The first half of 2025 saw a resurgence of major fintech funding rounds, defying earlier concerns about a slowdown. Investors redirected capital toward scalable platforms, infrastructure enablers, and vertical expansion plays. Here are the ten most significant rounds and what they signal about the fintech landscape.

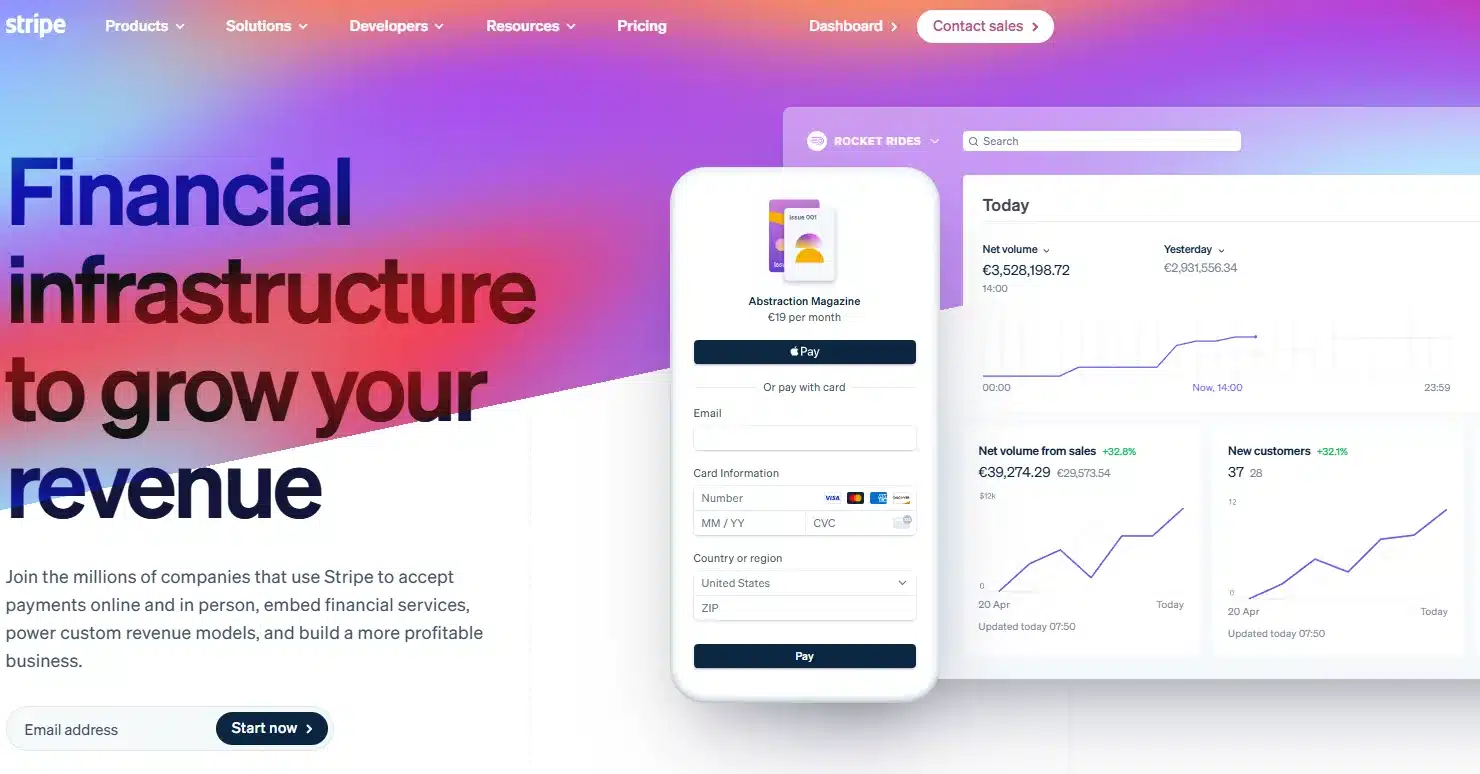

1. Stripe – $1.5B Series I

Stripe’s $1.5 billion Series I round is the largest fintech raise so far this year. The round was led by Sequoia Capital and included participation from existing backers like Andreessen Horowitz, General Catalyst, and Fidelity.

