Gr4vy offers a payment orchestration platform designed to simplify and optimise global payment processing for merchants. As payment ecosystems become more fragmented, orchestration platforms like Gr4vy play a critical role in managing growing complexity.

Gr4vy operates on a SaaS subscription model. Merchants pay for access to Gr4vy’s cloud-native infrastructure, which manages payment routing, redundancy, and provider integrations. The platform also supports revenue sharing for value-added services such as fraud prevention or alternative payment method add-ons. The SaaS model provides recurring revenue predictability while allowing merchants to scale their payment operations flexibly as transaction volumes grow.

Core features and architecture

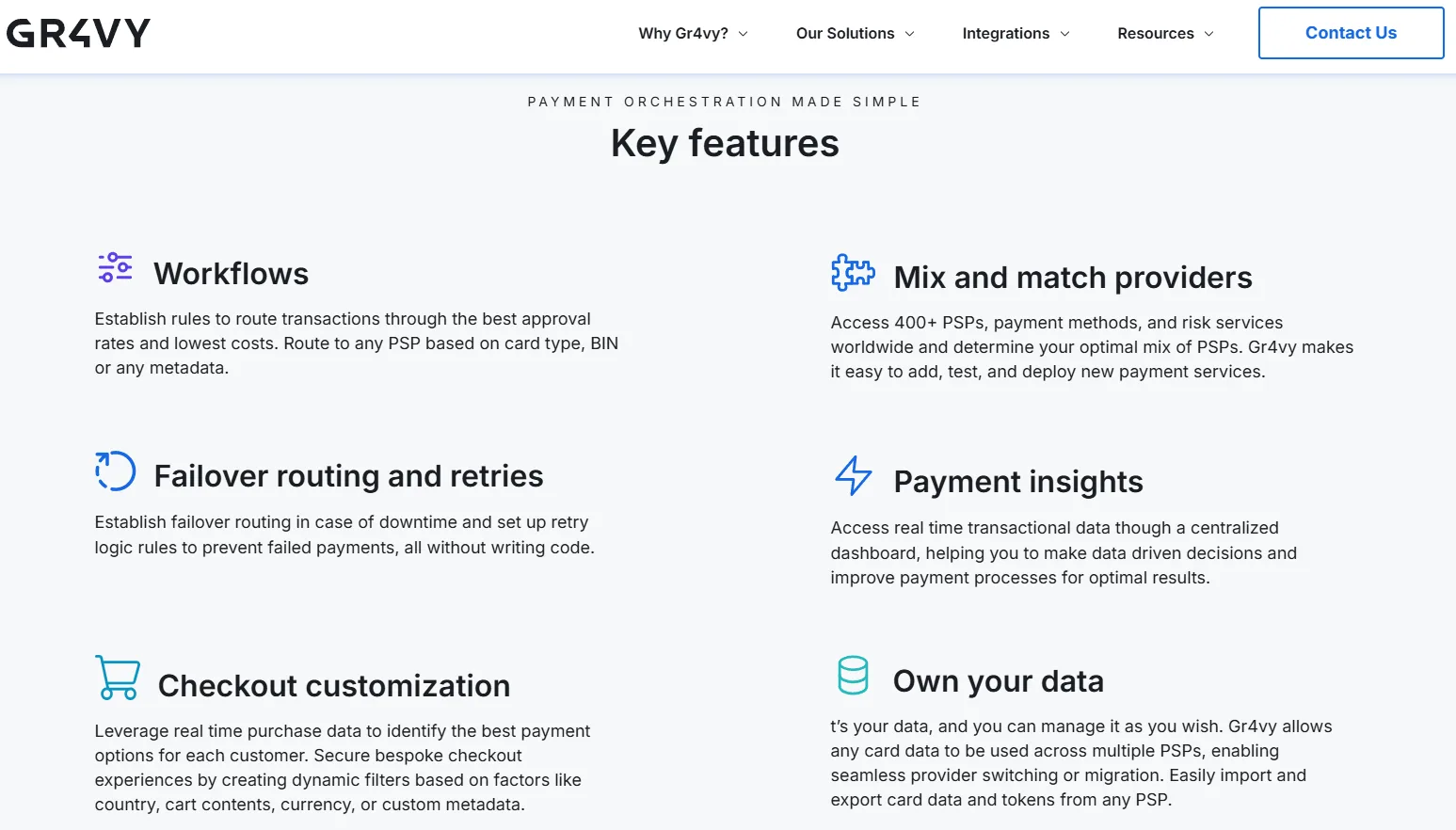

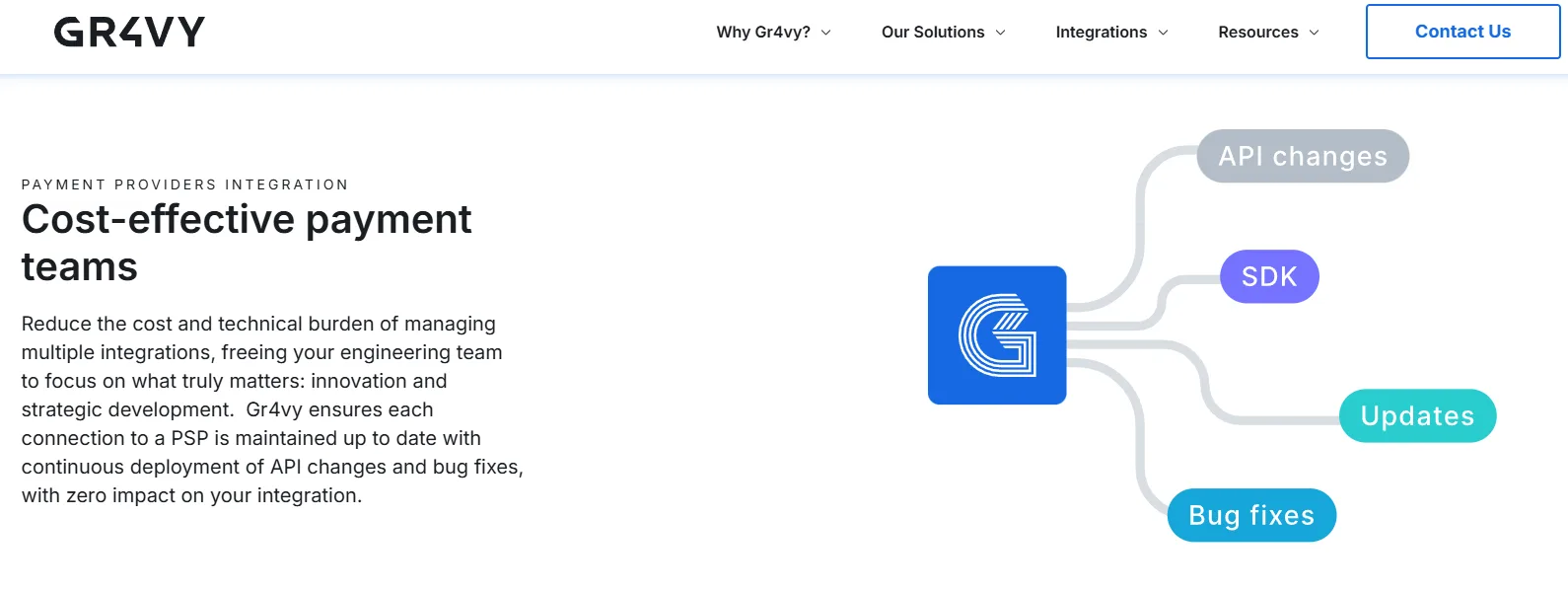

Gr4vy centralises payment management through a no-code interface. Merchants can add, configure, and switch payment providers without writing code. The platform offers smart routing, failover protection, and geographic optimisation to improve transaction success rates. By enabling merchants to automatically route transactions to providers based on cost, currency, geography, or performance, Gr4vy directly improves authorisation rates and reduces costs associated with failed payments.

Built on multi-tenant cloud infrastructure, Gr4vy offers flexibility, scalability, and high availability. Its cloud-native approach eliminates the need for merchants to maintain their own complex payment infrastructure.

This architecture supports rapid deployment, automatic scaling during peak periods, and easy geographic expansion, making Gr4vy particularly well-suited for international merchants managing multiple payment providers across different regions.

Security and compliance

Gr4vy handles PCI compliance, data tokenisation, and secure vaulting of payment credentials. This reduces merchants’ compliance burden and lowers security risks associated with handling sensitive payment data directly. By taking ownership of key regulatory and security requirements, Gr4vy lowers barriers to entry for merchants seeking to expand into new markets without facing the full complexity of local compliance frameworks.

Target audience and competitive positioning

