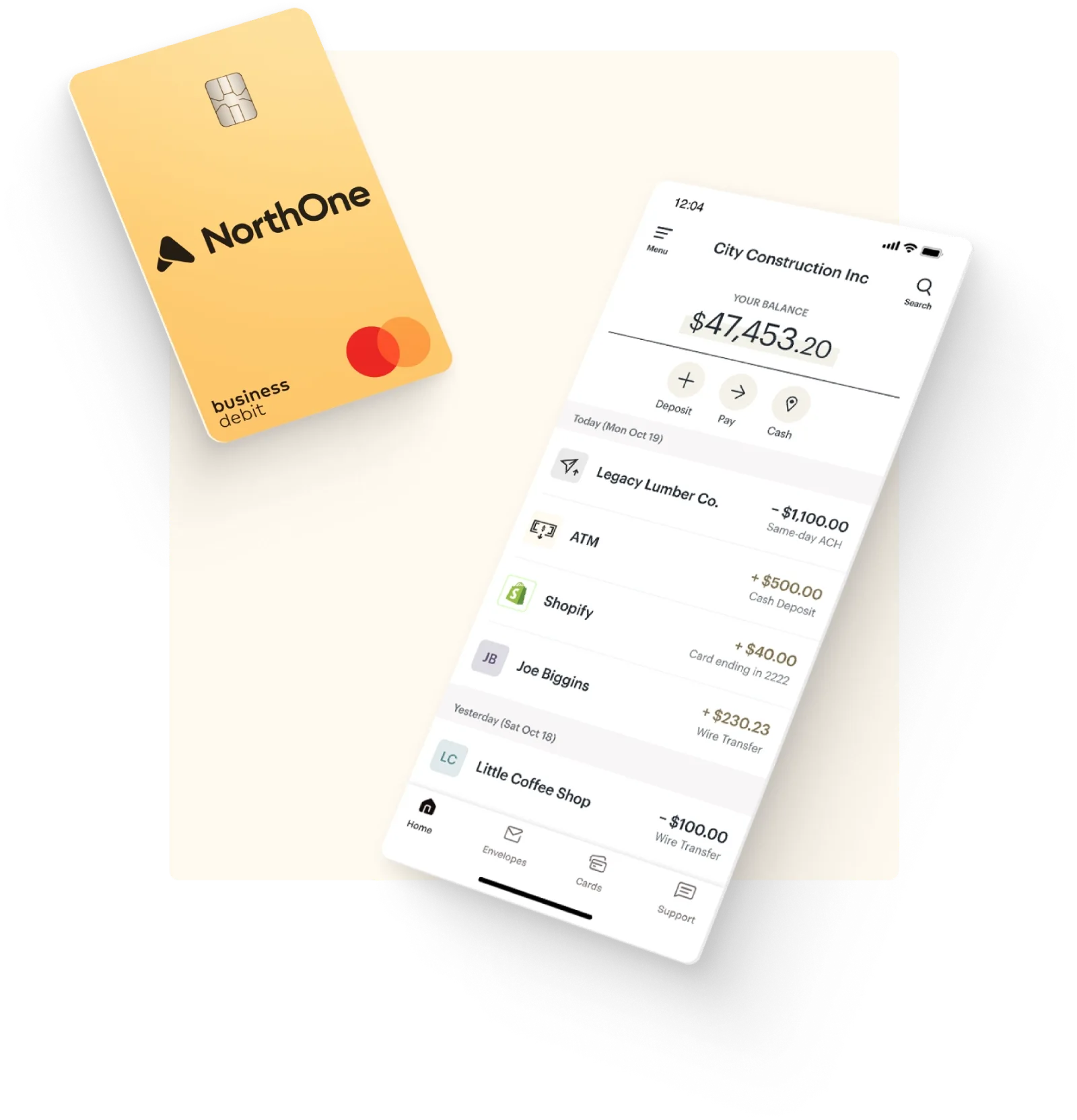

North One connects directly to popular business tools, including:

- QuickBooks and Xero (accounting)

- Stripe, PayPal, Shopify, Square (payments and sales)

- Amazon, Etsy (marketplaces)

These integrations allow North One to serve as a real-time dashboard for your business’s financial health.

