Titan is shaking up the world of investment management. Designed as an all-in-one investment platform for long-term investors, Titan offers actively managed portfolios, in-depth research, and a hedge fund-like experience for regular people. In a world where robo-advisors promise low fees and passive investing, Titan goes in the opposite direction, offering active management, tailored strategies, and direct access to investment experts. This Titan review breaks down what it is, how it works, who it’s for, and whether it lives up to the promise of democratising elite investing.

What is Titan?

Founded in 2018, Titan is a fintech company based in New York City. It positions itself as an active investment manager that gives retail investors access to hedge-fund-style strategies without the barriers of high fees, minimums, or exclusivity.

At its core, Titan is a mobile-first app that lets users invest in curated portfolios of U.S. stocks, international stocks, and crypto. But what makes Titan unique is that these portfolios are managed by a team of in-house analysts and portfolio managers. Users get regular updates, investment commentary, and research reports delivered via the app.

Titan was co-founded by Joe Percoco, Clayton Gardner, and Max Bernardy, who combined backgrounds in asset management and technology. Also, the company has raised funding from Andreessen Horowitz, General Catalyst, and other notable investors.

How Titan Works

When you open an account with Titan, you’re asked about your risk tolerance and investment goals. From there, Titan assigns you to one or more of its flagship portfolios:

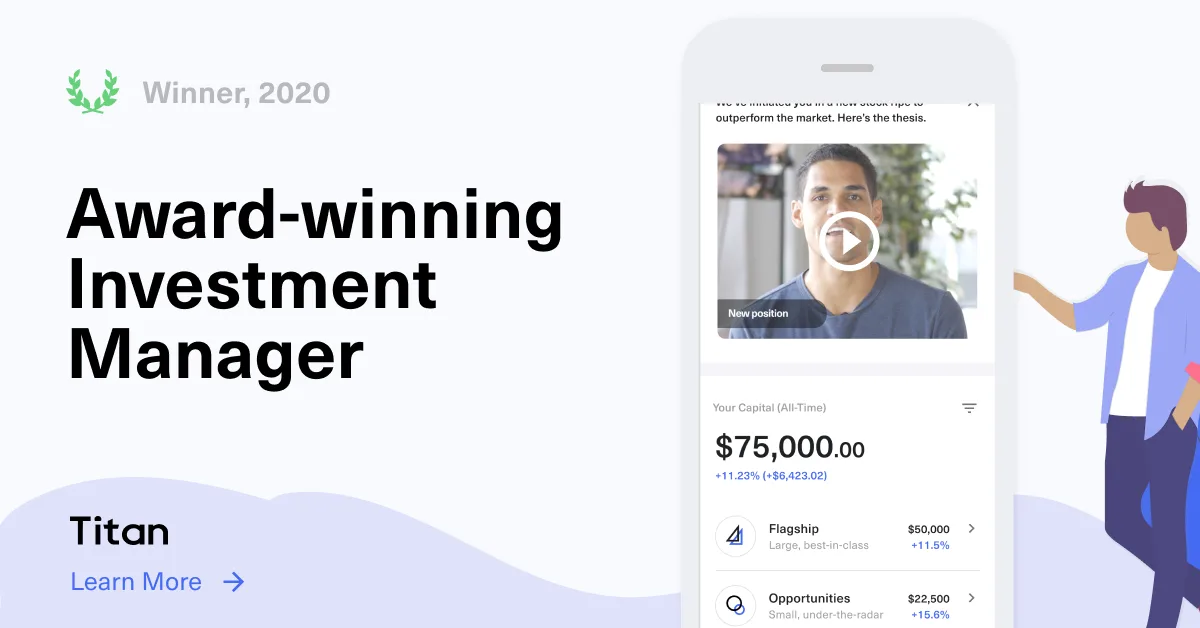

- Flagship (U.S. Growth): A high-conviction portfolio of 15–25 large-cap U.S. growth stocks.

- Opportunities (SMID Cap): Focused on small and mid-cap companies with high upside potential.

- Offshore (International Growth): Exposure to leading companies based outside the U.S.

- Crypto: A dynamic portfolio of crypto assets, actively managed and rebalanced based on the firm’s outlook.

Each strategy is managed separately, and investors can allocate across multiple based on their profile. You can start with as little as $100.

Titan is a registered investment advisor (RIA), which means it manages money directly rather than operating as a broker or exchange. This structure allows it to build direct relationships with users and differentiate itself from passive investment platforms.

Titan Review: Investment Philosophy

Titan is built on a belief that many retail investors are underserved by passive robo-advisors and traditional ETFs. Its investment approach combines:

- Active Management: Titan’s analysts make active decisions about which companies to include in each portfolio.

- Concentrated Positions: Unlike mutual funds with hundreds of holdings, Titan’s portfolios are focused, typically 15–25 names.

- Downside Protection: Titan sometimes adds hedges to portfolios to reduce volatility during market drawdowns.

- Transparency: Investors receive video updates, written notes, and market commentary explaining each move.