The new funding will support further international expansion, particularly in underpenetrated markets in Asia, Latin America, and Africa. Stripe also plans to roll out a suite of AI-powered tools for fraud detection, compliance automation, and embedded finance orchestration.

As traditional payments become increasingly commoditised, Stripe’s strategic focus is shifting toward owning more of the infrastructure stack and monetising software and data layers. The company continues to push the boundaries of what developer-first financial infrastructure can achieve.

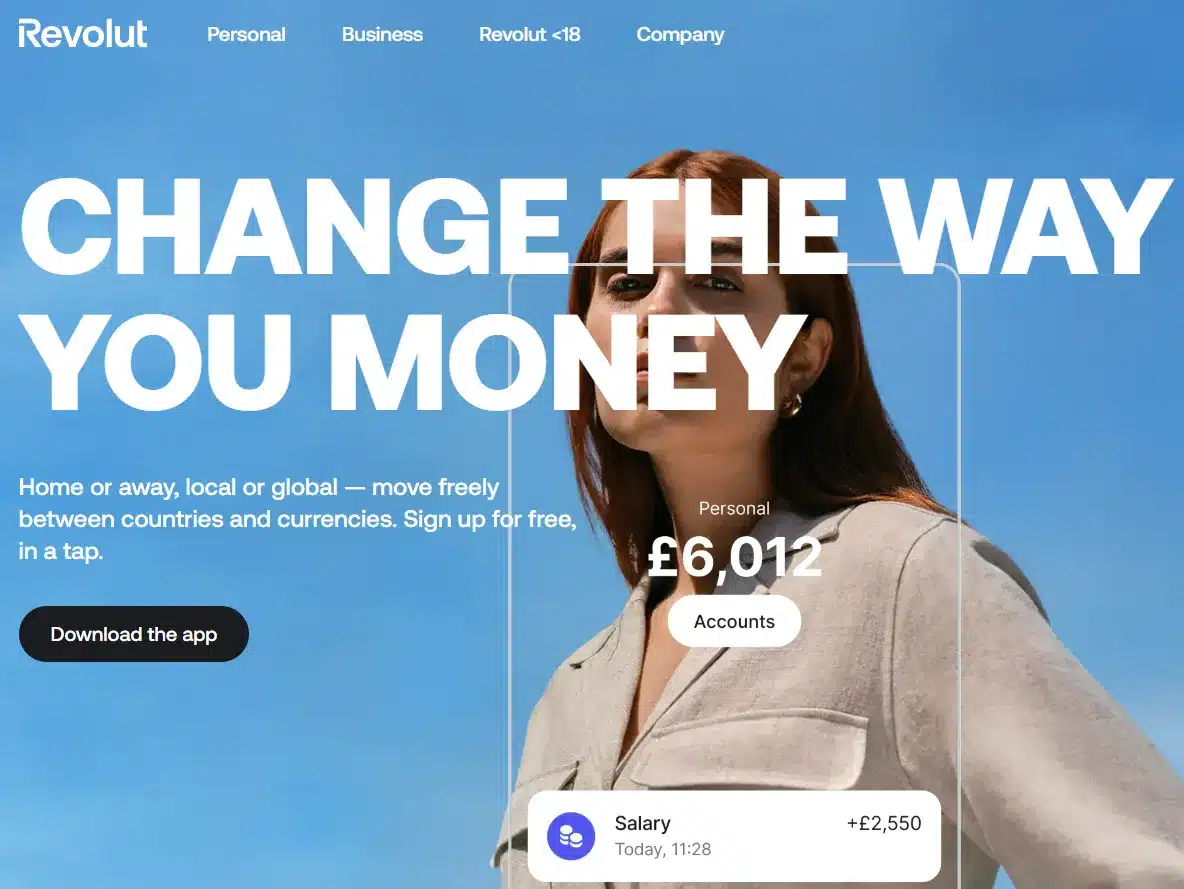

2. Revolut – $800M Series G

Revolut raised $800 million to continue its evolution from a digital bank into a global super-app. The round, backed by SoftBank Vision Fund 2 and Tiger Global, will be used to accelerate expansion into Latin America, deepen its crypto and investing offerings, and pursue banking licences in new jurisdictions including India and Australia.

