The landscape of wealth management has undergone a seismic shift in the last decade. What was once the domain of high-net-worth individuals with private banking relationships has become increasingly accessible to the “mass affluent”, those with investable assets between $100,000 and $1 million. At the heart of this evolution is the rise of automated investment platforms, often referred to as robo-advisors, with Wealthfront standing out as a clear pioneer.

Founded in 2008 and launched to the public in 2011, Wealthfront has consistently positioned itself as more than a simple robo-advisor. The platform blends algorithm-driven portfolio management, financial planning tools, and banking products to serve a generation of tech-savvy investors seeking low-cost, automated, and intelligent financial services.

In this in-depth review, we explore how Wealthfront works, what makes it unique, and how it is redefining modern investing for the mass affluent.

What Is Wealthfront?

Wealthfront is a U.S.-based digital investment management platform that automates portfolio construction, tax-efficient investing, and long-term financial planning. Headquartered in Palo Alto, California, the company was built with a vision of democratizing sophisticated wealth management services traditionally reserved for the ultra-wealthy.

The core of Wealthfront’s offering is an automated investment service that uses Modern Portfolio Theory (MPT) to build diversified portfolios tailored to a user’s risk tolerance and financial goals. But unlike some competitors, Wealthfront doesn’t stop at investing, it has evolved into a full-fledged automated financial advisor, with tools for saving, borrowing, spending, and planning integrated into one seamless interface.

Core Features of Wealthfront

1. Automated Investment Portfolios

Wealthfront uses low-cost exchange-traded funds (ETFs) to build personalized portfolios based on a questionnaire assessing your risk tolerance, time horizon, and financial goals. The platform offers access to:

- U.S. and international equities

- Dividend-paying stocks

- Municipal and corporate bonds

- Real estate (via REIT ETFs)

- Treasury inflation-protected securities (TIPS)

- Natural resources and emerging markets

Each portfolio is constructed using MPT principles to optimize expected return for a given level of risk. Portfolios are rebalanced automatically and updated based on market movement and deposit/withdrawal activity.

Wealthfront also supports Socially Responsible Investing (SRI) by allowing users to exclude certain categories (e.g., fossil fuels or tobacco) from their portfolios.

2. Tax-Loss Harvesting

One of Wealthfront’s most celebrated features is its daily tax-loss harvesting. This strategy involves selling losing investments to offset gains elsewhere in the portfolio, minimizing the investor’s tax liability.

Unlike many traditional advisors who may do this quarterly or manually, Wealthfront automates the process daily, ensuring maximum efficiency. This can result in thousands of dollars in tax savings over time, particularly valuable for higher earners in the mass affluent segment.

For accounts over $100,000, Wealthfront offers Stock-Level Tax-Loss Harvesting, a more granular version that uses individual U.S. stocks rather than ETFs to unlock more frequent tax-saving opportunities.

3. Path – The Financial Planning Tool

Wealthfront’s Path tool is a cornerstone of its financial planning strategy. Path is a goal-based planning engine that allows users to:

- Set and monitor financial goals (e.g., retirement, home purchase, college savings)

- Understand trade-offs between different financial decisions

- Simulate market scenarios based on economic data and Monte Carlo simulations

Unlike static retirement calculators, Path is interactive and updated in real time, giving users a personalized roadmap tailored to their exact situation.

This tool is particularly valuable for the mass affluent, those who may not be wealthy enough for a dedicated human advisor, but have complex enough needs to require tailored planning beyond budgeting apps.

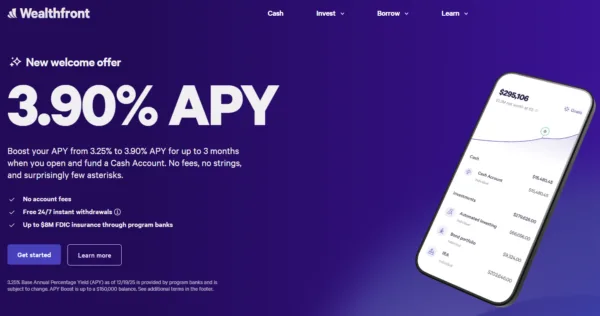

4. Cash Management and High-Interest Accounts

Wealthfront has expanded beyond investing into cash management, offering:

- A high-yield cash account (currently over 5.00% APY depending on rates)

- FDIC insurance up to $5 million through a partner bank sweep program

- No account fees or minimums

- Direct deposit, bill pay, and debit card access

Users can set up savings goals—such as travel, wedding, or home purchase—and link them to specific buckets within the cash account. The funds can easily be moved to investment accounts when needed, making Wealthfront a one-stop shop for saving, spending, and investing.

5. Borrowing with Portfolio Line of Credit

For clients with at least $25,000 invested, Wealthfront offers a Portfolio Line of Credit (PLOC). This allows users to borrow up to 30% of their portfolio value at low interest rates (as low as 5%–6%, variable).

Because it’s secured by your investment assets, the line of credit is easier to access than traditional loans. It’s useful for liquidity events, emergency cash needs, or tactical financial moves—without needing to sell assets or incur capital gains.

For the mass affluent investor, this is a powerful tool that enables liquidity without disrupting long-term strategy.