While critics of active investing point to long-term underperformance versus passive indexes, Titan argues that its concentrated and transparent approach can outperform over time, especially in volatile or uncertain markets.

Fees and Pricing

Titan’s pricing is refreshingly simple:

- No commissions or trading fees

- Annual fee of 0.90% of assets under management (AUM)

This fee structure is higher than most robo-advisors (which range from 0.25% to 0.50%) and passive index funds. But much lower than traditional financial advisors or hedge funds, which often charge 1–2% plus performance fees.

There are no account minimums, and users can start with as little as $100. Titan supports taxable accounts, traditional and Roth IRAs, and SEP IRAs.

User Experience

Titan is a mobile-first experience. The app is well-designed, intuitive, and packed with features:

- Portfolio Overview: See your balance, allocation, and performance at a glance.

- Investment Updates: Weekly commentary from portfolio managers, explaining rationale and outlook.

- In-App Research: Access deep dives on specific companies, market outlooks, and macroeconomic trends.

- Automated Deposits: Schedule regular investments to build wealth over time.

For users who want to understand what’s happening with their money, and why, it delivers a level of transparency most apps don’t. Therefore it strikes a balance between simplicity and depth, appealing to both beginners and sophisticated investors.

Titan Review: Crypto

In 2021, Titan added its actively managed crypto portfolio, positioning it as a hedge-fund-like strategy for digital assets.

The crypto strategy includes exposure to:

- Bitcoin and Ethereum

- DeFi tokens like Uniswap and Aave

- Layer 1s such as Solana and Avalanche

- Periodic rebalancing and risk reduction

Crypto investors receive the same research and update cadence as Titan’s equity strategies. Assets are held via a secure custodian (Apex Crypto), and the portfolio is rebalanced based on Titan’s outlook.

Titan’s crypto strategy is higher risk but also higher potential reward, designed for investors who want to participate in the digital asset economy without managing it day-to-day.

Safety and Security

Titan uses Apex Clearing as its custodian and SIPC member, which protects securities up to $500,000. Data encryption, two-factor authentication, and account monitoring are all standard.

Titan does not have FDIC insurance because it’s not a bank. But funds transferred in and out go through trusted partners and are held in segregated accounts.

Who is Titan Best For?

Titan is best suited for:

- Investors who want active management without going to a private wealth manager.

- People seeking transparency and communication, it does a great job of explaining its thinking.

- Younger professionals or tech-savvy users who prefer a mobile-first investing experience.

- Investors who want exposure to growth stocks and crypto with a long-term mindset.

Titan is not ideal for:

- Ultra-conservative or income-focused investors

- DIY traders who prefer to pick individual stocks

- Those who want the lowest fees possible and believe strongly in passive indexing

Performance and Results

Titan publishes historical returns for its portfolios compared to benchmarks. While past performance is not guaranteed, its strategies have generally kept pace with or outperformed relevant indexes in some periods, particularly during times of high volatility or market dislocation.

Performance is also net of fees, and Titan emphasises long-term compounding over short-term wins. Still, the active nature of the strategy means that results can diverge significantly depending on timing and market cycles.

Education and Transparency

One of Titan’s strongest features is how much it communicates with users:

- Weekly videos from the investment team

- In-app Q&As with analysts and leadership

- Performance reviews and long-term strategy updates

This is a stark contrast to most platforms where users are left in the dark. It treats users like investors, not just customers, and that culture of openness builds trust over time.

Competitor Comparison

Here’s how it compares to other fintech investing platforms:

| Platform | Type | Fee (AUM) | Style | Crypto Support |

|---|---|---|---|---|

| Titan | Active investing | 0.90% | Actively managed | Yes |

| Wealthfront | Robo-advisor | 0.25% | Passive indexing | Yes |

| Betterment | Robo-advisor | 0.25%–0.40% | Passive indexing | Yes |

| Robinhood | DIY trading | $0 | Self-directed | Yes |

| Public | Social investing | $0 | Self-directed | Yes |

Titan sits in a unique space, offering the sophistication of an asset manager with the ease and access of a fintech app.

Pros and Cons

Pros:

- Active investment management with no high net worth requirement

- Beautiful app experience with clear communication

- Crypto and equity portfolios in one place

- Transparent fees and no hidden charges

- Regular updates and educational content

Cons:

- Higher fees than passive robo-advisors

- Limited portfolio selection (no bonds, no ESG, etc.)

- No individual stock trading or DIY features

- Relatively new, limited long-term performance history

Final Verdict

Titan is a bold attempt to bridge the gap between Wall Street and Main Street. It rejects the idea that retail investors must settle for passive portfolios and instead brings them into the world of high-conviction, actively managed strategies.

The experience is tailored, premium, and educational. If you believe in the value of active management and want a more engaged relationship with your money, Titan is one of the most innovative fintech platforms available.

It’s not the cheapest option, but it offers something few others do: clarity, access, and the feeling that your money is being thoughtfully managed by a real team, not just an algorithm. For those who want more than just an index fund, Titan is a compelling option.