The funding also strengthens Revolut’s position as a major challenger to traditional banks and fintech incumbents alike. With over 45 million users worldwide, the company has grown from a money transfer app into a full-stack lifestyle platform encompassing trading, lending, travel insurance, and budgeting.

Revolut’s monetisation strategy continues to be highly diversified, with premium subscriptions, interchange fees, crypto commissions, and B2B services all contributing to revenue growth.

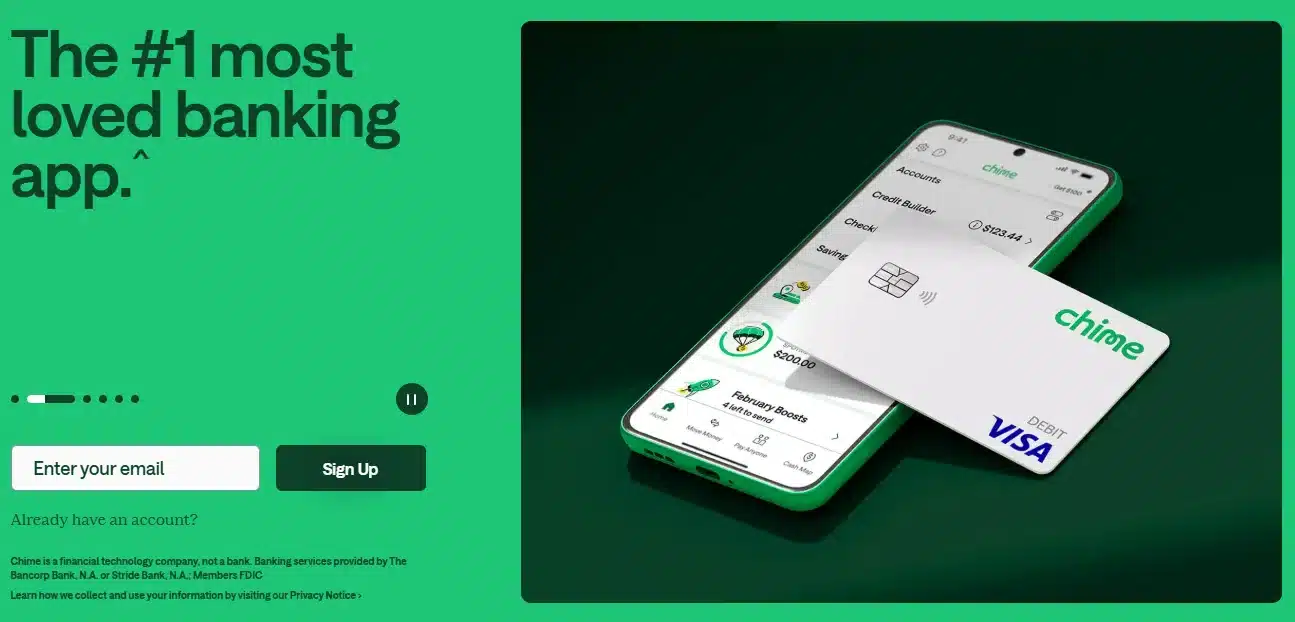

3. Chime – $750M Series F Extension

Chime secured $750 million in an extension of its Series F, bringing its total funding to over $3.3 billion. The round was led by Coatue and BlackRock, signalling strong late-stage interest in US neobanking.

The funding will fuel user acquisition campaigns, development of credit-building tools, and an expansion into small business banking. Chime is betting on deepening engagement across financial verticals without the friction of legacy banking infrastructure.

Chime’s differentiation lies in its brand loyalty, especially among Gen Z and underbanked populations. Its early mover advantage in fee-free banking and financial wellness has allowed it to retain users and grow average revenue per user, despite increased competition from SoFi, Varo, and Cash App.

