Europe’s crypto market has matured rapidly over the past few years. As the EU finalises its MiCA (Markets in Crypto-Assets) regulatory framework, trust and compliance are becoming top priorities for crypto exchanges operating across the continent. While global players like Binance and Coinbase are present, Europe is also home to its own robust ecosystem of regulated, user-friendly platforms.

In this article, we rank the top 10 crypto exchanges in Europe for 2025, based on factors such as regulatory standing, trading fees, user experience, security, and product offerings.

1. Bitstamp

Bitstamp is one of the longest-standing crypto exchanges in Europe, founded in 2011 and headquartered in Luxembourg. It holds a Payment Institution licence and is fully regulated under EU law.

Strengths: Strong reputation, robust security, low trading fees (starting at 0.30%)

Best for: Institutional investors and long-term traders seeking a compliant and reliable platform

2. Kraken

Kraken, a US-based exchange, has expanded significantly in Europe, securing a VASP (Virtual Asset Service Provider) registration in Ireland. It is one of the top crypto exchanges in Europe. It offers futures, margin trading, and staking with deep liquidity.

Strengths: Low fees (0.16% maker / 0.26% taker), wide asset support, strong compliance

Best for: Advanced traders and institutions in the EU

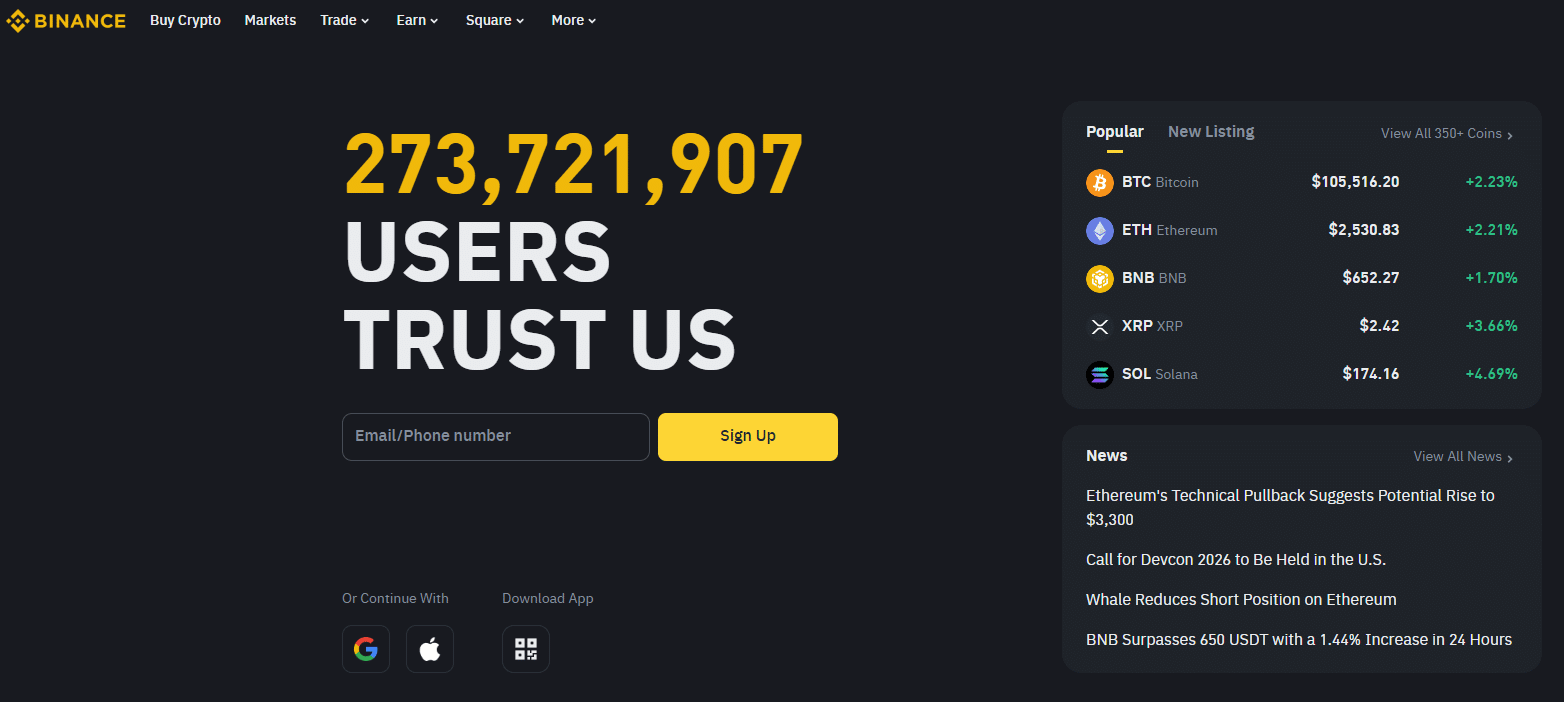

3. Binance

Binance holds registration in several European countries, including France, Italy, and Spain. Despite regulatory scrutiny elsewhere, its European operations remain strong.

