Review and Full Test of PickTheBank 2025

In recent years, the demand for high-yield savings products in Europe has grown drastically. Traditional banks continue to offer relatively low interest rates, pushing savers to look beyond their old banks and home markets. A new player, PickTheBank, has entered the scene, not as a bank itself, but as a platform that evolved from a trusted savings comparison engine into a full-service deposit application and portfolio management provider.

PickTheBank offers a compelling solution for savers frustrated with low local interest rates. By bridging the gap between European banks and retail clients, it combines the transparency of a comparison platform with the accessibility of a modern online banking service. The partnership with an EU-regulated bank ensures security, while the platform’s responsive support and multilingual service make it approachable for clients across the continent.

With rates up to 2.25% in EUR, 3.8% in USD, and 3.35% in GBP, PickTheBank provides access to savings opportunities that are often unavailable at local banks. This makes it especially attractive for those seeking to optimise their savings portfolio, particularly in multiple currencies.

At the same time, the broader European savings market remains fragmented. For decades, capital has moved easily across borders, but retail customers were left behind. Opening a bank account in another EU country meant paperwork, delays, and often rejection. PickTheBank positions itself as a modern response to this problem, enabling savers to benefit from cross-border opportunities without friction.

What is PickTheBank?

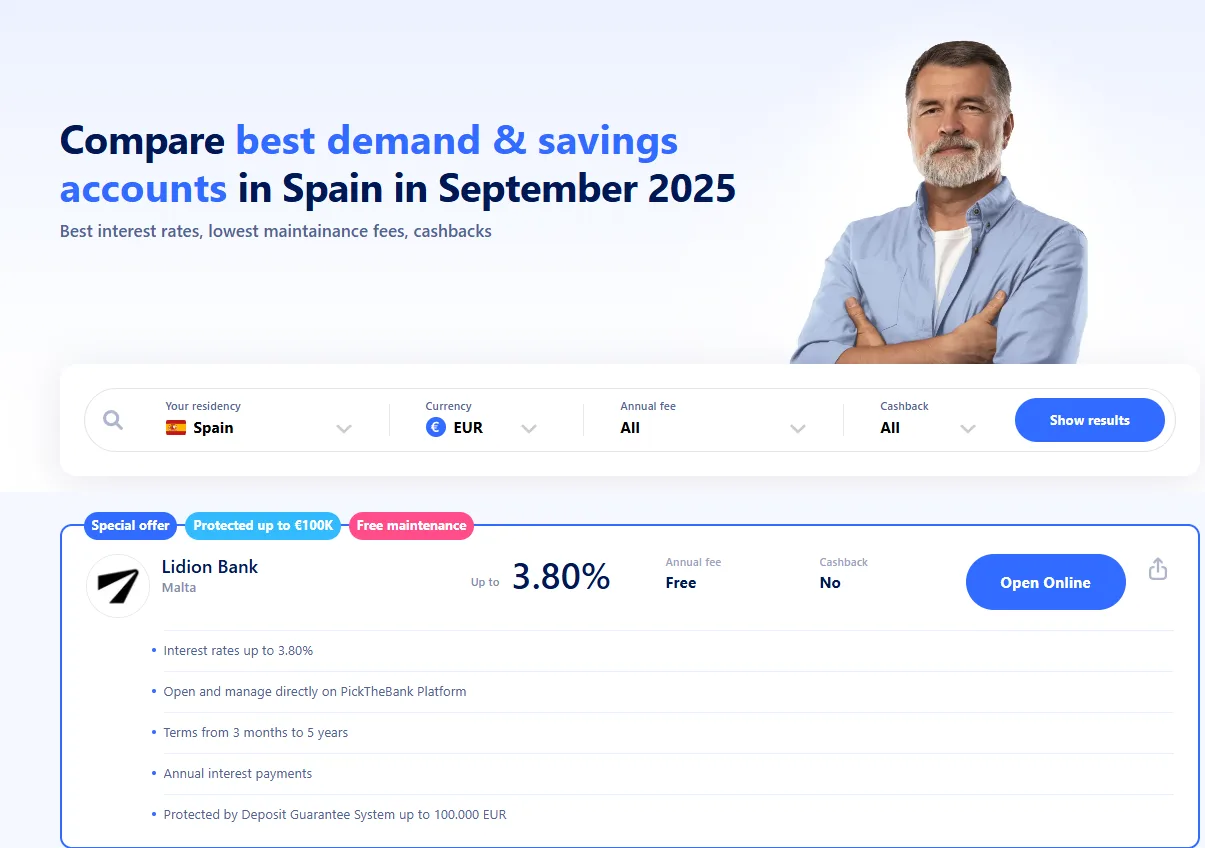

Founded in Cyprus, a country with a limited number of domestic financial institutions, PickTheBank began by aggregating savings offers from across Europe. Over time, it became clear that comparison alone was not enough for savers whose local banks offered subpar rates. PickTheBank responded by partnering with Lidion Bank of Malta, an EU-licensed bank passported across the European Union, to make their deposits directly available to retail clients in multiple countries.