5. Business Debit Card

Every account comes with a Mastercard business debit card that can be used for purchases and ATM withdrawals. Cards can be locked/unlocked in the app and replaced quickly if lost.

Pricing

North One offers a flat-fee model:

- $10 per month for the business account

- No additional fees for most features

- Optional fees for instant transfers or same-day ACH

There are no overdraft fees, no hidden charges, and no transaction limits. For small businesses that value simplicity and predictability, this pricing model is a major selling point.

However, the flat $10 monthly fee might be more than some neobanks or traditional banks that offer free basic business accounts, though those typically lack the features North One includes.

User Experience

North One’s app is designed with small business owners in mind. It’s clean, intuitive, and focused on action. The home screen shows balances and envelope allocations, recent transactions, and an easy “Transfer” button for moving money around.

Every feature is mobile-accessible, including bill pay, transaction categorization, and check deposit. While a web version exists for desktop users, the mobile app is clearly the primary interface.

The onboarding process is also quick. You can open an account in minutes by providing basic business information and ID verification. There’s no need to visit a branch or mail in documents.

Who is North One For?

North One is ideal for:

- Sole proprietors and LLCs who want a modern business account

- Freelancers and consultants tired of using personal accounts

- E-commerce sellers and side hustlers managing multiple payment platforms

- Tradespeople or service providers who want simple cash flow tools

It’s especially appealing for those who manage their own finances and don’t have a dedicated accountant or CFO. The envelope system, integrations, and support features act as a lightweight financial toolkit for managing a growing business.

North One is not built for:

- Large enterprises with complex treasury needs

- High-frequency traders or businesses with heavy cash deposits

- Users who need in-person banking or branches

Security, Regulation, Performance and Reliability

North One accounts are FDIC-insured through its banking partner (The Bancorp Bank, N.A.). The platform uses standard encryption, fraud monitoring, and account protections like instant card lock.

Since North One is not a chartered bank, it operates under a Banking-as-a-Service (BaaS) model. This is common among modern fintechs and offers the benefits of flexibility while still providing regulated protection of funds.

North One has consistently improved its reliability and feature set since launch. The app is fast, stable, and user reviews on both iOS and Android are generally positive.

A few users have reported occasional delays in transfers or customer service queues, but these appear to be the exception, not the norm. North One is also proactive about communicating outages or delays through its website and app.

The company has also demonstrated strong responsiveness to user feedback, rolling out new integrations, support improvements, and budgeting features over time.

Comparison With Competitors

| Feature | North One | Mercury | Novo | Bluevine |

|---|---|---|---|---|

| Monthly Fee | $10 | $0 | $0 | $0 |

| FDIC Insurance | Yes | Yes | Yes | Yes |

| Envelope Budgeting | Yes | No | No | No |

| QuickBooks Integration | Yes | Yes | Yes | Yes |

| Cash Deposit Support | Limited | No | No | Yes (via GreenDot) |

| Same-Day ACH | Optional ($) | No | No | Yes |

| Customer Support | Live chat + email | Email only | Chat + email | Chat + email |

While Mercury and Novo are great for tech startups or digital-first founders, North One’s edge is its envelope system, fast support, and broader applicability across industries like trades, retail, or consulting.

Pros and Cons

Pros:

- Intuitive mobile-first design

- Envelope budgeting for better cash flow planning

- Seamless integrations with major business tools

- Transparent, flat-fee pricing

- Fast and friendly customer support

Cons:

- $10 monthly fee may deter very small businesses

- Limited support for physical cash deposits

- No interest-bearing accounts (as of now)