Strengths: High liquidity, hundreds of coins, low fees (from 0.10%), wide product range

Best for: Altcoin traders and DeFi users comfortable with a high-volume exchange

4. Bitpanda

Based in Vienna, Bitpanda is a fully regulated exchange and broker platform. It allows users to trade crypto, stocks, ETFs, and precious metals, all in one place.

Strengths: Intuitive UI, multi-asset platform, EU licence passporting

Best for: Beginners and diversified investors seeking a single account for all assets

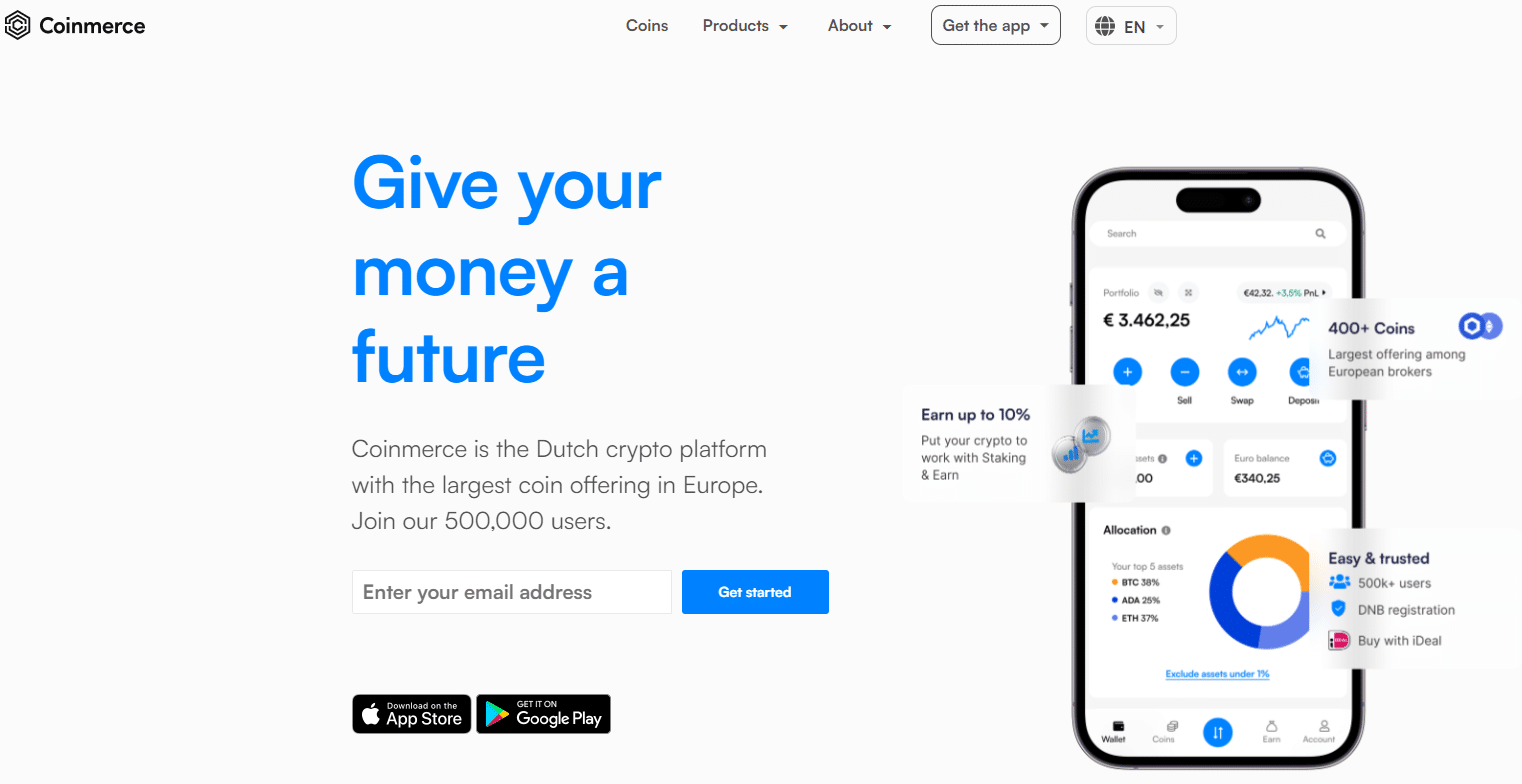

5. Coinmerce

Coinmerce is registered with the Dutch central bank and offers a smooth buying experience for over 200 cryptocurrencies. It supports SEPA transfers and has a strong compliance focus.

