Access to financial data underpins almost every modern fintech use case, from lending and account verification to accounting, compliance, and personal finance. Whether enabling credit decisions, automating reconciliation, or powering consumer-facing finance tools, accurate and timely data has become essential infrastructure. Yet despite this importance, much of the financial data layer still depends on fragile integrations that require constant maintenance.

Sophtron was built to address this challenge directly. Rather than adapting to the limitations of traditional aggregation models, the company has designed its platform around artificial intelligence from the outset. With the goal of making financial data access more resilient, scalable, and comprehensive.

Founded eight years ago, Sophtron has developed an AI-driven financial data platform designed to connect users to their financial accounts. Without relying on institution-specific integrations. By using an AI agent that navigates financial institution websites in a human-like manner, Sophtron aims to reduce dependency on manual connectors while expanding institutional coverage. This approach reflects a broader shift in fintech infrastructure, where automation and adaptability are increasingly prioritised over static integrations.

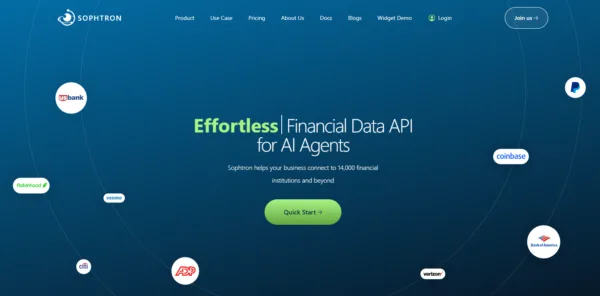

What is Sophtron?

Sophtron is a financial data infrastructure company focused on account access, verification, and data retrieval. Its core product is an AI-powered API that enables applications to connect to user-authorised financial accounts and retrieve structured financial and identity data in real time.

The platform supports a wide range of commonly required data points, including account ownership verification, balance and transaction retrieval, payment information such as ACH numbers, and identity data including name, address, email, and phone number. These capabilities are designed to support both regulated financial use cases and broader commercial applications.

Rather than offering a consumer-facing application, Sophtron operates primarily as backend infrastructure. Its role is to enable other platforms, whether lenders, fintech apps, or enterprise systems, to build financial services on top of a consistent and scalable data access layer.

How Sophtron’s technology works

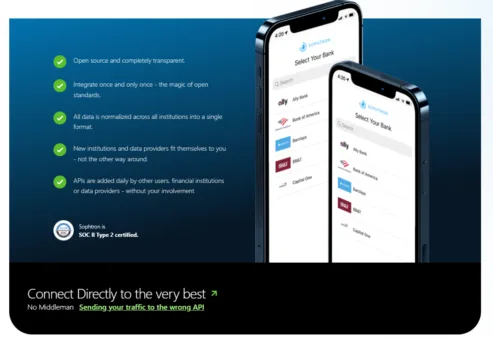

The defining feature of Sophtron’s platform is its AI-first approach to financial data access. Instead of building and maintaining direct integrations with individual banks or financial institutions, Sophtron has invested heavily in an AI agent that can navigate financial institution websites in a way that closely resembles human behaviour.

The agent does not rely on pre-coded knowledge of a bank’s website structure. It reads and interacts with each site dynamically, responding to page layouts, navigation flows, and authentication steps as they appear. This allows the system to operate across a wide range of institutions without requiring institution-specific engineering work.

This design addresses a long-standing weakness in traditional financial data aggregation. When banks or service providers update their websites, conventional integrations often break, leading to service interruptions and ongoing maintenance costs. Sophtron’s AI agent is designed to adjust automatically when these changes occur, reducing disruption and improving operational stability over time.

Institution coverage and supported data

Sophtron reports coverage of all 15,000 financial institutions in the United States and Canada. This includes traditional banks, credit unions, investment brokerages, card issuers, neobanks, and crypto exchanges. Achieving and maintaining this level of coverage would be challenging under a purely integration-based model.

Beyond traditional financial institutions, Sophtron also supports more than 30,000 non-traditional accounts. These include insurance providers, loan and mortgage accounts, health savings accounts, employee benefit platforms, and utility services. This reflects the reality that financially relevant data is increasingly distributed across many systems that fall outside core banking infrastructure.

The company also states that it has exclusive connections to widely used consumer fintech applications such as Cash App, Venmo, and PayPal. These connections extend Sophtron’s reach into everyday transaction data and support use cases where visibility across multiple platforms is essential.

Scale, clients, and use cases

Sophtron connects over ten million users to their financial accounts. Its client base includes financial institutions, credit bureaus, lenders, accounting firms, and large enterprises, including Fortune 500 companies. This range suggests that the platform is used across both consumer-facing and enterprise-grade environments.

Typical use cases include account verification, underwriting and credit assessment, financial reconciliation, compliance workflows, and data enrichment for digital finance products. In many cases, Sophtron operates behind the scenes, enabling these functions without being visible to end users.

The ability to serve enterprise and regulated clients also implies a focus on reliability, scalability, and consistency. These factors are critical for organisations that depend on financial data as a core operational input rather than a supplementary feature.

Sophtron and AI-native financial experiences

In addition to its core API offering, Sophtron has begun to explore how financial data integrates with AI-driven user interfaces. The company has released an in-chat application that allows users to connect and import their financial data directly into ChatGPT and other AI assistants.

This initiative reflects a broader shift in how financial information may be accessed and consumed. Instead of relying solely on dashboards or reports, users are increasingly interacting with financial data through conversational and agent-based systems that can interpret, summarise, and act on information in real time.

Sophtron also offers free financial data access to individual developers building personal assistants and everyday consumer tools. This developer-oriented approach supports experimentation and innovation at the intersection of AI and personal finance.

Security, consent, and trust

Sophtron operates based on explicit user authorisation when accessing financial accounts and personal data. As with any financial data platform, consent and trust remain central considerations.

As AI-driven data access becomes more widespread, expectations around transparency, auditability, and regulatory alignment are likely to increase. These considerations will shape how AI-based data platforms are assessed and adopted across financial services, particularly in regulated environments.

Final assessment

Sophtron represents a clear departure from traditional financial data aggregation models. By relying on an adaptive AI agent rather than institution-specific integrations, the company has built a platform designed for scale, resilience, and broad institutional coverage.

Its extensive reach, growing user base, and early focus on AI-native interfaces position Sophtron at the intersection of fintech infrastructure and artificial intelligence. For organisations seeking flexible and scalable access to financial data, Sophtron offers an alternative approach aligned with how financial services are evolving.