When people look back at the history of decentralised finance, one name will always stand out. Uniswap revolutionised how assets could be traded on the blockchain by removing traditional order books and introducing automated market makers. Launched in 2018 by Hayden Adams, Uniswap was not the first decentralised exchange, but it was the one that made the model accessible, efficient, and scalable.

Today, Uniswap is more than just a protocol. It is a cornerstone of DeFi, a household name in crypto, and a symbol of the power of open-source development. Billions of dollars flow through its smart contracts each day, and its token, UNI, has become a governance asset used by thousands of holders worldwide. This review explores Uniswap’s origins, technology, adoption, strengths, weaknesses, and future outlook.

Origins and Vision

Uniswap was born out of the Ethereum ecosystem. Hayden Adams, a mechanical engineer by training, was inspired by a post from Ethereum founder Vitalik Buterin about automated market making. Adams began experimenting with the concept and launched Uniswap in November 2018.

The goal was simple but transformative, create a decentralised exchange where users could trade tokens directly from their wallets without relying on centralised intermediaries. Instead of matching buyers and sellers, Uniswap would use liquidity pools where anyone could deposit assets and earn fees, while traders could swap against the pool at algorithmically determined prices.

This innovation solved many of the challenges that plagued earlier decentralised exchanges, which struggled with low liquidity and poor user experience.

How Uniswap Works

At the heart of Uniswap is the automated market maker model, AMM. Rather than maintaining an order book, Uniswap uses smart contracts that hold reserves of token pairs. Traders interact directly with these reserves.

Each pool holds two tokens, for example ETH and USDC. Anyone can deposit equal values to provide liquidity.

As traders buy one token, its pool balance falls, so its price rises. The product of balances stays constant.

Traders swap against the pool with their wallet. No order book. No intermediaries. Settlement is instant on-chain.

Each swap pays a small fee into the pool that accrues to liquidity providers, proportional to their share.

This simple but powerful design made trading frictionless and created a new financial primitive.

Evolution of Uniswap

The platform has undergone several major upgrades since launch.

Foundation

Introduced the basic automated market maker model with ETH as the common trading pair.

- Simple x × y = k pricing

- ETH-routed swaps

- Permissionless pool creation

Scale and features

Enabled direct ERC-20 to ERC-20 swaps, added flash swaps, and improved price oracles.

- Direct token-to-token routing

- Flash swaps for atomic strategies

- More robust time-weighted oracles

Capital efficiency

Introduced concentrated liquidity, letting providers choose price ranges for their capital.

- Tighter ranges, higher utilisation

- Greater control for LPs

- Deeper liquidity with less capital

Each iteration expanded functionality while keeping the core principle of decentralisation intact. But Uniswap V3 in particular transformed how liquidity is managed, achieving deeper liquidity with less capital.

Governance and the UNI Token

In September 2020, Uniswap launched its governance token, UNI. This marked a major shift in the protocol’s development. Holders of UNI can propose and vote on protocol upgrades, fee changes, and treasury allocations.

UNI also gave Uniswap a way to distribute ownership of the protocol to its users. Early adopters who had interacted with Uniswap before a set date received an airdrop of 400 UNI, worth several thousand dollars at the time. Therefore this rewarded loyal users and strengthened Uniswap’s reputation as a community-driven project.

The UNI token continues to play a central role in governance. Critics argue that voter participation is often low and that large holders, including venture capital firms, have disproportionate influence.

