Xapo Bank is one of the first licensed private banks built around Bitcoin. Founded in 2013 and based in Gibraltar, it has positioned itself at the intersection of traditional finance and digital assets. Unlike most crypto platforms, Xapo is regulated as a bank, providing the legal protections of the conventional system while offering services designed for the Bitcoin generation. The vision is clear: create a safe home for digital wealth that still provides the convenience and benefits of everyday banking.

Xapo Bank blends a regulated private bank with integrated Bitcoin custody, savings, and secured lending. Here is what stands out.

The Origins of Xapo Bank

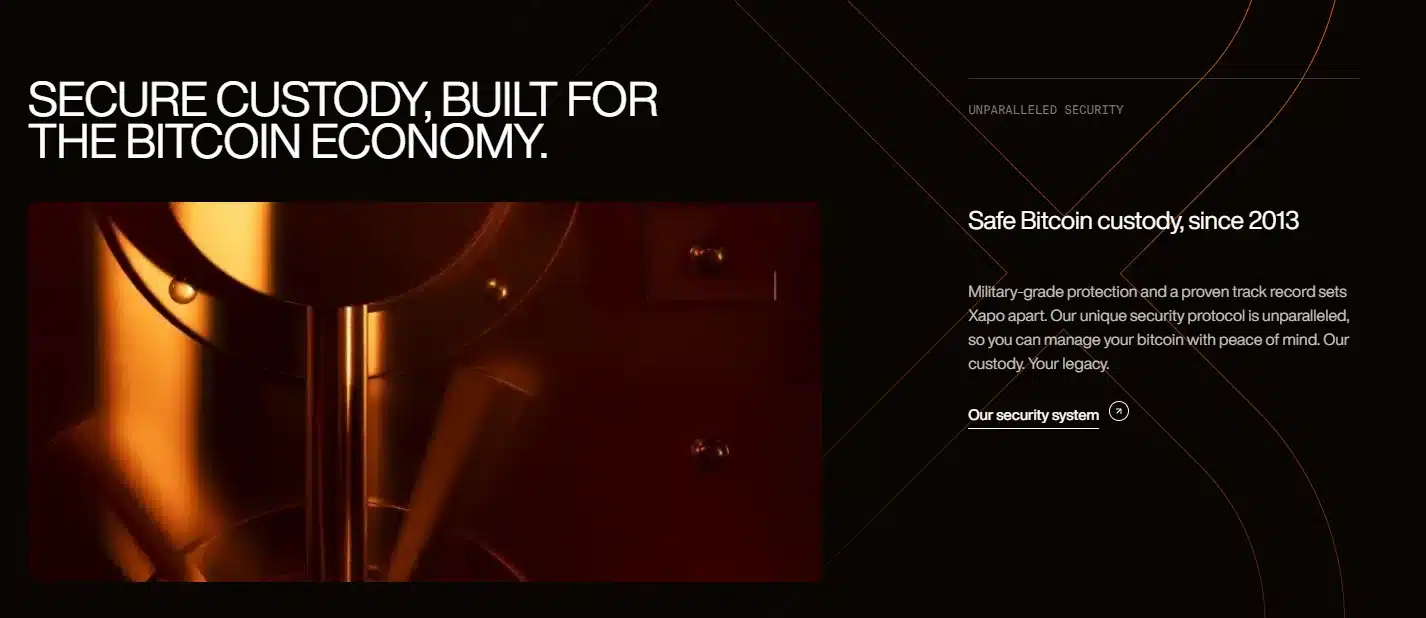

When Xapo launched in 2013, its focus was on storage. The company quickly gained recognition for its security infrastructure, famously building Bitcoin vaults in underground bunkers. At a time when exchanges were plagued by hacks and poor custody standards, Xapo differentiated itself by prioritising safety.

As its client base grew, however, it became obvious that wealthier Bitcoin holders wanted more than vaults. They needed banking services: yield-bearing accounts, lending options, and the ability to spend their wealth without converting it back into cash. By securing a full banking licence in Gibraltar, Xapo transitioned from custodian to private bank. This evolution gave it the credibility of regulation while maintaining its security-first culture.

👉 Related reading: What is a fintech company?

Is Xapo Bank Safe?

