Personal Finance

Personal finance apps are empowering individuals to budget, save, invest, and manage their financial lives digitally. Fintech Review explores the rise of financial wellness tools, mobile platforms, and technology-driven solutions that help consumers achieve better financial outcomes.

-

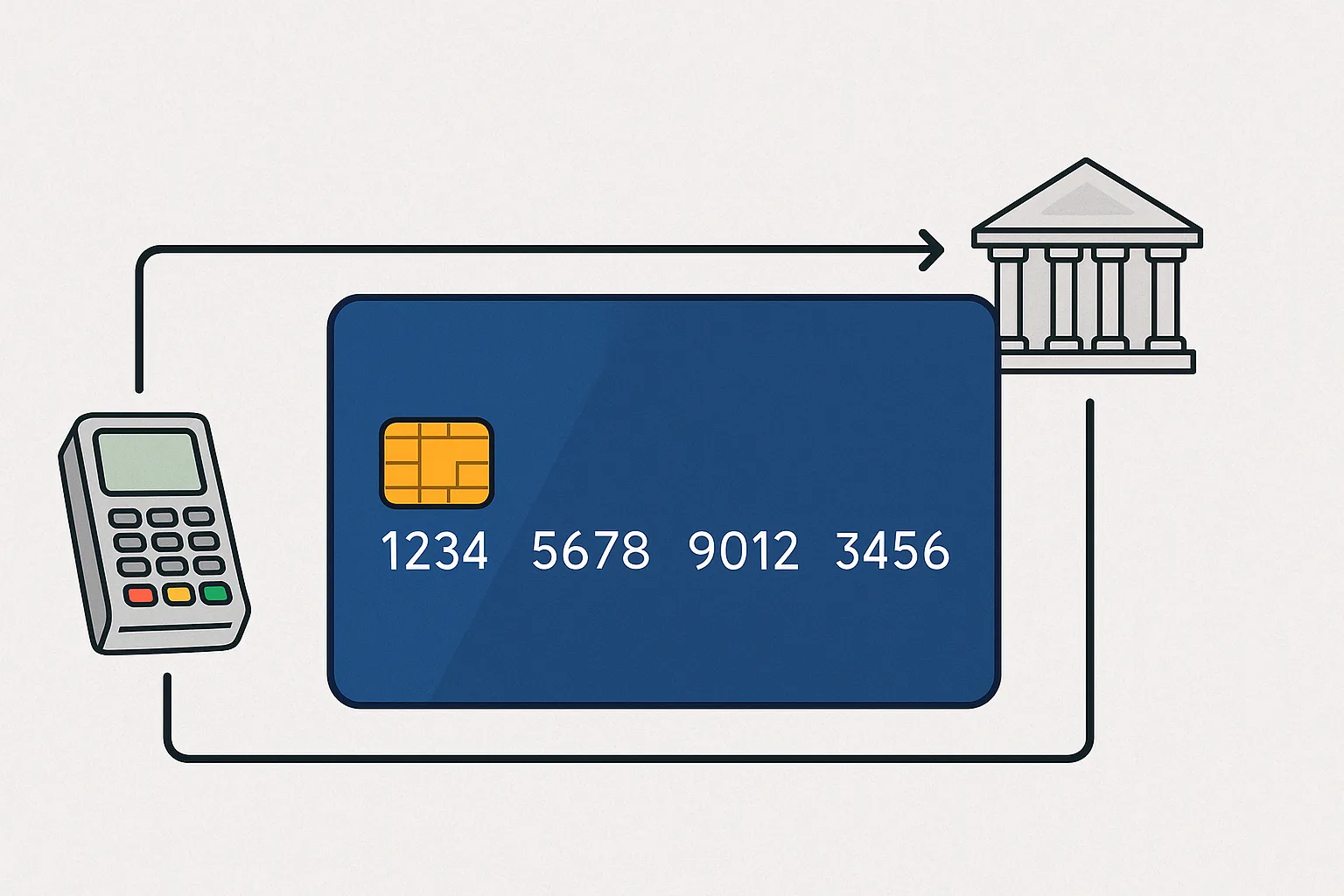

How does a Credit Card work?

Credit cards are one of the most widely used financial tools in the modern economy. They provide a convenient way …

-

Best Budgeting Apps for Banking: Take Control of Your Finances in 2025

Managing your money is easier than ever. If you use the right tools. Today’s budgeting apps do more than track …

-

Deloitte Reports US Consumer Spending Slump Amid Economic Uncertainty

In the face of a fluctuating economic climate, Deloitte has noted a significant shift in consumer behaviour. Their latest research …

-

How does a Mortgage Work?

Buying a home is one of the defining financial steps in life. It is probably the most important personal finance…

-

New York Residents Can Now Stake Crypto on Coinbase

New York residents can now stake their cryptocurrency on digital assets exchange Coinbase. This eagerly anticipated development lets investors …

-

Manchester, Leeds, Oxford Lead UK’s Economic Growth

A recent study reveals major UK business hubs, namely Manchester, Leeds, and Oxford, are driving the country’s economic growth. This …

-

Early Inheritance in a Borderless World

By Srbuhi Avetisian from Owner.One Too rich to be simple. Too poor to be protected. That’s the paradox of families …

-

FCA Cash Rules Anniversary Marked with New Monmouth Hub

The Financial Conduct Authority’s (FCA) access to cash rules celebrated their first anniversary with the opening of a new banking …

-

PickTheBank Review: Reinventing Cross-Border Saving in Europe

Review and Full Test of PickTheBank 2025 In recent years, the demand for high-yield savings products in Europe has grown …

-

Should You Invest in Crypto?

