The search for alternative investments has led many retail and accredited investors to explore new frontiers beyond stocks and bonds. Real estate, crypto, private equity, and even collectibles have taken center stage in recent years. But one asset class has quietly outperformed many traditional investments while offering resilience during market downturns: fine wine.

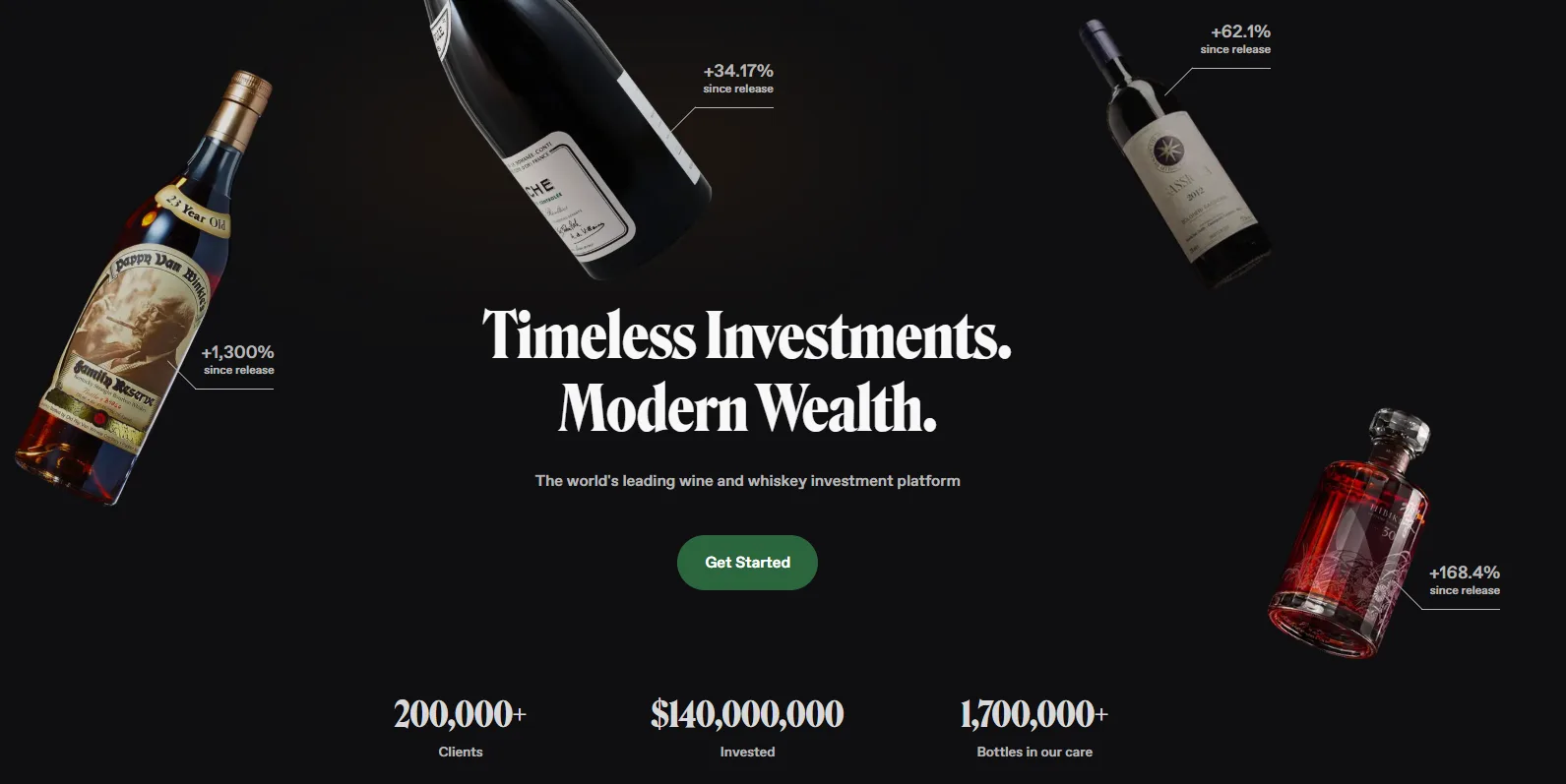

Vinovest, a platform founded in 2019, has positioned itself as the leading gateway for individuals to invest in fine wine without the need to build a private cellar. With AI-powered portfolio building, professional storage, and global market access, Vinovest simplifies a once-elite asset class into an accessible digital experience.