Strengths: Regulated, beginner-friendly, strong mobile app

Best for: Retail investors in the Eurozone

6. Uphold

Although based in the UK, Uphold continues to serve European users through its Gibraltar entity. It supports crypto, commodities, and FX, with unique cross-asset conversion tools.

Strengths: Multi-asset access, transparent spreads, strong security controls

Best for: Users who want instant swaps between crypto and fiat or metals

7. SwissBorg

SwissBorg is a mobile-first crypto wealth management platform that offers curated investment tools, including yield accounts and smart portfolio rebalancing.

Strengths: Smart yield tools, Swiss regulation, clean interface

Best for: Users looking to grow and manage crypto wealth passively

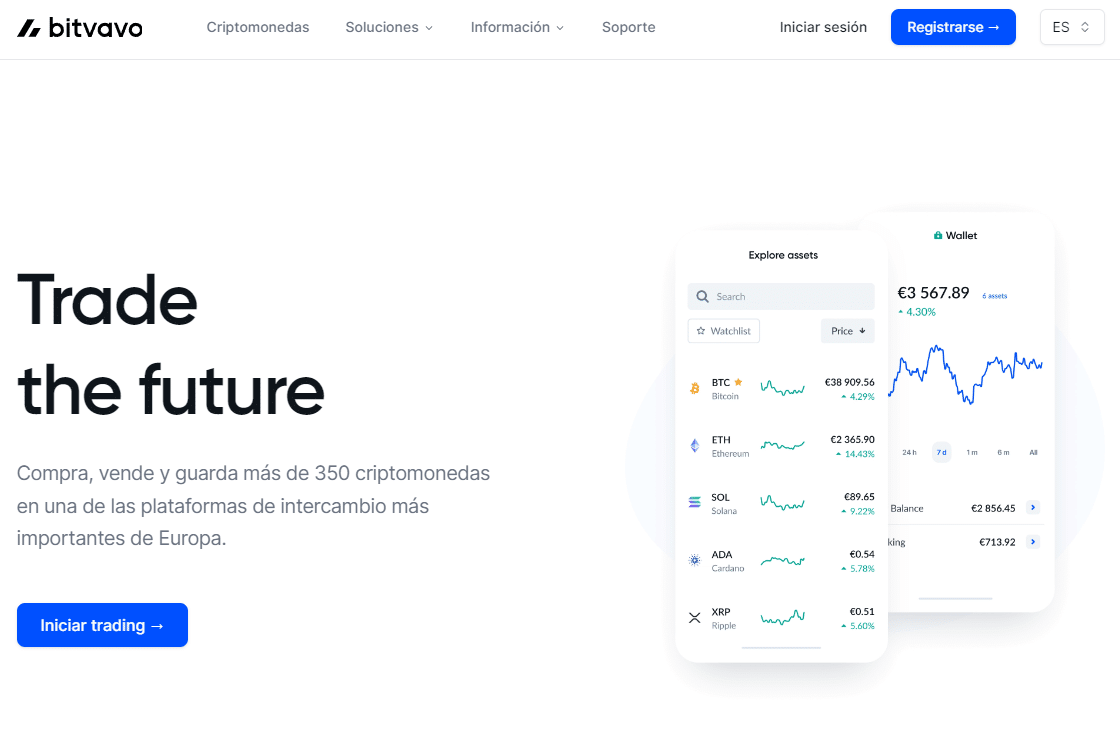

8. Bitvavo

Bitvavo is quickly becoming a favourite in the EU thanks to its low fees and regulatory clarity. Based in Amsterdam, it is registered with De Nederlandsche Bank.

Strengths: Trading fees from 0.25%, strong UX, high volume for EU pairs

Best for: Euro-denominated traders and low-fee seekers

9. eToro

eToro, known for social trading, is also a MiFID II-regulated platform that allows users to buy crypto alongside stocks, ETFs, and commodities.

