Managing personal finances has never been easier. Or more complex. The explosion of apps, platforms, and digital banks offers unprecedented convenience, yet choosing the right tools can feel overwhelming. In 2025, financial wellness is no longer about a single app, but about building a smart, connected ecosystem. Identifying the top personal finance tools 2025 helps individuals take control of spending, saving, investing, and planning with greater confidence and clarity.

The best personal finance tools today combine automation, real-time insights, and customisation. They fit seamlessly into daily life, allowing users to manage money without friction or complexity. In this article, we explore the leading solutions across budgeting, investing, banking, and holistic financial planning.

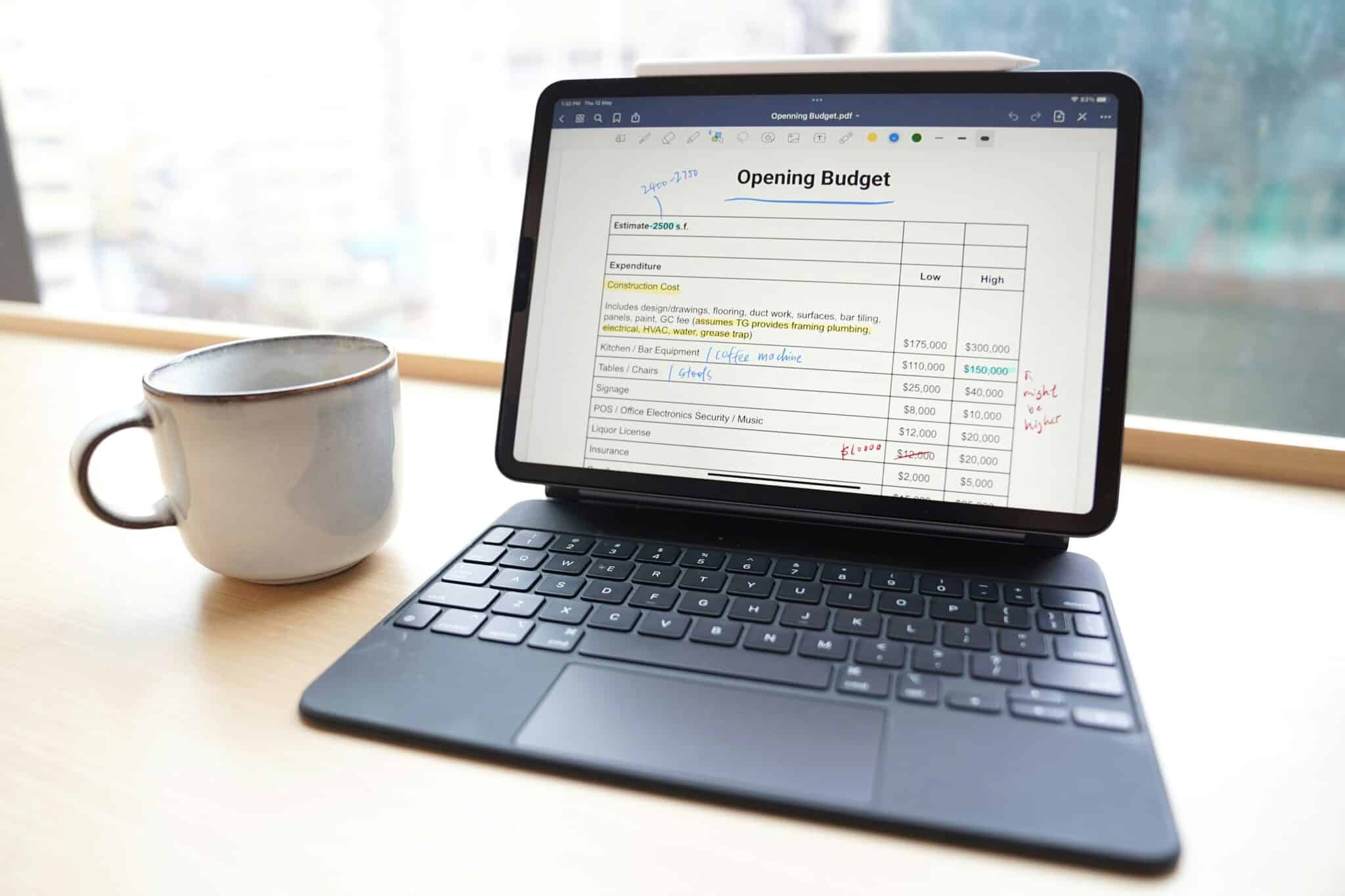

Budgeting and Expense Tracking

Effective money management starts with knowing where it is going. Modern budgeting tools go far beyond simple spreadsheets, offering real-time syncing with bank accounts, predictive analytics, and personalised spending insights.

YNAB (You Need a Budget) continues to be a favourite among disciplined savers. Its zero-based budgeting method forces users to assign every pound a job, promoting intentional spending and proactive planning.

PocketSmith offers advanced forecasting features, allowing users to model future cash flow scenarios based on planned expenses and income changes. It is ideal for users juggling irregular incomes or planning big financial milestones.

Monzo and Revolut, while primarily digital banks, integrate budgeting and analytics directly into their apps, giving users an all-in-one solution for managing daily finances.

Investment Management and Wealth Building

Investing has become more accessible than ever, and personal finance tools are leading the charge. Robo-advisors, micro-investment platforms, and self-directed brokerage apps offer options for every level of experience.

Wealthfront and Betterment provide automated investment portfolios based on risk tolerance and financial goals. Their low fees and tax-efficient strategies make them attractive for hands-off investors.

Public and Freetrade offer commission-free investing with a focus on transparency and community-driven insights. Users can build diversified portfolios across stocks, ETFs, and even alternative assets like crypto.

Acorns continues to popularise micro-investing by rounding up everyday purchases and investing the spare change automatically, helping users start building wealth without needing large sums upfront.

Banking and Payments Innovation

Digital banking is now the default for millions. The top platforms combine account management, payments, saving, and lending into sleek mobile experiences.

Chime, Starling Bank, and Ally lead the pack with features like early direct deposits, automatic savings, fee-free overdrafts, and instant payment notifications.

Wise (formerly TransferWise) has revolutionised cross-border banking, offering multi-currency accounts, low-fee international transfers, and real-time FX rates — crucial for digital nomads and global freelancers.

Cash App and Zelle dominate peer-to-peer payments, while offering optional debit cards, investing features, and crypto access within a unified ecosystem.

Holistic Financial Planning Platforms

For users looking to go beyond day-to-day money management, holistic financial planning tools offer a complete picture of their financial health.

Mint remains popular for its aggregation capabilities, pulling in data from multiple banks, credit cards, loans, and investments into a single view. Despite increasing competition, it remains one of the most recognisable brands in personal finance.

Emerging platforms like Monarch Money focus on a premium user experience, offering collaborative budgeting for families, goal tracking, and dynamic financial forecasting.

Trends Shaping Personal Finance Tools in 2025

Several trends are defining the evolution of personal finance tools:

- AI-driven financial coaching and personalised savings tips

- Integration with ESG and sustainable investing options

- Real-time credit monitoring and identity theft protection

- Enhanced financial literacy features embedded within apps

- Greater data privacy controls and opt-in consent models

These innovations point towards a future where personal finance management is not just passive tracking, but active, dynamic, and empowering.

Choosing among the top personal finance tools 2025 requires understanding your goals, preferences, and willingness to engage with your money. No single tool does it all. The best approach is building a personalised financial stack. A combination of apps that automate the basics, empower informed decisions, and fit naturally into your daily life.