In this review, we take a deep dive into Vinovest: what it is, how it works, who it’s for, and whether it deserves a place in your portfolio.

What is Vinovest?

Vinovest is a fintech company that enables individuals to invest in fine wine through a fully managed digital platform. Rather than buying bottles to drink, users purchase investment-grade wines that are stored securely and expected to appreciate over time. These assets can later be sold for a profit or even shipped to the user if desired.

Headquartered in Los Angeles, the company combines data science, wine market expertise, and secure logistics infrastructure to offer a seamless investing experience. The company is backed by venture capital and has become a top name in the growing world of alternative investing.

Key Features:

- AI-driven portfolio construction based on risk appetite

- Professional storage in insured, climate-controlled warehouses

- Access to rare and historically appreciating wines

- Buy, sell, or take delivery of your wine at any time

- Transparent fees and real-time portfolio tracking

Why Invest in Wine?

Fine wine is more than a luxury good. It’s a historically stable, non-correlated asset class that has consistently delivered strong risk-adjusted returns.

Benefits of Wine Investing:

- Low Volatility: Wine markets tend to be less susceptible to daily price swings than equities or crypto.

- Inflation Hedge: Physical assets like wine often retain value when fiat currencies decline.

- Diversification: Wine prices do not correlate strongly with stock market indices, making it an ideal diversifier.

- Cultural Scarcity: As fine wines age, they become more scarce and valuable, offering built-in appreciation potential.

According to the Liv-ex Fine Wine 100 Index, fine wine has delivered annualized returns of around 10% over the past two decades. That makes it competitive with traditional investments but with lower downside risk during recessions.

How Vinovest Works

Vinovest simplifies the process of wine investing into a few steps, accessible to anyone with internet access and a minimum starting capital.

Step 1: Create an Account

You sign up with your email, answer a few questions about your investment goals, and verify your identity.

Step 2: Portfolio Recommendation

Vinovest uses AI to recommend a wine portfolio tailored to your time horizon, risk tolerance, and return objectives. Options range from conservative (older, stable wines) to aggressive (younger wines with high growth potential).

Step 3: Funding Your Account

Investors can start with as little as $1,000, though higher-tier plans offer more features. Payments can be made via bank transfer or wire.

Step 4: Vinovest Buys and Stores Your Wine

Once your account is funded, Vinovest purchases physical bottles of wine on your behalf and stores them in secure, bonded warehouses around the world (UK, France, Singapore, and US).

Step 5: Monitor and Manage

You can track the performance of your wine portfolio through the dashboard, buy or sell wine at any time, or even request delivery of your bottles (though this removes the asset from the investment portfolio).

Vinovest Account Tiers

Vinovest offers several account types with increasing levels of service and benefits.

| Tier | Minimum Investment | Management Fee | Additional Benefits |

|---|---|---|---|

| Starter | $1,000 | 2.85% | Fully managed portfolio, dashboard access |

| Plus | $10,000 | 2.70% | Dedicated portfolio advisor, early access |

| Premium | $50,000 | 2.50% | Exclusive wines, cellaring options |

| Grand Cru | $250,000 | 2.25% | Bespoke portfolios, invitations to tastings |

All tiers include full insurance, storage, authentication, and global logistics.

Fees and Costs

Vinovest charges a management fee that covers storage, insurance, sourcing, and advisory services. Fees range from 2.25% to 2.85% annually, depending on the account tier.

