Real estate crowdfunding has transformed the way individuals access property investment. What was once a game reserved for institutional players and high-net-worth individuals is now open to everyday investors with as little as €10 or $100 to spare. The premise is simple: pool funds with others to invest in residential, commercial, or development projects, and earn returns via rental income, capital appreciation, or both. But beyond the headline appeal lies a fast-evolving market filled with different models, risks, regulations, and opportunities.

We explore what real estate crowdfunding is, how it works, who the main players are, and what investors should consider before diving in. Whether you are a beginner curious about passive income or a seasoned investor looking to diversify, this guide helps you navigate the growing world of crowdfunded real estate.

What is Real Estate Crowdfunding?

Real estate crowdfunding is a digital method of raising capital for property projects by pooling money from multiple investors through an online platform. Instead of buying an entire property outright, investors contribute smaller sums and share in the profits (or losses) based on their stake.

These platforms act as intermediaries between property developers or managers (who need funding) and investors (who want exposure to real estate). Some projects involve debt (loans to developers), while others involve equity (partial ownership in a property or fund).

There are two primary investment types:

- Debt-based crowdfunding: Investors lend money to property developers in exchange for interest payments, typically with lower risk and shorter timeframes.

- Equity-based crowdfunding: Investors become partial owners and earn a share of rental income and appreciation, but also bear higher risk and longer holding periods.

The Evolution of Property Crowdfunding

The concept took off after the 2008 financial crisis, fueled by fintech innovation, lower interest rates, and rising demand for alternative assets. Platforms like Fundrise in the US, Property Partner in the UK, and Urbanitae in Spain emerged to serve retail investors. Regulatory reforms such as the US JOBS Act and the European Crowdfunding Regulation (ECSPR) have since legitimised the model and expanded its reach.

In 2025, real estate crowdfunding sits at the intersection of proptech, fintech, and investment innovation. It combines the tangibility of real estate with the accessibility and liquidity of modern digital platforms.

Key Benefits of Real Estate Crowdfunding

1. Accessibility

Investors can get started with modest capital, sometimes under €100. This makes property investment possible for people previously priced out of the market.

2. Diversification

Rather than committing a large sum to a single asset, investors can spread capital across multiple properties, regions, or development types.

3. Passive Income

Many platforms pay quarterly or monthly dividends from rental income or loan repayments, appealing to those seeking recurring income streams.

4. Transparency

Crowdfunding platforms provide detailed deal breakdowns, including location, developer history, exit strategy, and projected returns.

5. Geographic Reach

Investors can gain exposure to international real estate markets without needing local connections or legal infrastructure.

Leading Platforms in 2025

1. Fundrise (USA)

Fundrise pioneered the eREIT (electronic real estate investment trust) model. It offers diversified portfolios across residential and commercial real estate in the US. Investors can choose from plans based on income, growth, or balanced returns.

- Minimum investment: $10

- Model: Equity

- Liquidity: Quarterly redemption window

2. RealtyMogul (USA)

RealtyMogul focuses on both debt and equity deals, with options for accredited and non-accredited investors. It offers single-asset deals as well as REIT-style funds.

- Minimum investment: $5,000 (REIT) or $25,000 (direct)

- Model: Equity and debt

- Target return: 8–12%

3. Urbanitae (Spain)

Urbanitae is one of the fastest-growing platforms in Europe, connecting investors with large-scale residential developments in Spain. It complies with ECSPR and is now expanding across the EU.

- Minimum investment: €500

- Model: Primarily equity

- Exit timeframe: 12 to 36 months

4. Reinvest24 (Estonia)

Reinvest24 offers property-backed loans and rental income projects across the Baltics and Central Europe. It has an auto-invest feature and secondary market for liquidity.

- Minimum investment: €100

- Model: Debt and equity

- Secondary market: Yes

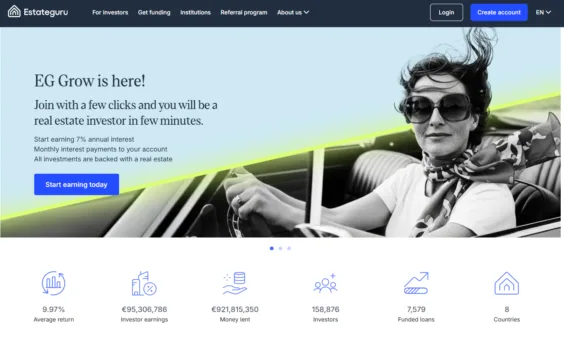

5. EstateGuru (Pan-European)

EstateGuru focuses on short-term real estate loans with strong collateral. It has funded over €700 million in projects and offers risk scores for each loan.

