Artificial intelligence is transforming financial services, and nowhere is this more visible than in consumer lending. In a world where legacy credit scores often exclude creditworthy individuals and delay decision-making, the need for smarter, faster, and fairer credit assessment tools has become urgent. Enter Upstart, a California-based fintech company using AI to revolutionize the way credit decisions are made and embedded into the broader digital economy.

Founded in 2012 by former Google employees, Upstart began as a platform focused on personal loans. Since then, it has evolved into an AI-powered lending ecosystem that now spans auto loans, small business credit, and embedded finance partnerships. The company’s mission is clear: to improve access to affordable credit by replacing traditional FICO-based decisioning with machine learning models that incorporate a broader range of variables and real-time data.

The Problem with Traditional Credit Decisioning

The standard consumer credit model in the United States has relied for decades on three-digit FICO scores. While this score offers a convenient shorthand for assessing risk, it is both limited and exclusionary. Millions of Americans either have no credit history or have scores that fail to reflect their actual ability to repay loans.

Traditional lenders are also hampered by rigid underwriting criteria, lengthy manual processes, and an inability to adapt to modern digital expectations. For many consumers, this translates into rejected applications, higher interest rates, or weeks-long waiting periods for approval.

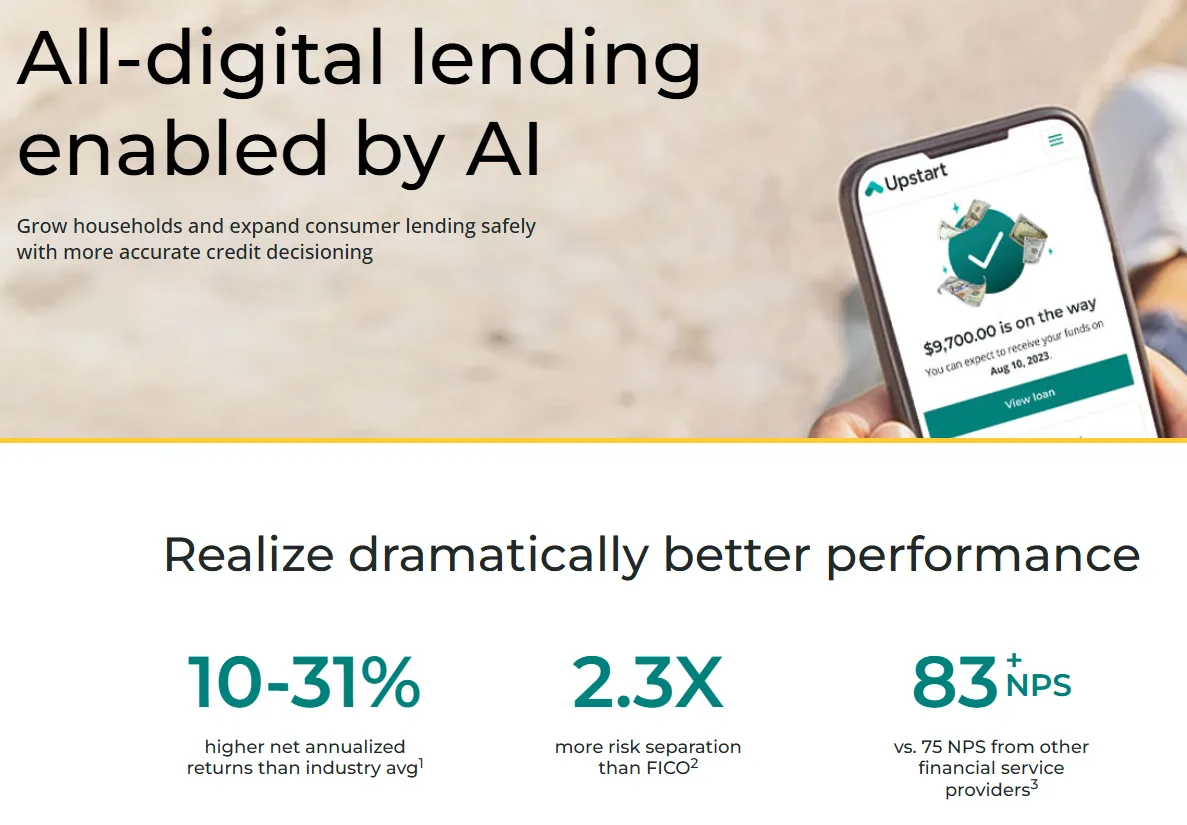

Upstart’s proposition is to offer a better way. By using machine learning to assess creditworthiness, it aims to provide more accurate risk assessments and increase loan approvals without increasing default risk. In short, it uses data to unlock fairer access to credit.