There are no separate transaction fees for buying or selling wine. The management fee is charged monthly and is based on the total portfolio value.

This fee structure is competitive compared to other alternative investment platforms, especially when factoring in the costs of climate-controlled storage, fraud protection, and global logistics.

Security and Authentication

A major concern when investing in physical assets is authenticity and security. Vinovest addresses this with rigorous sourcing and storage standards.

- Provenance Verification: All wines are authenticated before purchase.

- Bonded Warehouses: Wines are stored in government-regulated warehouses that protect against fraud and theft.

- Full Insurance: All holdings are insured at market value, including protection from breakage and spoilage.

- Ownership: You retain legal title to your wine, even though Vinovest manages the logistics.

This ensures peace of mind for investors who never physically touch their assets but rely on digital trust.

Buying and Selling

Vinovest operates its own marketplace and trading desk, allowing investors to:

- Sell wines early if market prices rise

- Hold wines long-term for compounding returns

- Request delivery for personal consumption

Wine liquidity is slower than traditional markets, but Vinovest’s global network and access to collectors and merchants help reduce the typical friction. The average holding period is 5 to 10 years, but sales can be made earlier if needed.

Performance and Historical Returns

Vinovest reports average annual returns of 10–13%, though performance varies based on strategy and market conditions. Some vintages have appreciated over 30% in a single year, while others may remain flat.

Wine investing is generally a long-term play. Unlike day trading, returns come from gradual appreciation over years, driven by factors like vintage rarity, critic scores, market demand, and dwindling global supply.

Vinovest publishes transparent performance reports and market insights for users who want to track historical trends.

Who Should Use Vinovest?

Vinovest is ideal for:

- Long-term investors seeking diversification

- Wealth builders who want low-volatility alternatives

- Luxury collectors who want a more data-driven approach

- Sustainability-focused investors interested in real assets

It may not be ideal for:

- Short-term traders looking for quick liquidity

- Investors on a tight budget, due to fees and time horizon

- Those uncomfortable with physical asset investing

That said, even a small allocation to wine can reduce portfolio volatility and enhance diversification.

User Experience and Design

The Vinovest dashboard is clean, modern, and intuitive. It includes:

- Portfolio overview with real-time valuation

- Individual wine details with region, producer, and critic ratings

- Market trends and Vinovest commentary

- Tools to request delivery or initiate sales

Vinovest also offers mobile access and customer support via chat and email. Higher-tier users gain access to dedicated advisors and curated insights.

Regulatory and Tax Considerations

Wine investing through Vinovest is not regulated as a security, since you’re buying physical goods. However, the platform adheres to strict compliance and KYC protocols to ensure legitimacy.

From a tax standpoint:

- Capital gains may apply when selling wine at a profit

- No tax deferral options like IRAs are available currently

- Wine as a collectible may be subject to different treatment in some jurisdictions

Consulting a tax advisor is recommended if wine becomes a significant portion of your portfolio.

Pros and Cons

Pros:

- Accessible starting point for fine wine investing

- Fully managed solution with real asset ownership

- Low correlation with stock markets

- Proven historical returns with moderate risk

- Professional-grade storage and security

Cons:

- Management fees can eat into returns for smaller accounts

- Long holding periods may not suit all investors

- Liquidity is not instant

- No tax-advantaged structures available

Final Verdict: Is Vinovest Worth It?

Vinovest offers one of the most user-friendly and credible ways to invest in fine wine. With low minimums, full ownership, and end-to-end management, it opens the door to an asset class once reserved for connoisseurs and ultra-wealthy collectors.

While not a substitute for core investments like stocks or bonds, fine wine can play a valuable role as a non-correlated, inflation-resistant, and culturally scarce asset. For those seeking diversification and a unique long-term store of value, Vinovest is a compelling choice.

Whether you’re a seasoned investor or just getting started with alternatives, Vinovest deserves consideration for your portfolio.