Zopa is one of the most recognisable names in UK fintech. Originally launched as the world’s first peer-to-peer (P2P) lending platform in 2005, Zopa helped pioneer alternative finance well before the term “fintech” became mainstream. Fast forward to 2025, and Zopa has fully transitioned into a licensed digital bank, reinventing consumer lending through a broader suite of banking services.

But has the evolution from P2P disruptor to full-service digital bank lived up to its promise? In this review, we explore Zopa’s current offerings, performance, and strategic positioning as it reshapes how consumers borrow, save, and manage their finances.

From P2P Lending Pioneer to Digital Bank

Zopa made headlines by introducing the concept of matching borrowers with retail investors online, bypassing traditional banks. For over a decade, its peer-to-peer model proved resilient, particularly in the UK’s underserved personal loan market.

However, regulatory shifts and increasing capital requirements pushed the company to rethink its structure. In 2020, Zopa obtained a UK banking licence and launched its digital bank, offering fixed-term savings accounts and credit cards alongside its existing loan products.

In 2021, Zopa officially closed its P2P lending arm, completing its pivot to a regulated, deposit-taking digital bank. The goal: to offer fairer, faster, and more flexible lending through a customer-first digital experience.

Core Products and Services

Today, Zopa operates as a fully digital consumer bank, offering lending, savings, credit products and now, a market-leading current account called Biscuit. Its targeted product range is designed to meet core consumer finance needs.

Personal Loans

Zopa’s flagship product remains personal lending. Loans range from £1,000 to £25,000 with fixed rates and terms up to five years. Interest rates start from 7.9% APR, depending on credit score and loan purpose. Decisions are typically instant, and funds are disbursed quickly. Often on the same day.

Credit Cards

Zopa’s credit card has gained traction for its smart budgeting features, including real-time credit score updates, spending alerts, and flexible repayment options. The app enables customers to set custom credit limits and freeze their card instantly.

Fixed-Term Savings

To support its lending book, Zopa offers competitive fixed-rate savings accounts. Customers can lock in terms from 1 to 5 years, with rates often outperforming high-street banks. Deposits are protected by the FSCS up to £85,000.

Car Finance and Refinancing

Zopa also provides auto loans and car refinancing, helping customers reduce monthly payments or consolidate car debt. This service is fully digital and integrates valuation tools and credit checks into one streamlined flow.

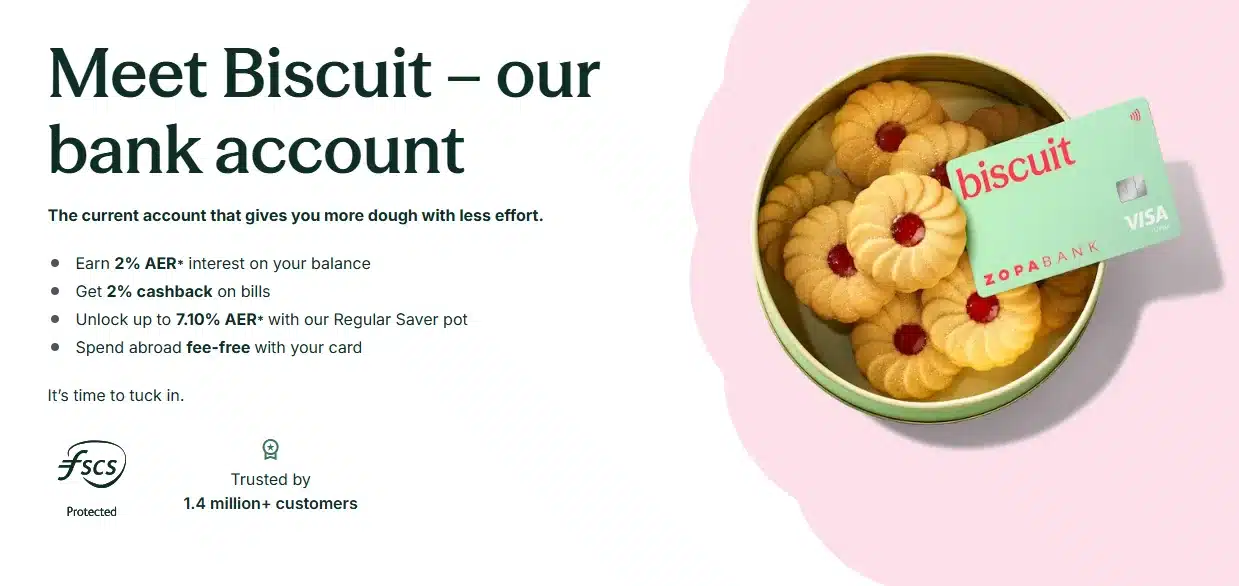

Biscuit – Zopa’s New Current Account launched publicly in June 2024

Following a successful beta, Biscuit is Zopa’s new current account, offering standout value in the UK market. Customers earn 7.10% AER on up to £300 saved monthly, 2.00% interest on balances, and 2.00% cashback on bills up to £1,500 per year. The account includes instant virtual cards and easy onboarding, with full access to Zopa’s savings, loan, and credit products via its app. A typical user could earn around £256 annually in interest and cashback.