Safety remains the foundation of Xapo’s identity. The bank is regulated by the Gibraltar Financial Services Commission, subject to the same rules as other financial institutions in the jurisdiction. This regulatory framework is rare in the crypto-banking world, where many competitors operate outside traditional oversight.

The bank’s heritage in vault security also remains central. Clients benefit from the same cautious approach to custody that made Xapo famous in the first place. Unlike fintech apps that simply bolt on crypto trading, Xapo integrates Bitcoin into a banking structure, giving clients confidence that their assets are managed with discipline and oversight.

Core Products and Services

Xapo Bank has built its offering around a handful of core services that link the digital and traditional sides of wealth management.

First, the bank provides high-yield savings accounts in U.S. dollars, currently offering 3.5% APY on deposits up to EUR 100,000. In addition, Bitcoin balances earn 0.5% APY on the first 2 BTC, with interest paid daily in BTC. Second,Xapo integrates Bitcoin custody directly within the banking model. Clients can store Bitcoin with confidence that it is protected under a regulated framework, rather than sitting on a trading platform.

Beyond storage and savings, Xapo also offers lending solutions. Members can borrow up to USD 1 million against their Bitcoin holdings, with loan-to-value ratios between 20%–40% and interest rates starting around 10% annually. Loan proceeds are credited instantly and can be used via transfers or debit card spending.This is particularly attractive for families managing wealth across multiple jurisdictions.

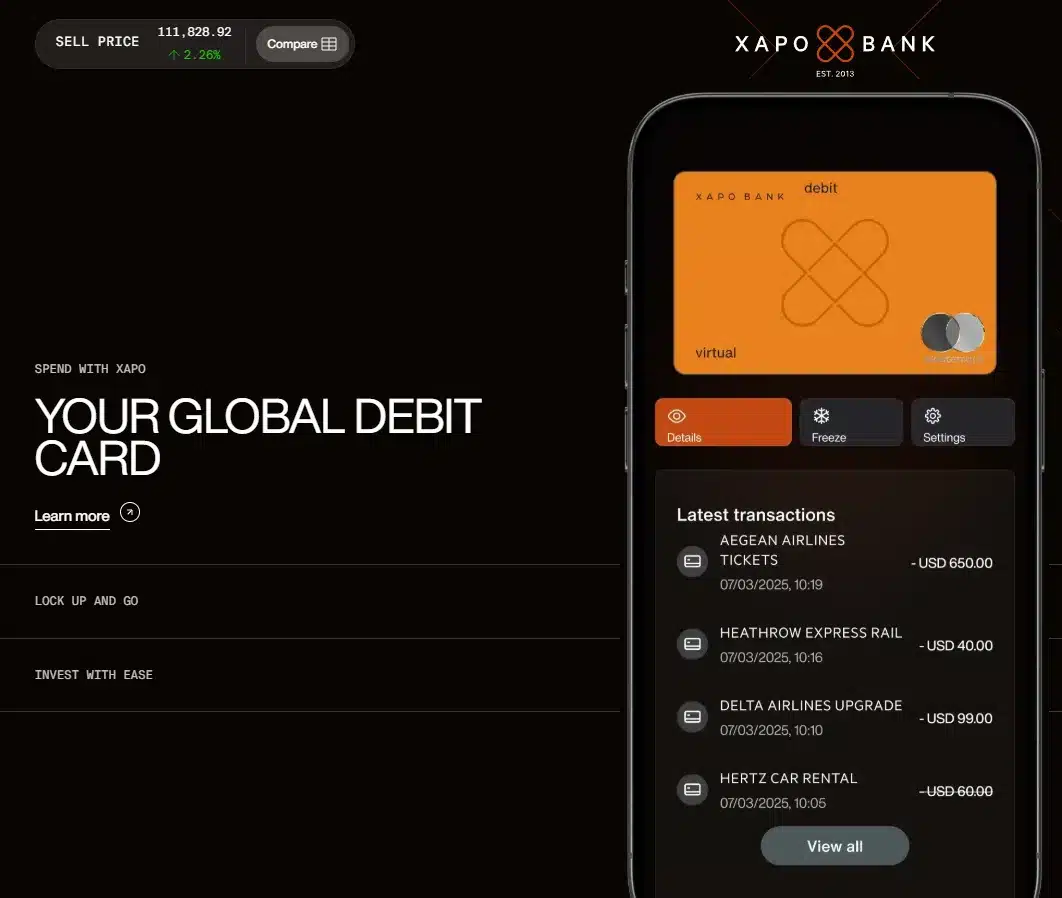

Finally, a global debit card connects the bank to daily life, allowing members to spend fiat balances seamlessly. The global debit card offers up to 1% uncapped cashback in Bitcoin, no FX fees, and high spending limits, making it one of the cheapest ways to spend BTC worldwide. Together, these services create an ecosystem where digital and traditional wealth strategies coexist.Xapo Bank has built its offering around a handful of core services that link the digital and traditional sides of wealth management.

