Category: Guest

How fintechs can navigate the super-apps landscape

By Chirag Shah, founder and CEO of Nucleus Commercial Finance and Pulse.io Super-apps, which are apps designed to provide a range of services to users, have been rising in popularity in regions across the world including in China and South-East Asia. In Western markets, critics have often met them with criticism. For fintech companies, which…

Internet of Things (IoT) in Banking Industry: Exploring the Strategies Implemented by Frontrunners

The Internet of Things industry is rapidly expanding, and it offers individuals across the globe a variety of digital devices and sensors. The IoT (Internet of Things) is a network of internet-connected devices that collect and transmit information. It is transforming the banking industry by personalizing rewards and offerings, enhancing capacity management, collecting debt, and…

How Open Commerce Can Solve the Global Trade Imbalance

By Soumaya Hamzaoui, Co-Founder and COO of RedCloud The face of global commerce has changed beyond recognition over the last decade. While large online retailers like Amazon and Facebook have profited from the switch to digital trading, they have also squeezed their smaller competitors in emerging markets and developing economies (EMDEs) out of the market…

Bouncing Back Better: How Fintech Advances Can Help Consumers Navigate the Cost-of-Living Crisis

By Richard McCall, the CEO of Armalytix. In the face of the current cost of living crisis, consumers find themselves grappling with economic challenges unseen since the 2008 financial crisis. One difference from that time is the significant transformation of the personal finance landscape. That is due largely to advancements in financial technology and regulation. A…

How AI and Open Banking are Unlocking Lending’s Potential

By Chirag Shah, founder and CEO of Nucleus Commercial Finance and Pulse.io The last 20 years have transformed the face of banking and lending. Previously, the traditional high street bank was where customers did everything from withdrawing and paying in money to applying for a loan or mortgage. You can now do everything at the…

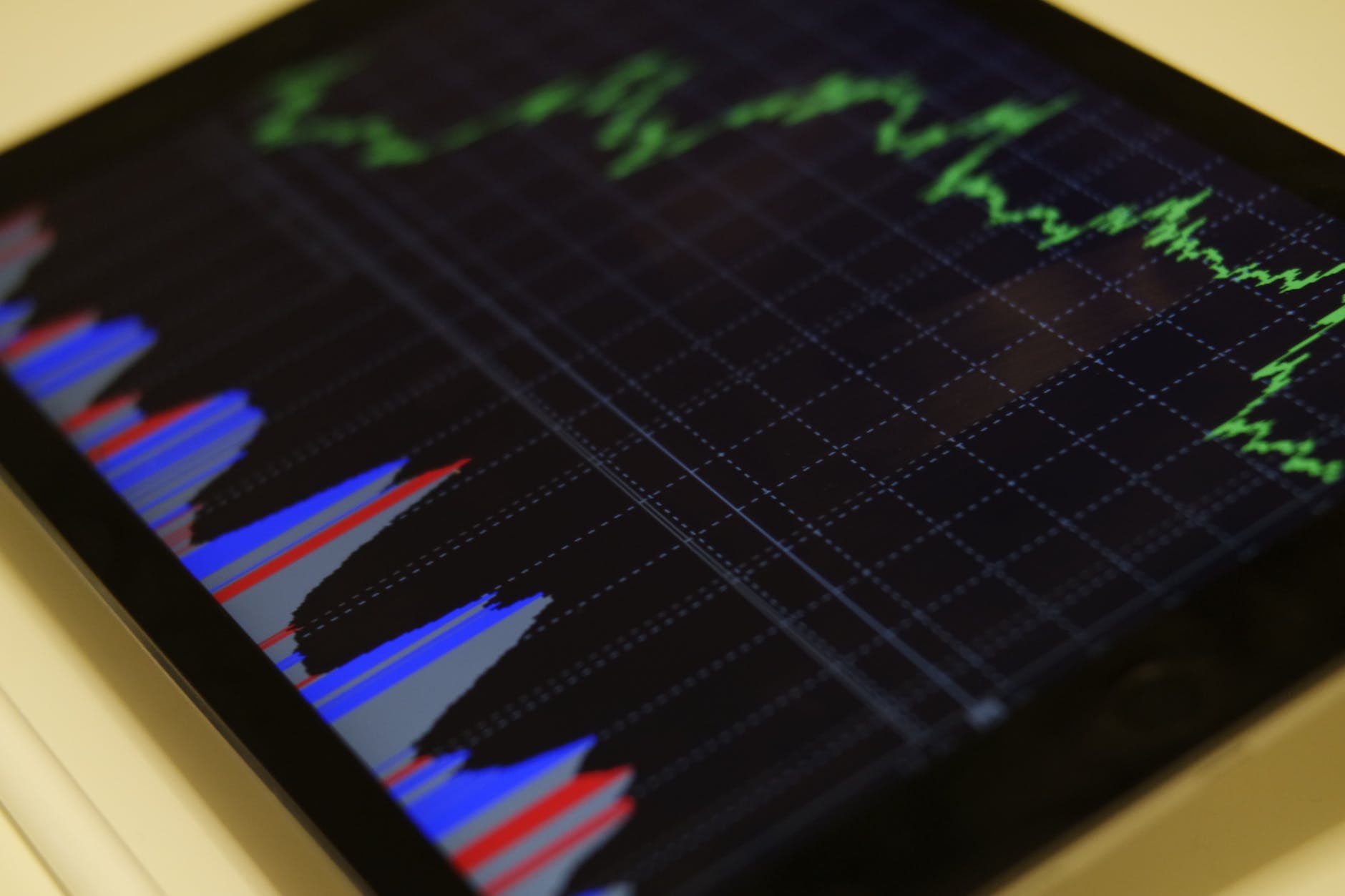

How Technological Innovations Can Help Diversify Your Investment Portfolio

By Daisy Moss The world of tech has transformed so many different industries across the world, with one of the most prominent being finance. In terms of what this means for your investment portfolio, we’re here to discuss how tech can help you to diversify your investments. And protect your future in a, let’s face…

Why Australian banks must embrace generative-AI

By Richard Scott, Group Vice President Asia Pacific, Informatica Australian banks have had an unsettling year. Global instability in the financial services sector combined with the nation’s cybersecurity and Privacy Act reforms are putting more pressure on banks with regard to how they manage and use data. At the same time, the rise of the…

Want to better support accounting teams and retain talent? Here’s how the right tech makes the difference

By Mike Whitmire, CEO, FloQast Despite the Bank of England expecting inflation to fall quickly in 2023, it can feel like we’re in a bit of a ‘permacrisis’. Just when your business has managed to weather the storm brought on by the pandemic, the Russia-Ukraine war begins and the cost-of-living crisis strikes. It’s not easy…

Why Fintech Software Solutions Must Balance User Needs and Company Values

In the world of financial technology, software is essential. As an increasing number of organizations develop high-tech solutions that aim to enhance and automate banking and financial services, fintech is helping companies, business owners and consumers better manage their financial lives. Leveraging specialized software and algorithms used on computers and, increasingly, smartphones, fintechs innovate how business is…

Why banks should switch to a people-focused digital security experience

By Louis Granger, Head of EMEA Solutions Consulting at UserTesting The rise of fintech has ushered in a new era for the banking industry. Traditional banking institutions are being outpaced by new digital-only services such as Monzo and Starling Bank. Customers have now come to demand a banking experience that is nimble, empathetic and personalised…