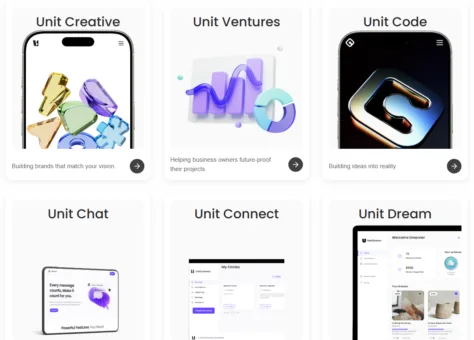

Unit Network is a Web3-native protocol designed to enable tokenisation and decentralised microservices at a community and organisational level. It positions itself as a turnkey platform for launching token economies, allowing communities, brands, cities, and projects to issue and manage their own tokens without requiring coding skills.

Built on Polkadot’s multi-chain architecture, Unit Network focuses on financial inclusion, decentralised ownership, and collaborative value creation. Tokens issued through the platform can represent identity, value, participation, governance, or local economic activity. The broader ambition is to democratise access to financial infrastructure by lowering the barriers to creating and operating token-based systems.

This review examines Unit Network’s vision, architecture, token economy, use cases, governance model, business model, funding, strengths, and challenges, while placing the project within wider decentralised finance and tokenisation trends.

Vision and Core Principles

Financial Inclusion and Economic Access

Unit Network’s core mission is to expand financial access through tokenisation. The platform targets individuals and communities underserved by traditional financial systems, including emerging economies and informal networks. By supporting both fiat and crypto-linked functionality, Unit aims to provide accessible digital financial tools for users previously excluded from mainstream banking.

Decentralised Ownership and Community Economies

Decentralised ownership sits at the centre of Unit’s design. Users can issue tokens that represent shared ownership in projects, brands, or local initiatives. These tokens can underpin shared treasuries, community banks, and participatory governance structures, enabling collective decision-making and resource allocation.

Token-Based Crowdfunding and Participation

Unit enables token-based crowdfunding models that align contributors and issuers through shared economic incentives. Contributors gain participation rights rather than making one-off donations, supporting co-ownership and long-term engagement within community economies.

Sustainability, Transparency, and Inclusivity

The protocol emphasises transparent rules, open participation, and long-term incentive alignment. Its economic design prioritises resilience and equitable participation across geography, identity, and economic status.

Architecture and Technology Stack

Polkadot Parachain Architecture

Unit Network operates as a Polkadot parachain or parathread, benefiting from shared security and native interoperability. This architecture allows Unit to integrate assets and data across multiple blockchains, including Bitcoin and Ethereum, within its tokenisation framework.

No-Code Token Issuance

Unit provides no-code tools that allow users to create tokens without technical expertise. Tokens are issued with collateral backing through vaults that stake the native UNIT token, enabling wrapped and collateralised assets with automated risk controls.

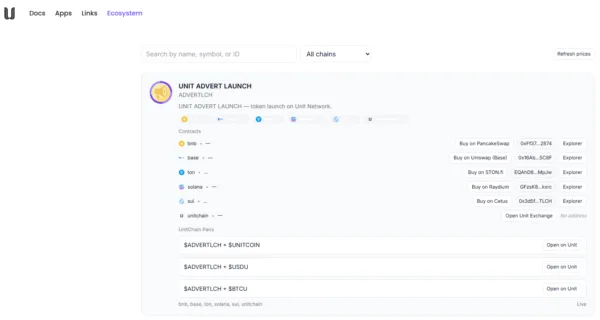

Decentralised Exchange and Asset Marketplace

The platform includes a decentralised exchange supporting the trading of community, city, brand, and asset-backed tokens. Liquidity is available from launch, reducing friction for new token economies.

Vaults and Collateral Mechanics

Vaults stake UNIT tokens in smart contracts to secure issued assets. If obligations are not met, collateral can be seized automatically. This model mirrors other Polkadot-based wrapped asset designs and supports trust-minimised issuance of external assets.

Ecosystem Tokens and Shared Treasuries

Ecosystem tokens function as shared treasury and coordination layers for partnerships and communities. They are used for governance, funding allocation, and service access across the Unit economy.

Token Economy and Incentives

UNIT Token Utility

UNIT is the native token of the network and serves several functions:

- Collateral for vaults and token issuance

- Staking and security participation

- Governance voting

- Transaction fee payment

Fee Structure

The platform applies a 2 percent fee on trades, allocated as follows:

- 0.5 percent to the referring user

- 0.5 percent to liquidity providers

- 0.5 percent to the UNIT treasury

- 0.5 percent to the issued token’s treasury

Withdrawals or unwrapping incur a 1 percent fee, split between the UNIT treasury and the relevant vault.

