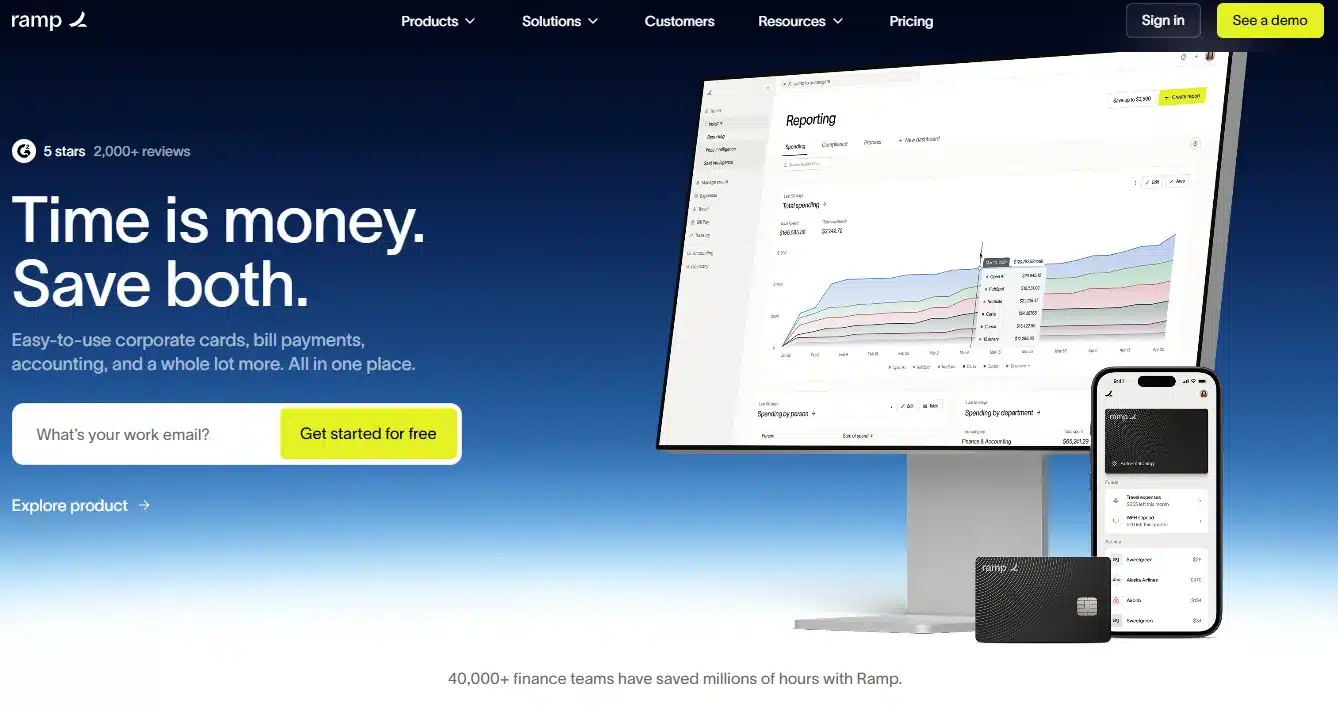

Ramp positions itself as a modern finance automation platform. It helps businesses manage expenses, control spending, and optimise financial workflows in real time, offering a distinct alternative to traditional expense systems.

Ramp offers a corporate card paired with expense management software. It earns revenue primarily through interchange fees from card networks when users make purchases. Unlike traditional SaaS models, Ramp provides its software free, monetising from card usage. This creates strong incentives for companies to centralise their spending on Ramp’s platform, driving recurring transaction-based revenue without direct software licensing fees.

Core features

Ramp delivers real-time spend control. Companies can set customised card limits, approval flows, and category-based restrictions. Automated receipt matching and transaction categorisation reduce manual reconciliation. The platform integrates with popular accounting tools, streamlining month-end processes and significantly reducing administrative workload for finance teams.

Ramp uses AI to identify savings opportunities. The platform detects duplicate subscriptions, negotiates vendor pricing, and surfaces cost-cutting recommendations. These proactive insights differentiate Ramp from basic expense tools. The emphasis is not only on monitoring expenses but actively improving financial efficiency, making Ramp a financial optimisation platform rather than a passive expense tracker.

Target audience and competitive positioning

Ramp focuses on startups, scale-ups, and mid-market businesses seeking better financial discipline without complex ERP systems. Its simple setup appeals to finance teams aiming for automation without sacrificing control.

Fast-growing companies benefit from its flexibility as they scale, while mid-sized businesses leverage the company to replace fragmented expense policies with unified oversight.

It competes with players like Brex, Airbase, and traditional corporate card providers. Its key differentiator lies in delivering financial savings, not just tracking expenses. Ramp promotes itself as a profit centre by reducing unnecessary costs and automating financial workflows that previously required manual oversight, freeing up finance teams for higher-value work.

Recent developments

Ramp has steadily expanded its product suite, adding accounts payable automation, procurement workflows, vendor management, and travel spend features. These additions deepen its value proposition as an all-in-one financial operations platform, positioning Ramp to serve larger organisations with more complex operational needs.

The company integrates with ERP systems like NetSuite, QuickBooks, Xero, and other popular finance platforms. Its partnerships with accounting firms and technology providers strengthen its ecosystem. Seamless integrations help users adopt Ramp without major workflow disruptions, making the platform easier to implement across multiple teams.

Funding, growth and challenges ahead

Ramp has attracted significant venture funding, reflecting strong market demand for modern spend management. Its growth trajectory suggests a sustained appetite for finance automation among businesses, especially in a market environment where cost control and efficiency are increasingly critical to business success.

The company must maintain product innovation to stay ahead of competitors. Large enterprises may still prefer established ERP systems for end-to-end financial management.

Balancing simplicity with feature depth remains key as Ramp seeks to expand into larger customer segments that demand robust customisation and deeper integrations.

Conclusion

Ramp transforms expense management into a cost-saving engine. Its unique revenue model, focus on automation, and AI-driven insights position it strongly in the evolving spend management market. As finance teams increasingly seek actionable insights alongside control, Ramp’s model aligns closely with modern CFO priorities.