Cryptocurrency has moved from the fringes of the internet to the front pages of global finance. What began with Bitcoin …

-

Fintech startup to launch new pension app that turns everyday spending into retirement savings

New fintech startup Chest, a cash rewards-to-pension app, is inviting young people to join its 1200-strong community lining up to …

-

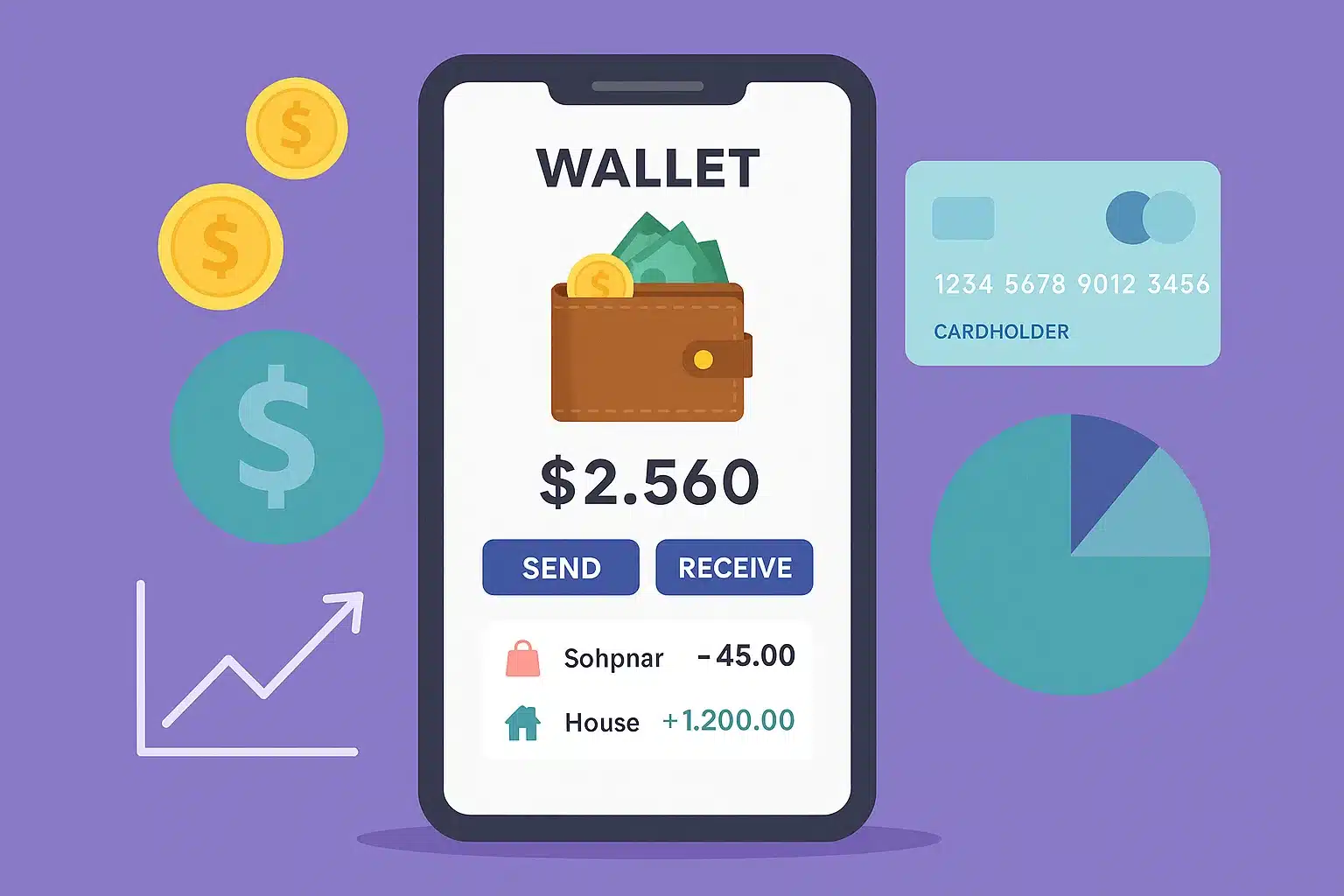

10 Steps to Design a Digital Wallet for Personal Finance in 2025

Digital wallets have evolved from simple payment apps into powerful personal finance ecosystems. In 2025, designing a digital wallet …

-

Toss Plans Australian Launch in Global Fintech Expansion

In a significant move, South Korean fintech firm Toss has unveiled plans for international expansion. The company, operated by Viva …

-

Robinhood Rolls Out AI Trading Tools in the UK

Robinhood Markets, Inc. (NASDAQ: HOOD) concentrates on retail finance, incorporating trading tools and AI-driven insights. They’re also exploring prediction markets. …

-

Should I Buy Gold in 2025?

Should I buy gold in 2025? That question is top of mind for many people watching inflation, interest rates, …

-

Crypto.com Joins Forces with Trump Media Group

Crypto.com, a Singapore-based cryptocurrency company, has recently partnered with Trump Media and Technology Group Corp. (TMTG). TMTG operates …

-

Top 100 Fintech Tools for Personal Finance

Managing your personal finances has never been more important, or more complex. From budgeting apps to crypto wallets, the fintech …

-

Gen Z Reshapes Financial Habits and Brand Engagement in Singapore

According to Visa, Gen Z is spearheading changes in financial habits, digital payments, and brand engagement in Singapore. This …

-

UPay Report Forecasts Growth in Digital Wallet Use by 2025

With the rise in digital transactions, the use of virtual cards and digital wallets has witnessed a significant upsurge. This …