Adoption and Ecosystem

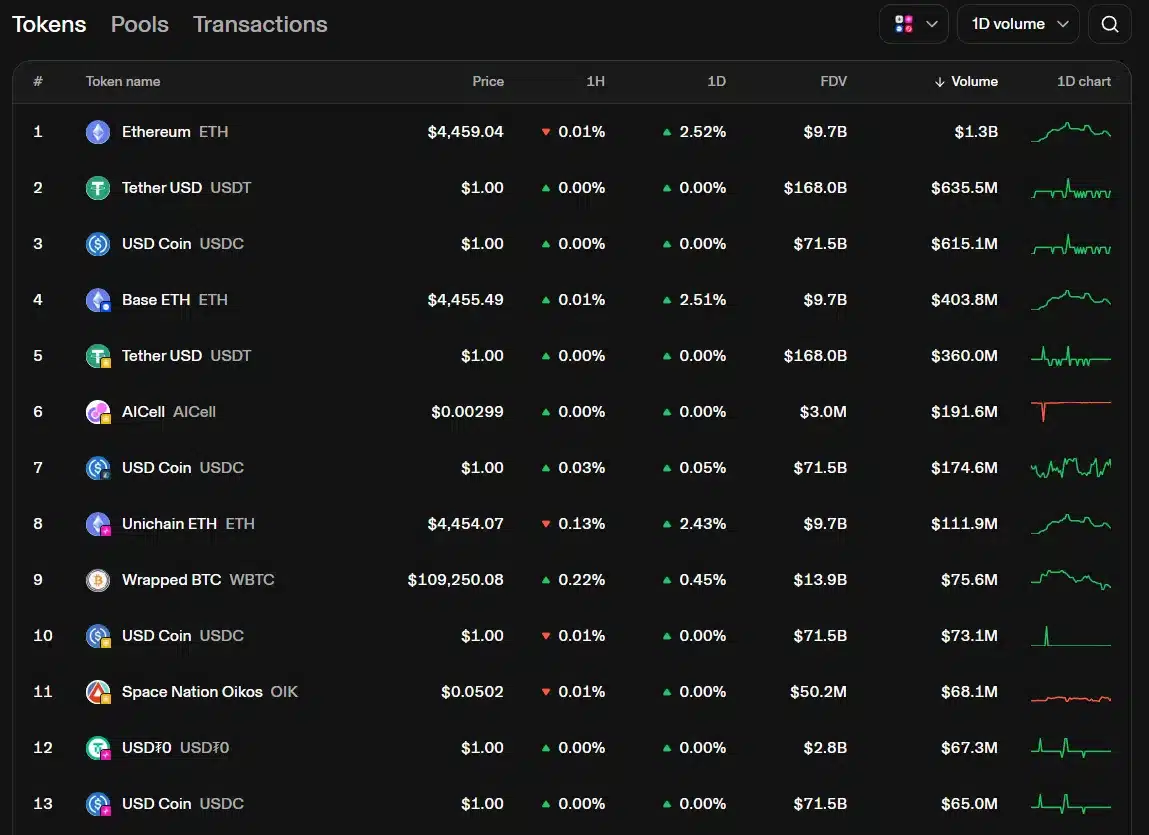

Uniswap quickly became the largest decentralised exchange on Ethereum and remains the benchmark for the sector.

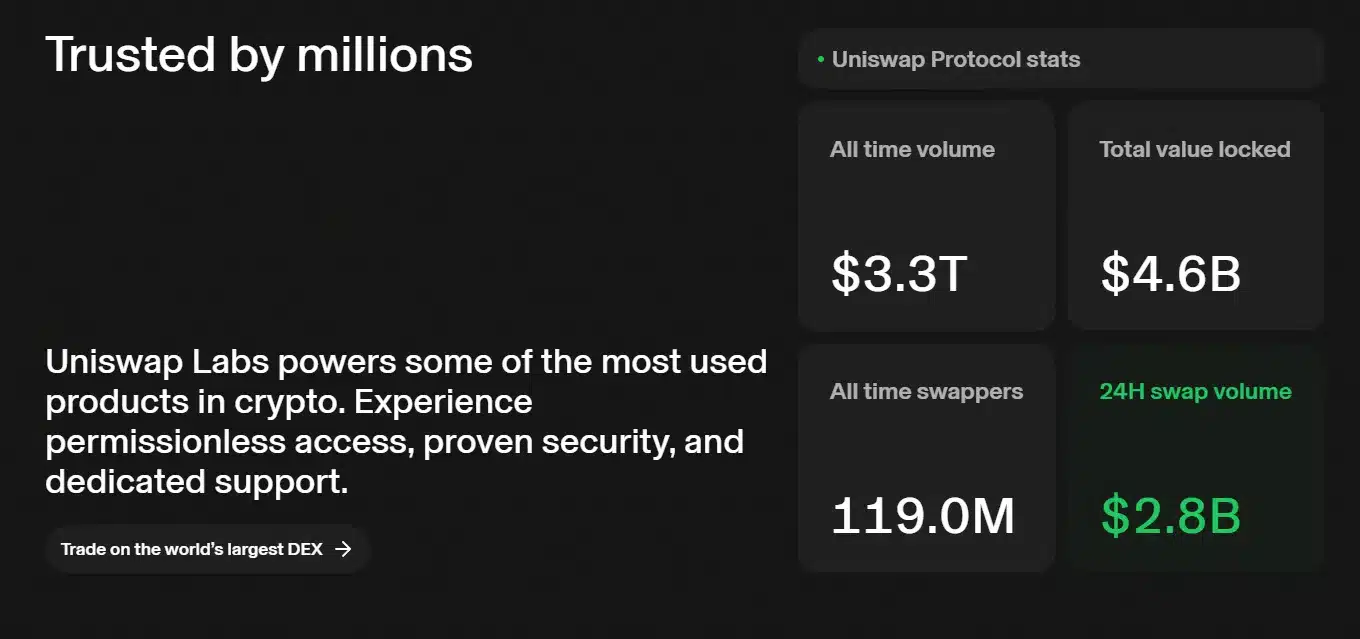

- Trading volume. At times, Uniswap’s daily trading volumes have rivalled those of major centralised exchanges. Its cumulative trading volume now measures in the trillions of dollars.