Gr4vy serves mid-size to large merchants operating across multiple markets and payment providers. It appeals to businesses seeking flexibility in managing global payment complexity while maintaining control over their payment stack. Industries such as e-commerce, marketplaces, SaaS platforms, and travel providers particularly benefit from the ability to quickly adapt payment strategies to local consumer preferences.

Gr4vy competes with other payment orchestration providers like Spreedly, Primer, Corefy, and in some segments, with PSPs offering bundled solutions. Its differentiator lies in its cloud-native design, ease of integration, no-code configuration, and focus on empowering merchants to fully control their payment strategy without heavy engineering resources or permanent vendor lock-in.

Recent developments and strategic advantages

Gr4vy has expanded its partner ecosystem, adding numerous payment gateways, fraud prevention tools, alternative payment methods, and buy-now-pay-later providers. This growing network enhances its orchestration capabilities and merchant flexibility. New features such as multi-PSP balancing and adaptive retry logic continue to strengthen its optimisation tools.

By decoupling merchants from single payment providers, Gr4vy reduces vendor lock-in. Merchants can test, optimise, and negotiate better terms across providers. This flexibility directly impacts transaction costs, payment conversion rates, and ultimately customer satisfaction, as merchants can offer more localised and frictionless payment experiences across geographies.

Challenges ahead

Gr4vy faces competition from integrated payment service providers that offer both processing and orchestration bundled together. Educating merchants on the long-term strategic value of orchestration versus bundled solutions remains a key challenge, especially for smaller merchants unfamiliar with orchestration concepts.

Gr4vy provides merchants with the tools to take control of complex global payments. Its cloud-native orchestration platform offers flexibility, resilience, and optimisation opportunities that can directly improve revenue performance. As merchants continue to seek payment stack agility, orchestration platforms like Gr4vy are positioned to become increasingly central to global payment strategies.