6. Stock Investing and ETFs

In 2022, Wealthfront introduced self-directed investing, enabling users to buy and sell individual stocks and ETFs outside of their managed portfolios. This allows more active or hybrid investors to:

- Maintain a core managed portfolio

- Experiment or allocate funds to specific convictions (e.g., tech stocks or thematic ETFs)

It’s particularly attractive to younger investors moving beyond robo-advisory into more personalized strategies.

7. College Savings

Wealthfront also offers over 500 college savings plans with the same automated investment logic. Users can:

- Open tax-advantaged accounts for education expenses

- Automate contributions and investment rebalancing

- Manage these goals alongside other financial priorities

Though not as widely used as its investment accounts, this feature is a hidden gem for families looking to plan for education without high advisor fees.

Wealthfront Pricing

Wealthfront has a simple, transparent pricing model:

- 0.25% annual advisory fee on invested assets

- No trading commissions or rebalancing fees

- No fees on the high-yield cash account

- ETF expense ratios (built into the funds) average around 0.06%–0.13%

There are no account minimums for cash accounts. The minimum to open an investment account is $500.

Compared to traditional financial advisors charging 1%+ AUM fees, or hybrid platforms like Vanguard Personal Advisor Services (0.30%), Wealthfront is among the most cost-effective for long-term investors.

User Experience and Mobile App

Wealthfront’s platform is praised for its clean, intuitive interface. Both the web dashboard and mobile app offer:

- Portfolio tracking and projections

- Goal-based planning tools

- Account transfers and deposits

- Tax impact summaries

- Real-time balance updates

The mobile app (iOS and Android) maintains nearly full parity with the desktop experience and has consistently received high user ratings.

Its usability makes it particularly appealing to younger, time-strapped investors who prefer digital-first financial tools over in-person advisory meetings.

Security and Account Protection

Wealthfront employs bank-grade security protocols:

- Two-factor authentication (2FA)

- AES-256 encryption

- Biometric login for mobile

- Continuous account monitoring

Investment accounts are held with Apex Clearing, and are protected by SIPC insurance up to $500,000 (including $250,000 for cash). The cash account is insured by the FDIC up to $5 million via partner banks.

Wealthfront does not lend out user funds or engage in risky custodial practices, and it does not accept cryptocurrency deposits, reducing regulatory and liquidity risks.

Pros and Cons of Wealthfront

Pros

- Low fees and high automation

- Daily tax-loss harvesting (and stock-level harvesting at $100k+)

- Excellent financial planning tools (Path)

- High-yield cash account with FDIC coverage

- Portfolio line of credit available for liquidity

- Smooth mobile and web experience

- Customizable portfolios with SRI and ETF flexibility

- Self-directed trading for more advanced users

Cons

- No access to human advisors (fully digital experience)

- Limited custom asset selection outside managed portfolios

- No support for cryptocurrency assets

- Not ideal for very high-net-worth individuals needing estate or tax planning

- Currently U.S.-only (for both residents and citizens)

Who Is Wealthfront Best For?

Wealthfront is best suited to:

- Mass affluent professionals earning $100,000+ annually

- Tech-savvy investors who want automation, not conversation

- Young families saving for multiple goals (retirement, home, college)

- DIY investors who want financial planning but not stock-picking

- Cash-rich individuals seeking high-yield savings with liquidity

It may not be ideal for:

- Investors seeking active management

- Those who prefer face-to-face advice

- Non-U.S. residents or international investors

- Users heavily interested in crypto or alternatives

Wealthfront vs. Competitors

| Feature | Wealthfront | Betterment | Vanguard PAS | Schwab Intelligent |

|---|---|---|---|---|

| Advisory fee | 0.25% | 0.25% | 0.30% (with human) | 0.00% (ETF only) |

| Tax-loss harvesting | Yes (daily) | Yes (daily) | No | Yes (basic) |

| Custom portfolios | Yes | Yes | Yes | Limited |

| Cash management | Yes (5.00%+ APY) | Yes (lower APY) | No | Yes |

| Access to advisors | No | Optional (0.40%+) | Yes (CFPs) | No |

| Account minimum | $500 | $10 | $50,000 | $5,000 |

| Mobile app rating | 4.9 (iOS) | 4.8 (iOS) | 4.0 | 4.5 |

Wealthfront holds its own, especially in automated planning, tax strategy, and user experience. While Betterment offers human advisor access (at extra cost), Wealthfront appeals to users confident in digital tools.

Wealthfront in 2025: Strategy and Outlook

Wealthfront was nearly acquired by UBS in 2022, but the deal was canceled. Since then, the company has doubled down on remaining independent, innovative, and digital-first.

Recent and upcoming initiatives include:

- Expansion of AI-driven financial advice features in Path

- Smart routing of deposits and investments across accounts

- Continued focus on cash yield optimization

- Integrating real estate and equity compensation into planning

- Exploring partner integrations in banking and lending

Wealthfront’s vision is to automate your entire financial life, making it possible for anyone to enjoy the benefits of sophisticated wealth management—without the old-school price tag.

Final Verdict

For the mass affluent investor seeking smart, automated, and low-cost investment management, Wealthfront is one of the strongest digital platforms available. Its combination of tax efficiency, personalized planning, seamless banking, and excellent design makes it a compelling all-in-one financial solution.

While it lacks human advisors and crypto features, its clarity of purpose—automating everything that can be automated—sets it apart in a crowded field.

If you’re comfortable managing your finances digitally, and want the tools to grow, plan, and protect your wealth intelligently, Wealthfront delivers on nearly every front.