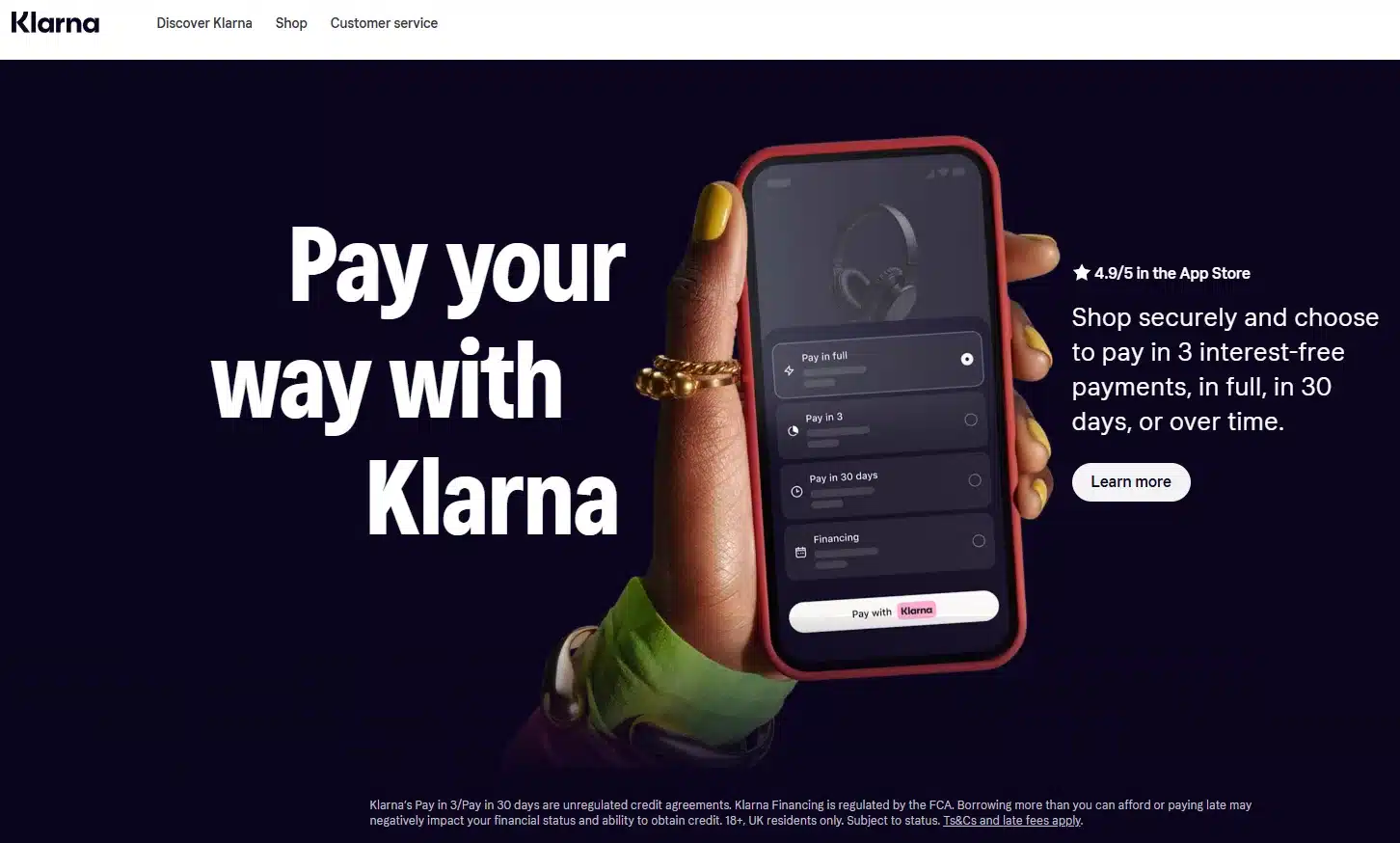

4. Klarna – $600M Private Round

Klarna raised $600 million in a private round led by Mubadala and Temasek. While the company previously faced scrutiny for aggressive expansion and high operating costs, the new funding marks a stabilisation phase.

Klarna is investing heavily in AI-driven underwriting and payment decisioning, aiming to reduce default rates while expanding beyond BNPL. New features include integrated shopping experiences, ad placements for merchants, and a shift toward a “consumer engagement platform.”