Participation Incentives

Vault operators, liquidity providers, creators, and referrers receive ongoing rewards. This structure aligns incentives across infrastructure providers, users, and communities, supporting sustained network activity.

Use Cases and Real-World Applications

City and Community Tokens

Local communities can issue city or regional tokens to support local commerce, civic engagement, and community funding. These tokens can be used for payments, rewards, and participatory budgeting.

Agency and Brand Tokenisation

Agencies can deploy token economies for clients, including loyalty programmes, crowdfunding campaigns, and community-backed initiatives, using Unit’s tooling and referral incentives.

Manufacturing and Private Networks

Unit supports industrial use cases such as private networks for manufacturing, where tokens coordinate sensor data, robotics, quality control, and operational workflows.

Software-Defined and Decentralised Networking

Tokenised governance models can underpin decentralised networking services such as routing, load balancing, firewalling, and monitoring, enabling adaptive infrastructure governed by participants.

Cross-Sector Applications

Additional use cases extend into education, healthcare, entertainment, digital identity, and public infrastructure, highlighting the flexibility of the tokenisation framework.

Ecosystem and Governance

DAO-Based Governance

Governance is decentralised and token-based. Ecosystem tokens enable communities to manage treasuries, allocate capital, and make strategic decisions independently while remaining aligned with the wider network.

Ecosystem Hubs

Hubs are semi-autonomous organisations providing education, onboarding, and growth support. They operate independently but are supported by Unit’s economic incentives and governance framework.

Partnerships and Community Engagement

Unit Network actively engages with the Web3 ecosystem through sponsorships, events, and advocacy around decentralised ownership and token economies.

Business Model and Funding

Revenue Model

Revenue is generated through transaction and withdrawal fees. A portion is redistributed to participants and treasuries, supporting a self-sustaining economic model.

Funding and Backing

In early 2025, Unit Network raised 18 million dollars in a funding round led by Web3-focused venture firms and angel investors. Funding is allocated towards real-world asset tokenisation, interoperability, and international expansion.

Growth Strategy

The project is focused on expansion across Europe, Asia, and the Middle East, with operations in London, Dubai, Hong Kong, and New York. The strategy centres on bridging traditional finance with decentralised token economies.

Strengths

Accessible Token Economy Creation

No-code tooling removes technical barriers, enabling individuals, communities, and small organisations to launch token-based initiatives.

Interoperable Asset Design

Collateralised wrapping of external assets supports interoperability and composability across blockchains.

Built-In Liquidity and Incentives

The integrated exchange, vault system, and referral incentives reduce friction and encourage early participation.

Community-Centric Governance

Shared treasury and governance models support autonomy while maintaining network alignment.

Practical, Real-World Use Cases

Applications extend beyond speculative finance into civic, industrial, and organisational contexts.

Challenges and Risks

Regulatory Uncertainty

Token issuance and asset backing may trigger securities, financial services, and compliance requirements depending on jurisdiction.

Liquidity and Adoption Risk

New tokens require sustained participation to maintain relevance and liquidity, even with built-in infrastructure.

Protocol and Smart Contract Risk

As an emerging protocol, Unit faces standard smart contract and operational risks despite collateral safeguards.

Competitive Landscape

The project competes with tokenisation platforms, DAO tooling providers, real-world asset protocols, and alternative layer-one ecosystems.

User Complexity

Despite no-code tooling, understanding token economics, governance, and risk remains challenging for non-technical users.

Example Use Case Scenarios

Community Token

A city-level token supports local commerce, civic initiatives, and mutual aid, with trading and reinvestment handled through the Unit exchange.

SME Co-Ownership Model

Small businesses raise capital by issuing tokens to employees and supporters, offering governance rights, discounts, or profit participation.

Industrial Network Token

Manufacturing firms share a token for procurement, coordination, and incentive alignment across a regional supply chain.

Agency-Led Token Campaigns

Agencies deploy rapid token solutions for clients, earning revenue from setup and transaction-based referrals.

Roadmap and Future Direction

Planned developments include:

- Continued geographic expansion

- Broader real-world asset tokenisation

- Expanded cross-chain interoperability

- Enterprise and public sector partnerships

- Governance and DAO framework upgrades

Conclusion

Unit Network presents an ambitious attempt to lower the barriers to tokenised economic participation. By combining Polkadot’s multi-chain infrastructure with no-code token tooling, collateralised issuance, and decentralised governance, it positions itself as an engine for community-driven and real-world token economies.

Its strengths lie in accessibility, incentive alignment, and practical use cases beyond speculative finance. However, long-term success will depend on regulatory navigation, ecosystem adoption, and effective onboarding for non-technical users.

Unit Network is not simply another decentralised finance protocol. It represents an attempt to build inclusive, user-owned financial infrastructure that can support communities, organisations, and collaborative economies at scale.