Strengths: Social trading, multi-asset platform, copy trading features

Best for: Beginners and passive investors who value a broader portfolio view

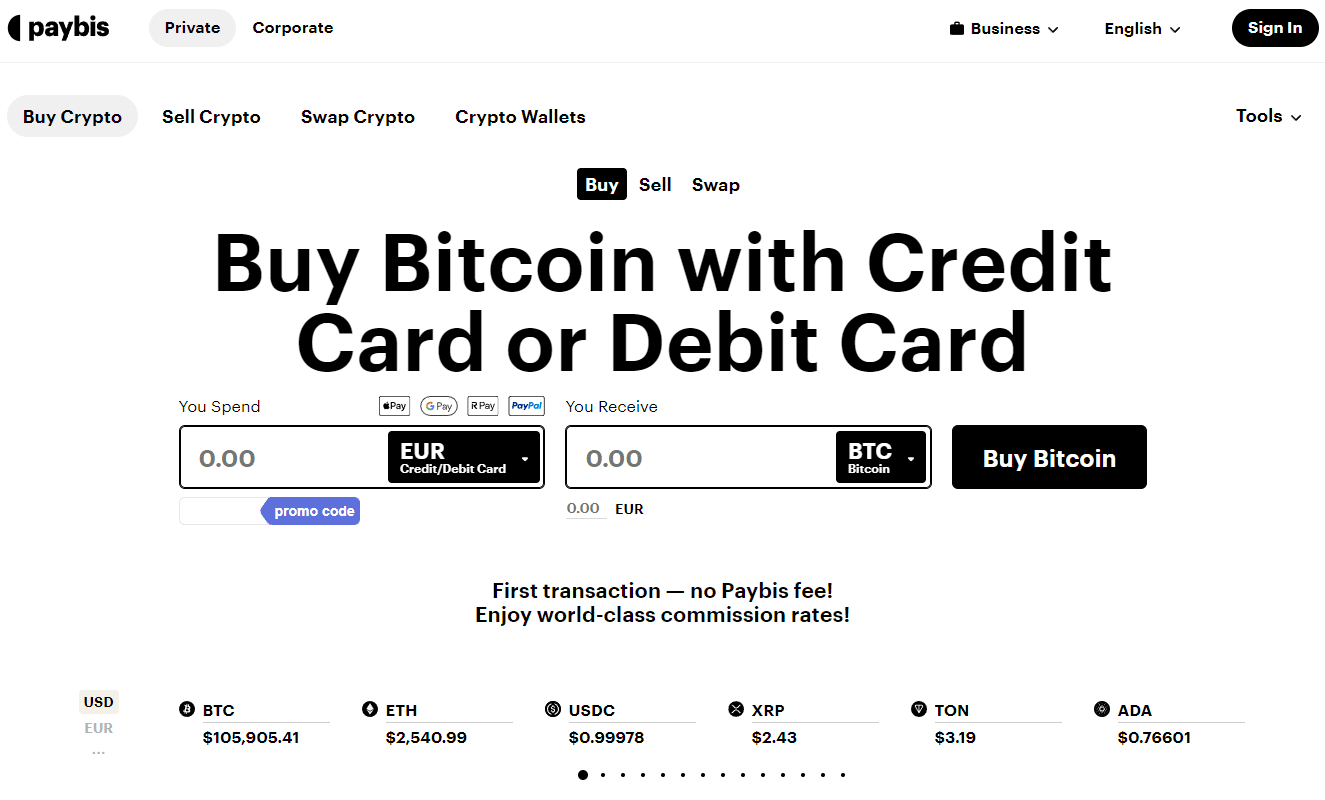

10. Paybis

Paybis is a lesser-known exchange that offers fast crypto purchases via credit card, Apple Pay, Google Pay, Skrill, and bank transfers. It holds multiple regulatory registrations: in the US, Canada, the UK, and Poland.

Strengths: Fast onboarding, strong fiat gateway, multi-jurisdictional regulatory coverage

Best for: First-time crypto buyers and those needing instant access

Conclusion

Europe’s crypto exchange landscape is one of the most diverse and regulated in the world. Whether you are a retail investor, institutional trader, or someone just starting out, the region offers a wide range of options tailored to different needs.

For those prioritising compliance and long-term stability, Bitstamp, Kraken, and Bitpanda stand out. On the other hand, if you’re seeking high liquidity and trading depth, Binance and Bitvavo are compelling options. Meanwhile, newcomers can benefit from the simplicity of Coinmerce or SwissBorg.

As regulation becomes harmonised under MiCA, expect further innovation, consolidation, and transparency. It is making Europe one of the safest regions to trade crypto globally.