- Mobile-first may not appeal to desktop-heavy users

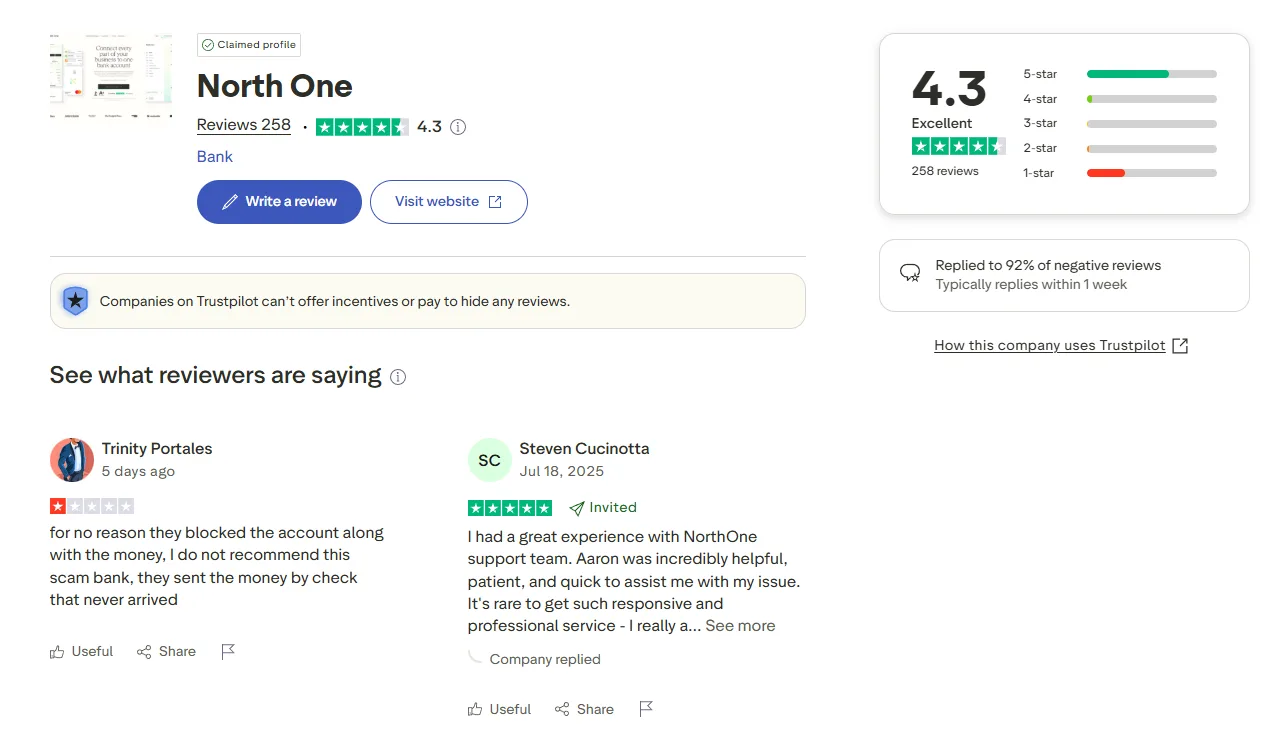

Testimonials and User Feedback

Business owners consistently praise North One for its ease of use and customer service. Common themes in user reviews include:

- “Finally, a business bank that speaks my language.”

- “Envelope budgeting has changed how I plan for taxes.”

- “The support team actually responds quickly.”

Users also appreciate that they can set up their entire financial back office, from checking to accounting syncs, within one app. For businesses that have outgrown their personal accounts but don’t want the complexity of a full commercial bank, North One hits a sweet spot.

Is North One Right for You?

If you run a small business and want a streamlined, modern banking solution that:

- Simplifies budgeting with smart envelopes

- Connects easily to your accounting and sales platforms

- Offers transparent pricing and no surprises

- Gives you fast support when you need it

Then North One is well worth considering.

It may not offer the cheapest base pricing, but the combination of features, integrations, and service justifies the $10/month fee for many entrepreneurs. And with no minimums, you can try it out with minimal risk.

The Bigger Picture

North One is part of a new wave of fintech platforms built on the idea that banking should work for people, not the other way around. While big banks still dominate the commercial space, small businesses are increasingly turning to tools that speak their language. Digital-first, fast, and transparent.

As of today, North One serves tens of thousands of business owners across the U.S. and continues to grow through partnerships, API integrations, and community referrals.

In a space cluttered with legacy pain points and fintech buzzwords, North One is a practical, focused solution. It doesn’t try to do everything, but what it does, it does extremely well.