As the world of digital payments grows increasingly fragmented, businesses are facing a challenge: how to manage dozens of payment gateways, methods, and geographies efficiently. This is where Spreedly, a leading payments orchestration platform, comes in. Designed to sit between merchants and payment service providers (PSPs), Spreedly offers a powerful set of tools to optimise transaction performance, reduce fraud, and increase payment flexibility.

In this Spreedly review, we explore the platform’s features, benefits, pricing model, integrations, and how it compares to other payment orchestration providers. Whether you’re a SaaS platform, marketplace, or global retailer, Spreedly can provide the infrastructure to scale your payments strategy intelligently.

What Is Spreedly?

Spreedly is a cloud-based payments orchestration platform that enables businesses to connect to multiple payment gateways and services through a single integration. Founded in 2008 and headquartered in Durham, North Carolina, Spreedly is focused on helping merchants and platforms build flexible, global payment stacks.

Rather than acting as a payment processor itself, Spreedly provides the infrastructure to route transactions, vault payment data, and optimise success rates across providers. It supports over 120 payment gateways globally, along with fraud tools, 3-D Secure services, network tokenisation, and more.

Core Use Cases

Spreedly is designed for a variety of organisations in the payments ecosystem:

- Merchants and retailers operating in multiple countries

- SaaS platforms integrating payments for their customers

- Marketplaces coordinating payments between buyers and sellers

- Subscription services managing recurring billing across gateways

By offering a flexible API and tokenisation layer, Spreedly becomes the glue that binds a complex, multi-provider payment stack.

Key Features of Spreedly

1. Payment Gateway and Service Integration

Spreedly supports over 120+ payment gateways and alternative payment methods, including:

- Stripe, Adyen, Braintree, Worldpay, Authorize.Net, CyberSource

- Regional PSPs like PayU, Mercado Pago, Razorpay, and iPay88

This allows businesses to connect to multiple providers via a single API, supporting:

- Smart routing and failover

- Geographic optimisation

- Cost efficiency and redundancy

No need to build and maintain dozens of direct integrations, Spreedly handles it.

2. Secure Card Vault and Tokenisation

Spreedly offers a PCI-compliant card vault to store customer card details securely. Merchants retain the flexibility to move between gateways without re-collecting card data.

- Universal vault token: Can be used across gateways.

- PCI Level 1 compliance: Highest security standards.

- Vaulting for recurring payments and cross-border use.

This makes card portability and migration easier, especially when switching providers or entering new markets.

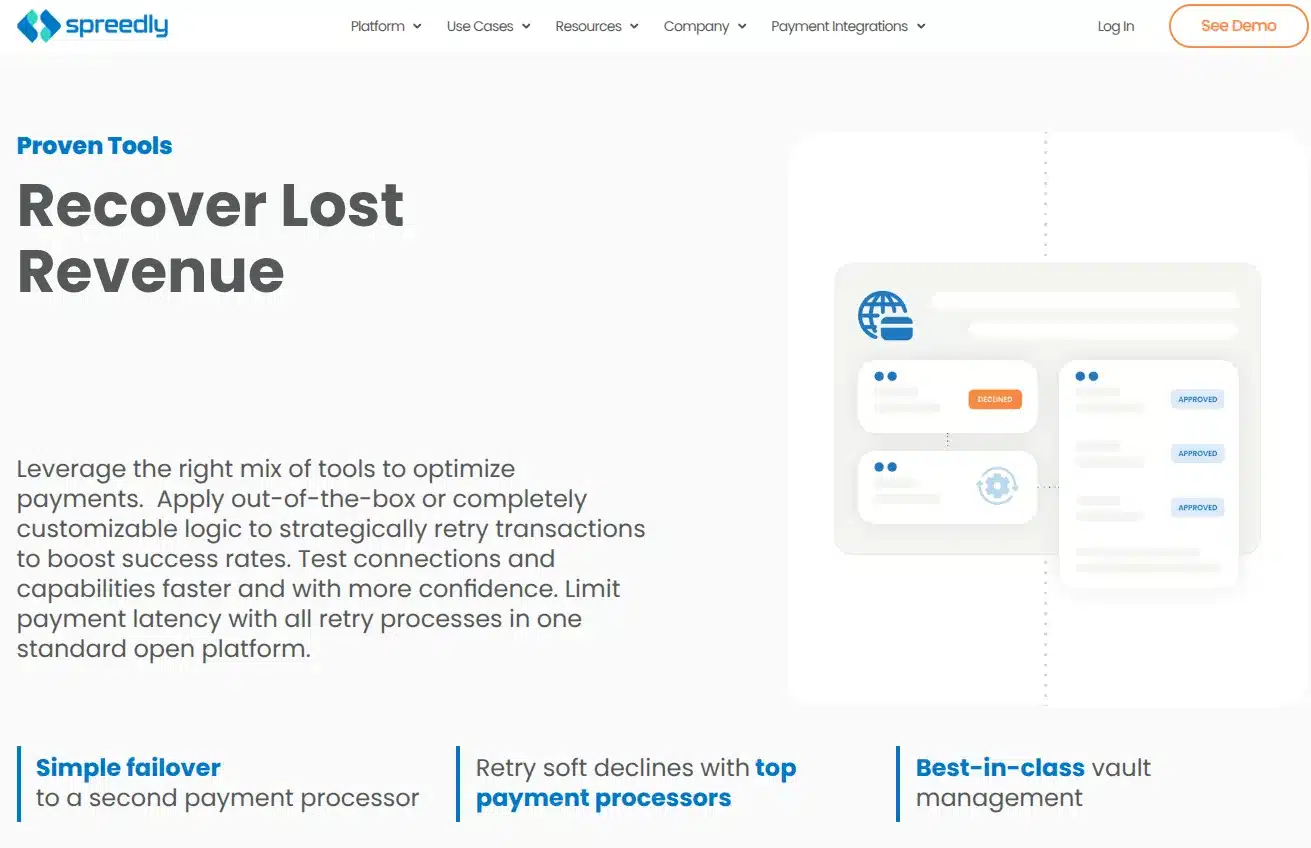

3. Transaction Orchestration and Smart Routing

Spreedly allows for customised routing logic based on:

