Personal Finance

Personal finance apps are empowering individuals to budget, save, invest, and manage their financial lives digitally. Fintech Review explores the rise of financial wellness tools, mobile platforms, and technology-driven solutions that help consumers achieve better financial outcomes.

-

Building a Smarter Spending Routine: Simple Habits for Better Money Decisions

Smart money management starts with small, consistent actions. In an era of subscriptions, contactless payments, and one-click orders, it’s easy …

-

FCA to Consult on Motor Finance Compensation Scheme

The Financial Conduct Authority (FCA) plans to consult on a broad compensation scheme. This could lead to motor finance customers …

-

FCA Warns of Car Finance Scam Calls in the UK

The Financial Conduct Authority (FCA) has issued a warning about fraudulent calls from sham car finance lenders. These fraudsters falsely …

-

UK Inflation Surges Past Predictions in July 2025

The UK Consumer Prices Index (CPI) experienced an unexpected surge, exceeding projections for the 12 months leading up …

-

N26 Co-founder Valentin Stalf Steps Down as CEO

Valentin Stalf, co-founder of the European digital bank N26, has reportedly stepped down as CEO. This move coincides with …

-

PayLaterr and Experian Partner for Enhanced Fraud Detection

The online payment platform, PayLaterr, has recently teamed up with the global credit reporting firm, Experian. This strategic …

-

Crowd Street Partners with Callan to Diversify Offerings

Crowd Street, a key player in the private securities marketplace, is always on the lookout for fresh ways to …

-

Mitigately Review: Making Debt Disappear

Debt can be overwhelming. From high-interest credit cards to personal loans and medical bills, many people struggle under the weight …

-

UK Inflation Rates Steady, Fintech Sector Eyes Rate Cut

Today, the recent inflation statistics were released, showing an increase rate that met expectations. The Consumer Price Index (CPI) reported …

-

US Retirement Market Opens to Cryptocurrency Investments

The US retirement market is now welcoming cryptocurrencies. Devere Group‘s CEO Nigel Green has shared that Donald Trump’s executive …

-

Gen Z Takes Charge of Financial Health, Bank of America Reports

Gen Z, the demographic aged 18-28, is realizing that adulthood costs more than they expected. Consequently, about three quarters are …

-

Fynance Hub Review: How It Works, What It Offers, and Is It Worth Using?

In today’s world of online financial tools, platforms that promise to simplify mortgage and insurance decisions are everywhere. Fynance Hub …

-

PensionBee Bolsters Retirement Security Efforts

The UK-based online pension provider, PensionBee, recently made headlines. They announced new commercial partnerships and called for pension reform, …

-

Senate Committee’s Bill Aims to Boost UK Housing Supply

The Senate Banking Committee has recently announced a bipartisan bill. This piece of legislation aims to significantly increase the housing …

-

Retail Investors Navigate Market Volatility with eToro Insights

In today’s uncertain global financial era, retail investors are proving their resilience and adaptability. eToro‘s recent Retail Investor Beat …

-

DailyPay Expands On-Demand Pay Solutions for Employees

DailyPay, an industry leader, is redefining employee earnings access. The earned wage access (EWA) / worktech platform is extending …

-

Lloyds Bank Boosts UK Economy with New Initiatives

Lloyds Banking Group recently rolled out new initiatives to boost the UK economy and cater to diverse customers. These include …

-

Bondora Group Reports 17% Spike in Loan Originations

The realm of online investing is constantly changing, and Bondora Group is making significant strides. Their performance statistics from June …

-

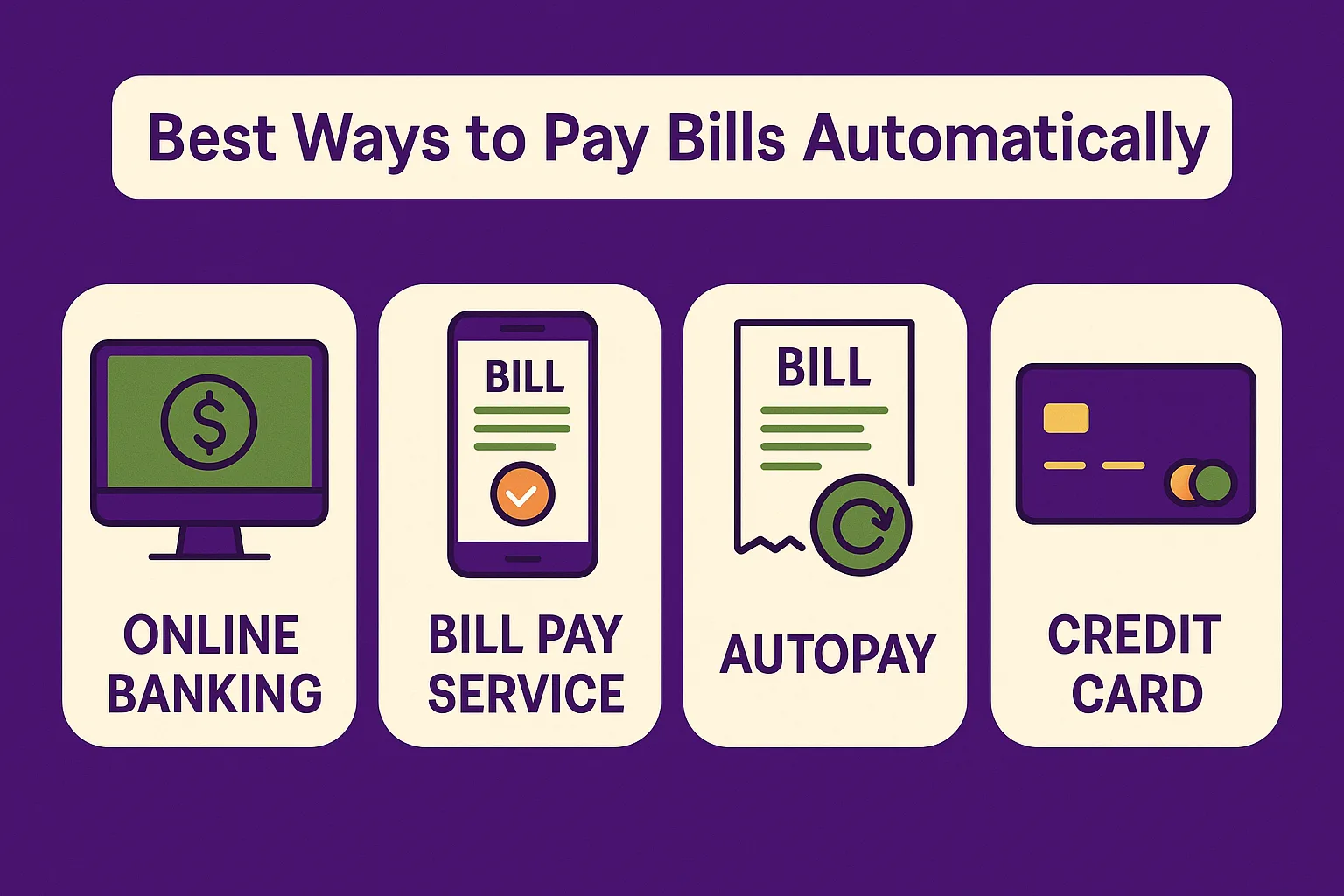

5 Ways to Pay Bills Automatically

Pay bills on time is essential, but managing multiple due dates can quickly become overwhelming. That is why setting up …

-

DailyPay Secures £200m to Break Paycheck Cycle

DailyPay, a leading provider of On-Demand Pay and financial wellness solutions, recently announced a major milestone in its quest …