As fintech continues to reshape the global financial landscape, more investors are looking to gain diversified exposure to the sector without picking individual stocks. Exchange-Traded Funds (ETFs) offer a simple, cost-effective way to invest in fintech through a curated basket of companies spanning digital banking, payments, blockchain, and wealthtech.

In 2025, fintech ETFs provide a compelling entry point for both retail and institutional investors. They reduce company-specific risk while capturing the broader upside of financial innovation. Below is a selection of the top fintech ETFs to consider in 2025, based on performance, composition, and strategic focus.

1. ARK Fintech Innovation ETF (ARKF)

Ticker: ARKF

Issuer: ARK Invest

Expense Ratio: 0.75%

Assets Under Management: $1.2 billion+

ARKF is one of the most well-known fintech ETFs, managed by ARK Invest’s Cathie Wood. It focuses on companies that are transforming the financial industry through digital platforms and innovative business models. Holdings include Block (Square), Coinbase, Robinhood, and Shopify.

ARKF stands out for its high-conviction, actively managed approach. While this can lead to volatility, it also offers exposure to emerging leaders in payments, blockchain, and mobile finance. In 2025, with renewed interest in decentralised finance and digital wallets, ARKF remains a high-risk, high-reward choice for fintech believers.

2. Global X FinTech ETF (FINX)

Ticker: FINX

Issuer: Global X

Expense Ratio: 0.68%

Assets Under Management: $900 million+

FINX provides a more traditional, passive approach to fintech investing. It tracks the Indxx Global FinTech Thematic Index and includes companies involved in mobile payments, peer-to-peer lending, and robo-advisory.

Top holdings include Intuit, Fiserv, PayPal, and Adyen. This ETF offers broader exposure than ARKF, with less concentration in US-based disruptors. FINX is suitable for investors seeking balanced global exposure with a long-term growth perspective.

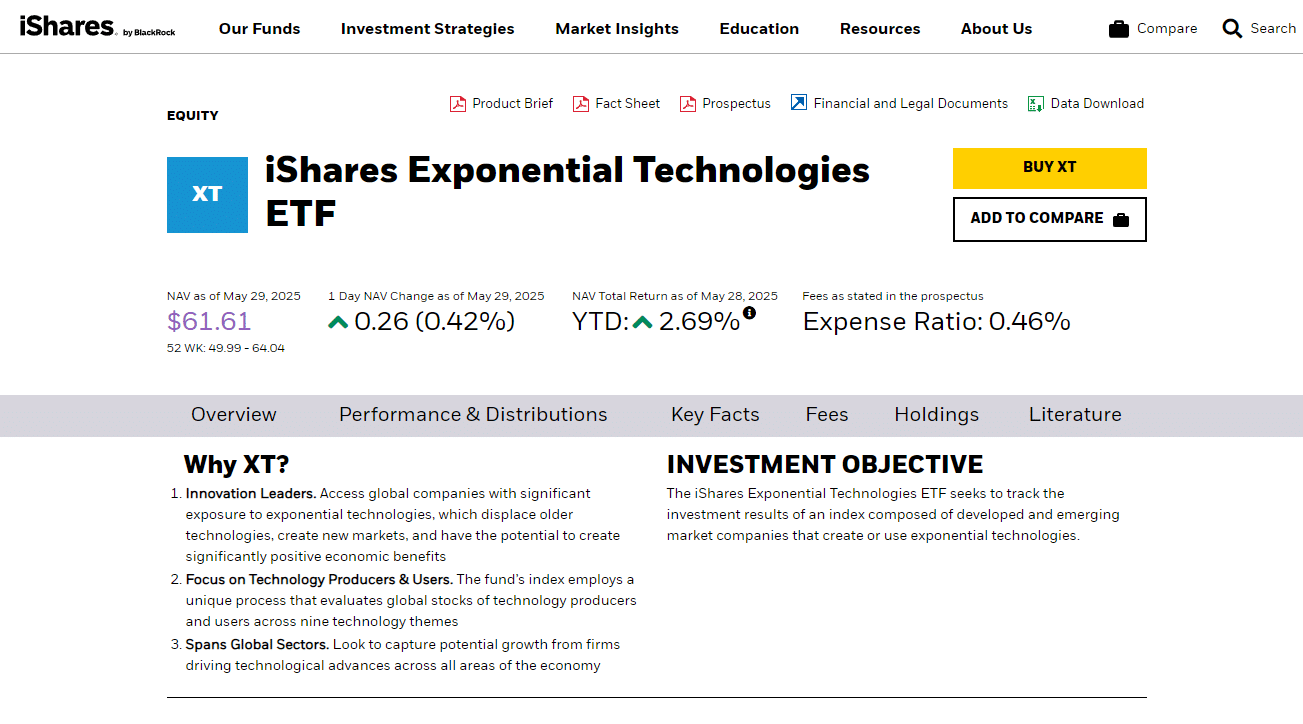

3. iShares Exponential Technologies ETF (XT)

Ticker: XT

Issuer: iShares (BlackRock)

Expense Ratio: 0.46%

Assets Under Management: $3.5 billion+

While not purely fintech-focused, XT includes fintech as one of several innovation themes, alongside artificial intelligence, robotics, and biotech. Its fintech exposure covers legacy tech firms entering financial services and emerging disruptors.