- Transaction value

- Geography

- Card type

- Customer profile

- Gateway performance

For example, you could route high-value transactions through a preferred low-fee gateway while using an alternate for cards from a specific region.

Smart routing helps:

- Maximise transaction approval rates

- Reduce gateway fees

- Improve redundancy and uptime

4. Network Tokenisation and Card Lifecycle Management

Spreedly supports network tokens from Visa, Mastercard, and others, which replace card numbers with secure tokens. These are automatically updated when a card expires or is replaced.

Benefits include:

- Higher authorisation rates

- Reduced fraud risk

- Lower transaction declines

- Compliance with issuer requirements

It also simplifies card-on-file management for recurring billing businesses.

5. 3DS2, Fraud Tools, and Compliance

Spreedly integrates with:

- 3-D Secure 2.0 providers for SCA compliance in Europe

- Fraud tools like Sift, Kount, and Ekata

- Custom metadata tagging for risk profiling

These features allow you to meet regional compliance requirements (like PSD2), reduce fraud, and maintain conversion rates.

6. Merchant Aggregator Support

Platforms and marketplaces can use Spreedly to manage payments for multiple sub-merchants, making it ideal for:

- SaaS platforms embedding payments

- Marketplaces distributing funds

- Vertical SaaS platforms expanding payment features

Each sub-merchant can be configured with their own payment gateway rules while sharing the same API infrastructure.

Developer Experience and API

Spreedly is built with developers in mind. Its RESTful API and extensive documentation make it easy to:

- Add new gateways

- Configure routing rules

- Tokenise and vault cards

- Create transactions and capture payments

- Monitor gateway performance

There’s also a robust dashboard with:

- Transaction logs and analytics

- Token management

- Developer sandbox for testing

For technical teams managing high-volume payment flows, Spreedly offers a scalable and developer-friendly foundation.

Pricing

Spreedly doesn’t publish detailed pricing on its website, as pricing varies based on transaction volume, gateway count, and enterprise features.

However, it generally includes:

- Monthly platform fees

- Per-transaction fees

- Add-ons for premium features like network tokenisation or additional vaults

Typical pricing tiers include:

- Startups and growth-stage companies: Entry-level plans with limited gateway usage

- Mid-market companies: Custom pricing for regional routing and recurring billing

- Enterprises: White-glove support, SLAs, and global scaling

You must request a quote for exact pricing, but Spreedly is generally positioned for mid to large-scale businesses rather than very small merchants.

Pros of Spreedly

- Global reach: Support for 120+ gateways and regional PSPs

- Flexibility: Use multiple gateways for failover and routing

- Card portability: Vault once, use anywhere

- Improved conversion rates: Smart routing and network tokenisation

- Platform-friendly: Supports marketplaces and SaaS payment use cases

- Scalable API: Built for enterprise-scale infrastructure

Cons of Spreedly

- Not a payment processor: You still need to integrate with and manage PSPs

- Opaque pricing: No public pricing, making budgeting difficult for smaller teams

- Enterprise focus: Best suited to mid-size or larger businesses

- Requires payment expertise: Managing orchestration adds operational complexity

Spreedly stands out for its breadth of gateway integrations, robust vaulting capabilities, and strong developer support. While newer platforms like Gr4vy offer more built-in orchestration UIs and no-code options, Spreedly is preferred by technical teams who want control and scalability.

Ideal Customer Profile

Spreedly is best suited for:

- Mid to large-sized businesses with international presence

- Platforms and marketplaces offering embedded payments

- Merchants with high decline rates looking to optimise success

- Teams managing multiple gateways or transitioning between PSPs

It may not be ideal for:

- Solo entrepreneurs or very small shops

- Businesses looking for a one-stop payment processor

- Non-technical teams with no development resources

The Future of Spreedly

Spreedly is well-positioned to grow in an era of increasingly fragmented payment ecosystems. Its roadmap includes:

- More native tools: Including analytics and routing logic interfaces

- Deeper integrations with fraud and KYC providers

- Expanded tokenisation support for new payment methods

- Partnerships with PSPs, fintechs, and vertical SaaS platforms

As embedded finance grows and merchants demand greater payment agility, Spreedly’s orchestration model is likely to gain even more traction.

Final Verdict: Is Spreedly Worth It?

If your business needs to scale payments across multiple gateways, reduce decline rates, or enable flexible merchant payment setups, Spreedly is a powerful solution. It doesn’t replace your PSPs. It makes them work better, together.

While its pricing and implementation complexity may deter small businesses, for growing platforms and global merchants, Spreedly offers the reliability and flexibility needed to compete in today’s diverse payments landscape.

For teams serious about optimising payments as a growth lever, Spreedly is a strong partner to consider.