- Minimum investment: €50

- Model: Debt

- Average loan term: 12 to 18 months

How Returns Work

Returns in real estate crowdfunding depend on the deal structure:

- Debt deals typically offer fixed interest (8–12% annually) paid monthly or quarterly. Capital is returned at loan maturity.

- Equity deals involve rental distributions and a lump sum when the property is sold. Returns vary but can exceed 15% annually for successful projects.

Some platforms offer automated strategies that reinvest earnings into new deals. Others require manual selection, which gives more control but demands research.

Investors should always read the expected IRR (internal rate of return), which reflects total annualised performance, including dividends and capital gains.

Risks to Consider

As with any investment, real estate crowdfunding comes with risks:

1. Default Risk

In debt deals, developers may fail to repay. Although platforms usually have legal recourse, recoveries can be slow.

2. Liquidity Risk

Many investments are locked in for several years. While some platforms offer secondary markets, these are not always active.

3. Market Risk

Falling property values, construction delays, or economic shocks can reduce returns or lead to losses.

4. Platform Risk

If the crowdfunding platform goes out of business, access to investments and payouts could be disrupted.

5. Regulatory Risk

Cross-border investing depends on compliance with local laws. Changing rules can affect platform operations or investor protections.

Regulatory Framework in 2025

Europe has unified its crowdfunding rules under the European Crowdfunding Services Providers Regulation (ECSPR). As of 2025, all platforms operating in the EU must be licensed under this regime to raise capital from retail investors across borders.

Key features include:

- Maximum €5 million per project per year

- Transparent risk disclosures and key investment information sheets (KIIS)

- Conflict-of-interest policies and investor categorisation

- Passporting rights across all EU member states

The US operates under the Regulation Crowdfunding and Reg D exemptions, which distinguish between accredited and non-accredited investors.

Investors should check whether a platform is properly registered, licensed, and audited. Regulation has improved, but due diligence is still essential.

Trends Shaping the Market

1. Fractional Ownership + Tokenization

Blockchain is enabling property shares to be tokenised, allowing smoother secondary trading and lower transaction costs. Several platforms are experimenting with NFTs and smart contracts for real estate investment.

2. ESG-Focused Deals

Green buildings, energy-efficient renovations, and socially responsible housing projects are gaining traction among impact investors. Some platforms now rate deals on ESG metrics.

3. Institutional Participation

Family offices and smaller institutions are entering the crowdfunding space, especially in curated funds or co-investment models.

4. AI-Powered Due Diligence

Platforms are using machine learning to evaluate risk, developer track records, and real-time market signals, improving deal quality and transparency.

5. Increased Liquidity Options

Secondary markets and scheduled exit windows are becoming more common. This helps address one of the main barriers to entry for hesitant investors.

Who Should Consider Real Estate Crowdfunding?

This asset class is best suited for:

- Long-term investors who want passive exposure to real estate without owning or managing property

- Young professionals looking to diversify beyond stocks and crypto

- Retirees seeking income-generating assets

- Property enthusiasts with limited capital or geographic access

It is not ideal for:

- Those needing short-term liquidity

- Investors unfamiliar with risk or economic cycles

- Anyone who does not understand the underlying deal terms

Final Thoughts

Real estate crowdfunding has matured into a viable investment option for retail and professional investors alike. It combines the reliability of property with the convenience and flexibility of digital finance. As regulation strengthens and platforms continue to innovate, the barriers to entry are lower than ever.

Yet, the market is still young. Investors must approach it with clear expectations, a diversified strategy, and an understanding of the risks. Choosing the right platform, understanding the structure of each deal, and aligning with your risk tolerance are critical steps.

In the end, real estate crowdfunding is not just about pooling money. It is about democratising access to an asset class that has traditionally been off-limits to most. As fintech continues to open new doors in wealth building, property investment is no longer reserved for the few. With the right approach, anyone can take part in the future of real estate.