This ETF is ideal for those who want to invest in fintech as part of a broader innovation strategy, reducing sector-specific risk. It holds positions in firms like Mastercard, Nvidia, and Square, all of which straddle the line between technology and finance.

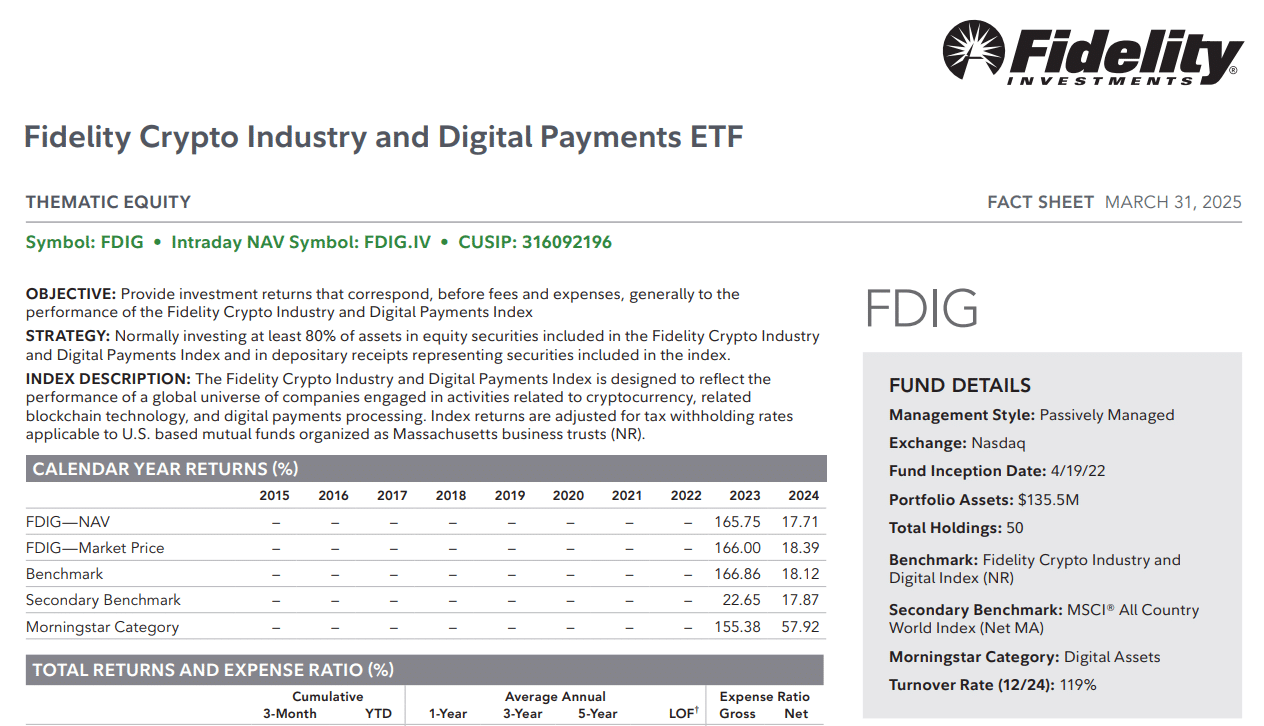

4. Fidelity Digital Payments ETF (FDIG)

Ticker: FDIG

Issuer: Fidelity

Expense Ratio: 0.39%

Assets Under Management: ~$250 million+

Launched in 2021, FDIG focuses exclusively on digital payment technologies. This includes companies involved in electronic transactions, payment processing, and point-of-sale technologies. Top holdings include Visa, Mastercard, Adyen, and PayPal.

In 2025, digital payments remain a core fintech theme, driven by the rise of mobile wallets, contactless commerce, and embedded finance. FDIG is suitable for investors who believe payments will continue to be the backbone of fintech growth.