How Upstart Works: AI at the Core

Upstart’s platform is powered by proprietary AI models that evaluate over 1,600 variables per applicant. These go beyond FICO scores and include:

- Education (institution, field of study, GPA)

- Employment history

- Income and cash flow

- Bank transaction data

- Online behaviour and application metadata

These models are continuously trained using real-world lending outcomes, making them increasingly predictive over time. Importantly, Upstart’s models do not only seek to approve more borrowers. They also aim to price risk more accurately, allowing lenders to offer lower rates to more qualified borrowers while maintaining profitability.

The platform automates 70 to 80 percent of loan decisions, often delivering instant approvals. By embedding AI directly into the lending process, Upstart reduces manual underwriting, increases consistency, and accelerates loan origination.

The company also places a strong emphasis on regulatory compliance and fairness. Its models are tested for bias and are regularly audited. In fact, Upstart was the first company to receive a “no-action” letter from the Consumer Financial Protection Bureau (CFPB) for its use of AI in lending.

From Marketplace to Embedded Lending Infrastructure

Upstart began as a direct-to-consumer lending platform, matching borrowers to loans issued by bank partners. While this remains a core part of the business, the company has increasingly positioned itself as a lending-as-a-service platform that enables banks, credit unions, and digital platforms to offer AI-powered loans via white-labeled or API-based solutions.

This shift toward embedded credit decisioning is a major evolution. It allows partners to:

- Digitally originate loans with minimal friction

- Use Upstart’s AI models instead of legacy scorecards

- Customise loan products while relying on Upstart’s infrastructure

Through these partnerships, Upstart is moving toward a future where credit decisioning becomes an embedded layer of the digital economy. Whether it is an auto dealership offering financing at the point of sale or a community bank upgrading its digital lending experience, Upstart provides the engine behind the scenes.

This model is scalable and capital-light, as Upstart does not keep most of the loans on its balance sheet. Instead, it earns fees from loan originations and servicing, while banks and institutional investors provide the capital

Auto Lending: A Strategic Expansion

In 2020, Upstart acquired Prodigy Software to enter the auto lending market. This move allowed the company to integrate its lending technology into car dealerships, enabling instant credit approvals and digital financing directly at the point of sale.

Auto loans represent one of the largest segments of consumer credit in the U.S., and the industry is ripe for disruption. Dealerships often rely on legacy systems, manual paperwork, and suboptimal lender matchups. Upstart Auto Retail modernizes this process by combining inventory, financing, and contracting into a single digital workflow.

For Upstart, auto lending is more than just a vertical expansion. It is a proving ground for embedded credit decisioning and demonstrates the potential of its AI engine beyond personal loans.

Financial Performance and Market Dynamics

Upstart went public in December 2020 and saw a meteoric rise in its stock price in 2021, driven by investor excitement around AI and digital lending. However, like many fintechs, it experienced volatility as macroeconomic conditions changed.

Interest rate hikes, inflation concerns, and risk-off sentiment in lending led to significant headwinds. In 2022 and 2023, Upstart faced challenges related to loan volume, capital supply, and rising defaults. The company responded by tightening underwriting standards, diversifying funding sources, and focusing more heavily on its embedded platform strategy.

Despite these fluctuations, Upstart remains one of the most sophisticated AI players in the lending space. Its loan-level performance data, underwriting transparency, and tech-first approach differentiate it from both traditional lenders and newer fintech rivals.

Key metrics from recent filings include:

- Over $35 billion in loans originated since inception

- Partnerships with more than 100 banks and credit unions

- A growing share of loans processed via embedded or partner channels

- High automation rates across loan types

Upstart continues to invest in expanding its AI models, especially for new verticals like home equity and small business credit.

Strengths and Competitive Advantages

Risks and Challenges

Upstart’s Role in the Future of Lending

Despite the risks, Upstart is helping define a new paradigm in lending. Traditional scorecards and manual underwriting are no longer sufficient in a digital-first economy. Consumers expect faster decisions, better rates, and more inclusive access.

Upstart’s AI-driven platform addresses these needs. It allows partners to embed smart credit decisioning into any digital experience. Whether it is a mobile banking app, an ecommerce checkout, or an enterprise SaaS platform, lending can now be a seamless feature, not a separate service.

In this vision, Upstart is not just a lender. It is a credit infrastructure company, similar to how Stripe is infrastructure for payments or Plaid for financial data. If it can maintain performance, expand into new categories, and strengthen its funding base, it may become one of the foundational players in embedded finance.

Final Verdict: A Quiet Powerhouse

Upstart may not have the consumer brand recognition of some fintech giants, but its impact is deep and growing. It has already helped banks expand access to credit, powered billions in personal and auto loans, and shown the viability of AI-first lending at scale.

As embedded finance continues to evolve, Upstart is building the decisioning layer that allows any company to offer smart, responsible lending. Its strengths in AI, automation, and compliance give it a meaningful edge in a space that rewards precision as much as speed.

While the market remains volatile and execution risks persist, Upstart is a quiet powerhouse redefining what modern credit infrastructure looks like.