PickTheBank emerged from the frustration many savers share: local banks often offer poor rates, but finding better ones abroad is complicated. The founders recognised that technology and regulation had evolved enough to make a new model possible. Remote onboarding is now commonplace, reusable KYC can reduce compliance friction, and digital interfaces allow customers to manage multiple accounts without complexity.

By focusing exclusively on deposits, PickTheBank has chosen a segment where demand is broad, the risk profile is conservative, and the value of convenience is high. This sets it apart from neobanks that compete on daily banking features or investment apps chasing higher-risk returns. It is targeting the middle ground, people who want to preserve and grow their wealth safely, with less effort.

Products and Deposit Terms

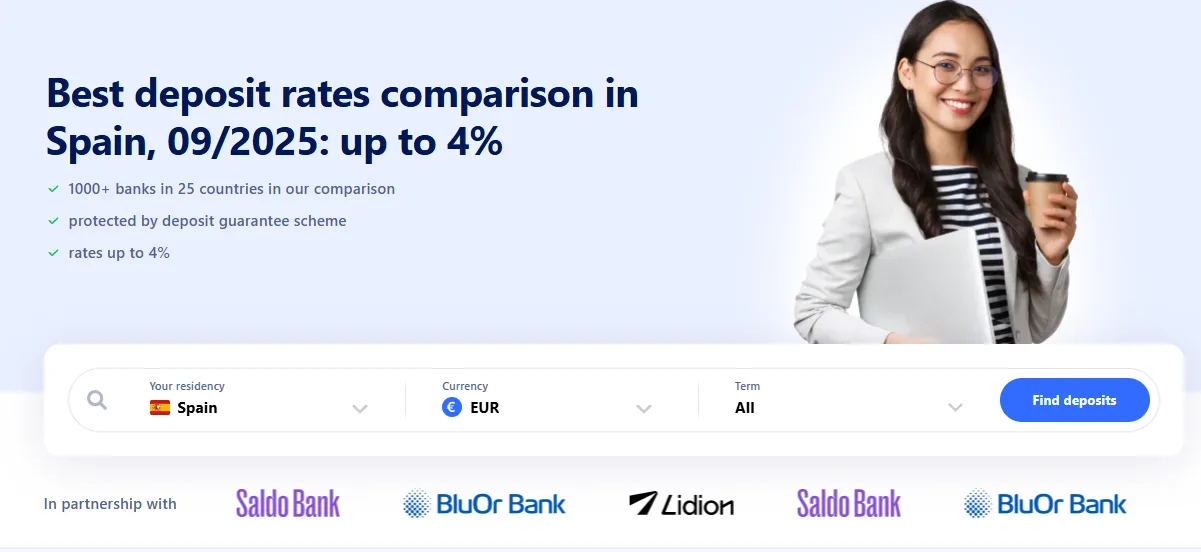

What’s on offer: PickTheBank currently facilitates fixed-term deposits through its partner bank. These are straightforward time deposits with guaranteed returns, available in several currencies and term lengths.

Key parameters:

- Currencies: EUR, USD, GBP

- Rates: Up to 2.25% in EUR, 3.8% in USD, 3.35% in GBP

- Terms: Vary from short-term (3 months) to long-term (up to 5 years)

- Interest payout: Either at maturity or annually (depending on the product)

- Early termination: Not allowed during the term of the deposit, but a wide choice of maturities is available

- Taxation: No withholding tax in Malta, the full interest amount is paid and must be declared in the country of tax residence according to local laws

- Countries of availability: Deposits are available to residents of EU member states, in line with the bank’s passporting rights

The platform is designed with transparency in mind. No hidden fees, no fine print. Customers see the offer, click, and deposit. The value proposition is simplicity combined with security.