- Liquidity depth. Billions of dollars in assets are locked in Uniswap pools, making it one of the most liquid venues for ERC-20 tokens.

- Developer adoption. Uniswap has become a foundational building block in DeFi. Other protocols integrate its liquidity and pricing, using it as infrastructure for lending, derivatives, and stablecoin systems.

- Cross-chain expansion. Uniswap has expanded beyond Ethereum to chains such as Polygon, Arbitrum, Optimism, and BNB Chain. This broadens its reach and reduces costs for users.

The protocol’s dominance is not just technical but cultural. Because for many, Uniswap represents the ethos of DeFi, open access, permissionless innovation, and community ownership.

Strengths of Uniswap

Several qualities have enabled Uniswap to maintain leadership in DeFi.

- Simplicity. The AMM model is easy to understand and use, lowering barriers to entry.

- Liquidity depth. As one of the largest liquidity venues, Uniswap offers reliable execution for traders.

- Decentralisation. No central authority controls who can trade or list tokens. Anyone can participate.

- Continuous innovation. With upgrades such as concentrated liquidity, Uniswap remains at the forefront of AMM design.

- Network effects. As the first mover and largest protocol, Uniswap benefits from a cycle of liquidity attracting traders and traders attracting more liquidity.

Weaknesses and Criticisms

Uniswap also faces challenges and criticisms.

- Gas costs. On Ethereum mainnet, transaction fees can be high during congestion. This limits accessibility for smaller traders.

- Complexity for liquidity providers. Concentrated liquidity increases efficiency but requires more active management, exposing providers to impermanent loss if they choose poor ranges.

- Competition. Exchanges such as Curve, SushiSwap, and Balancer attract liquidity with specialised models or incentives.

- Governance centralisation. Despite UNI’s broad distribution, large token holders often dominate governance, raising questions about how decentralised decision-making is in practice.

- Regulatory pressure. As Uniswap grows, it attracts regulatory attention. The protocol is decentralised, yet Uniswap Labs, which develops the interface, operates in a regulated environment that may create points of vulnerability.

Competitive Positioning

Uniswap is the clear leader among decentralised exchanges. Because Curve focuses on stablecoin trading. Balancer offers customisable pools. SushiSwap adds community-driven incentives. None has displaced Uniswap’s dominance.

The first-mover advantage, liquidity depth, and steady upgrades have kept it ahead. Expansion to layer-two networks and other chains keeps costs down and relevance high. Anyways, for many developers, integrating Uniswap liquidity is the default choice.

Centralised exchanges still dominate total crypto trading volumes. But for Uniswap to challenge them more directly, it must keep improving user experience and scaling.

Who Should Use Uniswap

Traders. Buy or sell ERC-20 tokens with deep liquidity and no intermediaries.

Liquidity providers. Earn fees by supplying liquidity, while managing risks such as impermanent loss.

Developers. Integrate Uniswap’s liquidity and pricing oracles as infrastructure.

Retail users. On layer-two networks, smaller users can avoid high mainnet fees.

However Uniswap is less suitable for users who prefer custodial services or need advanced order types and leverage, which centralised exchanges provide.

Slide to buy Token X with Token Y

Future Outlook

Uniswap’s roadmap focuses on scaling, governance, and cross-chain expansion. However as Ethereum upgrades and layer-two solutions gain traction, Uniswap should benefit from lower costs and improved throughput. The protocol is also exploring better user interfaces and liquidity management tools.

But governance will remain key. Therefore, improving participation, ensuring decentralisation, and balancing the interests of large stakeholders with the wider community will be important for long-term legitimacy.

Expansion across chains recognises that DeFi is multi-chain. Uniswap aims to provide liquidity wherever users are, regardless of the underlying network.

Conclusion

Uniswap transformed the crypto industry by proving that decentralised exchanges can work at scale. Its automated market maker model became a standard, copied and adapted across the ecosystem. Over time, it has grown into one of the largest and most influential protocols in DeFi.

The strengths are clear, simplicity, decentralisation, deep liquidity, and continuous innovation. However, the weaknesses, high fees on Ethereum and governance concentration, remain challenges, yet they are being addressed through scaling and broader participation.

Meanwhile, for traders, liquidity providers, and developers, Uniswap is a vital tool in the Web3 toolkit. It is not perfect, yet it is foundational. More than an exchange, Uniswap embodies permissionless finance and community-led innovation. As DeFi grows, Uniswap will remain central to that story.