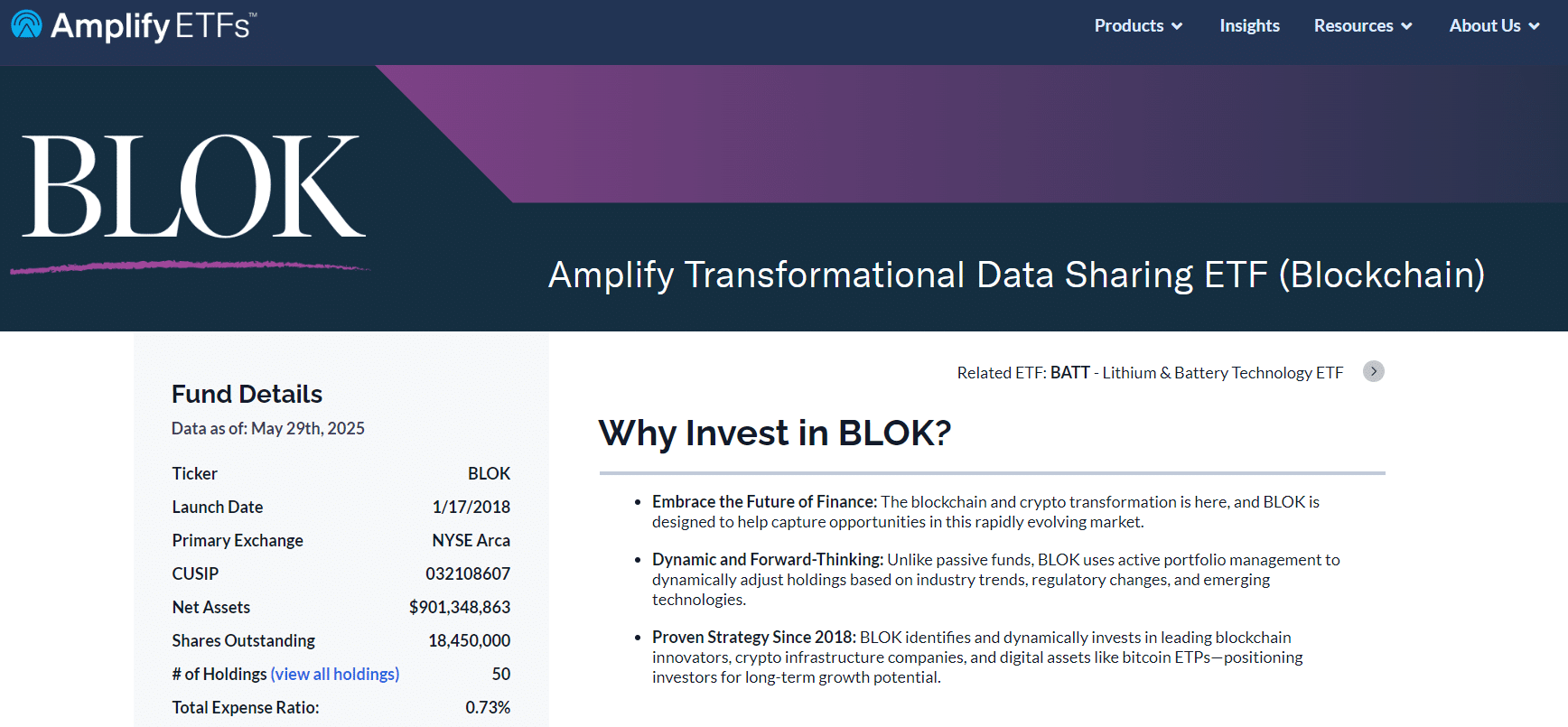

5. Amplify Transformational Data Sharing ETF (BLOK)

Ticker: BLOK

Issuer: Amplify

Expense Ratio: 0.75%

Assets Under Management: $1.1 billion+

Although technically a blockchain ETF, BLOK holds a significant portion of fintech-related companies. These include crypto exchanges, digital banks, and fintech infrastructure providers. Holdings vary by quarter but have included Coinbase, Galaxy Digital, and Silvergate.

BLOK is actively managed, with a focus on companies leveraging blockchain to disrupt traditional financial services. In 2025, as blockchain adoption matures, BLOK offers targeted exposure to the most innovative edge of fintech.

Choosing the Right Fintech ETF

When deciding which fintech ETF to invest in, consider:

- Your risk tolerance: Actively managed ETFs like ARKF are more volatile, while index-based funds like FINX offer greater stability.

- Geographic exposure: Some ETFs focus heavily on US fintech, while others include firms from Europe and Asia.

- Thematic focus: Some ETFs concentrate on payments, others on blockchain, and others offer broader fintech coverage.

- Fees and liquidity: Always compare expense ratios and average trading volumes before making a decision.

It’s also worth assessing how each ETF complements your existing portfolio. If you’re already exposed to tech, a more narrowly focused fintech ETF could offer better diversification than a general innovation fund.

Final Thoughts

In 2025, the fintech sector continues to evolve quickly—with themes like AI-powered finance, embedded payments, and digital asset infrastructure leading the charge. For investors who want to gain exposure without the risk of betting on a single company, ETFs remain one of the most efficient ways to invest in fintech.

Whether you prefer an actively managed, high-growth ETF or a passive, diversified fund, there are more fintech ETFs than ever to choose from. Each offers a unique way to capture the upside of financial innovation while spreading risk across a basket of companies.