Despite increasing BNPL regulation, Klarna is positioning itself as a retail operating system, combining payments, discovery, and loyalty under one umbrella. With 150 million users globally and deep merchant integrations, its scale remains unmatched in Europe.

5. Plaid – $500M Series D Extension

Plaid raised a $500 million extension to its Series D, bringing its valuation to over $14 billion. The round was led by Index Ventures with participation from Goldman Sachs and Altimeter.

Funds will be used to expand Plaid’s presence in Europe, Japan, and Brazil, enhance API performance, and build new use cases around lending and identity. The company also plans to launch Plaid Signal, a machine learning-powered risk intelligence platform for fintechs and banks.

Plaid remains the backbone of thousands of consumer finance apps, enabling seamless account aggregation, verification, and transaction sharing. As open finance adoption accelerates worldwide, Plaid is uniquely positioned to monetise both B2B infrastructure and regulatory enablement.

6. Brex – $450M Series E Extension

Brex raised $450 million to push further into the mid-market and enterprise segments. The round included participation from TCV, Greenoaks, and Y Combinator Continuity.

Brex began as a startup credit card company but has evolved into a full financial stack provider. Its platform now includes bill pay, procurement workflows, travel spend management, and automated budgeting tools. The funding will support deeper integrations with enterprise ERPs and embedded AI features for CFOs.

By positioning itself as a modern replacement for legacy corporate card programmes and AP systems, Brex aims to become the system of record for spend-based decision-making. Its user growth and net revenue retention rates remain among the highest in the spend management space.

7. Deel – $400M Series D2

Deel raised $400 million in a continuation of its Series D, led by Durable Capital and Dragoneer. With a post-money valuation of $7.5 billion, Deel is one of the most valuable players in the global payroll and HR compliance segment.

The company supports businesses hiring remote employees in 150+ countries, handling onboarding, contracts, payments, tax compliance, and local benefits. The new capital will be used to improve self-service compliance tools, expand its global contractor marketplace, and build deeper API-based integrations.

As remote and hybrid work models continue to mature, Deel’s infrastructure is becoming indispensable for cross-border talent management. Its success highlights how fintech intersects with HR tech to solve structural global employment challenges.

8. Rapyd – $375M Series D Extension

Rapyd raised $375 million to strengthen its position as a one-stop-shop for embedded financial services. The funding, led by Target Global and Fidelity, will accelerate Rapyd’s expansion into India, Southeast Asia, and the Middle East.

Rapyd offers APIs covering payments, disbursements, FX, card issuing, wallets, and compliance. All from a single integration. Its customers include marketplaces, SaaS platforms, and neobanks seeking to launch in new markets without building local infrastructure.

This round signals investor confidence in horizontal fintech infrastructure that can scale across verticals and regions. Rapyd’s interoperability and global coverage remain its strongest competitive advantages.

9. Monzo – $300M Pre-IPO Round

Monzo raised $300 million in a pre-IPO round led by CapitalG and Tencent. The funding prepares the UK-based neobank for an expected 2026 IPO.

Monzo will use the capital to expand into US and EU markets, grow its business banking unit, and develop lending products including BNPL and overdraft alternatives. The bank’s app remains one of the highest-rated in the UK and boasts over 9 million personal account holders.

With its recent shift toward profitability, Monzo is proving that neobanks can scale responsibly. Its data-driven product roadmap and focus on transparency continue to differentiate it in a crowded digital banking landscape.

10. Fireblocks – $250M Series E

Fireblocks raised $250 million to scale its crypto custody and tokenisation infrastructure. The round was led by Lightspeed, Spark Capital, and BNY Mellon.

The company’s MPC-based wallet infrastructure is trusted by more than 1,800 financial institutions, including major banks, exchanges, and asset managers. With digital asset adoption increasing, Fireblocks is expanding into tokenised securities, stablecoin issuance, and real-world asset custody.

As institutions seek secure and compliant crypto infrastructure, Fireblocks offers a turnkey platform with built-in compliance, AML, and risk tools. Its ability to support both retail trading apps and high-security institutional use cases is a key market differentiator.