Security, Risk and Legal

Deposits are held with Lidion Bank, and are covered by the Maltese Depositor Compensation Scheme up to €100,000 per depositor per bank. Lidion Bank’s participation in the scheme is listed by the Maltese Financial Services Authority.

Lidion Bank is a licensed financial institution under the Maltese Financial Services Authority. The partnership between PickTheBank and Lidion Bank has been confirmed by the bank itself in an official press release. Funds are transferred directly to the deposit bank, not through PickTheBank, which is a positive from a safety perspective.

According to the terms and conditions, PickTheBank acts as a service partner of the bank, facilitating the exchange of information. Customers sign for deposits directly with the bank and acknowledge the bank’s terms. In practice, the deposits function like regular banking deposits.

More broadly, regulation is often viewed as a barrier, but here it is part of the solution. EU rules require national deposit guarantee schemes to cover residents as well as citizens. A German saver in Spain, for example, is entitled to protection from a French bank’s scheme, provided the account is opened correctly. By ensuring compliance and enabling reusable KYC, PickTheBank streamlines access across jurisdictions without exposing customers to unnecessary risk.

User Experience

Onboarding process

You can open an account entirely online. The process starts with a questionnaire covering personal details, wealth, income, and address. This is followed by identity verification, which requires a passport or ID card and proof of address (not required if the ID card already contains the address).

Onboarding completes on both desktop and mobile devices in about 5 minutes if you have your documents ready. You finalise the application with a one-time SMS code.

Speed

Although onboarding is fast, deposit applications take time to be approved by the partner bank. Which is normal. Most applications are approved within several hours, after which pay-in details are provided.

Support and convenience

The multilingual interface is clear and easy to use. Live chat and email support respond quickly, often within minutes during working hours, and phone support is available in English.

Funds transfer

PickTheBank provides the pay-in details, and customers transfer funds themselves via SEPA for EUR or bank transfer for USD and GBP. Card payments or alternative methods are not available. The system typically confirms transfers within hours. The service supports only deposits, not daily banking or third-party transfers.

Taxation and lifecycle

No withholding tax is charged by Lidion Bank. Customers receive the full interest amount and must declare it according to their local tax rules. Applications remain valid for 30 days, allowing savers to lock in rates. During the term, balances and accrued interest can be tracked via the account. At maturity, principal and interest are returned to the reference account. Renewal is manual, with PickTheBank contacting savers a week before maturity.

Customer experience narrative

This process is significantly smoother than dealing with traditional banks, which often impose local restrictions and require branch visits. With PickTheBank, the experience is reduced to a few steps on a phone or laptop. For digitally savvy but conservative savers, this unified approach is a major upgrade. They want better rates and safety, not complex investments. PickTheBank delivers exactly that.

Who Will Benefit Most

- Savers looking for higher returns than those offered by local banks

- Those who want currency diversification (EUR, USD, GBP)

- Individuals seeking an additional EU bank for diversification and deposit guarantee protection

- Clients who value clear online processes and personalised support

PickTheBank’s target customers are digitally comfortable but financially cautious. They prefer simplicity, safety, and transparency over speculative returns.

Final Verdict

PickTheBank offers a compelling solution for savers frustrated with low interest rates offered by local banks. With competitive EUR offers and market-leading USD and GBP rates, it opens opportunities that many savers could not previously access.

It is always positive when more options exist in the savings market and competition increases. For those seeking to optimise their savings portfolios, especially across multiple currencies, PickTheBank is a platform worth considering.

Beyond today’s product, the long-term outlook is significant. PickTheBank is carving out a space between neobanks and investment apps, focusing narrowly on deposits. This clarity of purpose is a strength. Recent milestones, such as multi-currency expansion and the launch of the iOS app, are deliberate steps toward building scale and trust.

The business model is straightforward: banks gain new deposits without heavy acquisition costs, customers gain better access and higher returns. Challenges remain, from regulatory complexity to customer awareness, but the foundations are solid.

If executed well, PickTheBank could become a household name in European savings. It is not only offering smarter deposits, it is laying the groundwork for a more integrated retail banking market. For savers, it promises better returns with less effort. For banks, it opens new distribution channels. And for the broader ecosystem, it represents progress toward a true single market in finance.