👉 Related reading: Top 100 Fintech Tools for Personal Finance

Who Uses Xapo Bank?

The target audience is clear: internationally minded individuals and families with substantial wealth, particularly those with significant Bitcoin exposure. For clients with portfolios in the $3 million to $99 million range, Xapo offers something that neither mass-market neobanks nor conventional private banks deliver, a combination of discretion, yield, and integrated digital asset services.

This positioning sets Xapo apart from everyday fintech platforms that compete on user experience and low fees. Instead, it appeals to clients who see Bitcoin as part of a long-term wealth strategy and who want it managed within a banking-grade framework.

Membership costs USD 1,000 annually, which covers access to these privileges including daily interest payouts, premium debit card features, and institutional-grade Bitcoin spreads of just 0.1%.

“Think of Xapo as a private bank with a Bitcoin backbone. The distinction drives safer design choices than a trading-first app.”

Competitors and Market Position

Xapo Bank sits at the crossroads of three industries. On one side are traditional private banks, many of which are still cautious about touching digital assets. On another are neobanks like Revolut, which offer crypto trading but without the legal protections of a licensed bank. Then there are specialist custodians such as Coinbase Custody or BitGo, which secure assets but do not provide lending, payments, or savings accounts.

By combining the best elements of each category, Xapo creates a distinctive niche. It is not without risks, though. Larger banks may eventually replicate this model as regulation evolves. When that happens, Xapo will need to lean on its first-mover advantage and its reputation for security.

| Feature | Xapo Bank | Neobank + Crypto | Private Bank |

|---|---|---|---|

| Regulatory posture | Bank license, crypto native | E-money, partner routed | Conservative, exceptions only |

| BTC custody integration | Native, within bank | Trading add-on | Limited, external |

| Savings + Lending | Integrated | Partial, via partners | Fiat only, no BTC |

| Client fit | BTC-forward private clients | Mass retail | UHNW fiat-focused |

Strengths, Weaknesses, and Risks

Xapo’s biggest strength is credibility. Few crypto-facing platforms can claim to be fully licensed as banks, and even fewer have a decade-long reputation for security. The integration of yield, lending, custody, and payments into one platform also makes it attractive for clients who want simplicity and reliability.

At the same time, Xapo’s niche focus limits its scale. It is not built for the mass retail market, and its identity remains closely tied to Bitcoin. Should larger private banks begin offering similar services, the competition could quickly intensify. There is also the challenge of operating under a Gibraltar licence while serving a global membership base, an issue that could require additional regulatory footprints in the future.

The Future of Xapo Bank

The outlook for Xapo depends on two major factors: Bitcoin’s role in global finance and the evolution of digital asset regulation. If Bitcoin continues to cement itself as a long-term store of value, wealthy families will increasingly demand the services Xapo provides. If regulators worldwide create clearer frameworks, Xapo may expand its licences beyond Gibraltar to attract an even broader client base.

There is also room for Xapo to expand into new areas, such as family office advisory, tokenised assets, or broader wealth management. Its model as a private bank gives it flexibility to grow with client needs.

Final Verdict

Xapo Bank is a unique experiment in financial services. By merging the regulatory credibility of a bank with the flexibility of Bitcoin integration, it has created a safe and sophisticated platform for wealthy clients. For individuals and families with substantial digital wealth, Xapo offers a blend of yield, liquidity, and trust that few competitors can match.

The challenge will be maintaining that niche as larger banks move into the digital asset space. For now, however, Xapo Bank stands as one of the clearest examples of what private banking in a Bitcoin-driven world can look like.

Disclaimer: This communication is not intended for, and must not be acted upon by persons resident in the United Kingdom.