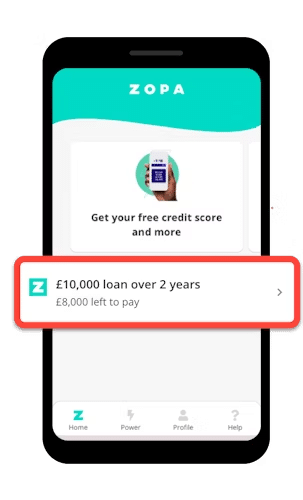

User Experience and Mobile App

Zopa has put considerable focus into building a seamless digital experience. The mobile app is central to its value proposition, combining lending, savings, credit management, and real-time financial insights.

The interface is modern and intuitive. Users can view loan balances, track repayments, apply for new products, and access their credit score within a few taps. Zopa also offers educational tools and credit coaching through the app.

Push notifications, budgeting features, and a clean dashboard design make it easy to stay on top of personal finance. In terms of usability, Zopa consistently receives high ratings across app stores and independent reviews.

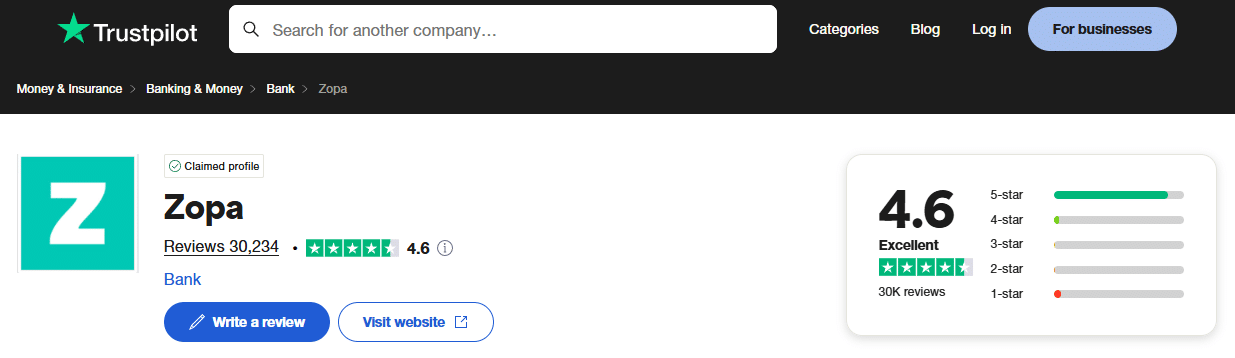

Customer Service and Trust

Zopa’s reputation has been built on transparent pricing, ethical lending, and responsive support. It consistently scores highly in customer satisfaction, with a Trustpilot rating above 4.5 stars.

Support is offered via in-app messaging, phone, and email. Many queries are resolved through the app’s automated support features, but human help is readily available when needed.

Crucially, Zopa positions itself as a lender that wants to lend responsibly. Borrowers are assessed with a focus on affordability, and the app encourages good habits rather than revolving debt.

How Zopa Stands Out

While the UK neobank space is crowded, with the likes of Monzo, Starling, and Revolut vying for attention, Zopa stands out by prioritising credit-first banking. Rather than focusing on flashy features or multi-currency accounts, Zopa has chosen to optimise core lending and saving functions, backed by responsible credit principles. The addition of Biscuit extends Zopa’s proposition into everyday banking, without sacrificing its focus on value and simplicity.

Key differentiators include:

- Rapid loan decisions and funding

- Built-in credit health tools and tracking

- No complex pricing or hidden fees

- FSCS protection for savings

- Strong integration of financial education

Zopa’s strategy reflects a focus on trust, regulation, and execution. Rather than expansion into everything at once.

Weaknesses and Limitations

Zopa’s narrow focus comes with trade-offs. It does not yet offer current accounts, investment products, or insurance. Users looking for an all-in-one banking solution may need to supplement Zopa with another provider.

Additionally, while Zopa’s rates are competitive, they are not always the lowest. Some price-sensitive borrowers may find better offers through aggregators or traditional banks during promotions.

The company also exited P2P lending, which disappointed some long-term supporters. However, this was a necessary step to operate as a scalable, regulated bank.

Final Verdict

Zopa has successfully reinvented itself as a modern, trustworthy digital bank built around smart lending and now, smart everyday banking through Biscuit. Its transformation from P2P pioneer to fully licensed institution reflects the maturation of fintech itself.

In 2025, Zopa offers one of the most user-friendly lending experiences in the UK, with added tools for credit awareness, financial discipline, and secure savings. It combines the agility of fintech with the accountability of a bank—striking a balance that many newer players have yet to master.

If you’re looking for a digital-first way to borrow, save, and manage credit without the clutter, Zopa remains a standout choice.